[ad_1]

Oscar Wong/Second by way of Getty Pictures

Funding Thesis

Snowflake (NYSE:SNOW) is a globally famend knowledge expertise firm whose knowledge transactions and administration platform may be very common amongst prospects who’ve something to do with knowledge, particularly massive enterprises. The corporate’s inventory is additionally generally held amongst many institutional shoppers, comparable to Berkshire Holdings and Bridgewater Associates.

Over the previous 3 months, Snowflake has loved a terrific run, rising virtually 60% from November since a reacceleration in cloud spending forecasts turned across the progress prospects of many expertise corporations. On the again of such an enormous rally, I imagine valuations are stretched and premiums have expanded exuberantly, with traders being too optimistic about Snowflake’s earnings. I fee this inventory as a maintain for now and have defined my reasoning beneath.

Snowflake’s subsequent chapter of the information platform progress

Snowflake was considered one of the primary corporations to supply database-as-a-service (DBaaS), a cloud-based trade that was fairly nascent within the final ten years however has exponentially grown since then. On this interval, Snowflake and different standalone knowledge platform corporations comparable to MongoDB (MDB) and Databricks disrupted the legacy database market that was historically on-premise.

Snowflake rapidly pivoted from its on-premise providing to a hybrid cloud product suite, permitting enterprise customers to securely join, question, and transact with their very own enterprise knowledge in Snowflake’s cloud. The convenience of use and fast growth of functionalities made the corporate’s knowledge merchandise extraordinarily common, which led to Snowflake’s meteoric progress.

Nonetheless, with automation and AI now taking heart stage, each firm on this planet has reviewed its long-term technique to remain related in a brand new world. Snowflake seems to be swaying towards rising the modalities of accessing knowledge on its platform, with progress pillars I’ll talk about later.

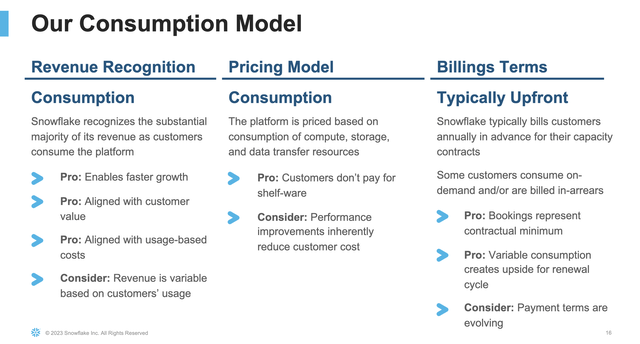

Permitting customers completely different modes to entry knowledge might be a genius transfer by the corporate whereas staying related within the age of AI, particularly as a result of the corporate makes use of a consumption-based income mannequin that awards prospects credit per future use. This seems to be the brand new mannequin shifting ahead that almost all AI corporations have adopted, together with ChatGPT, and so on.

Snowflake’s consumption-pricing technique, Q3-FY24 investor presentation

Rising modalities of information entry improve consumption and income progress charges

I discussed earlier how Snowflake is rising the modalities of person entry to its knowledge with the objective of driving up knowledge consumption. This technique might be accretive to Snowflake’s future progress mannequin, provided that increased consumption results in increased consumption charges, resulting in stronger product income progress. One other manner that Snowflake additionally earns income is thru seat growth. For each new person that an enterprise provides, Snowflake fees a charge and awards platform credit to the seat or new person for capped future use.

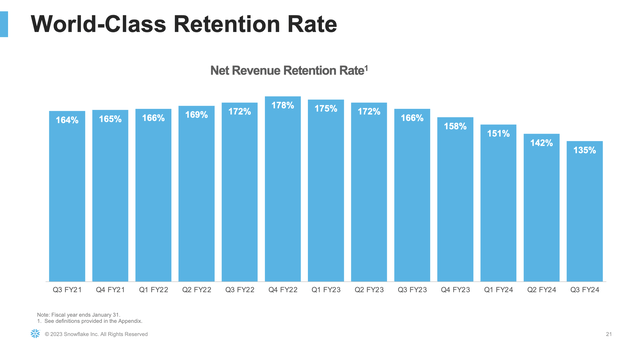

Up to now, the corporate has been very profitable in quickly penetrating an oversaturated on-premise database market whose disruption was overdue. Due to this fact, it made sense to me {that a} majority of Snowflake’s prospects, whom the corporate had acquired in the previous few years, can be centered on simply migration workloads, i.e., migrating knowledge from their outdated database methods, comparable to Teradata or Oracle, to Snowflake. However I think Snowflake had lengthy deliberate for this second the place platform spending would flatline or, worse, decline. So the corporate labored in direction of constructing extra options and functionalities for its prospects to do extra with their knowledge than simply migrate and transact with it. These traits may be seen within the dollar-based Web Retention Charges (NRR) that are nonetheless one of many strongest NRR traits seen in expertise corporations.

Q3-FY24 investor presentation

Whereas the final development in Snowflake’s NRR is decelerating, its final identified NRR of 135% continues to be one of many strongest within the expertise trade, displaying prospects are spending greater than they did vs. the identical interval final yr, simply not as strongly as they did earlier. One other high-growth expertise inventory, Datadog, final reported its NRR at ~120%.

Though inflation and excessive rates of interest have positively dampened the expansion charges for all the expertise trade, I imagine the surge of AI and ML enterprise adoption has compelled Snowflake to fast-forward its product roadmap or threat a de-rating. In spite of everything, for Snowflake to commerce at ~205 occasions this yr’s ahead consensus EPS estimates or 138 occasions subsequent yr’s ahead EPS estimates is just not low cost, for my part.

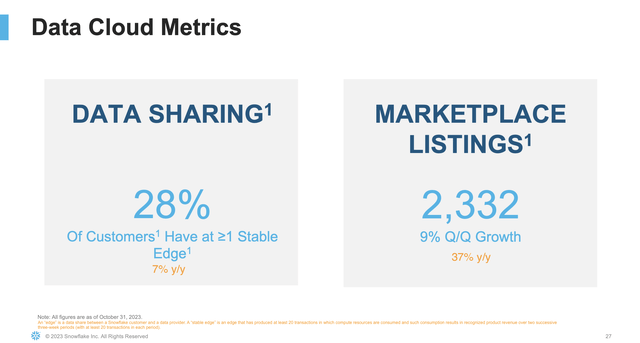

Due to this fact, Snowflake has launched into a few progress pillars within the post-AI period to permit prospects to do extra with their knowledge and to spur adoption, consumption, and ultimately income. In June 2022, Snowflake launched Snowpark, which allowed builders to unlock the ability of their enterprise knowledge utilizing acquainted programming languages comparable to Python along with the common SQL-data language. As well as, Snowflake additionally added knowledge sharing options, which look like an rising section inside the DBaaS market, as per Gartner. Information sharing permits house owners of information on Snowflake’s platform to securely, lawfully, and safely promote extremely anonymized knowledge to prospects on the Snowflake community. Snowflake’s direct competitor, Databricks, has already moved rapidly to launch its personal data-sharing providers. However Snowflake has wasted no time and is shifting to kind partnerships, most not too long ago with Salesforce, to launch knowledge sharing options utilizing anonymized Salesforce knowledge. I’ve hooked up a modified screenshot from Snowflake’s presentation, the place I’ve additionally added y/y numbers beneath for Snowflake’s Information Sharing and Market listings.

Q3-FY24 investor presentation

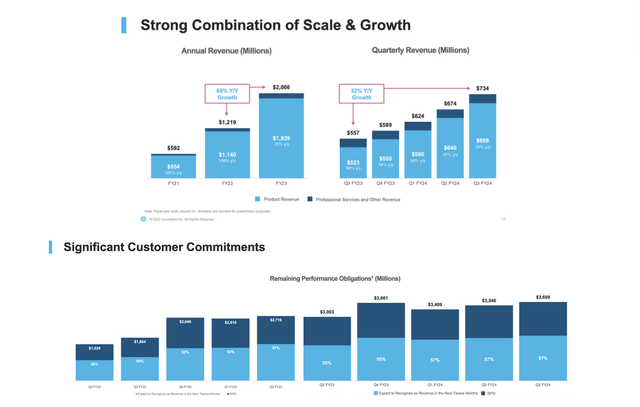

Furthermore, the corporate seems to be doubling down on its technique to launch knowledge sharing by buying a younger startup, Samooha, that operates within the knowledge sharing area. Up to now, these methods have probably not moved the needle on re-accelerating progress in Snowflake’s income traits, as seen beneath. Worse, its Remaining Efficiency Obligations have flatlined for a lot of months now, which is an indication that prospects is probably not spending extra on the platform in, roughly, the subsequent twelve months or so. I anticipate the corporate to replace its outlook for traders within the full-year FY24 name when Snowflake experiences later this month, on February 28.

Q3-FY24 investor presentation

Valuation suggests Snowflake is richly valued

Utilizing Snowflake’s long-term working mannequin, I estimate that Snowflake will develop its income at a CAGR of 24% to succeed in its FY29 income goal of $10 billion. That is additionally primarily based on Snowflake’s personal ahead estimates of their FY24 steerage, as reported of their Q3 FY24 earnings presentation. Nonetheless, in my opinion, the actual menace of their steerage lies of their non-GAAP working margin estimates, that are projected to develop from 7% in FY24 to ~25% in FY29. Per my calculations, non-GAAP working earnings must be rising at a CAGR of an infinite 54% over the subsequent 5 years. These sorts of ahead progress charges are very spectacular, provided that the long-term earnings progress fee for the S&P 500 is 8%.

After making use of a reduction fee of 8% on future earnings and utilizing their present share depend, I arrive at a ahead estimated share value of $230, assuming a ahead PE of 45. I feel a ahead PE of 45 is truthful given the spectacular progress charges that Snowflake wants to keep up. Nonetheless, it seems traders have already priced in all the firm’s future progress, since Snowflake is at the moment buying and selling at its truthful worth.

Dangers & Different Elements to contemplate

With no different talking engagements from Snowflake’s administration scheduled for the subsequent two weeks, it seems traders should look ahead to extra official steerage and outlook within the earnings name on the finish of the month. I will probably be keenly searching for any extra data from administration about adoption charges and traits of their Snowpark and data-sharing merchandise. I may also be rigorously listening for administration’s views on the broader macro outlook by way of the financial system in addition to inside tech enterprise spending. In November final yr, Gartner projected cloud spending to rise ~20% y/y this yr, which is barely increased than the FY23 17.8% progress in projected cloud spending.

Conclusion

Snowflake has been capable of journey the unprecedented AI hype cycle since November final yr, however I feel the rally to present ranges has left no room for any additional upside and makes the corporate weak to a selloff since it’s richly valued. There isn’t a doubt in regards to the reputation of Snowflake’s merchandise or about Snowflake’s wonderful administration, which has a wealthy historical past of driving high-performance groups up to now, however valuation stays an enormous query right here as issues at the moment stand. I fee Snowflake as a HOLD.

[ad_2]

Source link