[ad_1]

thitivong

ZIM Built-in (NYSE:ZIM) is a foremost beneficiary of the present turmoil within the Pink Sea, which is considerably disrupting container delivery and consequently resulting in a noticeable enhance in freight charges. Traders ought to think about {that a} main portion of Europe-Asia maritime commerce passes by way of the Pink Sea. Actually, it’s estimated that roughly 30% of all container quantity between Europe and Asia transits by way of the Suez Canal. If such a excessive commerce quantity can be diverted to go the Cape of Good Hope, there would definitely be an infinite capability scarcity of delivery containers, as present provide is locked-in for materially longer routes.

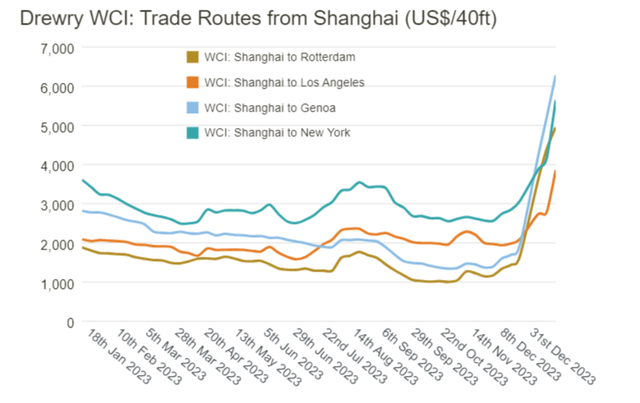

First indicators of a possible provide/ demand steadiness disruption are already observable by way of sky-high container charges. Actually, the

Drewry World Container Index (WCI) for a 40-foot container signifies that prices for delivery are quickly approaching COVID-like charges, with the Shanghai to Rotterdam benchmark having elevated by virtually 5x vs. early November, to about $5,000. For reference, the normalized pre-pandemic charge for this route was roughly $1,300 – $1,800.

Drewry World Container Index

Evidently, corporations like ZIM are poised to learn drastically from these larger charges. The final time container charges have stood this excessive (post-COVID), ZIM showered shareholders with $3.3 billion in dividends, which is 2x ZIM’s present market cap.

Though the thesis is so enormously interesting, it’s fascinating to notice that market contributors have thus far failed to completely value the upside state of affairs, with ZIM shares buying and selling round $1.65 billion market capitalization.

In search of Alpha

One cause why traders haven’t but piled progressively into ZIM shares could also be anchored on the uncertainty in regards to the period of the disruption. On that be aware, I argue that the majority situations look favorable. Actually, I level out that the presence of army ships within the area, and joint motion by U.S. and U.Okay., has thus far failed to resolve the disruptions. This means that prime container charges could doubtlessly persist till the battle in Israel/ Gaza stabilizes, which may take a number of months, if not years! That stated, traders ought to think about that the provision chain disruption attributable to COVID lasted only some quarters and was nonetheless adequate to immediate monumental dividend payouts.

Admittedly, I’ve argued already in Might 2023 {that a} vital, sudden dividend payout could also be anticipated. The thesis turned out to be improper, as container freight charges edged unexpectedly decrease on a worse than anticipated commerce quantity backdrop. Nonetheless, you will need to be aware that my thesis at the moment contrasts sharply with my argument made 3 quarters in the past: At present there’s a catalyst and the core argument of the thesis is just not anchored on “bettering charges”, however on charges which have already materialized. Thus, whereas the argument again in Might 2023 was primarily based on a “guess”, the argument at the moment is extra essentially anchored.

On a unique be aware, I additionally level out that present disruptions could have already brought about sufficient stress with container/ delivery service patrons to lock in ahead delivery charges at an elevated charge. This may increasingly help bullish business momentum all through 2024, even when the Pink Sea disruptions had been to be resolved in a “well timed” schedule.

In any case, present consensus estimates for ZIM are seemingly a lot too low to replicate the occasions of the previous few weeks and a altering container delivery surroundings. Actually, referencing estimates collected by Refinitiv, I level out that analyst consensus income revisions have thus far been minor, pricing a income delta of solely +$500 million for 2024. I’m not certain why analysts have thus far didn’t replicate the Pink Sea disruptions of their estimates, because the impression on charges is indeniable (see DWCI). I argue that issues about disruption period play a job, in addition to an fairness analysis business bias in direction of “wait and see” moderately than “anticipate and speculate”.

Refinitiv

Personally, I take the possibility to take a position that analysts are behind the curve, and I open a place in ZIM shares. Traders ought to consider that ‘returning money to shareholders’ stays a key precedence of ZIM CEO Eli Glickman. And though predicting the chance and quantity of a dividend distribution in 2024 is difficult, it is vital to notice that the potential for a dividend seems to be very promising on a possible revenue surge as a result of Pink Sea route disruption. I assign a speculative “Robust Purchase” ranking.

As a last be aware, I level out that it’s extremely troublesome, and arguably unreasonable to worth an organization like ZIM Built-in primarily based on money movement or earnings, as a result of the basics of the enterprise are so risky and cyclical. Accordingly, for valuation steerage I might moderately have a look at accounting e-book worth, or liquidation worth. And on that be aware, I believe at 0.6x P/B the draw back for ZIM seems to be well-protected.

[ad_2]

Source link