[ad_1]

imaginima

The Avantis Worldwide Fairness ETF (NYSEARCA:AVDE) invests throughout a diversified basket of overseas shares from developed markets.

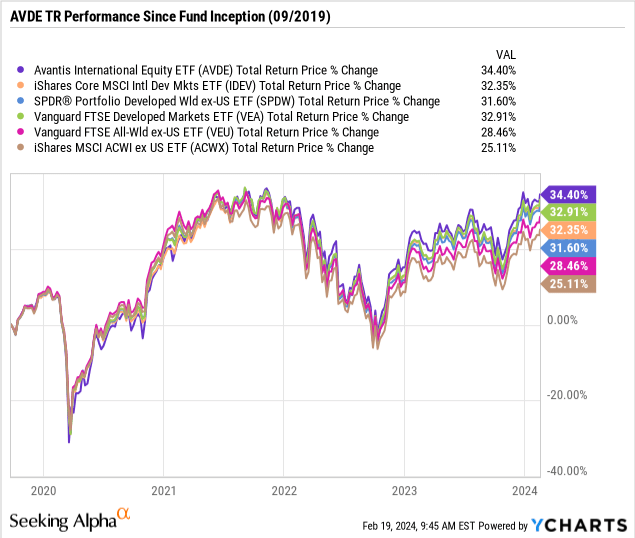

The attraction right here is an actively managed technique the place the funding crew has the pliability to shift allocations in an effort to boost returns. Impressively, AVDE has outperformed benchmarks and comparable ETFs for the reason that fund inception date in 2019 with an general strong file.

We view AVDE as possibility for traders as a core portfolio holding to seize strategic long-term publicity to this essential market section. Within the context of the present market surroundings, we anticipate AVDE to proceed benefiting from a number of macro tailwinds with additional upside within the yr forward.

What’s the AVDE ETF?

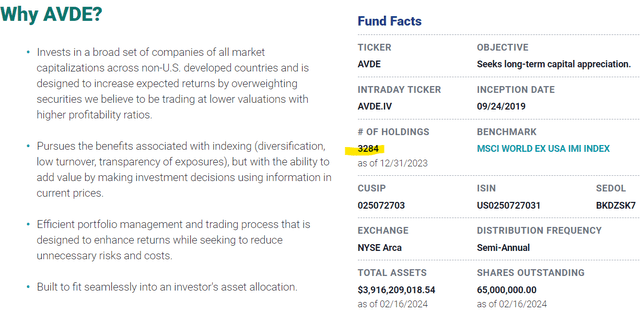

AVDE is managed by Avantis Traders, which is a subsidiary of “American Century Investments”, a well-recognized institutional asset supervisor. The fund seeks long-term capital appreciation by means of a comparatively broad mandate to spend money on non-U.S. corporations throughout international locations, market sectors, and business teams.

Whereas AVDE is actively managed, that means the fund will not be meant to trace any explicit index, the technique right here is comparatively refined with a give attention to diversification and balanced danger by means of 3,284 present holdings.

The fund prospectus explains an effort to obese corporations that the funding crew expects can ship increased returns whereas underweighting these with much less favorable fundamentals.

supply: Avantis Funds

AVDE Portfolio

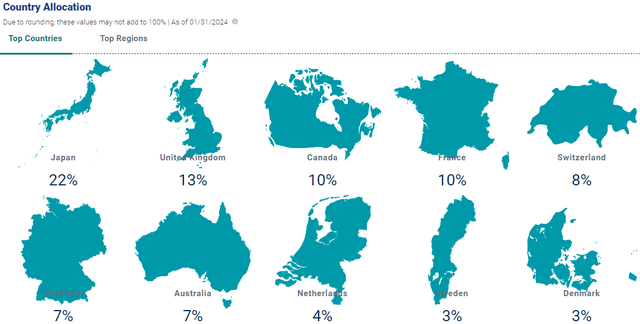

The “Worldwide Fairness” element of the fund identify refers back to the particular give attention to developed economies that stand out as having increased ranges of revenue on common with a extra mature authorized system and credible regulatory framework.

The concept right here is that corporations from developed international locations in Europe, Australia, Canada, and Japan needs to be at decrease danger in comparison with rising markets within the context of the political backdrop. That is essential when eager about more moderen volatility in areas like Asia-Pacific or Latin America which have underperformed in recent times, regardless of the next development potential.

At present, shares from Japan symbolize about 22% of the AVDE portfolio, adopted by the UK at 13%, and Canada at 10%

supply: Avantis

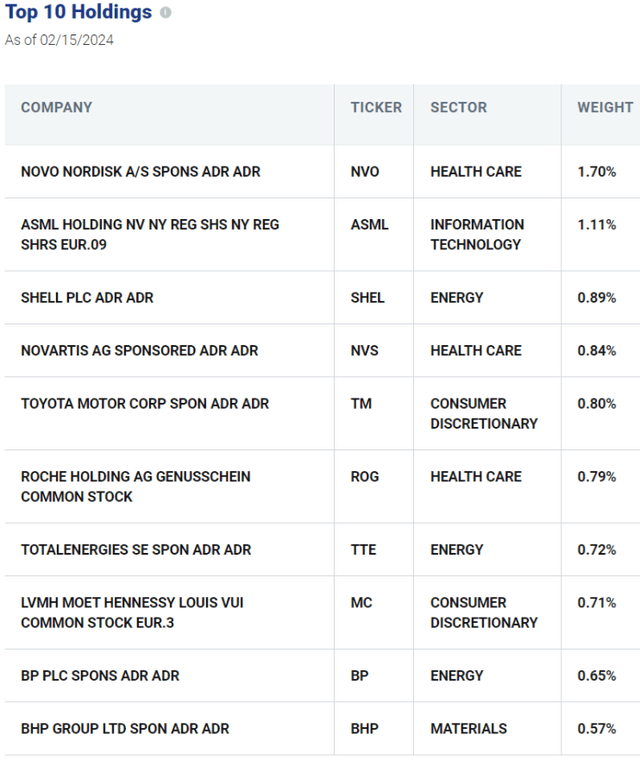

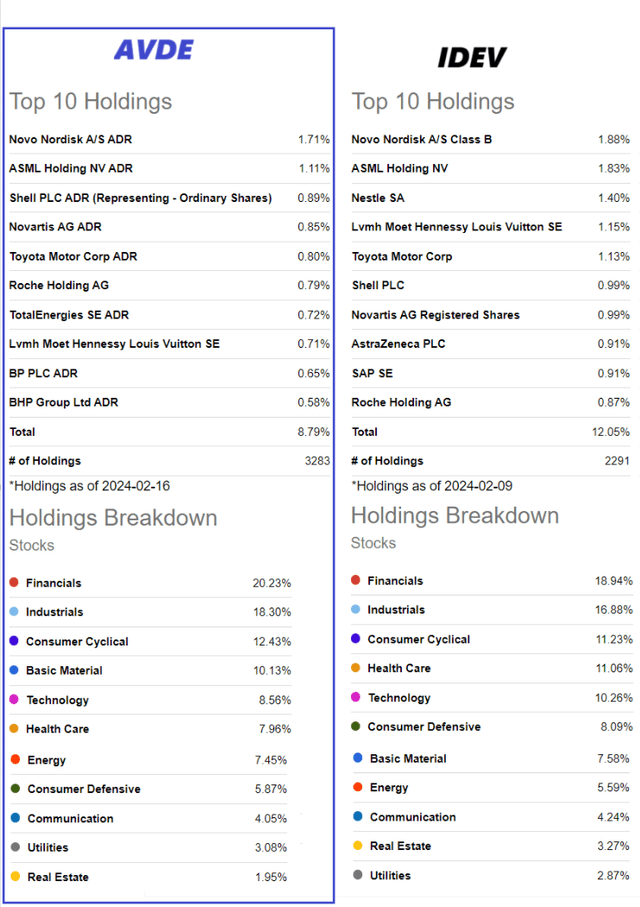

Going by means of the present portfolio, worldwide mega-caps compose the highest holdings with Denmark-based pharmaceutical big Novo Nordisk A/S (NVO) as the biggest place with a 1.7% weighting. ASML Holding N.V. (ASML) from the Netherlands represents 1.1% of the fund, adopted by Shell plc (SHEL) at 0.9%.

Given the scale of the portfolio and variety of corporations, what’s essential right here is much less the company-specific contributions to the fund efficiency, however extra so the high-level macro traits and sector themes.

supply: Avantis

On this level, going again to that time period we utilized in describing AVDE’s actively-managed technique as “refined”, we discover that the exposures listed here are a minimum of just like the “MSCI World EX US IMI Index” which the fund makes use of as its official efficiency benchmark. Merely put, it seems AVDE modestly tilts the weightings to attain its funding technique objectives.

Right here we are able to distinction AVDE to the choice passively-managed iShares Core MSCI Worldwide Developed Markets ETF (IDEV) which is designed to carefully monitor the identical “MSCI World ex US IMI Index”.

What we discover is that whereas there’s a important overlap by way of prime holdings, there are additionally some essential variations. AVDE holds a bigger variety of shares, marginally capturing extra small-cap publicity down the portfolio, whereas the sector breakdown is obese in some sectors and underweight in others.

For instance, AVDE’s 20.3% weighting within the Monetary sector is above the 18.9% place in IDEV. Then again, AVDE’s 5.9% weighting in Shopper Defensive shares is under the 8.1% place of the sector inside IDEV.

Related dynamics may be noticed with the Vanguard FTSE Developed Markets Index ETF (VEA), which tracks the separate “FTSE Developed All Cap ex US Index”.

Looking for Alpha

AVDE Efficiency

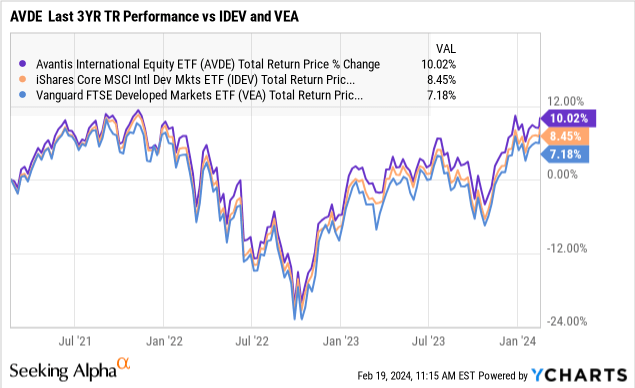

Our interpretation is that a majority of these spreads, additionally seen on the nation allocation degree, clarify AVDE’s modest class outperformance in recent times in opposition to these benchmarks. During the last three years, AVDE has returned 10.0%, in comparison with 8.5% from IDEV and seven.2% from VEA.

This era captures not solely the worldwide post-pandemic market selloff by means of 2022 but in addition the stronger rebound since 2023. It seems that the Avantis crew has been able to producing extra returns by means of its technique of safety choice and environment friendly portfolio administration.

We consider this file helps to justify AVDE’s 0.23% expense ratio, increased compared to VEA at 0.05% or IDEV at 0.04%. The opposite level right here is that these three funds all function a dividend yield of round 3%, whereas AVDE’s payout is distributed semi-annually.

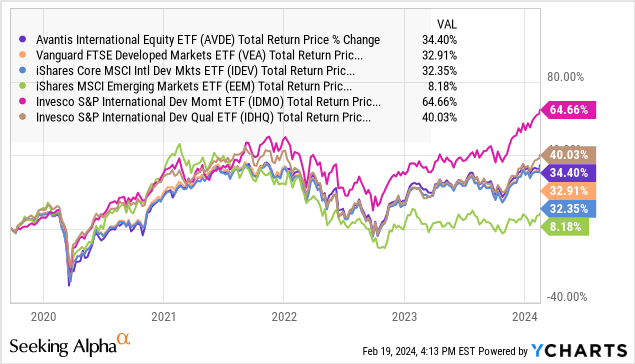

Traders also needs to perceive the technique limitations. We particularly contrasted AVDE with funds like VEA and IDEV as reference level for what Avantis does effectively, however needless to say there are additionally various developed market methods that will also be enticing for various causes.

We will convey up the Invesco S&P Worldwide Developed Momentum ETF (IDMO) which targets shares with the momentum issue being the quantitative technique to systematically goal particular person shares which have carried out effectively in current intervals. There’s additionally the Invesco S&P Worldwide Developed Market High quality ETF (IDHQ), which screens for corporations with robust fundamentals.

Notably, each of those issue ETFs have outperformed AVDE traditionally, which highlights the problem in objectively proclaiming one fund or technique is at all times higher than one other.

Traders who solely maintain U.S. shares can profit from including publicity to worldwide equities however also needs to take into account the significance of rising markets (EMs). On this case, whereas funds just like the iShares MSCI Rising Markets ETF (EEM) have lagged in recent times, it’s doable EMs could lead on increased sooner or later the place that uncertainty can solely be overcome by retaining a diversified place.

Ultimate Ideas

There’s loads to love concerning the Avantis Worldwide Fairness ETF which does an excellent job inside its ETF class. Our expectation is for AVDE and developed market equities general to proceed performing effectively amid an surroundings of resilient financial circumstances globally, with cooling inflationary pressures and stabilizing rates of interest serving to to assist danger sentiment.

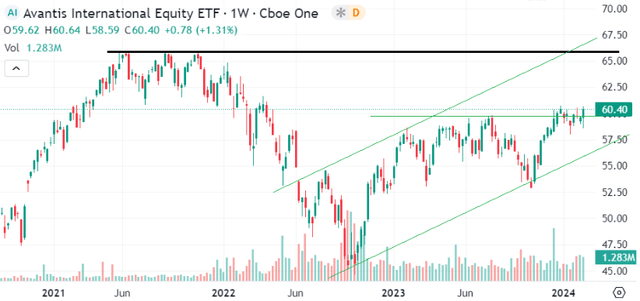

Technically, the fund stays under its all-time excessive reached again in 2021 close to $66.00 per share, roughly 10% increased than the present degree, which we consider turns into the pure upside goal from right here.

When it comes to danger, financial indicators from key developed market economies are a monitoring level in addition to traits within the U.S. Greenback which might introduce some FX danger to the fund in opposition to the businesses that generate the vast majority of their enterprise in foreign currency echange. Exterior of a serious deterioration to the macro backdrop, we see AVDE reclaiming these highs sooner reasonably than later.

Looking for Alpha

[ad_2]

Source link