[ad_1]

Hispanolistic

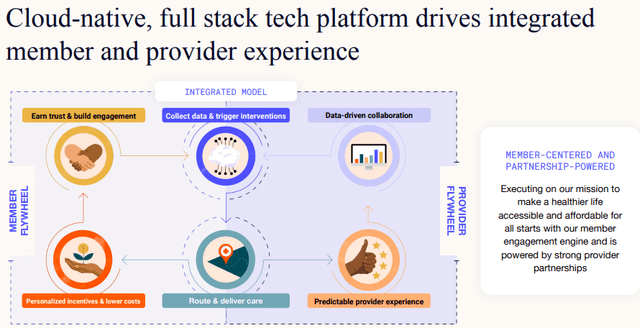

Oscar Well being (NYSE:OSCR) provides an revolutionary healthcare insurance coverage platform that performs into {industry} tendencies like consumerization, digitization, and value-based care.

It makes use of AI and large information to allow members to navigate via the Byzantine world of US healthcare, matching plans to particular person conditions. It provides a bunch of companies like, from Investopedia:

These plans supply entry to free doctor-on-call companies, free care crew companies, 24/7 entry to a supplier, and no referral requirement to see specialists, so long as they’re in-network… Oscar’s members even obtain money incentives (as much as $100 per 12 months) for maintaining with their each day step rely, because the app can hyperlink as much as many sensible pedometers and watches.

The platform makes use of AI and Care Groups to information members to probably the most acceptable caregivers primarily based on private conditions and is pushed by subtle price and high quality algorithms.

The information generated additional enhances the algorithms reinforcing the cycle of belief by growing the standard of care and decreasing price, in addition to member belief.

OSCR IR presentation

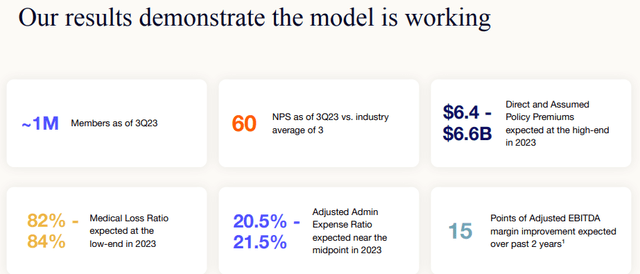

These are all good phrases and intentions, however does it work? There are indications:

OSCR IR presentation

Till lately, this mannequin was profitable in quickly growing its membership however that development has stalled because of ‘portfolio sculpting’ efforts (focusing extra on these actions that generate excessive returns) which made the corporate even go away complete states (like Florida, albeit short-term, and California).

So quickly gaining membership is not an indication of a customer-friendly enterprise mannequin anymore, however an industry-leading NPS (Internet Promotor Rating) rating elevated to 60 the place opponents scored properly under that, no less than a 12 months in the past.

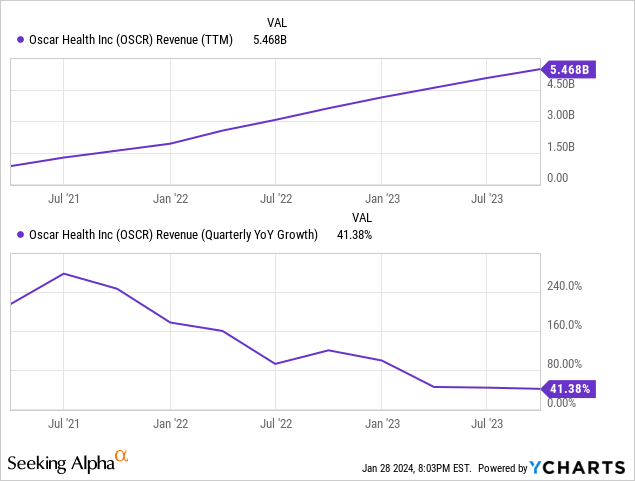

Nonetheless, they will develop even with out including new members. The expansion fee might need come down fairly a bit to ‘simply’ 41.3%, but it surely’s nonetheless very sturdy:

Nonetheless, as we’ll argue under, the primary drivers of that development (decreasing ceding premiums to reinsurance and danger changes) in addition to the effectivity enhancements are working into diminishing returns.

That’s, so as to carry on rising the corporate has to revive membership development to maintain the expansion going. It is a little arduous to foretell given the shifting state-level economics which led the corporate to even droop new members in states like Florida and California.

However administration believes they will broaden membership once more and one has to admire the flexibleness within the firm’s enterprise mannequin that enabled robust momentum even in occasions of stagnating membership.

Development drivers

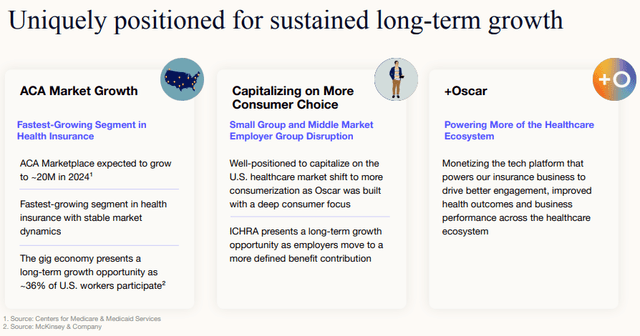

OSCR IR presentation

ACA development Member development Increasing in current markets and/or getting into new markets New packages Direct and assumed premiums

The corporate is current in 18 states, two fewer than a 12 months in the past so it is not increasing to new states in the meanwhile. It introduced its FY24 enlargement plan in a PR in October 2023. It does plan to extend its footprint in current states (PR):

Beginning in 2024, Oscar can have a footprint in 18 states and 512 counties and broaden its presence in Arizona, Florida, Georgia, Illinois, Iowa, Kansas, Missouri, North Carolina, Ohio, Oklahoma, Tennessee, Texas, and Virginia. The enlargement will enhance entry to care in underserved and rural markets via Oscar’s consumer-focused expertise platform.

There are different new initiatives like

Its Spanish-speaking program HolaOscar, representing a rising a part of the ACA. They may even introduce new particular person and household plans in 2024 just like the lately launched Breathe Simple program for members affected by COPD and bronchial asthma and an enhanced Diabetes plan.

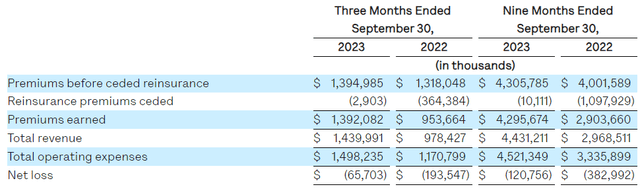

Premium development is pushed by retention, new members, and premium will increase, and these produced a 5% decline in Q3 to $1.6B. The decline was attributable to a discount in membership that was solely partially offset by increased premiums (earnings PR):

Premiums earned within the quarter have been up 46% YoY, pushed primarily by the influence of deposit accounting for quota share reinsurance agreements, and decrease danger switch per member as a % of premiums.

Quota share is an association between an insurer and a reinsurer. The accounting generally is a little advanced but it surely does not alter the fundamental fundamentals.

Nonetheless, the corporate historically has a more healthy and youthful membership (as these are extra web savvy) than the market common which obliged them to make substantial funds into the danger adjustment program.

Nonetheless, this danger adjustment is declining as their members transfer in the direction of the typical ACA inhabitants profile (Q3CC):

our premiums earlier than ceded reinsurance, which incorporates the influence of our decrease danger adjustment switch grew 6% year-over-year to $1.4 billion.

Oscar additionally acknowledged a $27M in danger adjustment profit associated to 2023 as their danger strikes in the direction of the typical ACA and so they anticipate decrease danger switch going ahead.

Nonetheless, nearly all income development merely got here from holding extra insurance policies on the books, fairly than ceding them to reinsurance corporations:

OSCR earnings PR

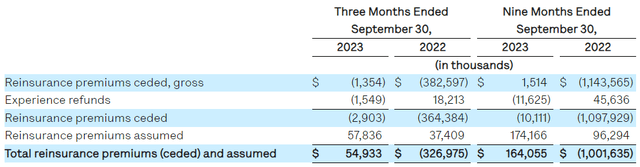

Virtually all income development comes from ceding nearly no insurance policies to reinsurance, simply $2.9M value, whereas this was $364M in Q3/22 with the nine-month decline much more dramatic. In actual fact, fairly than ceding insurance policies to reinsurance corporations, the corporate shifted to net-assuming insurance policies from reinsurance corporations:

OSCR earnings PR

+Oscar

+Oscar is the enterprise line the place they monetize their expertise platform to healthcare suppliers and payers, or no less than some modules, most notably the Marketing campaign Builder (10-Okay):

Marketing campaign Builder is an engagement and automation platform that permits scalable, customized interventions and automates workflows, designed to drive development, ship best-in-class medical outcomes, and optimize administrative operations.

It already has two clients (one is Cigna) serving 500K individuals and added a 3rd in Q3 within the type of Stanford Well being Plan. The corporate can also be constructing extra OpenAI options into +Oscar (in addition to their insurance coverage enterprise).

Financials

OSCR IR presentation

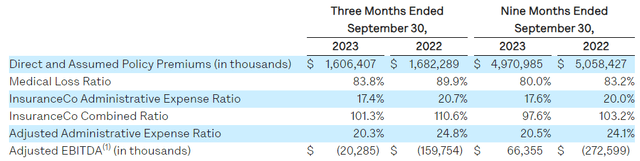

Two related ratios are capturing the effectivity of the corporate

MLR or Medical Loss Ratio (the share of complete well being care premiums spent on medical claims and efforts to enhance the standard of care). The MLR has to remain above 80% for the ACA. The AER or Administrative Expense Ratio.

Each ratios are bettering, the MLR improved 610bp to 83.3% y/y (Q3CC):

resulting from our disciplined pricing actions and complete price of care initiatives

The AER improved 330bp y/y to 17.4% (Q3CC):

pushed by decrease danger switch per member as a % of premiums and distribution optimization.

That is a mixed enchancment of 935bp in Q3 (and 560bp for YTD). There’s a additional increase from the curiosity ($44M in Q3) they make on their $2.6B money reserves, which they stored principally in short-term devices to benefit from the rising fee surroundings.

The reserves have been fairly a bit increased 1 / 4 in the past as they paid their annual danger adjustment switch in Q3.

No surprise AEBITDA retains on bettering in a reasonably complete trend:

The corporate was capable of improve AEBITDA margin by a mean of 800bp per 12 months during the last three years, there may be appreciable working leverage even within the absence of member development. Q3 AEBITDA improved by $140M to a lack of simply $20M for the insurance coverage firm, and for the general firm, there was a $340M enchancment to an AEBITDA revenue of $66M.

Nonetheless, take into account the next:

OSCR earnings PR

The MLR for YTD is already on the minimal required 80%, that’s, additional enhancements aren’t attainable (and unlikely anyway as an enormous a part of the development is supplied by fewer danger adjustment funds, with Oscar’s inhabitants profile approaching the typical for the ACA, additional features are tougher).

Steering

From the earnings PR:

Direct and Assumed Coverage premiums on the excessive finish of the $6.4 billion – $6.6 billion vary Medical Loss Ratio on the low finish of the 82% – 84% vary InsuranceCo Administrative Expense Ratio close to the midpoint of the 17% – 18% vary InsuranceCo Adjusted EBITDA(1) of $155 million – $165 million, above the high-end of the prior vary of $20 million – $120 million Adjusted Administrative Expense Ratio close to the midpoint of the 20.5% – 21.5% vary Adjusted EBITDA(1) lack of ($60) million – ($50) million, above the high-end of the prior vary of ($175) million – ($75) million

Valuation

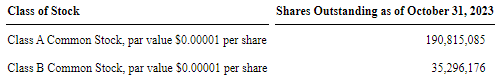

From the 10-Q:

OSCR 10-Q

In regards to the latter one ought to notice (10-Q):

Our Class B widespread inventory has 20 votes per share, and our Class A typical inventory has one vote per share. As of September 30, 2023, the holders of our excellent Class B widespread inventory, which encompass Thrive Capital and our Co-Founders, beneficially personal 21.3% of our excellent capital inventory and maintain 81.8% of the voting energy of our excellent capital inventory (assuming the train of all choices to amass shares of Class B widespread inventory and the conversion of the 2031 Notes, in every case which are beneficially owned as of September 30, 2023).

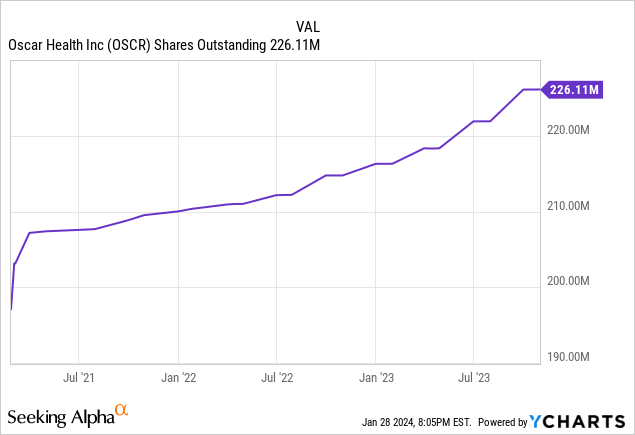

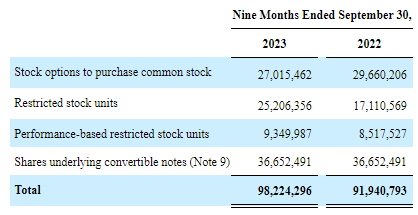

There may be extra dilution on the best way, from the 10-Q:

OSCR 10-Q

So absolutely diluted there are 324.3M shares excellent, producing a market cap of $3.89B (at $11 per share) and an EV of simply $1B. We hesitate to base valuation on the EV because the $2.6M money and funding stability is essentially there to underpin claims.

Primarily based on anticipated FY23 income of $5.9B the shares appear low cost to us with a P/S of 0.66x even when the corporate nonetheless produces losses, and insiders appear to agree as they purchased 5M shares from a promoting holder.

One factor to remember is that there are numerous transferring elements having an influence on firm development and financials and these can transfer in sudden methods.

Conclusion

The outcomes that Oscar Well being continues to generate are spectacular; nonetheless, we expect that three of the drivers of income development and working leverage this 12 months are dealing with diminishing returns with considered one of these (insurance policies ceded) already at zero:

Virtually all income development comes from a dramatic decline within the ceding to reinsurance corporations, since these declined to nearly zero this could’t increase development going ahead. Whereas the development in AEBITDA continues to impress, we’re uncertain concerning the mileage left, particularly in bettering the MLR, given the truth that by regulation it can not fall below 80%. Economies of scale and the growing use of AI would possibly very properly proceed to supply working leverage, however maybe to not the extent traders have develop into accustomed to. Threat adjustment is one other issue the place declining marginal returns have set in.

So mainly, to proceed to develop the corporate must broaden its members, which has been stagnating for a 12 months. Administration expects member development within the excessive teenagers and premium development within the low 20s.

If they will ship on that (and up to date insider buys recommend administration has appreciable confidence in these forecasts) it will nonetheless produce enticing development (albeit not the 50% development the corporate has been producing this 12 months).

However they gave only a few particulars about how one can obtain that, other than their enlargement to rural areas in states the place they have already got a presence. We assume that should not be too arduous and given the enticing worth proposition to clients and the all-digital and consumer-centric benefits of their enterprise mannequin in a rural setting we assume they will obtain this.

There may be additionally more likely to be additional working leverage left, principally from platform scale economics and using AI, which they’re adopting with appreciable gusto, however diminishing returns are more likely to have set in regarding the AER and particularly the MLR enhancements.

So we expect there are causes for optimism and provided that the shares aren’t costly we expect they will nonetheless be purchased below $11 so long as traders remember that issues can change shortly for the corporate though they’ve a powerful monitor file of manufacturing enhancements regardless of circumstances.

[ad_2]

Source link