[ad_1]

TommL

By Eric Winograd.

Falling inflation hasn’t but translated into good emotions amongst US shoppers. Based mostly on the newest information, that is perhaps altering.

Over the previous few months, analysts have coined a brand new time period to explain this confounding US financial setting: a “vibe-cession.” It appears there’s a large disconnect between economists’ optimistic assessments primarily based on incoming information and a cussed pessimism amongst shoppers. To place it bluntly, shoppers simply aren’t feeling the vibes.

We expect there’s a reasonably easy motive for the hole. What’s extra, we predict it’s beginning to shut.

By most financial metrics, 2023 was an exceptionally good 12 months. Progress in headline inflation, as measured by the Client Value Index, cooled markedly, and it did so with out the recession many forecasters seen as essential to recalibrate inflation solely a 12 months in the past. The unemployment fee stayed below 4%, wage progress outpaced inflation and the inventory market ended the 12 months at an all-time excessive.

Regardless of all the excellent news, most measures of shopper confidence remained subdued at greatest, which poses one thing of a puzzle. However we do see a proof—and an answer.

With Inflation, It’s a Matter of Perspective

For starters, economists and policymakers view inflation a lot otherwise than households do.

Month-to-month inflation information measures the share change in value ranges. So, when inflation falls from 9.1% to three.4%, because it has over the previous 18 months, costs are nonetheless rising however extra slowly. There’s good motive for policymakers to give attention to the speed of change quite than the extent of costs, as a result of they’ll’t do something in the present day to deal with yesterday’s costs. They will solely affect tomorrow’s—and that requires taking a look at how a lot costs are altering; not how excessive they’re.

Monetary markets, not surprisingly, take a look at inflation over a fair shorter time horizon. Markets have rallied in current weeks largely as a result of the three- and six-month inflation charges have fallen again to the Fed’s goal inflation charges. This progress means that fee cuts ought to flip up within the subsequent few months.

Households expertise inflation in a really completely different approach.

Some inflation classes—rents and housing particularly—matter extra to households than they do as contributors to the general value index, and people parts have been significantly lofty. Additionally, whereas markets might solely look again just a few months and policymakers maybe a 12 months, shoppers have made it very clear prior to now few months that they’ve a for much longer reminiscence.

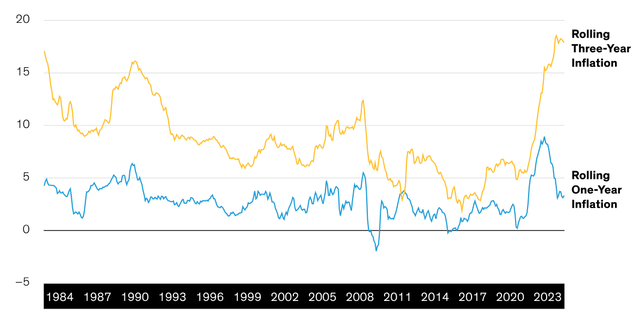

That distinction creates a a lot completely different perspective on costs. Inflation might look roughly regular in the present day trying again over a one-year time horizon, however over a three-year time horizon, costs have risen greater than at any time because the early Nineteen Eighties (Show). It’s no marvel households stay skeptical of the market’s perception and policymakers’ rising confidence that inflation has already been defeated.

Considered Over a Three-12 months Horizon, Inflation Is Nonetheless at a 40-12 months Excessive

Client Value Index, Proportion Change

Previous efficiency doesn’t assure future outcomes.

Via December 31, 2023

Supply: LSEG Datastream and AllianceBernstein (AB)

Indicators of Enhancing Client Spirits Are Encouraging

Going ahead, right here’s the query that issues most to the financial outlook: How lengthy is the buyer’s reminiscence?

Policymakers have no real interest in pushing costs down; deflation would virtually actually require a nasty recession and, over the long term, be extra disruptive to financial progress than inflation would. One of the best they’ll do is restore inflation to regular charges however doing that hasn’t but made households be ok with the scenario. Assuaging that pessimism is crucial to stoking financial progress, since family consumption represents roughly two-thirds of gross home product.

Not too long ago, there’s been encouraging information on that entrance.

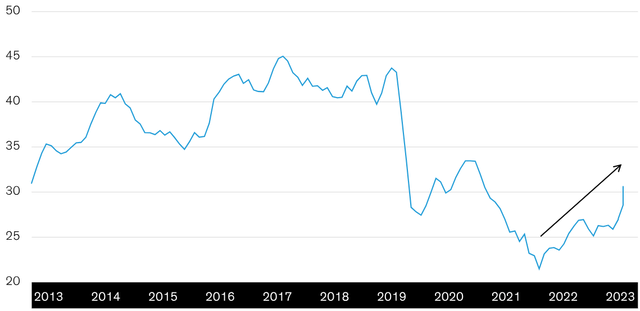

Readings on shopper confidence have climbed, significantly in terms of households’ assessments of the longer term state of the economic system and their very own funds. The proportion of households that anticipate their monetary scenario to be higher within the subsequent six months, whereas nonetheless beneath pre-pandemic ranges, is up practically 10 share factors prior to now few quarters—a post-pandemic excessive (Show).

Households Are Feeling Higher About Their Monetary Prospects

Proportion of Respondents Anticipating Improved Monetary State of affairs a 12 months from Now

Previous efficiency doesn’t assure future outcomes.

Combines “considerably higher off” and “significantly better off” responses.

Via December 31, 2023

Supply: LSEG Datastream and AllianceBernstein (AB)

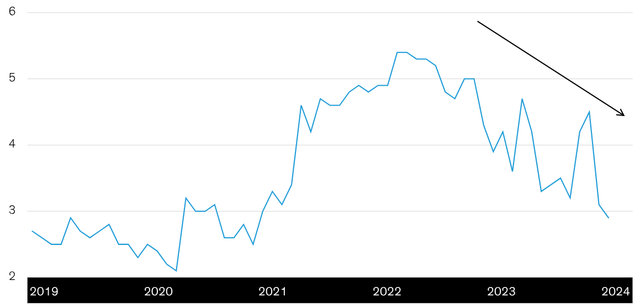

That elevated optimism has coincided with a transparent downward pattern in shoppers’ expectations for future inflation charges (Show), which means that the statute of limitations on previous inflation charges could also be ending. More and more, it appears that evidently households are specializing in the speed of value adjustments primarily based on the “new regular” value degree.

A Clear Downward Development in Shoppers’ Inflation Expectations

One-12 months-Ahead Client Inflation Expectations (%)

Present evaluation doesn’t assure future outcomes.

Via January 19, 2024

Supply: LSEG Datastream and AllianceBernstein (AB)

Falling inflation expectations provide information that’s simply as optimistic as rising total shopper sentiment. That’s as a result of inflation expectations are usually self-reinforcing: precise future inflation is closely influenced by what people, companies and governments anticipate inflation to be, as a result of expectations information their financial selections.

How ought to we take into consideration all this? We’re clearly not fairly on the finish of the inflationary highway simply but. Nevertheless, current information counsel that our forecast that inflation will proceed falling via 2024 and into 2025 remains to be the most probably end result. If that state of affairs performs out, shoppers’ spirits might enhance additional, and the “vibe-cession” could also be on its approach out. That might be a superb factor for the US economic system.

The views expressed herein don’t represent analysis, funding recommendation or commerce suggestions and don’t essentially signify the views of all AB portfolio-management groups. Views are topic to revision over time.

Authentic Put up

Editor’s Be aware: The abstract bullets for this text have been chosen by In search of Alpha editors.

[ad_2]

Source link