[ad_1]

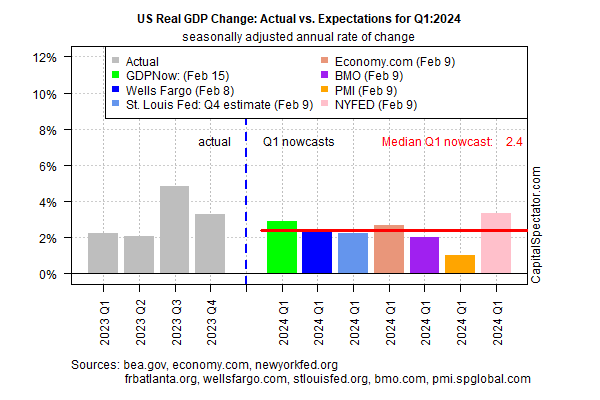

Development stays on monitor to melt within the first quarter, based mostly on the median nowcast for a set of estimates compiled by CapitalSpectator.com.

Though recession threat remains to be low, output seems set to downshift for a second straight quarter.

Q1 progress is presently projected to rise 2.4% (seasonally adjusted annual charge), by way of at present’s median estimate.

The nowcast compares contrasts with This autumn’s sturdy 3.3% rise, which marks a downshift from Q3’s red-hot 4.9% improve, in accordance with information revealed by the Bureau of Financial Evaluation.

US Actual GDP Change

Though Q1 output nonetheless seems headed for a softer run, the specter of financial contraction stays low for the rapid future, based mostly on a number of indicators.

For starters, observe that at present’s nowcast for the primary quarter marks a decide up from the .

Extra causes for anticipating that progress will persist embody the Philly Fed’s ADS Index, which reveals US financial exercise increasing at simply barely beneath common by way of Feb. 9.

In the meantime, the Dallas Fed’s Weekly Financial Index by way of Feb. 9 continues to indicate a pick-up in financial exercise relative to final spring, when many economists mistakenly anticipated a recession was close to.

On each counts, the newest numbers point out low recession threat.

Yesterday’s weaker-than-expected report for January triggered new warnings from some analysts that the US outlook is deteriorating.

However by some accounts, there’s nonetheless no smoking gun for deciding that the financial enlargement has run its course.

“It’s a weak report, however not a elementary shift in client spending,” says Robert Frick, company economist for Navy Federal Credit score Union.

“December was excessive because of vacation purchasing, and January noticed drops in these spending classes, plus frigid climate plus an unfavorable seasonal adjustment.

Client spending seemingly received’t be nice this 12 months, however with actual wage positive aspects and growing employment it must be a lot to assist preserve the financial system increasing.”

The same view prevails at Wells Fargo:

“At the same time as we anticipate spending will reasonable this 12 months, the January slowdown could overstate the near-term pullback in consumption,” economists on the agency write.

“Households have benefited from an actual earnings tailwind over the previous 12 months as inflation is slowing greater than wage progress.

Whereas the distinctive elements of extra liquidity and quick access to low-cost credit score are tales of the previous within the story of consumption, a still-sturdy labor market ought to result in solely a gradual moderation, somewhat than collapse in spending this 12 months.”

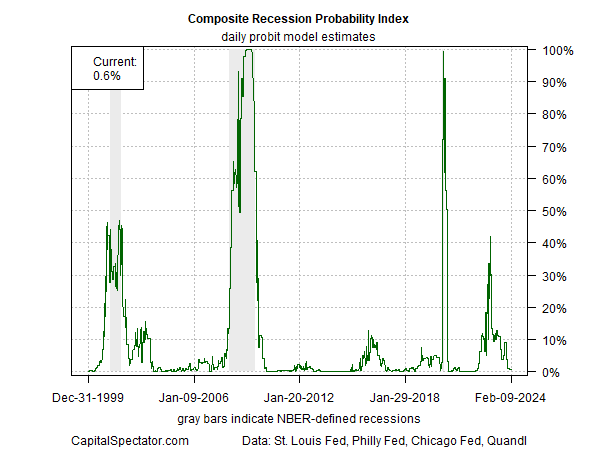

In the meantime, the latest recession threat estimate revealed by The US Enterprise Cycle Danger Report (a sister publication of CapitalSpectator.com) stays low, based mostly on information by way of Feb. 9.

CRPI Every day Probit Mannequin

When the Composite Recession Likelihood Index (CRPI), which aggregates alerts from a number of enterprise cycle benchmarks, rises considerably from present ranges it would point out elevated threat that an NBRE-defined contraction is brewing.

For now, nevertheless, the potential for a extreme slowdown in financial exercise seems low.

[ad_2]

Source link