[ad_1]

Benchmark indexes are set to conclude the week positively, pushed by bullish surges in key shares.

So on this article, we’ll check out the highest 4 shares when it comes to efficiency this week and use InvestingPro to investigate their prospects going forward.

Nvidia, and Walmart are among the names we intend to investigate on this article

In 2024, make investments like the massive funds from the consolation of your property with our AI-powered ProPicks inventory choice software. Study extra right here>>

Benchmark indexes , , and the are poised to complete the week on a constructive notice. We’ve got seen notable performances from 4 key shares:

Moderna (NASDAQ:) +9.11%

Nvidia (NASDAQ:) +8.09%

Walmart (NYSE:) +3.60%

Tenaris (NYSE:) +7.75%

What’s Driving These Shares?

Moderna’s per share of $0.55 and income of $2.8 billion exceeded consensus estimates, attributed to lowered bills and fee delays.

Nvidia file revenues of $22.10 billion, up 22% from the third quarter and 265% from a yr earlier, beating expectations. Earnings per share have been $5.16, up 28% from the earlier quarter and 486% from a yr earlier, surpassing consensus estimates.

Walmart analyst estimates with earnings per share of $1.80 and income of $173.4 billion for the quarter, together with a quarterly dividend improve of 9.2% to $0.6225 per share.

Tenaris noticed 2023 of $14.869 billion, a 26% improve from 2022, and internet revenue rose to $3.958 billion, a 55% enchancment over 2022. The board intends to suggest a dividend fee of $0.60 per share on the upcoming shareholders’ assembly on April 30.

On this piece, we’ll analyze every inventory utilizing InvestingPro’s Honest Worth. The Honest Worth is decided for every inventory based mostly on varied monetary fashions tailor-made to the shares’ particular metrics.

1. Moderna

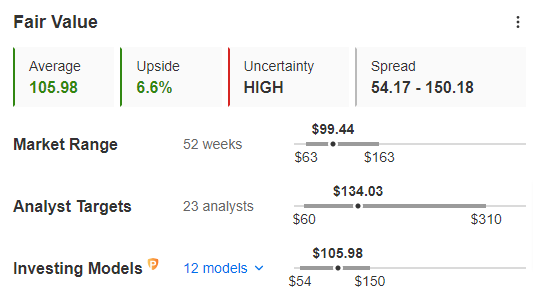

For Moderna, InvestingPro’s Honest Worth, which summarizes 12 funding fashions, stands at $105.98.

Fai Worth

Supply: InvestingPro

Analysts are strongly bullish on the inventory, with a goal value of $134.03 and consequently removed from the common Honest Worth.

Whereas analysts and Honest Worth disagree on the opportunity of bullishness and goal value, the low-risk profile is constructive. It has good monetary well being, with a rating of three out of 5.

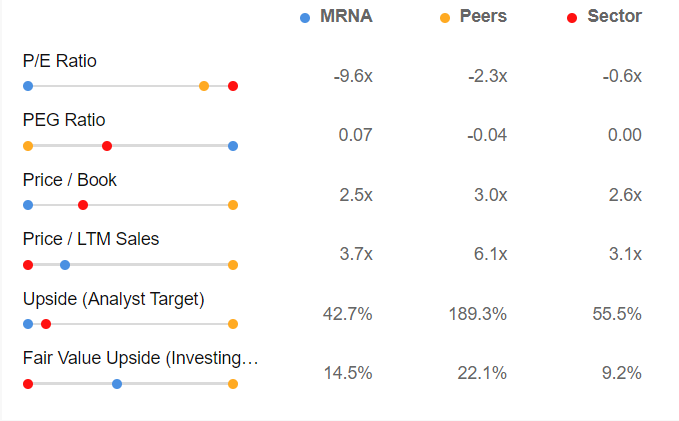

Delving deeper into the inventory with the market and rivals, the inventory is presently undervalued.

Supply: InvestingPro

Moderna is now value greater than 2.5x its revenues in comparison with the 3x sector common.

The Worth/Earnings ratio at which the inventory is buying and selling is -9.6x in opposition to an business common of -0.6 p.c, which once more stands to verify its present undervaluation.

2. Nvidia

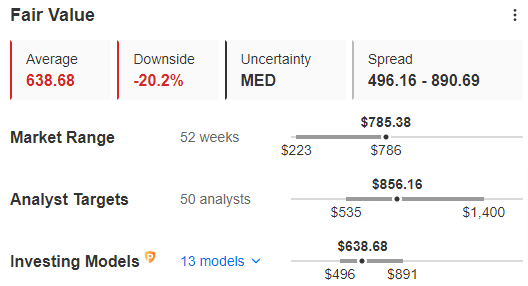

For Nvidia, InvestingPro’s Honest Worth, which summarizes 13 funding fashions, stands at $638.68, which is 20.2% lower than the present value.

Honest Worth

Supply: InvestingPro

InvestingPro subscribers carefully tracked analysts’ forecasts, and they’re optimistic concerning the inventory, setting a bullish goal value of $856.16.

Whereas there is a present disparity between analysts and Honest Worth concerning the potential for an increase, the constructive side lies within the low-risk profile. The inventory reveals glorious monetary well being, incomes a rating of 4 out of 5.

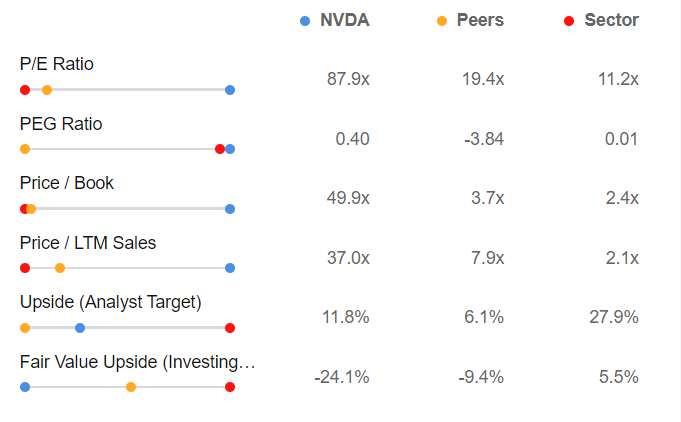

Upon nearer examination, when in comparison with the market and rivals, there are indications that the inventory is perhaps doubtlessly overvalued.

Supply: InvestingPro

Taking a look at well-known indicators, Nvidia’s present worth is 37 occasions its income, considerably increased than the business common of two.1x.

The Worth/Earnings ratio for the inventory is 87.9X, whereas the business common is 11.2x, indicating a considerable overvaluation.

3. Walmart

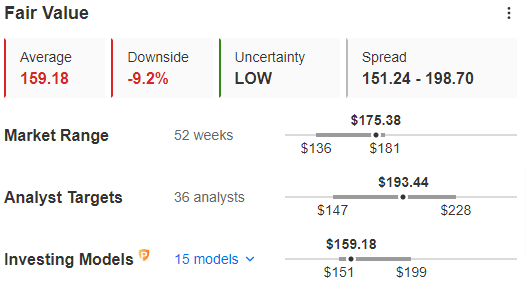

For Walmart, InvestingPro’s Honest Worth, which summarizes 15 funding fashions, stands at $159.18, or -9.2% from the present value.

Honest Worth

Supply: InvestingPro

Analysts venture a bullish goal value for the inventory at $193.44.

Regardless of a disparity in views between analysts and Honest Worth concerning the chance of an increase, the constructive side is the inventory’s low-risk profile. The corporate demonstrates good monetary well being, scoring 3 out of 5.

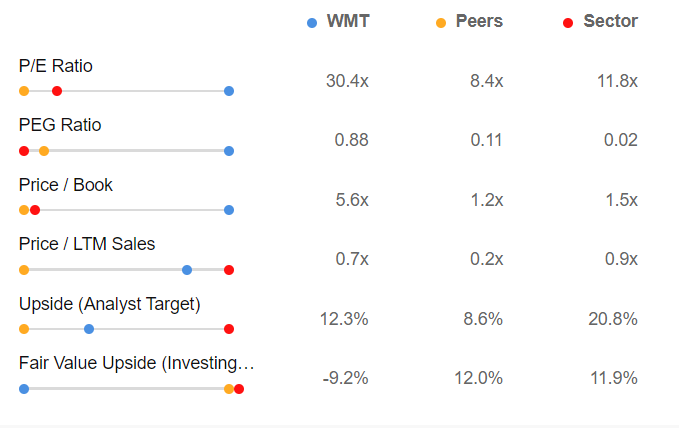

A comparability with the market and rivals reinforces the notion that the inventory could presently be overvalued.

Supply: InvestingPro

We are able to see that Walmart is now value 0.7x its gross sales in comparison with 0.9x within the business, and the Worth/Earnings ratio at which the inventory is buying and selling is 30.4X in opposition to an business common of 11.8x, which stands to verify its overvaluation.

4. Tenaris

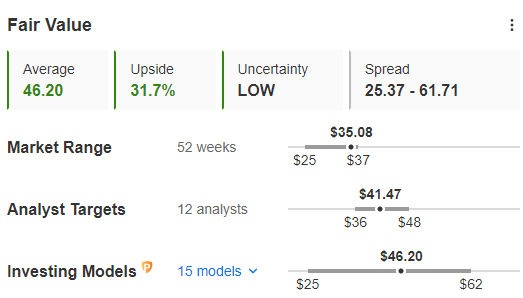

For Tenaris, InvestingPro’s Honest Worth, which summarizes 15 funding fashions, stands at $46.20, or +31.7% increased than the present value.

Honest Worth

Supply: InvestingPro

InvestingPro subscribers tracked analyst forecasts, that are optimistic concerning the inventory, projecting a goal value of $41.47.

The chance profile can be encouraging, with a powerful monetary well being score of 4 out of 5.

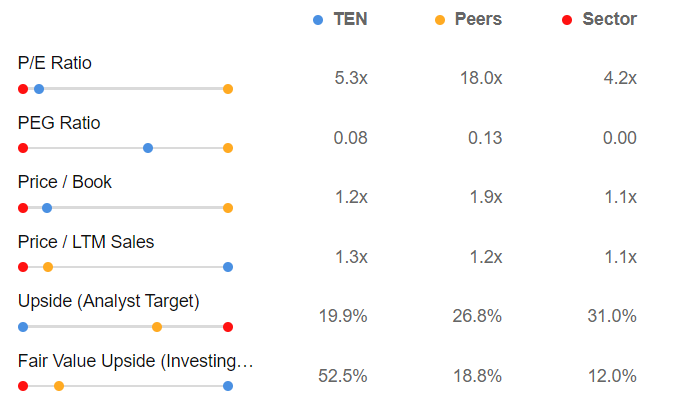

Nevertheless, when evaluating the inventory to the market and rivals, we do not discover the anticipated affirmation. At present, the inventory has a doubtlessly inflated valuation.

Supply: InvestingPro

We are able to see that Tenaris is now value 1.3x occasions its income in comparison with 1.1x within the business, and the Worth/Earnings ratio at which the inventory is buying and selling is 5.3X in opposition to an business common of 4.2x, which stands to verify its overvaluation.

Conclusion

In conclusion, analysts recommend that Moderna would possibly rebound quickly regardless of the Honest Worth indicating that the costs are at a good degree with restricted upside. The inventory’s downtrend may doubtlessly come to an finish quickly.

As for Nvidia and Walmart, though they boast a powerful monetary standing and well-defined strengths, there is a cautious outlook.

Nvidia has seen spectacular features of +278% over the previous yr, whereas Walmart has recorded +22%. These robust features may result in a correction ultimately, though traders presently have faith of their bullish tendencies.

Relating to Tenaris, regardless of its strong monetary standing and bullish Honest Worth, sure indicators recommend that it is perhaps overvalued. Traders ought to preserve this in thoughts whereas contemplating their funding choices.

***

Take your investing sport to the subsequent degree in 2024 with ProPicks

Establishments and billionaire traders worldwide are already nicely forward of the sport in terms of AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and decrease losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own properties with our new flagship AI-powered stock-picking software: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% over the past decade, traders have one of the best number of shares out there on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe As we speak!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or suggestion to take a position as such it isn’t meant to incentivize the acquisition of belongings in any means. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding choice and the related threat stays with the investor.

[ad_2]

Source link