[ad_1]

Up to date on February twenty third, 2024 by Bob Ciura

The “Canines of the Dow” investing technique is a quite simple method for traders to attain diversification and earnings of their portfolios whereas remaining within the sphere of extra conservative blue chip shares.

The technique consists of investing within the 10 highest-yielding shares within the Dow Jones Industrial Common, an index of 30 U.S. shares.

Excessive dividend shares are shares with a dividend yield effectively in extra of the market common dividend yield of ~1.6%.

With that in thoughts, we have now created a free listing of over 200 excessive dividend shares with dividend yields above 5%. You may obtain your copy of the excessive dividend shares listing beneath:

The “Canines of the Dow” technique produces above-average earnings and concentrates on shares that sometimes commerce at decrease valuations relative to the remainder of the DJIA. On condition that the DJIA represents among the largest firms on the earth, its “canines” are sometimes firms with robust observe information which have hit momentary issues.

It is a nice and easy technique for worth traders trying to buy good companies which might be presently out of favor.

To implement this technique, take the sum of money it’s a must to make investments after which divide it equally among the many 10 highest-yielding shares within the DJIA. Maintain these shares for an entire 12 months after which on the finish of 12 months, take a look at the 30 Dow shares once more and resort them by dividend yield from highest to lowest.

Rebalance and reallocate your capital accordingly and repeat the method. Along with the simplicity and give attention to high quality, worth, and earnings that this technique generates, it additionally improves self-discipline by stopping extreme emotion-driven buying and selling.

It additionally encourages traders to reap the tax advantages from holding positions for a minimum of one 12 months earlier than promoting, thereby being taxed on the long-term capital positive factors tax price as a substitute of the short-term price.

The 2024 Canines of the Dow

The listing of the 2024 Canines of the Dow is beneath, together with the present dividend yield of the top-ten yielding DJIA shares. Click on on an organization’s title to leap on to evaluation on that firm.

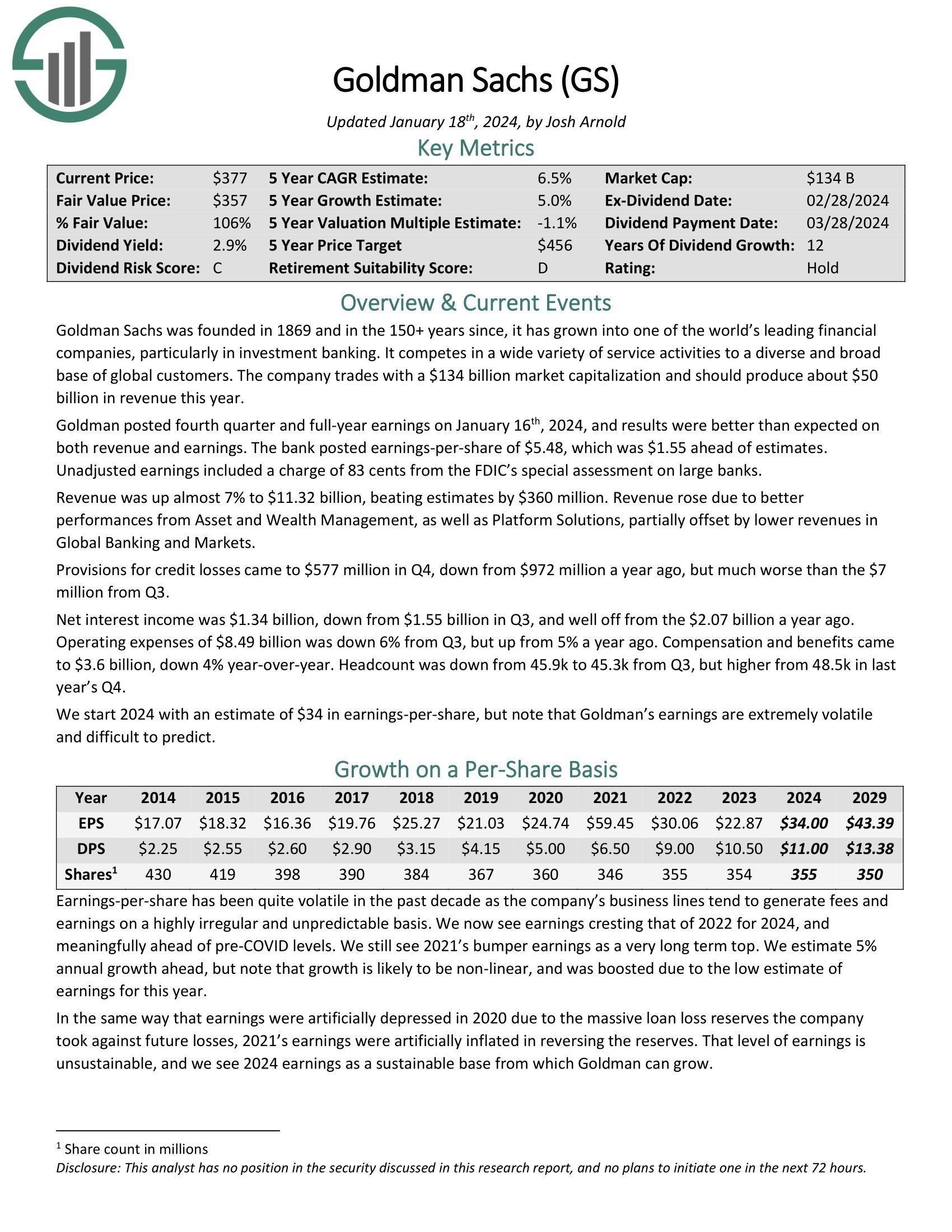

Canine of the Dow #10: Goldman Sachs (GS)

Goldman Sachs was based in 1869 and within the 150+ years since, it has grown into one of many world’s main monetary firms, notably in funding banking. It competes in all kinds of service actions to a various and broad base of worldwide clients. The corporate trades with a $134 billion market capitalization and may produce about $50 billion in income this 12 months.

Goldman posted fourth quarter and full-year earnings on January sixteenth, 2024, and outcomes had been higher than anticipated on each income and earnings. The financial institution posted earnings-per-share of $5.48, which was $1.55 forward of estimates. Unadjusted earnings included a cost of 83 cents from the FDIC’s particular evaluation on giant banks.

Income was up nearly 7% to $11.32 billion, beating estimates by $360 million. Income rose as a consequence of higher performances from Asset and Wealth Administration, in addition to Platform Options, partially offset by decrease revenues in International Banking and Markets.

Click on right here to obtain our most up-to-date Certain Evaluation report on GS (preview of web page 1 of three proven beneath):

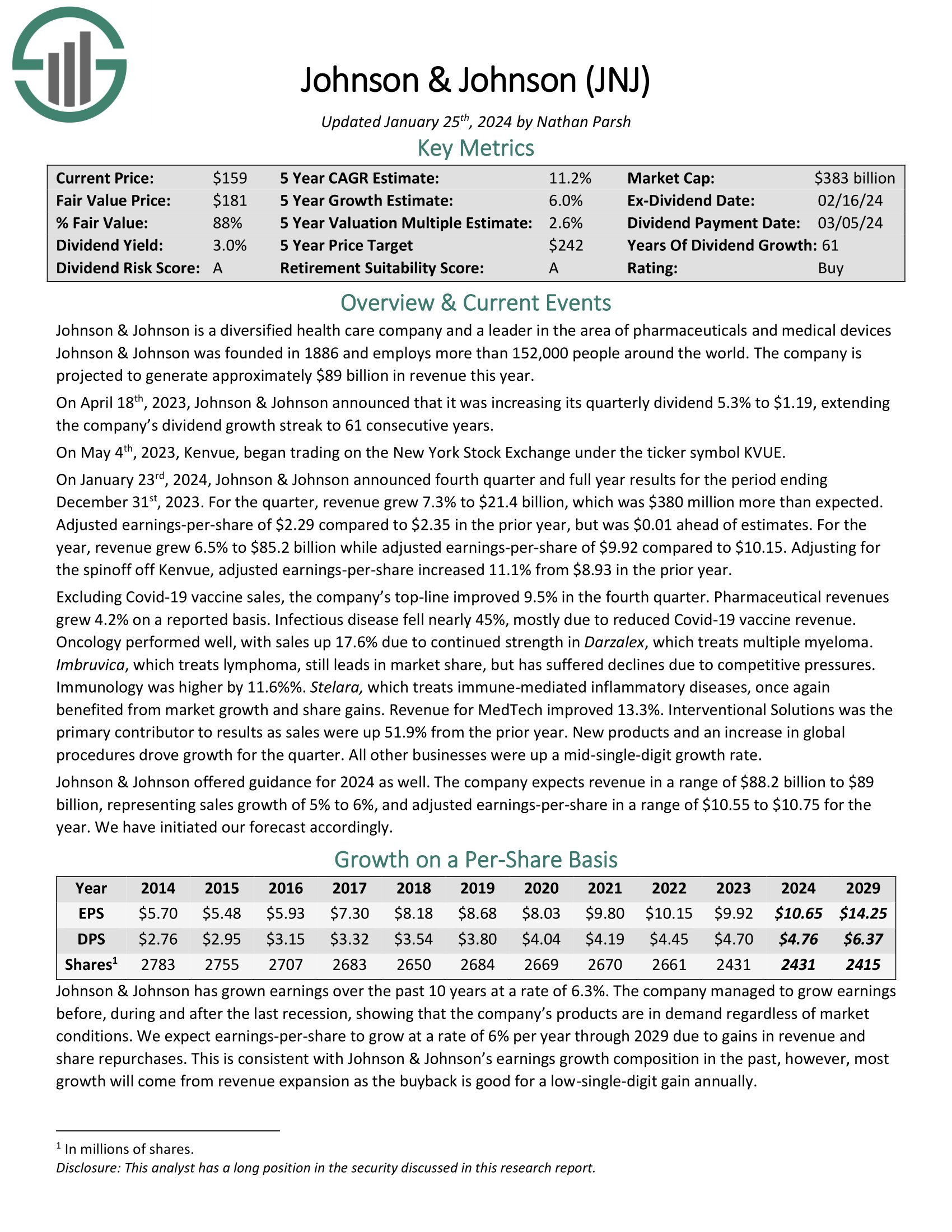

Canine of the Dow #9: Johnson & Johnson (JNJ)

Johnson & Johnson is a world healthcare large. The corporate presently operates two segments: Pharmaceutical, and Medical Units & Diagnostics. The company consists of roughly 250 subsidiary firms with operations in 60 nations and merchandise offered in over 175 nations.

On January twenty third, 2024, Johnson & Johnson introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2023. For the quarter, income grew 7.3% to $21.4 billion, which was $380 million greater than anticipated. Adjusted earnings-per-share of $2.29 in comparison with $2.35 within the prior 12 months, however was $0.01 forward of estimates.

For the 12 months, income grew 6.5% to $85.2 billion whereas adjusted earnings-per-share of $9.92 in comparison with $10.15. Adjusting for the spinoff off Kenvue, adjusted earnings-per-share elevated 11.1% from $8.93 within the prior 12 months.

The corporate has elevated its dividend for 60 consecutive years, making it a Dividend King. The inventory is owned by many well-known cash managers. For instance, J&J is a Kevin O’Leary dividend inventory.

Click on right here to obtain our most up-to-date Certain Evaluation report on JNJ (preview of web page 1 of three proven beneath):

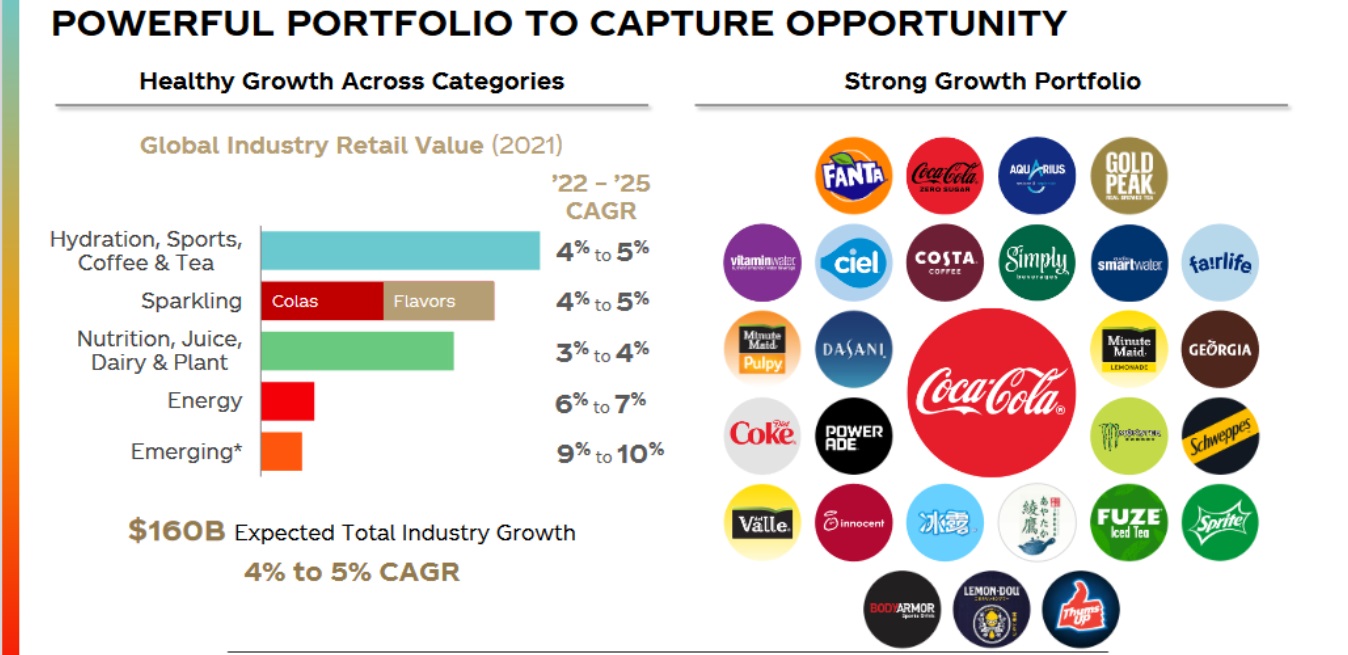

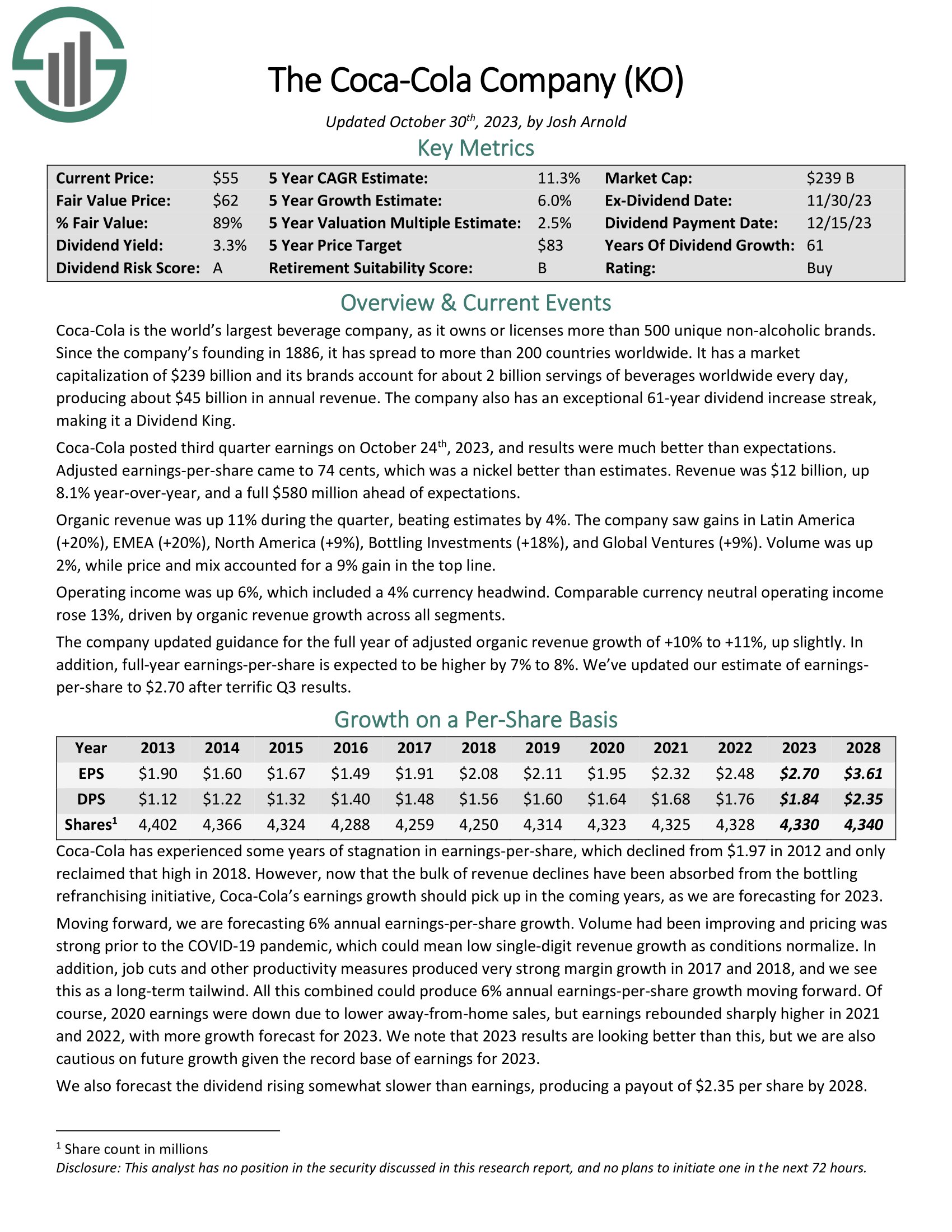

Canine of the Dow #8: Coca-Cola (KO)

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. Because the firm’s founding in 1886, it has unfold to greater than 200 nations worldwide.

Supply: Investor Presentation

The corporate additionally has an distinctive 59-year dividend enhance streak.

Coca-Cola posted third quarter earnings on October twenty fourth, 2023, and outcomes had been significantly better than expectations. Adjusted earnings-per-share got here to 74 cents, which was a nickel higher than estimates. Income was $12 billion, up 8.1% year-over-year, and a full $580 million forward of expectations.

Natural income was up 11% throughout the quarter, beating estimates by 4%. The corporate noticed positive factors in Latin America (+20%), EMEA (+20%), North America (+9%), Bottling Investments (+18%), and International Ventures (+9%). Quantity was up 2%, whereas worth and blend accounted for a 9% achieve within the prime line.

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven beneath):

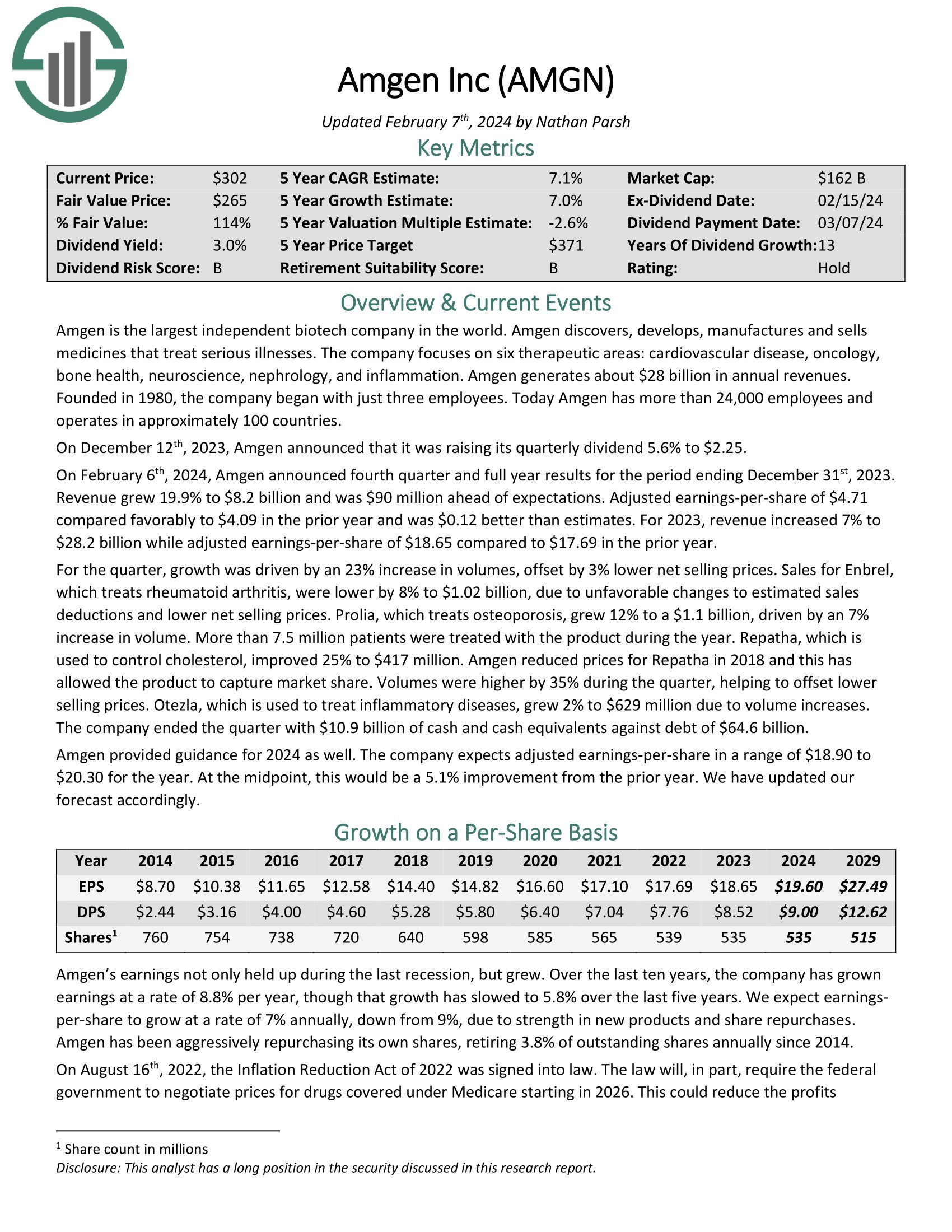

Canine of the Dow #7: Amgen Inc. (AMGN)

Amgen is the biggest unbiased biotech firm on the earth. Amgen discovers, develops, manufactures, and sells medicines that deal with severe sicknesses. The corporate focuses on six therapeutic areas: heart problems, oncology, bone well being, neuroscience, nephrology, and irritation.

On February sixth, 2024, Amgen introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2023. Income grew 19.9% to $8.2 billion and was $90 million forward of expectations. Adjusted earnings-per-share of $4.71 in contrast favorably to $4.09 within the prior 12 months and was $0.12 higher than estimates. For 2023, income elevated 7% to $28.2 billion whereas adjusted earnings-per-share of $18.65 in comparison with $17.69 within the prior 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on Amgen Inc. (AMGN) (preview of web page 1 of three proven beneath):

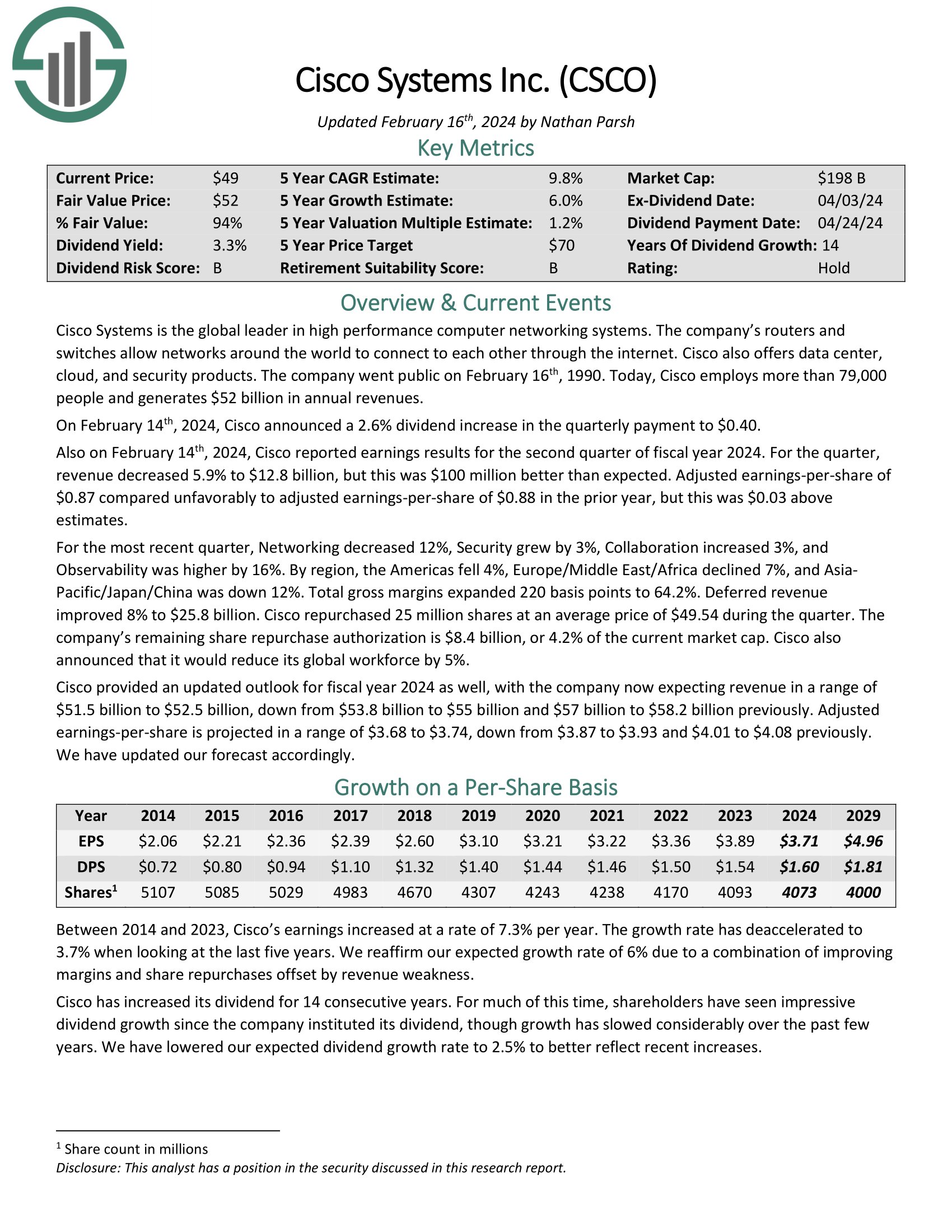

Canine of the Dow #6: Cisco Methods (CSCO)

Cisco Methods is the worldwide chief in excessive efficiency pc networking methods. The corporate’s routers and switches enable networks all over the world to attach to one another by means of the web. Cisco additionally provides information heart, cloud, and safety merchandise. The corporate went public on February sixteenth, 1990. Right this moment, Cisco employs greater than 79,000 individuals and generates $54 billion in annual revenues.

On February 14th, 2024, Cisco reported earnings outcomes for the second quarter of fiscal 12 months 2024. For the quarter, income decreased 5.9% to $12.8 billion, however this was $100 million higher than anticipated. Adjusted earnings-per-share of $0.87 in contrast unfavorably to adjusted earnings-per-share of $0.88 within the prior 12 months, however this was $0.03 above estimates.

Click on right here to obtain our most up-to-date Certain Evaluation report on Cisco Methods (CSCO) (preview of web page 1 of three proven beneath):

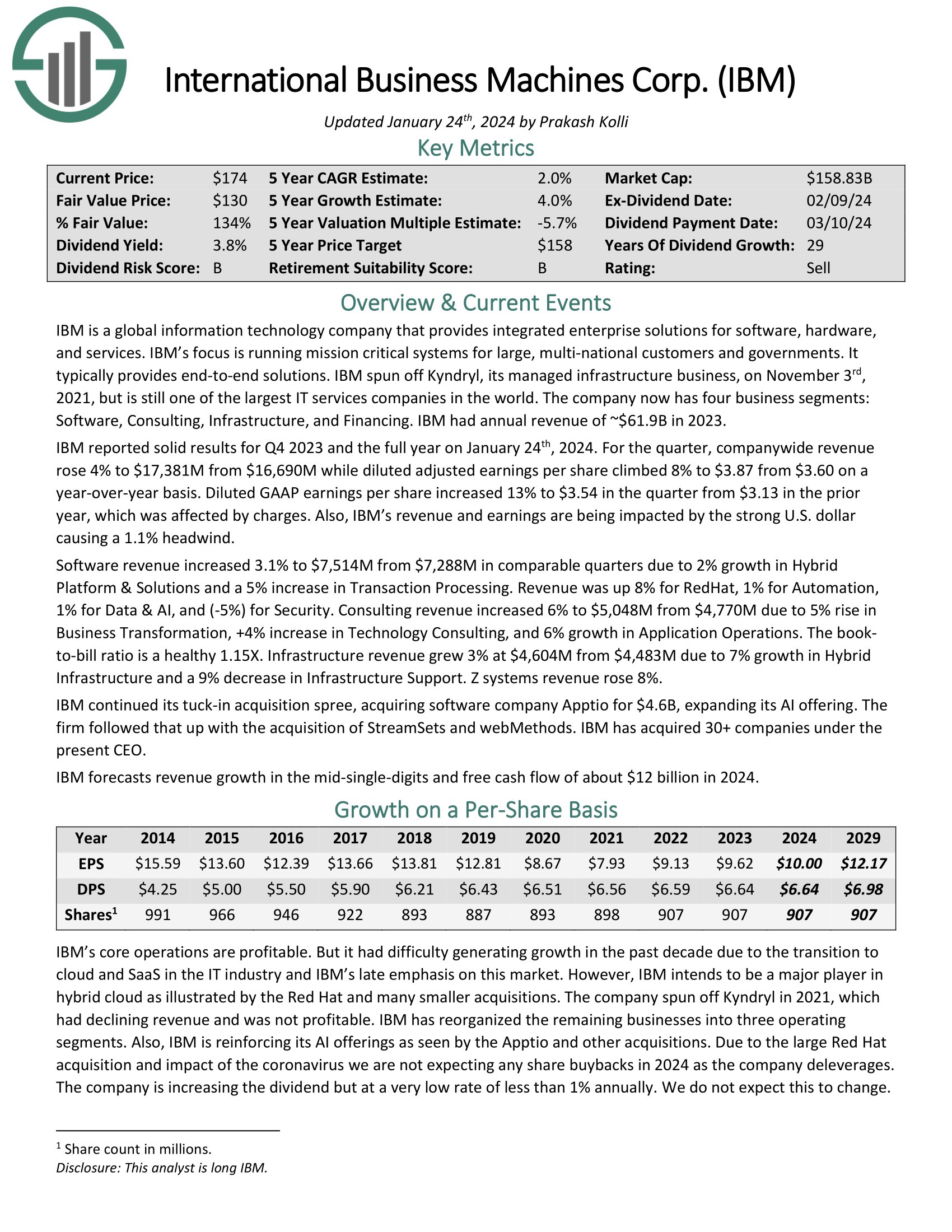

Canine of the Dow #5: Worldwide Enterprise Machines (IBM)

IBM is a world info know-how firm that gives built-in enterprise options for software program, {hardware}, and providers. IBM’s focus is working mission-critical methods for giant, multi-national clients and governments. IBM sometimes gives end-to-end options. The corporate now has 4 enterprise segments: Software program, Consulting, Infrastructure, and Financing.

IBM reported stable outcomes for This autumn 2023 and the complete 12 months on January twenty fourth, 2024. For the quarter, company-wide income rose 4% to $17,381M from $16,690M whereas diluted adjusted earnings per share climbed 8% to $3.87 from $3.60 on a year-over-year foundation. Diluted GAAP earnings per share elevated 13% to $3.54 within the quarter from $3.13 within the prior 12 months, which was affected by expenses. Additionally, IBM’s income and earnings are being impacted by the robust U.S. greenback inflicting a 1.1% headwind.

Click on right here to obtain our most up-to-date Certain Evaluation report on Worldwide Enterprise Machines (IBM) (preview of web page 1 of three proven beneath):

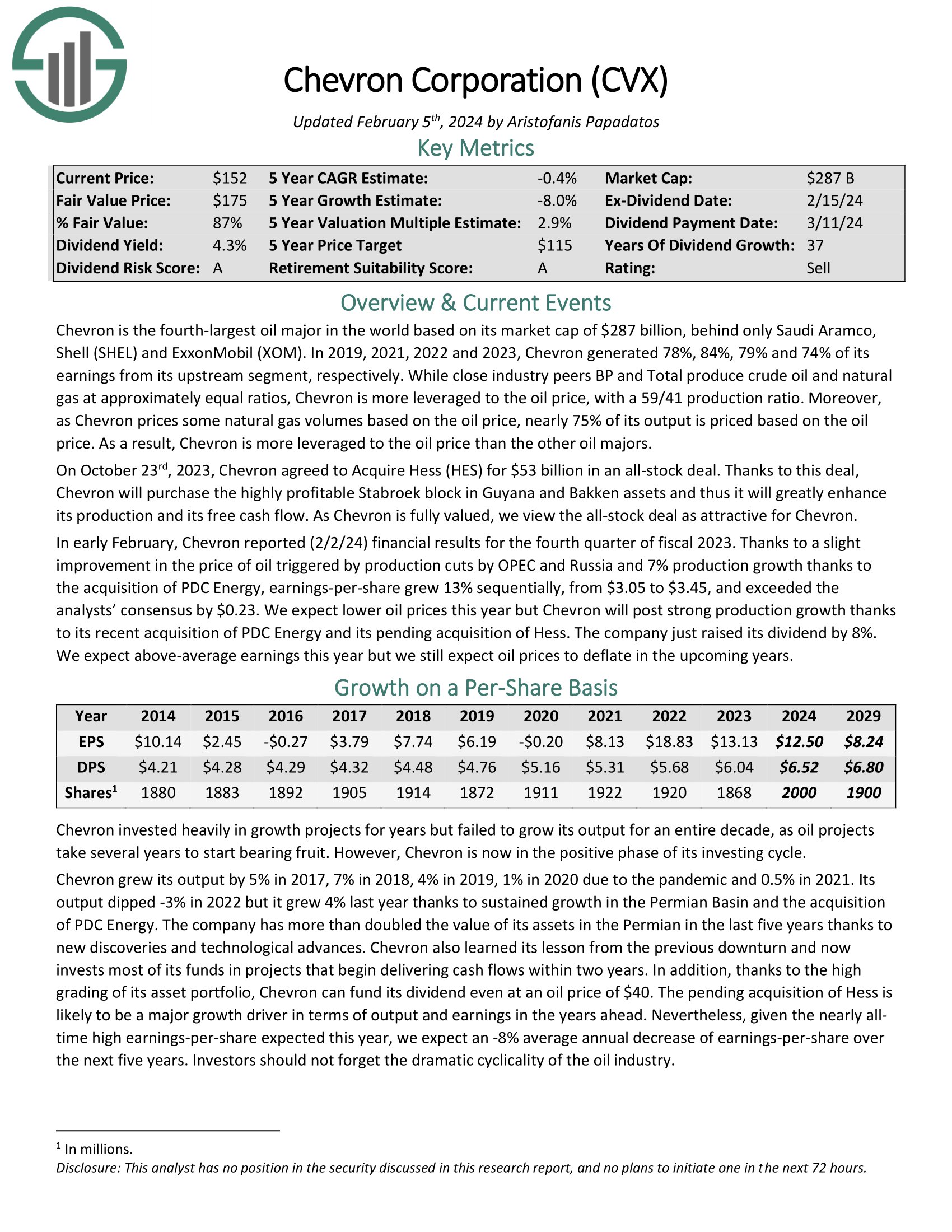

Canine of the Dow #4: Chevron Company (CVX)

Chevron is among the largest oil majors on the earth. The corporate sees the majority of its earnings from its upstream section and has a better crude oil and pure fuel manufacturing ratio at 61/39 than most of its friends. Chevron additionally costs some pure fuel volumes primarily based on the oil worth. In the long run, the corporate is extra leveraged to the oil worth than the opposite oil majors.

In early February, Chevron reported (2/2/24) monetary outcomes for the fourth quarter of fiscal 2023. Because of a slight enchancment within the worth of oil triggered by manufacturing cuts by OPEC and Russia and seven% manufacturing development due to the acquisition of PDC Vitality, earnings-per-share grew 13% sequentially, from $3.05 to $3.45, and exceeded the analysts’ consensus by $0.23.

Click on right here to obtain our most up-to-date Certain Evaluation report on Chevron Company (CVX) (preview of web page 1 of three proven beneath):

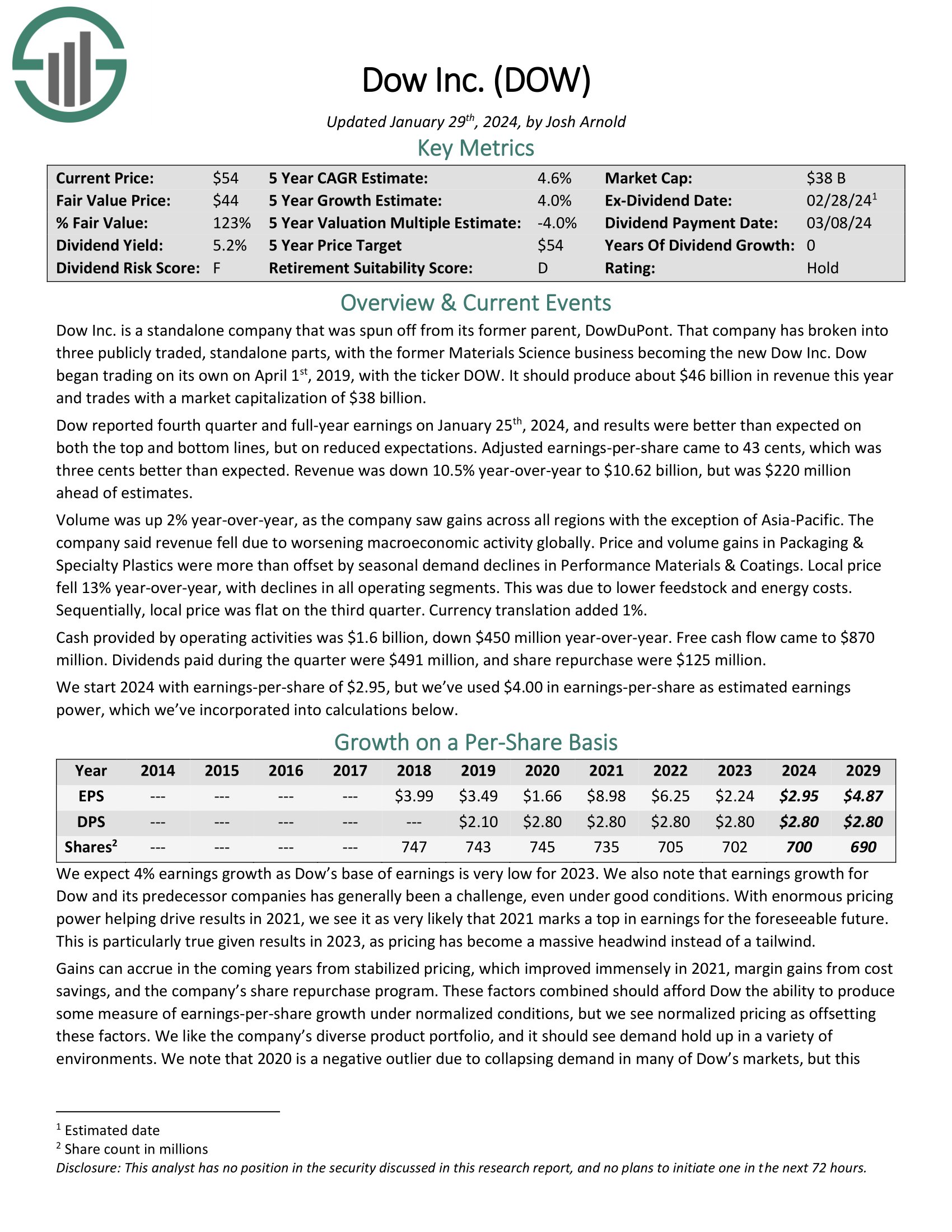

Canine of the Dow #3: Dow Inc. (DOW)

Dow Inc. is a standalone firm that was spun off from its former father or mother, DowDuPont. That firm has damaged into three publicly traded, standalone components, with the previous Supplies Science enterprise turning into the brand new Dow Inc. Dow started buying and selling by itself on April 1st, 2019, with the ticker DOW. It ought to produce about $44 billion in income this 12 months.

Dow reported fourth quarter and full-year earnings on January twenty fifth, 2024, and outcomes had been higher than anticipated on each the highest and backside strains, however on lowered expectations. Adjusted earnings-per-share got here to 43 cents, which was three cents higher than anticipated. Income was down 10.5% year-over-year to $10.62 billion, however was $220 million forward of estimates.

Click on right here to obtain our most up-to-date Certain Evaluation report on Dow Inc. (DOW) (preview of web page 1 of three proven beneath):

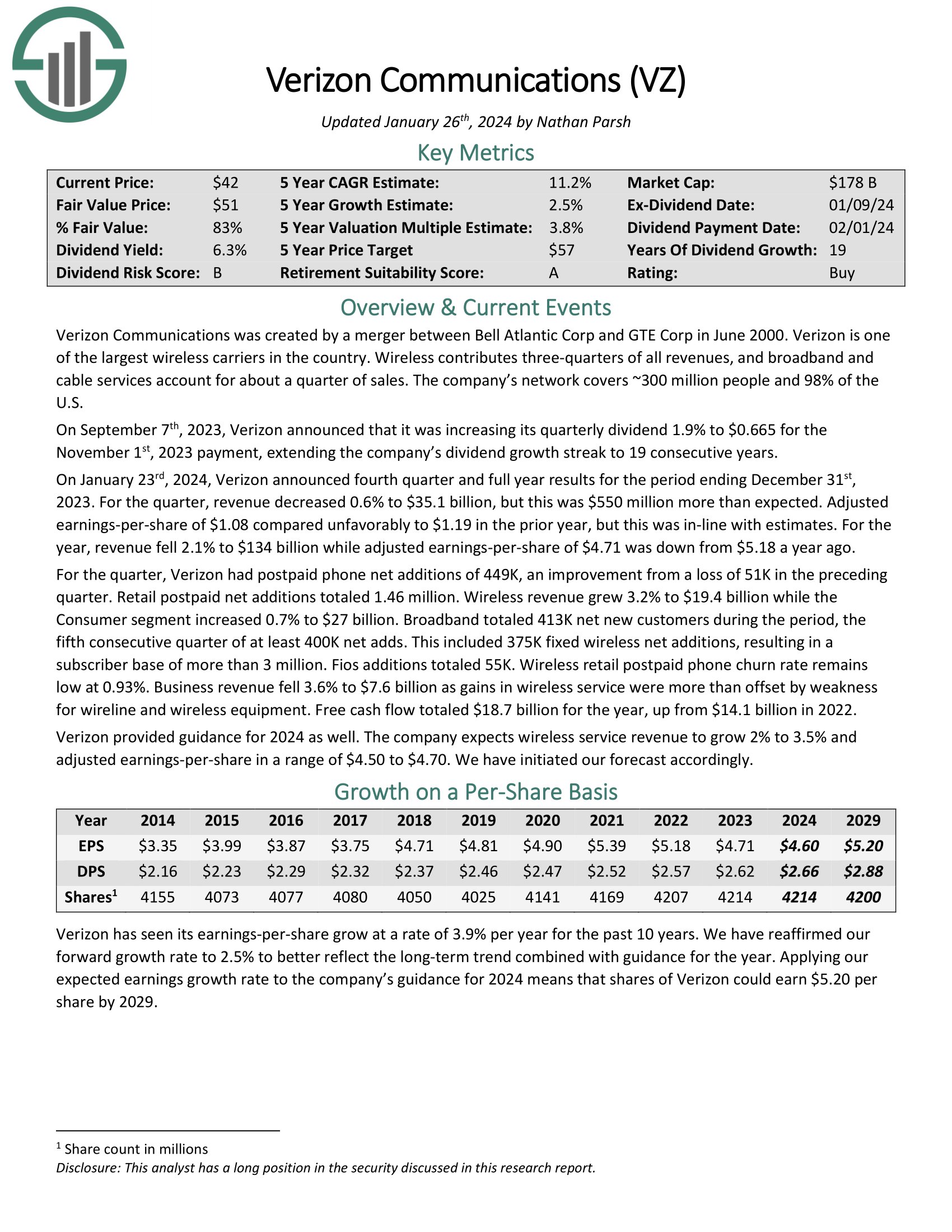

Canine of the Dow #2: Verizon Communications (VZ)

Verizon Communications is among the largest wi-fi carriers within the nation. Wi-fi contributes three-quarters of all revenues, and broadband and cable providers account for a couple of quarter of gross sales. The corporate’s community covers ~300 million individuals and 98% of the U.S.

On January twenty third, 2024, Verizon introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2023. For the quarter, income decreased 0.6% to $35.1 billion, however this was $550 million greater than anticipated. Adjusted earnings-per-share of $1.08 in contrast unfavorably to $1.19 within the prior 12 months, however this was in-line with estimates. For the 12 months, income fell 2.1% to $134 billion whereas adjusted earnings-per-share of $4.71 was down from $5.18 a 12 months in the past.

Click on right here to obtain our most up-to-date Certain Evaluation report on VZ (preview of web page 1 of three proven beneath):

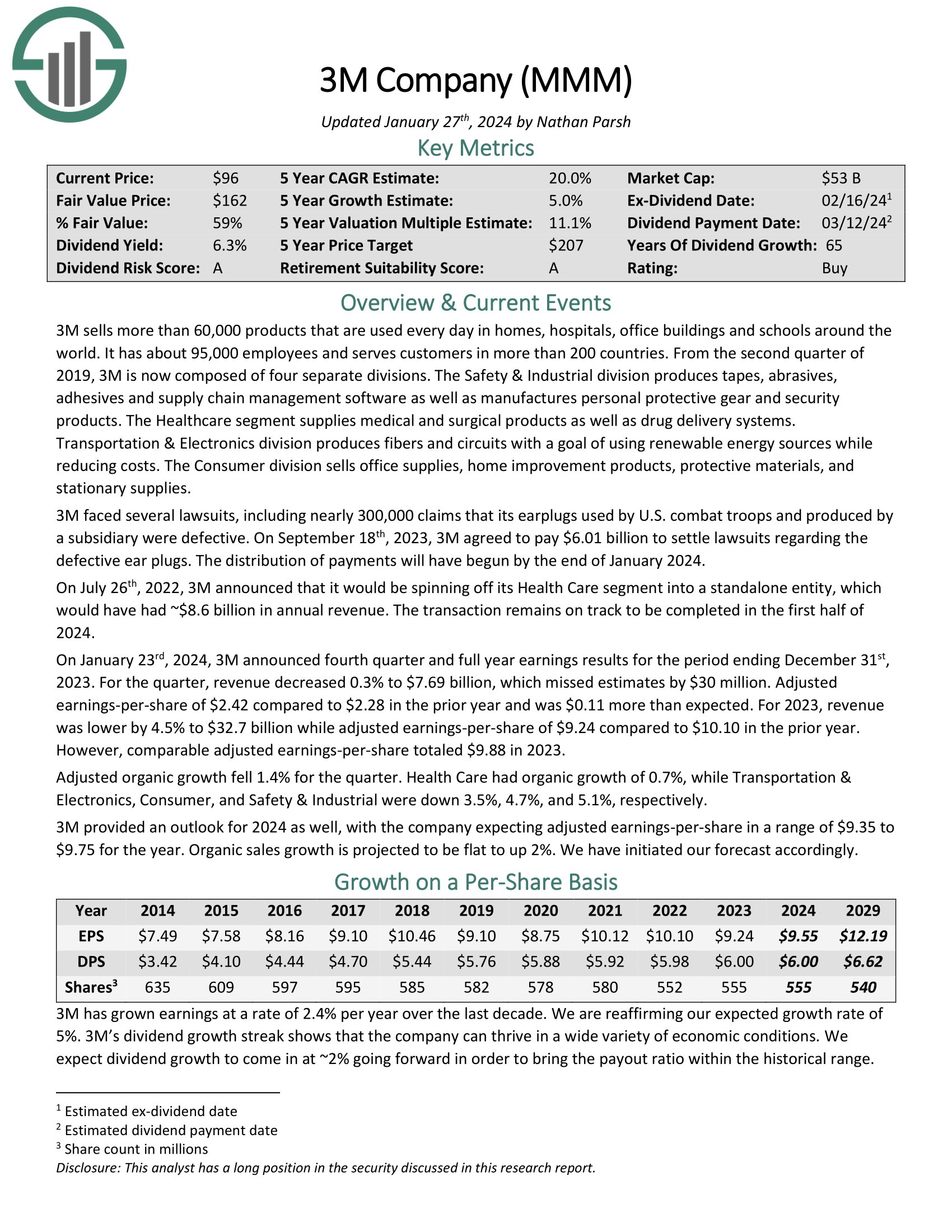

Canine of the Dow #1: 3M Firm (MMM)

3M is an industrial producer that sells greater than 60,000 merchandise used every day in properties, hospitals, workplace buildings, and faculties worldwide. It has about 95,000 staff and serves clients in additional than 200 nations.

On January twenty third, 2024, 3M introduced fourth quarter and full 12 months earnings outcomes for the interval ending December thirty first, 2023. For the quarter, income decreased 0.3% to $7.69 billion, which missed estimates by $30 million. Adjusted earnings-per-share of $2.42 in comparison with $2.28 within the prior 12 months and was $0.11 greater than anticipated.

For 2023, income was decrease by 4.5% to $32.7 billion whereas adjusted earnings-per-share of $9.24 in comparison with $10.10 within the prior 12 months. Nonetheless, comparable adjusted earnings-per-share totaled $9.88 in 2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on 3M Firm (preview of web page 1 of three proven beneath):

Remaining Ideas

Given the descriptions above, the Canines of the Dow are clearly a really numerous group of blue-chip shares that every take pleasure in important aggressive benefits and prolonged histories of paying rising dividends.

In consequence, this investing technique is a superb, low-risk method for unsophisticated traders to method dividend development investing.

Whereas it could not outperform the broader market yearly, it’s nearly assured to offer traders with a mixture of enticing present yield with steadily rising earnings over time.

If you’re desirous about discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Certain Dividend assets shall be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link