[ad_1]

Africa’s monetary panorama is advanced, comprising a variety of financial components. To raised grasp this panorama, GeoPoll carried out a speedy survey of Ghanaians’ and Kenyans’ borrowing habits and debt dynamics.

In this report, we’ll share the insights we’ve gained from the research carried out in January 2024 within the two nations, providing a glimpse into Africans’ monetary behaviour concerning loans and debt.

The survey addressed a number of urgent matters, together with:

Present monetary scenario

Family revenue

Financial training and literacy

Common lenders

Challenges skilled whereas accessing loans/credit score

Mortgage compensation

Strategies used to handle and scale back money owed

Present monetary scenario

In October 2022 GeoPoll surveyed Latin America and the Caribbean, Africa, the Center East, and Asia on the World Price of Dwelling Disaster. A part of the findings indicated that rising costs have impacted virtually everybody. 75% say costs have “elevated lots,” decreasing their household’s lifestyle.

Two years on, the identical sentiments persists when people have been questioned about their present monetary standing. The biggest phase, comprising 37.87% of respondents, characterised their scenario as neither good nor dangerous. Subsequently, 22.26% reported their monetary situation as dangerous, whereas an in depth 21.37% expressed a constructive outlook, saying it was good. Notably, 10.63% conveyed that their monetary scenario was horrible.

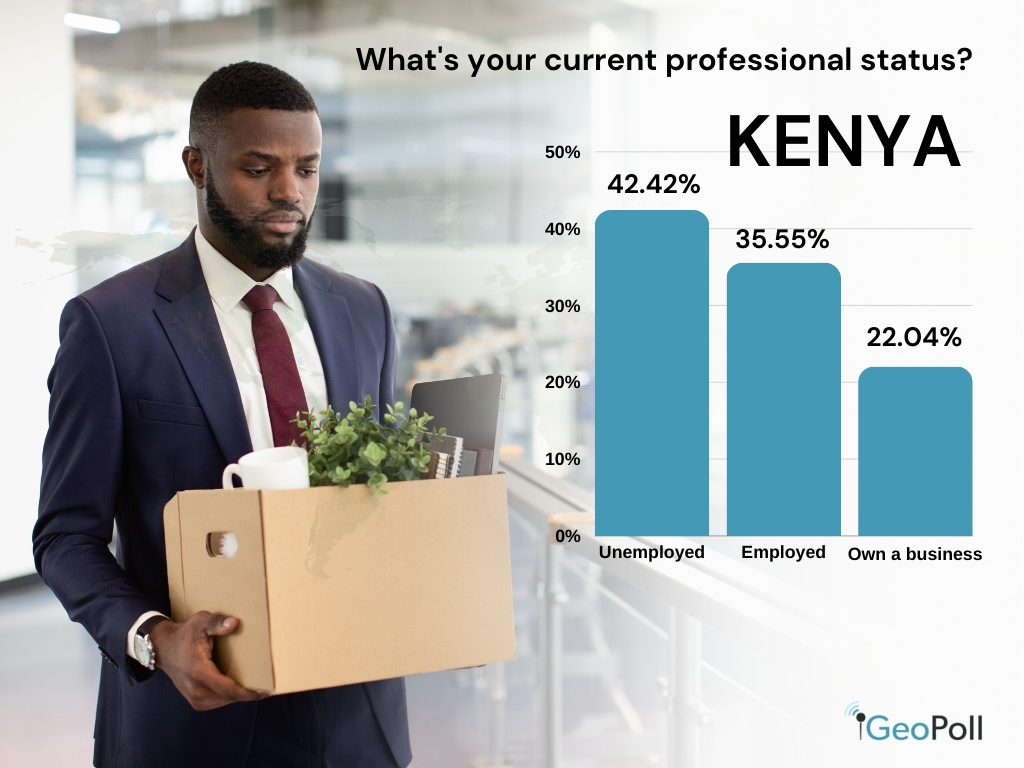

Employment Price

In keeping with Statista, the unemployment price in Africa is predicted to succeed in seven % in 2024. Within the interval underneath evaluate, unemployment within the continent peaked at 7.2% in 2021. Unemployment ranges diverse considerably throughout African nations. South Africa was estimated to register the best price in 2024.

In Kenya, our survey findings point out that 42.42% of the respondents are unemployed, 35.55% are employed, and 22.04% personal their very own companies. Ghana stands out with a extra favorable employment state of affairs, with 50.22% stating they’re employed, 40.61% are unemployed, and 9.17% personal a enterprise.

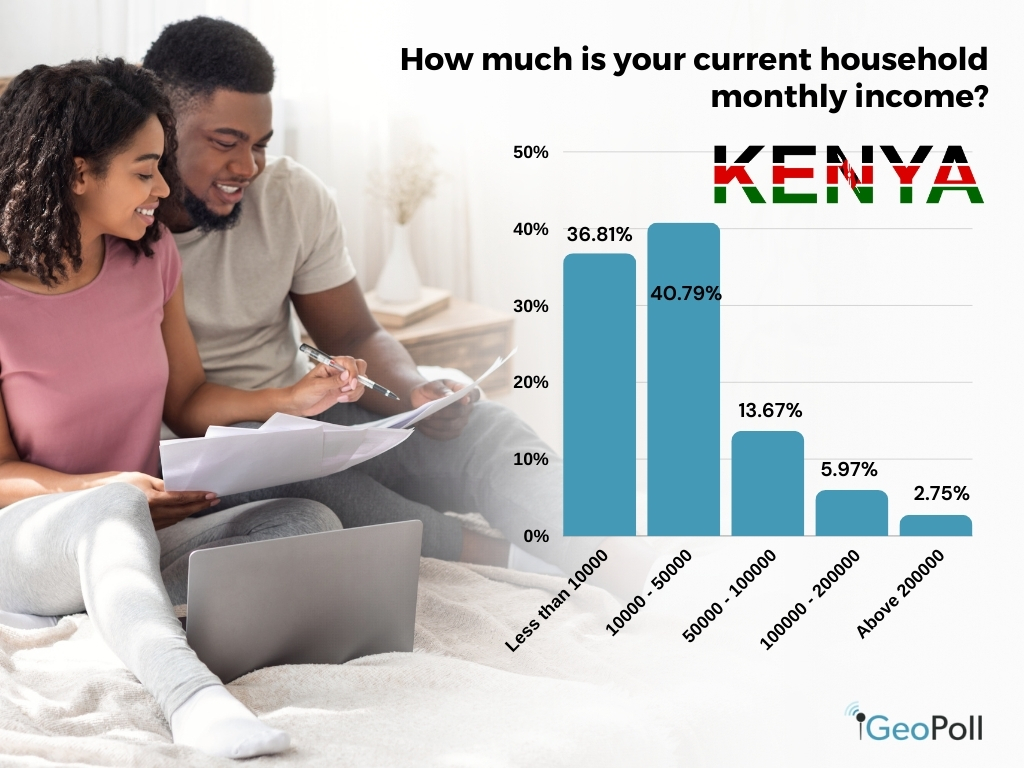

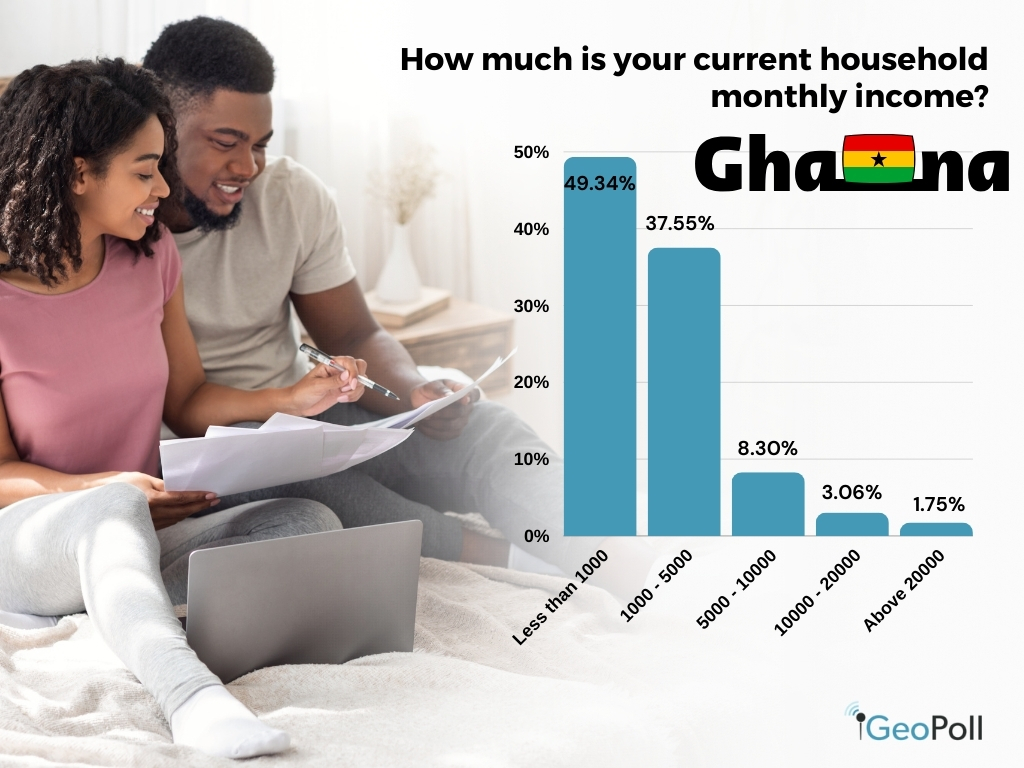

Family Earnings

In keeping with the World Financial institution virtually 700 million folks around the globe reside as we speak in excessive poverty – they subsist on lower than $2.15 per day, the acute poverty line. Simply over half of those folks reside in Sub-Saharan Africa.

A important proportion of respondents in Kenya, totaling 40.79%, obtain a month-to-month revenue throughout the vary of Kes. 10,000 ($61) to Kes. 50,000 ($305). Shut behind, 36.81% earn lower than Kes. 10,000 ($61). Moreover, 13.67% report earnings between Kes. 50,000 ($305) and Kes. 100,000 ($610), whereas 5.97% fall into the revenue bracket of Ke. 100,000 ($610) to Kes. 200,000 ($1,219). Lastly, a modest 2.75% signifies incomes greater than Kes. 200,000 ($1,219).

A definite pattern emerges in Ghana, the place 49.34% of respondents earn a month-to-month wage of 1000 Ghana Cedis ($80). Following intently, 37.55% fall into the revenue vary of 10,000 Cedis ($800) to 50,000 Cedis ($4,000), with a mere 1.75% indicating an revenue exceeding 20,000 Cedis ($1,600).

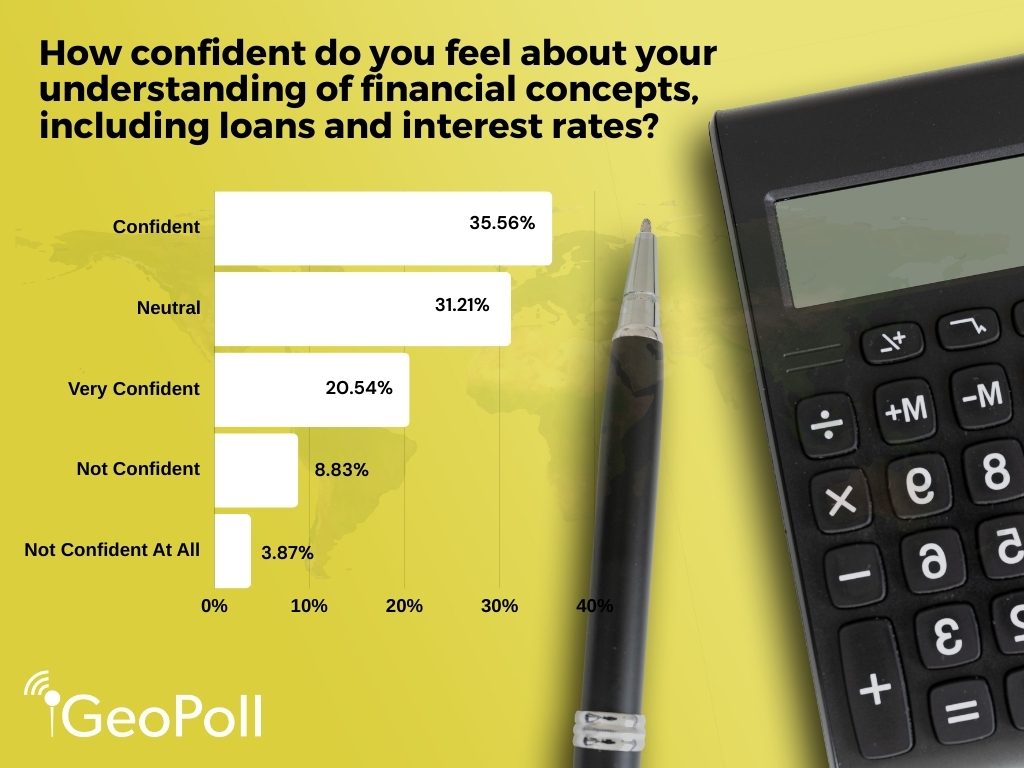

Monetary Information

When requested how assured they really feel about their understanding of monetary ideas, together with loans and rates of interest, the bulk, comprising 35.56%, expressed confidence of their monetary literacy. One other 31.21% really feel impartial, whereas 20.54% convey excessive belief. Apparently, 12.7% acknowledge a insecurity of their monetary data.

Borrowing Patterns Throughout Areas

Respondents from the 2 nations exhibited distinct borrowing patterns. A major 80.24% have beforehand borrowed loans or incurred debt, whereas 19.76% have by no means sought a mortgage or debt.

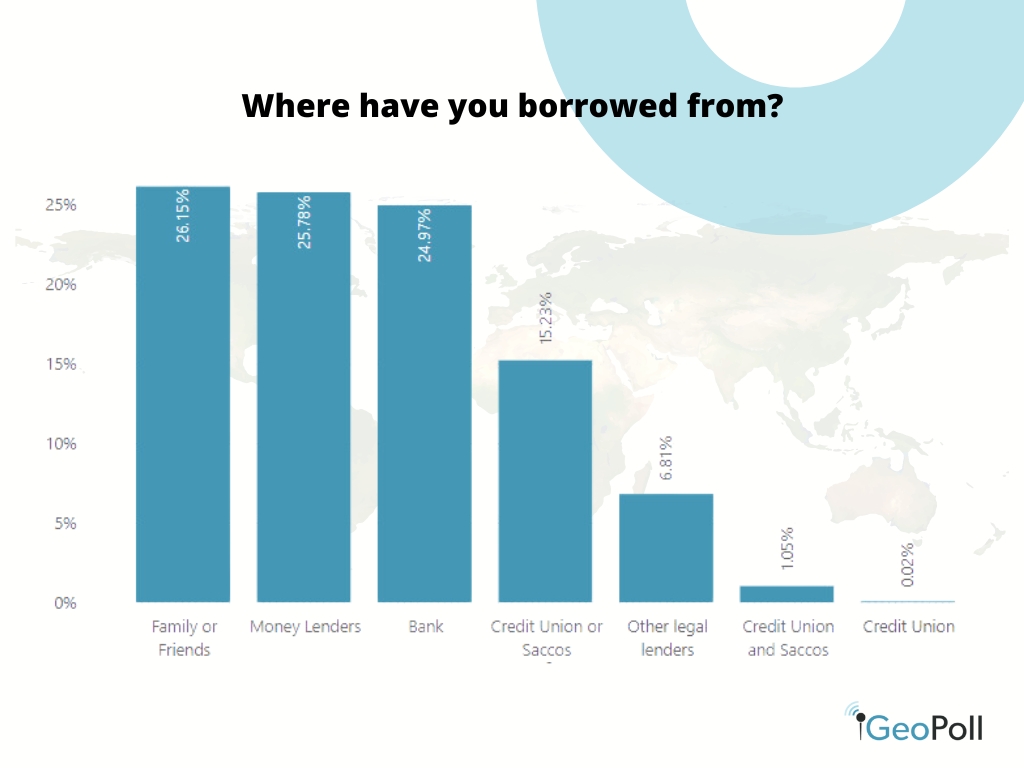

We delved into discovering the first selections utilized by folks to borrow. Household or Buddies emerged as probably the most favored possibility, with 26.15%, intently adopted by cash lenders at 25.78%. Moreover, 24.97% favor conventional banks, 16.28% go for credit score unions or SACCOS, and 6.81% lean in direction of different authorized means.

Accessing of loans/credit score

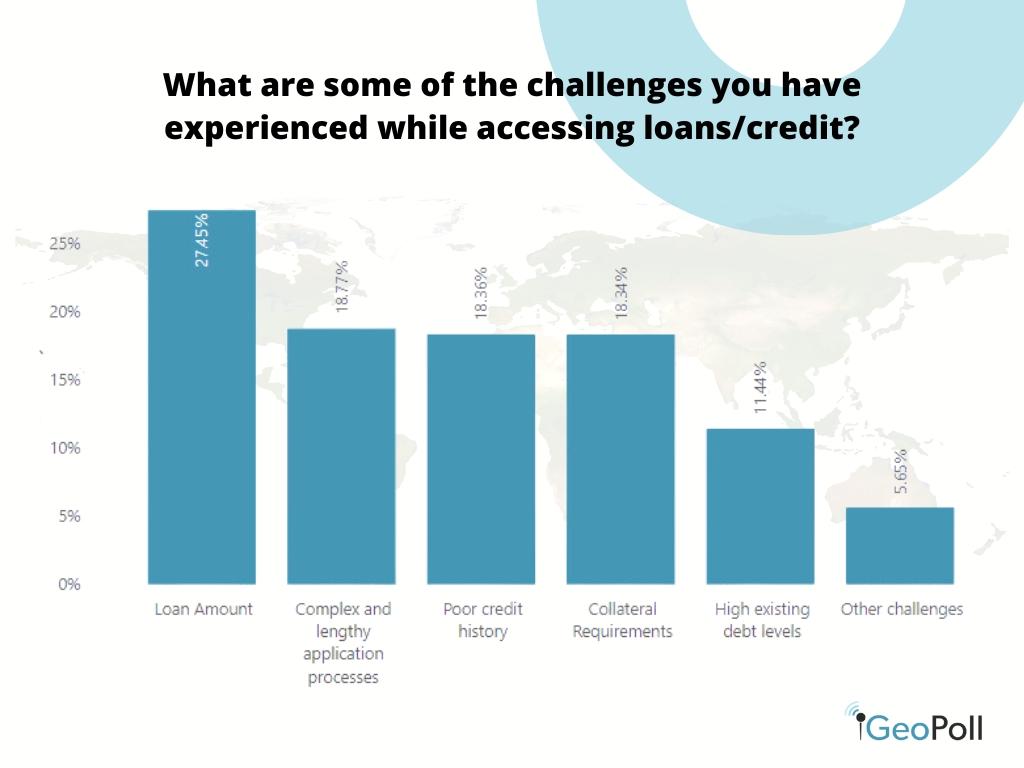

With a major majority, 77.16%, expressing challenges in accessing loans, we delved into the explanations behind these difficulties. Among the many respondents, 27.45% attributed their challenges to insufficient mortgage quantities, 18.77% lamented the prolonged and difficult utility course of, and 18.36% cited a poor credit score historical past for mortgage denials. Collateral necessities have been recognized by 18.34% as a hindrance, and 11.44% pointed to their excessive debt ranges as contributing to their mortgage entry challenges.

Use of Loans

The survey highlighted the various functions for which Africans search loans. Training is the predominant goal, with 40.17% using loans to help their research. Medical wants comply with intently at 20.59%, whereas 17.53% safe loans for house or mortgage functions. One other 12.05% search monetary help for private pursuits, 4.87% for leisure functions, and, lastly, 4.80% particularly for auto or automotive loans.

Debt Administration

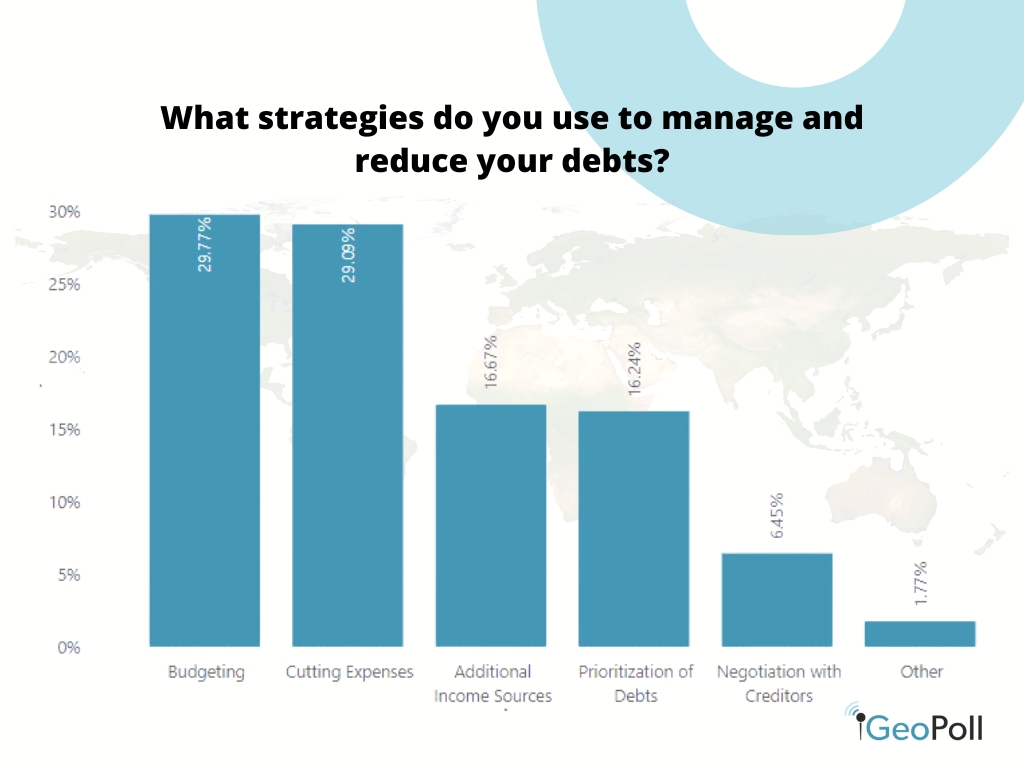

With 81.12% of respondents acknowledging challenges in repaying loans or money owed, we additionally explored the methods employed by people to handle or alleviate their monetary burdens. Notably, 29.77% of respondents undertake budgeting as a way of debt administration, whereas 29.09% decide to scale back their bills. Moreover, 16.67% search to reinforce their revenue by exploring further sources, 16.24% prioritize their money owed, and 6.45% negotiate with lenders or collectors.

What’s subsequent?

As we embark on the brand new yr, monetary issues take centre stage for a lot of people as they strategize round their objectives and aspirations. In keeping with The Ascent, 82% of millennials and 74% of Gen Zers intend to determine monetary objectives for the approaching yr, surpassing the figures for Gen Xers at 69% and child boomers at 49%.

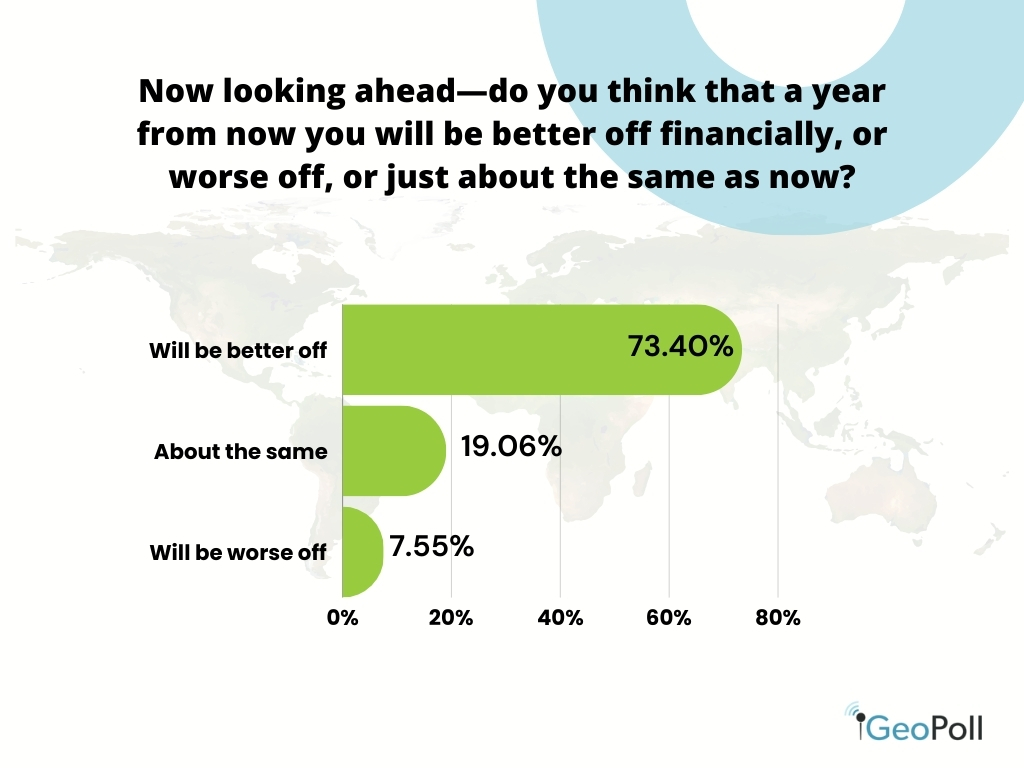

When questioned about their monetary outlook for the brand new yr, a major majority, 73.40%, specific optimism that their monetary scenario will enhance, in the meantime, 19.06% anticipate their monetary standing to stay unchanged, and seven.55% assume they are going to be worse off.

Methodology/About this Survey

This Unique Dipstick Survey was run through the GeoPoll cell utility in January 2024 in Ghana and Kenya. The pattern measurement was 3,290, composed of random customers between ages 18 and 60. Being an app survey, the pattern was skewed in direction of youthful age teams, males, and concrete dwellers.

To get extra particulars about unique GeoPoll surveys or to conduct a scientific research on funds or different matters in Africa, Asia, and Latin America, please contact us.

[ad_2]

Source link