[ad_1]

US core PCE and Eurozone flash CPIs to maintain inflation worries within the foregroundJapanese and Australian inflation numbers additionally arising RBNZ would possibly strike a hawkish tone Manufacturing PMIs additionally within the spotlightPCE inflation to headline busy US knowledge weekThe Fed is in no rush to ease coverage and markets are lastly beginning to come spherical to the prospect of no fee cuts earlier than the summer season. But, inventory markets have remained bullish, suggesting that the actual fact alone that rates of interest will begin to fall this 12 months is sufficient to spur optimism.

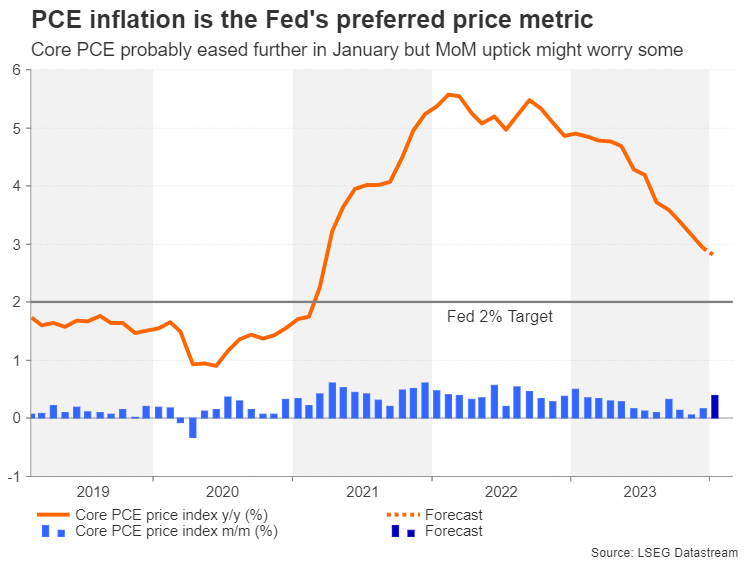

For the US greenback, nevertheless, any additional delay may very well be essential for its year-to-date uptrend, therefore, subsequent week’s releases will type one of many final items of the puzzle earlier than the March FOMC assembly. Particularly, all eyes shall be on the private revenue and outlays report for January that features the all-important core PCE value index, which is the Fed’s inflation indicator of selection.

After each the CPI and PPI figures stunned to the upside, one other scorching inflation print may forged doubt on even a June fee reduce. It’s doable although that January’s PCE inflation readings due Thursday won’t sway fee reduce odds in both route.

The core PCE value index is forecast to have cooled barely on an annual foundation from 2.9% to 2.8%, however an acceleration within the month-on-month fee to 0.4% would probably maintain buyers on their toes.

Within the occasion of a combined set of PCE value knowledge, the market response may very well be decided by how sturdy the private revenue and spending numbers are. Private consumption unexpectedly jumped by 0.7% m/m in December. It’s projected to have moderated to 0.3% in January, doubtlessly easing issues about an overheating US financial system.

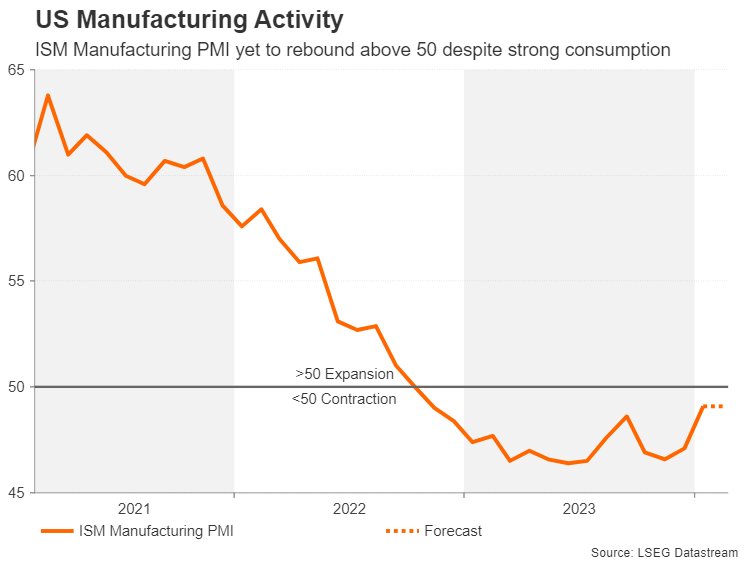

Will knowledge flurry present a raise to the greenback?Inflation and client spending won’t be the one knowledge in focus as there’s a slew of different releases on the US agenda subsequent week, most notably the ISM manufacturing PMI on Friday. The carefully watched PMI gauge is forecast to have stayed unchanged at 49.1 in February, pointing to ongoing contraction within the sector.

However ought to the information paint a broadly wholesome image, the US greenback would possibly simply have the ability to resume its ascent, although any positive factors would probably be restricted with out further catalysts.

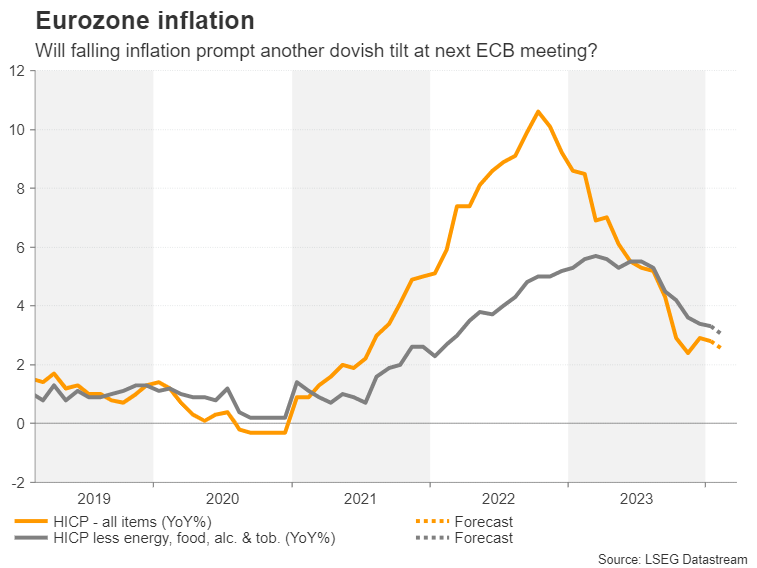

Final flash CPI report earlier than March ECB meetingThe European Central Financial institution’s subsequent coverage assembly is quick approaching on March 7 and there’s intense hypothesis as as to whether or not policymakers will flag a fee reduce quickly. Inflationary pressures within the euro space are considerably extra subdued than in America, thanks primarily to a a lot weaker financial system. Headline inflation dipped to 2.8% year-on-year in January, confounding expectations of a return to the three.0% deal with.

The flash estimates for February are due on Friday and if there’s a additional decline, markets will most likely understand that as a inexperienced mild for policymakers to formally pave the way in which for a fee reduce in the summertime.

Nevertheless, it’s additionally probably that policymakers won’t wish to pre-commit to a fee reduce earlier than there’s been additional progress in decreasing underlying inflation. The core determine excluding meals and vitality stood at 3.6% in January, whereas the measure that additionally excludes tobacco and alcohol costs was barely decrease at 3.3% however nonetheless far away from the two% goal.

The euro has been having fun with a little bit of a rally in opposition to the dollar these days regardless of Fed fee reduce bets being pushed again. Nevertheless, there’s a threat of these positive factors being reversed if the inflation numbers are on the gentle aspect as that might enhance the chances of the ECB chopping charges earlier than the Fed.

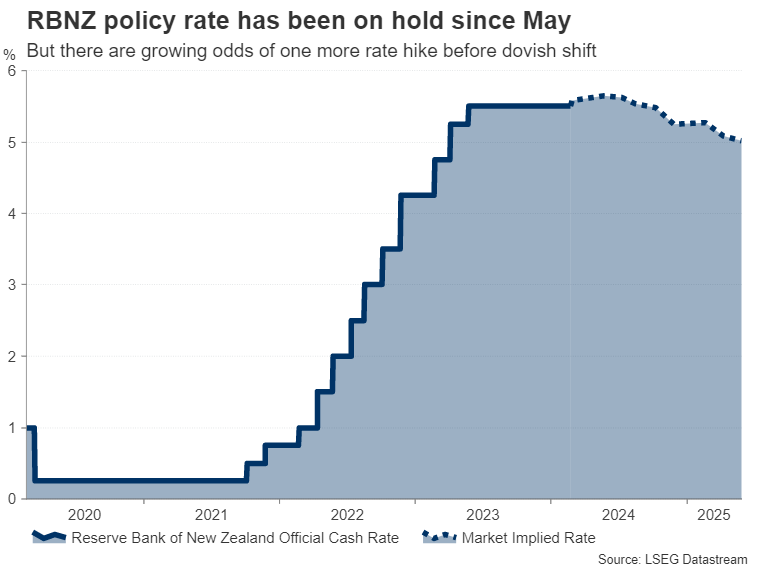

RBNZ would possibly buck the speed reduce trendAs most central bankers begin to brazenly talk about shifting to an easing stance quickly, the Reserve Financial institution of New Zealand has taken a hawkish flip. In current feedback, Governor Adrian Orr appeared to suggest that there was a threat inflation wouldn’t return to the 1-3% goal band with out additional tightening.

Though progress in New Zealand has been sluggish over the previous few quarters and the labour market has cooled considerably, enterprise confidence is on the rise. The newest ANZ enterprise outlook survey is out on Thursday. Extra importantly, CPI stays elevated at 4.7%, elevating fears about persistent value pressures.

The percentages of a further fee hike have subsequently shot up, reaching virtually 60% for the Could assembly. For the February resolution on Wednesday, markets have assigned a 30% chance. What’s extra sure, nevertheless, is that the RBNZ received’t be chopping charges anytime quickly, if in any respect in 2024.

In its final quarterly projections, the RBNZ had forecast that charges wouldn’t begin to fall earlier than the primary quarter of 2025. Ought to these forecasts be additional pushed again within the quarterly Financial Coverage Report back to be printed on Wednesday, the New Zealand greenback may stretch its current spectacular positive factors.

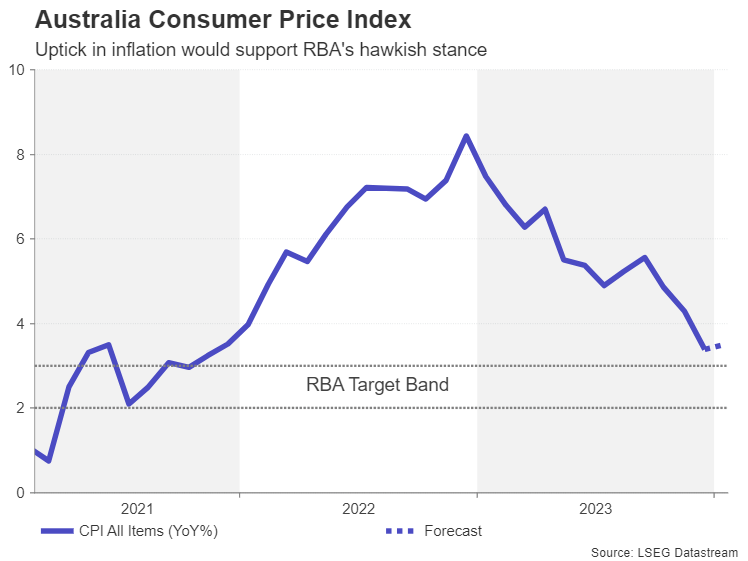

Can the prolong its rebound? One other central financial institution that appears set to lag others in chopping charges is the Reserve Financial institution of Australia. Nevertheless, inflation in Australia has now began to drop extra rapidly. The month-to-month headline fee had tumbled to three.4% y/y in December. The January numbers are out on Wednesday and are forecast to indicate a slight uptick, giving the RBA extra cause to stay hawkish.

Stalling disinflation could be optimistic for the Australian greenback, which lately broke above its bearish channel. However financial knowledge, each domestically and from its largest buying and selling companion – China – pose a draw back threat. The fourth quarter estimate for capital expenditure is out on Thursday, whereas China’s official manufacturing and Caixin manufacturing PMIs are due on Friday.

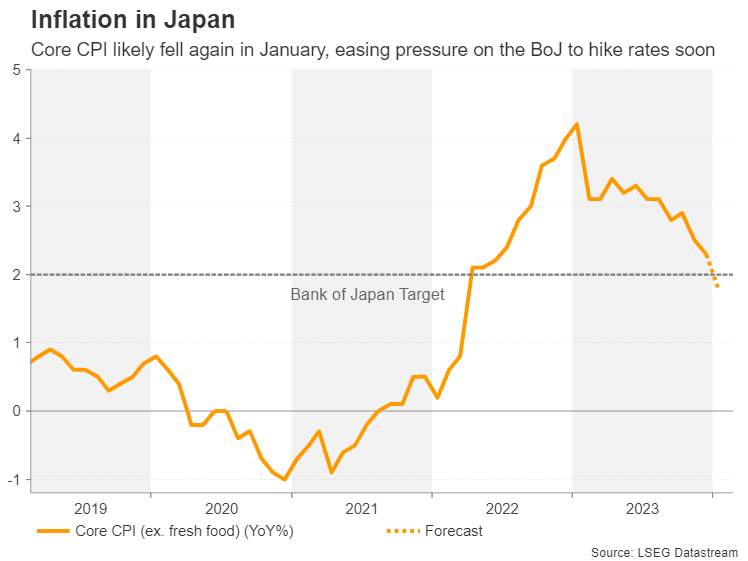

Japanese CPI unlikely to halt yen’s slideInflation may even be the spotlight in Japan because the Financial institution of Japan ponders whether or not to exit from damaging rates of interest. The core client value index is predicted to have risen by 1.8% y/y in January, in what could be a slowdown from the two.3% fee in December, eradicating any urgency for policymakers to raise charges quickly.

The yen may come below strain from weaker-than-expected figures, though the BoJ’s major focus proper now’s the spring wage negotiations, so any response would most likely be modest.

[ad_2]

Source link