[ad_1]

BalkansCat

Expensive subscribers,

Try to be conscious, in the event you comply with my work, that I am a reasonably prolific investor in luxurious items firms in Europe, particularly one thing like LVMH (OTCPK:LVMUY). One other instance of a luxurious items firm that I am taking a look at and now am investing extra closely into (0.3% of portfolio to date, increasing), is Pernod Ricard (PRNDY).

Pernod has made it to my top-10 “BUY” listing of firms which are each qualitative and with a excessive upside on the investing and potential return facet. On this article, I’ll present you why that’s and what makes this such a stable potential funding.

In any other case, I would not be investing in it, in any case.

That is my first article on Pernod Ricard. I have never correctly coated it on SA earlier than, and that is one thing I imply to alter at the moment.

Let’s examine what we, at the moment, have going for us.

Pernod Ricard – Lots to love at this valuation with an over 20% annualized upside in luxurious spirits

Pernod, like most luxurious firms and most French luxurious firms particularly, is never undervalued. I’d say this firm grew to become a horny purchase over 3 years in the past – and I did not purchase at the moment, sadly.

The corporate was fashioned again within the mid-Seventies by way of the then-merger of two aniseed liqueur makers with the respective names of Pernod and Ricard, and since then, it is made a reputation for itself by turning into a serial acquirer of luxurious and qualitative spirit manufacturers. Which means it has a historical past that is truly in some methods “richer” or no less than older than LVMH as a enterprise.

This can be a sector the place we now have a reasonably heavy focus total, and outdoors the foremost gamers like Pernod, there aren’t many companies which have an excessively vital market place, with loads of fragmentation exterior these main gamers – which for spirits additionally contains LVMH.

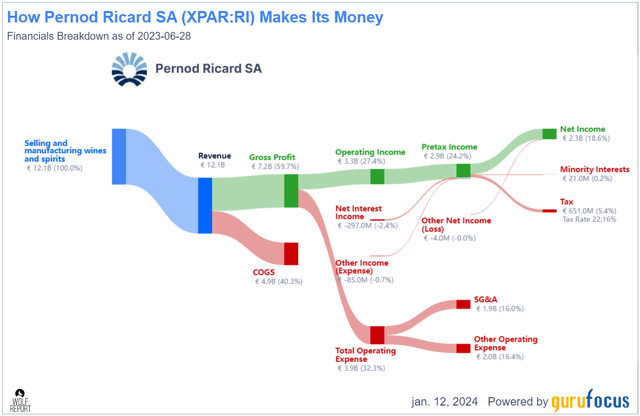

Pernod Ricard manages annual gross sales of over €12B, and for the newest full-year fiscals, the corporate elevated this 13%, with an natural 10% YoY development. On that internet gross sales, which is a few sixth of the gross sales stage managed by LVMH, the corporate manages a internet revenue of about €2.2B, with €3.3B of operational revenue, additionally an 11-13% YoY development.

The corporate does this whereas managing a conservative internet debt/EBITDA of sub-3x, presently at 2.7x and whereas producing between €1.4-€2B price of free money circulation.

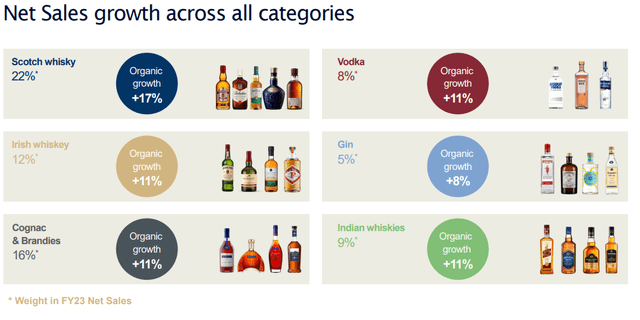

Listed below are the corporate’s varied segments and the way they carried out throughout that final fiscal.

Pernod Ricard IR (Pernod Ricard IR)

Briefly, the corporate noticed gross sales development in each single phase and each single geography. Like a lot of the posh market, the corporate is heaviest in weight when it comes to Asia/to Asia. The corporate has a 42% gross sales weight to the geography at the moment, with 29% in each NA and Europe. Asia can be rising sooner than Europe, and far sooner than the Americas, no less than for this final fiscal.

Pernod Ricard IR (Pernod Ricard IR)

The corporate’s portfolio accommodates greater than 240 premium spirits manufacturers, and it is the worldwide #1 participant within the premium spirits class, with 17 manufacturers of the corporate’s present choice discovered within the international high 100.

There are, no less than in line with the market, the explanation why this firm is presently buying and selling down. I simply do not occur to agree with them. The corporate manages a gross margin stage of over 59%, with an working margin of over 27% and a internet margin above 18%. That places it on par with LVMH in how “good” it’s, and whereas it is not as stable as LVMH when it comes to lack of excessive debt, it is nonetheless very spectacular up there.

A collection of the manufacturers that the corporate owns embody:

Ricard Pernod Lillet Beefeater Havana Membership Absolut Vodka Ballantine’s Jameson Aberlour Glenlivet Perrier Jouet

…and lots of others.

Wanting on the firm from a purely enterprise perspective, it is easy to see, as I discover it, that it is a high quality enterprise mannequin with a variety of issues going for it. Any enterprise mannequin that manages to squeeze a constant 15% internet margin from its revenues is what I’d take into account one of many higher ones on the market.

Pernod Ricard Enterprise Mannequin (GuruFocus)

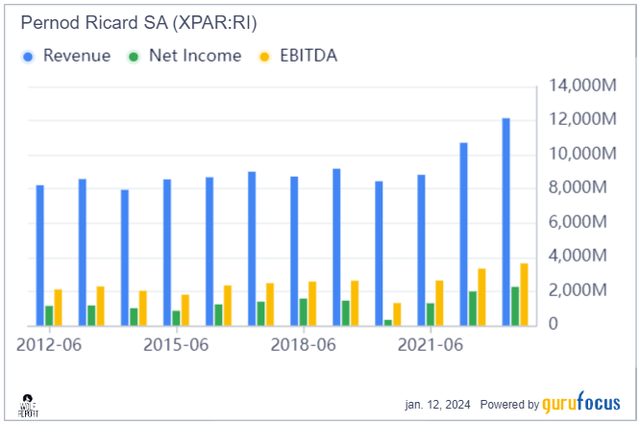

This can be a firm that is persistently ROIC/WACC constructive, and whereas its report of rising revenues after the GFC and till 2019-2020 was lackluster, it has began choosing up its development over the previous few years.

Pernod Ricard Income/internet earnings (GuruFocus)

So what I wish to showcase right here is the corporate’s high quality and security. Pernod additionally comes with a BBB+ credit standing, and in contrast to LVMH doesn’t commerce at a cloth type of premium – as we’ll see afterward, it trades at what might be thought-about a cloth low cost to each historic and truthful worth estimates.

The corporate additionally provides you a well-covered 3%+ yield, which is not the highest on the market for positive, but it surely’s what I’d take into account to actually be ok right here.

Like most international distillers and vintners, together with LVMH, RI is placing religion within the premiumization of components (massive components) of its total portfolio. What we have been seeing within the business is merchandise like spirits taking market shares from Beers and wines as shoppers buy the previous as an alternative of the 2 latter, and we have seen a median natural development of 20 bps from one to the opposite when it comes to segments for the previous decade. If this development continues, which I do not see there any motive past possibly pricing to not proceed, then this would offer a really stable backdrop for a tailwind for Pernod Ricard right here.

This contains the exercise in new markets like China, the place Pernod stays closely invested, and the place it has a really sturdy presence. Pernod has labeled each the Indian and the Chinese language markets as markets the place the corporate “Should” win.

RI is a really M&A-capable firm, and the historical past proves this.

Pernod Ricard IR (Pernod Ricard IR)

In the meantime, Pernod can be including improvements to its portfolio, together with issues like non-alcoholic gin options – a so-called 0.0 (Seagram), cocktails, twist & combine spirits (an innovation which I’ve but to check out), and different issues.

So, as I see it, there are many issues to get enthusiastic about right here. The corporate is continuous to push a heavy capital circulation in the direction of investing.

RI IR (RI IR)

And whereas the dividend does not showcase an ideal development trajectory, it nonetheless has delivered stable development over time, beginning at €1.88 for the 2016 12 months, and ending in 2023E at a €4.7/share which might deliver the present yield to a complete of three.15%, accepted on the firm AGM.

The corporate, even with the newest crash, has additionally considerably outperformed a lot of the comparative and comparable indices, if not my very own portfolio or many different portfolios on the market. As all the time, it comes down to purchasing it on the proper type of valuation.

General, I see the next dangers and upsides for Pernod Ricard as a basic funding.

Dangers & Upsides for Pernod Ricard

The best threat to the corporate is cyclicality, and it is a extra cyclical luxurious enterprise than LVMH. The spirits specialization is extra cyclical than different staple classes and does endure a traditionally confirmed drawdown throughout downturns – and this additionally interprets to some larger share value volatility. The corporate, as you possibly can learn within the information, has additionally seen some heavy-handed regulatory intervention in key areas like China and India, even Russia, and it is a secondary threat – as a result of governments are inclined to have sturdy opinions about alcohol of their nations, one thing that is not essentially true in different luxurious segments or sub-segments.

Some analysts will argue that the corporate’s publicity to wine additionally provides it extra cyclicality as a result of it is a largely fragmented market. There’s some reality to that, however total I view it as overstated, as a result of Pernod operates in very enticing “Area of interest” classes and sub-categories of spirits and merchandise, which I argue insulates them from a few of these ups and downs.

On the additional upside, I’d clearly state that Pernod Ricard has a few of the greatest moats on the market within the business. The corporate’s portfolio creates a few of the most complete entry limitations on the market, supported by mature product classes with clear firm price benefits. Whereas it will probably by no means be stated that any model or class is immune, I really feel that the spirits business shouldn’t be someplace that anybody can simply “get into”.

As a remaining benefit, I’d level to Pernod’s unbelievable pricing energy for its established merchandise, confirmed by its internet margins. It has ample room to drive development, each natural and inorganic, and dislodging this firm from wherever shouldn’t be a straightforward factor.

Let’s take a look at why I am so excited right here – the valuation.

Pernod Ricard – The upside

For those who’ve been following my posts and the chat, you may know that I’ve been pushing cash to work for a number of weeks now and that my tempo of pushing cash to work, removed from slowing down, has been rising.

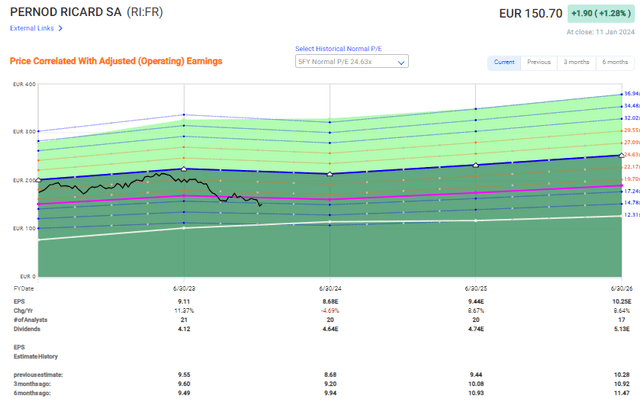

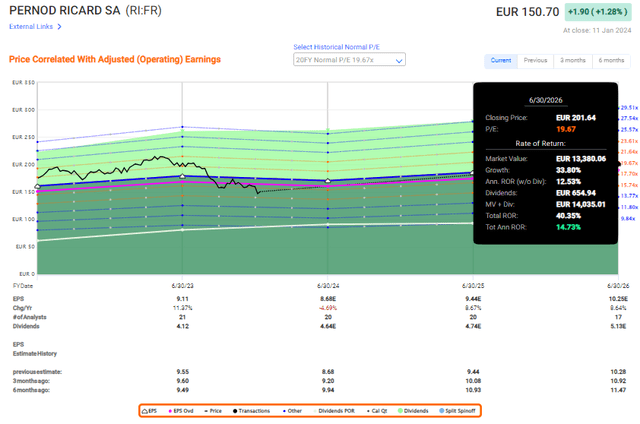

Pernod Ricard Valuation (Pernod Ricard FAST Graphs)

That, pricey readers, is the rationale. Pernod is now right down to 16.9x, and beneath 17x for this firm is kind of uncommon. It is exhausting to say whether or not we’ll see additional materials draw back – I am investing slowly right here – but when we do, I will purchase much more.

In relation to Pernod, I’d be snug with a 2.5-3% portfolio place, simply. Even when the corporate have been to underperform right here and handle solely the 20-year common, which primarily dilutes a lot of the latest upside the corporate has been reaching, we nonetheless have a market-beating 15% annualized upside right here of very shut to fifteen% per 12 months.

Pernod Ricard Upside (FAST Graphs)

And I am removed from the one one which sees this. S&P International analysts for the corporate give us a median value goal of over €180/share, from 22 analysts between €137 as a low and €250/share as a excessive with a median of €183. I nonetheless view that as too low primarily based on the corporate’s development potential and total security.

I’d say forecasting Pernod on the 10-year common is a extra truthful estimate, and at 22x P/E, this firm manages to present traders, beneath present forecasts, a 20% annualized, or nearly 60% till the 2026E.

So, whereas I’ve already established a small and rising place in Pernod, I hope we see additional short-term draw back on account of the continuing probes but additionally on account of the continuing uncertainty for the 2024E outcomes. It would allow me to decrease my price foundation additional and put together very properly for an eventual upside right here, the place I’ve an precise very excessive conviction that it’s in reality coming.

Out of twenty-two analysts, 12 have the corporate at a “BUY” right here, with most others at “HOLD”. There may be clearly some ready for an additional draw back right here. That may come, and I will be prepared for it. However as issues stand now, I imagine that RI is in an excellent higher place than LVMH to see an upside from luxurious, since you’re in a position to purchase it cheaper. Granted, not the identical type of high quality – no argument from me there – however not a lot much less, as the worth would in any other case recommend right here.

Even in the event you test providers like Morningstar, you may discover that they’ve, for the previous few weeks, been bumping this firm up, and provides it a fair-value estimate of €185/share.

Let me run by way of the upsides I see right here.

The working margin is in enlargement The P/B ratio is at a 3-year low The P/E ratio is at a 10-year low The Rev/share is displaying constant total development. The P/S ratio is at a 5-year low The dividend yield is at a 10-year excessive.

That is, as I see it, a low-risk high-fundamental play, and people are pretty uncommon. Even only a median of the corporate’s P/S implies a €200+ share value right here.

I say “BUY” right here, and I offer you my introductory thesis for Pernod Ricard.

Thesis

Pernod Ricard is without doubt one of the extra fascinating luxurious vintners and distillers on the market. The corporate owns a portfolio of one of the market-beating firms and types on the market, giving it a terrific moat and making it very investable on the “proper” type of total value. The corporate has been overvalued or no less than totally valued for a while. Nonetheless, at beneath €175/share, it now not is overvalued, and I’ve began including shares to my portfolio. I imagine Pernod Ricard, primarily based on a development estimate of 7-11% for the subsequent few years, has the potential to outperform the market at 13-20% per 12 months, and because of this it qualifies as a conservatively-adjusted market-outperforming firm so far as my method is worried. I fee it a “BUY” with a €190/share long-term share value, at minimal.

Keep in mind, I am all about:

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly large – firms at a reduction, permitting them to normalize over time and harvesting capital beneficial properties and dividends within the meantime.

2. If the corporate goes nicely past normalization and goes into overvaluation, I harvest beneficial properties and rotate my place into different undervalued shares, repeating #1.

3. If the corporate does not go into overvaluation, however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

This firm is total qualitative. This firm is basically secure/conservative & well-run. This firm pays a well-covered dividend. This firm is presently low cost. This firm has a sensible upside primarily based on earnings development or a number of enlargement/reversion.

I went backwards and forwards on calling this firm “low cost” right here, however I do in reality imagine that it’s “low cost” at sub-€150/share. Which means that the corporate fulfills each single certainly one of my standards, making it comparatively clear why I view it as a “BUY” right here.

Thanks for studying.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.

[ad_2]

Source link