[ad_1]

In June 2022, inflation within the US reached a 40-year excessive. Nonetheless, by December 2023, it had considerably decreased, per the newest information from the US Bureau of Labor Statistics (BLS). This decline will be attributed to a number of elements resembling US Federal Reserve rate of interest hikes, supply-chain efficiencies, and a decline in gasoline costs.

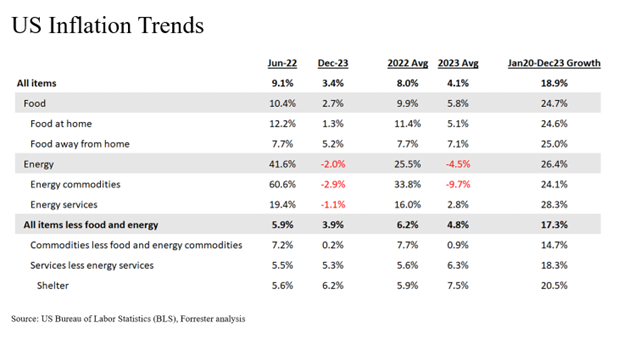

Despite the fact that inflation has come down, customers are nonetheless feeling the pinch of upper costs. It is because the costs are up considerably in comparison with the pre-pandemic. If we evaluate costs in December 2023 to January 2020, general costs are up 19%, meals costs are up 25%, power costs are up 26%, and the costs of shelter companies are up by 21% (see Determine beneath).

Allow us to take a look at the developments within the numerous measures of inflation reported by the BLS.

Headline inflation declined from 9.1% in June 2022 to three.4% in December 2023. It refers back to the general enhance within the common worth degree of all items and companies in an economic system. BLS refers to it as ‘All Objects’ class. On an annual common foundation, that is down from 8.0% in 2022 to 4.1% in 2023.

Meals inflation declined from 10.4% in June 2022 to 2.7% in December 2023. It refers back to the enhance within the common worth of meals over time. Throughout the meals class, the BLS distinguishes between “meals at dwelling” and “meals away from dwelling.” The meals at dwelling class contains grocery retailer purchases, resembling fruits, greens, dairy merchandise, meat, and different important meals objects. It declined from 12.2% in June 2022 to 1.3% in December 2023. The meals away from dwelling class consists of meals and snacks bought at eating places, cafes, and different meals institutions. It has remained considerably elevated. In December 2023, meals away from dwelling inflation was 5.2%.

Power inflation is down from 41.6% in June 2022 to -2.0% in December 2023. It’s one other necessary facet of general inflation, as power prices considerably influence each households and companies. The BLS classifies power inflation into two foremost classes: power commodities and power companies. Power commodities embrace bodily power assets which can be consumed, resembling gas oil, gasoline, diesel gas, and different motor fuels. It declined from 60.6% in June 2022 to -2.9% in December 2023. Power companies embrace electrical energy and utility (piped) gasoline companies. It declined from 19.4% in June 2022 to -1.1% in December 2023.

Core inflation declined from 5.9% in June 2022 to three.9% in December 2023. It’s a measure of worth adjustments for all objects within the CPI apart from meals and power. This exclusion relies on the concept meals and power costs will be extra risky and topic to short-term fluctuations, which can not essentially mirror the underlying inflationary pressures within the broader economic system. The BLS refers to it as ‘All objects much less meals and power’ class.

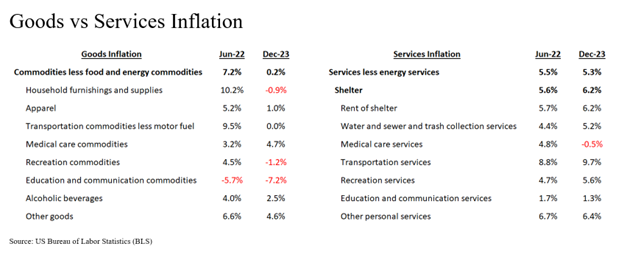

Items inflation. BLS reviews inflation charges for numerous commodity classes, together with “Commodities much less meals and power commodities.” It decreased from 7.2% in June 2022 to 0.2% in December 2023. Subcategories embrace family furnishings and provides (window and ground coverings, furnishings, bedding, home equipment, instruments, housekeeping provides), attire (males’s, ladies’s, infants’, footwear, jewellery), transportation commodities much less motor gas (new autos, used automobiles, elements), medical care commodities (prescription and nonprescription medication, gear), recreation commodities (video/audio merchandise, pets, sporting items), schooling and communication commodities (books, computer systems, smartphones), alcoholic drinks, and different items (tobacco, private care merchandise). All commodities noticed a decline in inflation besides medical care commodities (see Determine beneath).

Providers inflation. The BLS reviews inflation charges for numerous companies classes, together with “Providers much less power companies.” It remained elevated at 5.3% in December 2023. It has a ‘Shelter’ subcategory, which is a catch-all class for all of the companies together with, lease of shelter, water and sewerage upkeep, rubbish and trash assortment, family operations, medical care companies (hospital, insurance coverage, professionals), transportation companies (rental, upkeep, insurance coverage, public), recreation companies (video/audio, pet, film/occasion tickets), schooling and communication companies (tuition, phone, Web), and different private companies (authorized, monetary, private care, laundry, and many others.). The Shelter inflation has been stickier and remained elevated at 6.2% in December 2023.

Trying forward into 2024, Forrester expects headline inflation to lower from a median of 4.1% in 2023 to 2.6% in 2024. We count on core inflation will lower to three.0% in 2024, primarily as a consequence of an anticipated decline in companies inflation. These estimates are based mostly on Forrester’s evaluation of BLS inflation information and different macroeconomic indicators. We are going to proceed to observe BLS inflation information and supply periodic updates as extra precise information turns into accessible.

In our upcoming report US Shopper Spending Outlook, 2024, we talk about how key US macroeconomic developments will influence shopper spending in several classes throughout 2024. In that very same report, we additionally discover the implications for B2C entrepreneurs and model producers. We’re internet hosting a webinar on this subject for Forrester purchasers on February 12, 2024. In case you are a Forrester shopper and want to study extra, please schedule an inquiry or steering session with Dipanjan Chatterjee or me!

[ad_2]

Source link