[ad_1]

On the lookout for assist to undercover hidden gems? Look no additional than ProPicks.

This device could make discovering high-potential shares a breeze.

On this piece, we are going to focus on 4 shares which have caught ProPicks’ eye and are set to outperform going forward.

In 2024, make investments like the massive funds from the consolation of your own home with our AI-powered ProPicks inventory choice device. Study extra right here>>

Each investor goals of not simply getting cash on investments, but additionally being able to navigate the markets in a sound, balanced, and environment friendly approach.

Let me introduce you to the brand new InvestingPro device that would make that dream a risk – ProPicks. This progressive device uncovers hidden gems available in the market, enabling strategic and well-informed funding selections.

As you discover ProPicks, you’ll uncover six funding portfolios, every embodying a definite philosophy tailor-made to particular markets. Notably, month-to-month changes are made, signaling whether or not to promote one inventory and purchase one other.

These portfolios leverage synthetic intelligence, basic evaluation, and over 100 metrics to information selections on which shares to purchase or promote. Maybe most compellingly, they constantly outperform the markets by a big margin.

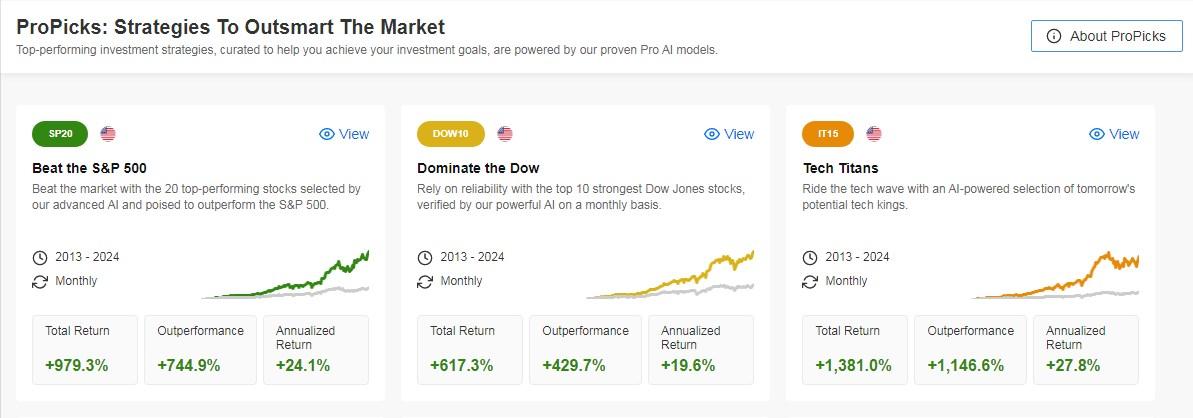

Listed here are a few of the methods obtainable on the platform together with the efficiency:

Supply: InvestingPro

Earlier than delving into the portfolio, it is important to grasp the Sharpe ratio, which calculates return as a perform of danger.

This ratio serves as a simple technique to evaluate funding portfolio efficiency. The correlation is obvious: the riskier the funding, the upper the anticipated return.

A better Sharpe ratio signifies more practical danger administration, with the portfolio return adequately compensating for the chance taken. Sharpe ratios surpassing 1 are thought of extremely favorable.

Now, let’s swiftly undergo every of them:

S&P 500 Portfolio:

It’s made up of 20 firms from the index.

Its Sharpe ratio is 1.04.

Its annualized return is +24.1%.

Dow Jones Portfolio:

Consists of 10 firms within the index.

Its Sharpe ratio is 1.07.

Its annualized return is +19.6%.

Expertise Portfolio:

Consists of 15 firms from the S&P 500 index.

Its Sharpe ratio is 0.96.

Its annualized return is +27.8%.

Undervalued Property Portfolio:

Consists of 20 firms within the S&P 500 index.

Its Sharpe ratio is 1.05.

Its annualized return is +22.9%.

Warren Buffett’s Better of Warren Buffett Portfolio:

It’s made up of 15 firms from the S&P 500 index, which can be the perfect shares in Buffett’s portfolio, and is analyzed and up to date each quarter.

Its Sharpe ratio is 0.81.

Its annualized return is +15.7%.

Mid-sized Inventory Portfolio:

Consists of 20 firms within the S&P 500 index.

Its Sharpe ratio is 0.76.

Its annualized return is +20.1%.

Now, let’s delve into the essence of the article and discover 4 intriguing shares unveiled by ProPicks.

These shares not solely caught the attention of ProPicks but additionally aligned with the market consensus. They kind an important part of the six portfolios mentioned above.

1. Ringcentral

Ringcentral (NYSE:) gives cloud communications, video conferencing, and software program options. The corporate was integrated in 1999 and is headquartered in Belmont, California.

On February 12 it presents its accounts and is anticipated to extend earnings per share (EPS) by +5.10% and by 2024 by +9.9% together with income development of +9.2%.

Ringcentral Upcoming Earnings

Supply: InvestingPro

It presents 27 scores, of which 14 are purchase, 13 are maintain and none are promote. InvestingPro fashions give it potential at $46.01.

Ringcentral Analyst Targets

Supply: InvestingPro

2. Caesars Leisure

Caesars Leisure (NASDAQ:) operates as a gaming and hospitality firm in america. The corporate owns, leases, and manages properties in 16 states. It was based in 1937 and is headquartered in Reno, Nevada.

It stories its numbers on February 20 and is anticipated to report earnings per share (EPS) development of +5.56%. For 2023, the anticipated improve within the EPS is +208.7%.

Caesars Leisure Upcoming Earnings

Supply: InvestingPro

It has 16 scores, of which 12 are purchase, 4 are maintain and none are promote. The market offers it a possible at $60.

Caesars Leisure Analyst Targets

Supply: InvestingPro

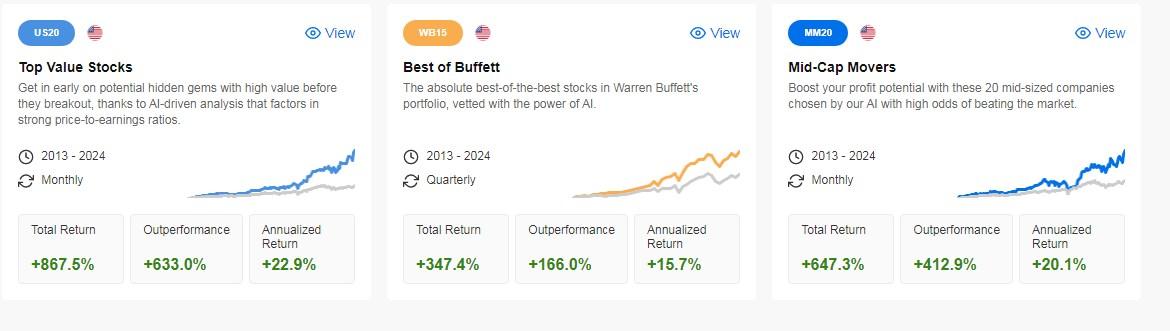

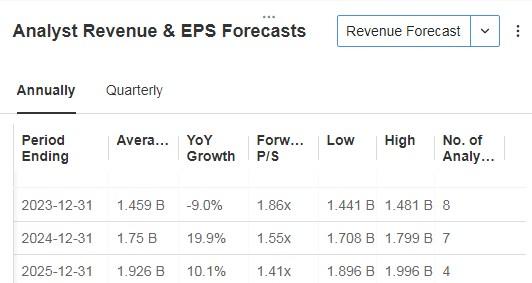

3. Fox Manufacturing facility Holding

Fox Manufacturing facility Holding (NASDAQ:) designs, manufactures and markets dynamic driving merchandise worldwide. The corporate was integrated in 2007 and is headquartered in Duluth, Georgia.

On February 22, we are going to know its earnings report. Waiting for 2024, earnings per share (EPS) are anticipated to extend by +12.9% and income by +19.9%.

Fox Manufacturing facility Holding Income and EPS Forecasts

Supply: InvestingPro

It presents 8 scores, of which 4 are purchase, 4 are maintain and none are promote. InvestingPro fashions give it potential at $87.95.

Fox Manufacturing facility Holding Analyst Targets

Supply: InvestingPro

4. Euronet Worldwide

Euronet Worldwide (NASDAQ:) offers transaction and fee processing and distribution options to monetary establishments, retailers, service suppliers, and particular person shoppers worldwide.

The corporate was previously often called Euronet Companies and adjusted its identify to Euronet Worldwide in August 2001. It was based in 1994 and is headquartered in Leawood, Kansas.

February 7 is the date once we will know its accounts. Earnings per share (EPS) are anticipated to extend by +10.75%. By 2024 the rise could be +13% and +8% by way of income.

Euronet Worldwide Upcoming Earnings

Supply: InvestingPro

It has 10 scores, of which 6 are purchase, 4 are maintain and none are promote.

Extra market gamers proceed so as to add that they like the corporate for this yr, the final one being Truist Securities that sees it at $115.

Supply: InvestingPro

InvestingPro fashions see extra potential, particularly at $129.15.

Euronet Worldwide Analyst Targets

Supply: InvestingPro

Wish to see all of the picks from our methods?

Subscribe right here for as much as 50% off as a part of our year-end sale and by no means miss a bull market once more!

*Readers of this text an additional 10% off our annual and 2-year Professional+ plans with codes PROTIPS2024 and PROTIPS20242. Restricted time supply – act now!

Declare Your Low cost Immediately!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or suggestion to take a position as such it’s not supposed to incentivize the acquisition of property in any approach. I wish to remind you that any sort of asset, is evaluated from a number of factors of view and is very dangerous subsequently, any funding choice and the related danger stays with the investor.

[ad_2]

Source link