[ad_1]

hocus-focus/iStock Unreleased by way of Getty Pictures

Regardless of a cautiously optimistic market that’s energized by the AI increase, traders ought to preserve super warning round richly valued progress shares. I’ve moved extra of my portfolio towards money and value-oriented performs for the reason that begin of the 12 months and locked in positive factors on a lot of my progress positions.

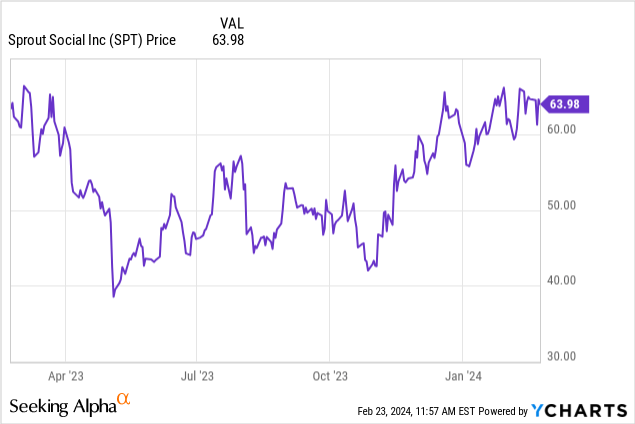

Sprout Social (NASDAQ:SPT) is one inventory that bears shut watching. This social media administration platform has rallied greater than 50% for the reason that begin of November and is up practically 10% already this 12 months. The corporate’s latest This autumn earnings print and FY24 steerage did not dent the corporate’s momentum, both.

I final wrote an article on Sprout Social with a maintain score in November, when the inventory was nonetheless buying and selling within the mid-$40s. Now, with the inventory sitting materially larger and with income anticipated to decelerate considerably heading into this 12 months, I am as soon as once more downgrading this place to promote and inspiring traders to lock of their positive factors.

There is not any doubt that Sprout Social continues to be a fast-growing participant with a self-reported TAM of over $120 billion. The corporate has already hit profitability from a professional forma working margin standpoint regardless of its small scale. We additionally like the truth that Sprout Social is platform-agnostic, designed to work with all social media platforms that companies select to promote on.

But on the identical time, we’ve to be conscious of quite a lot of dangers:

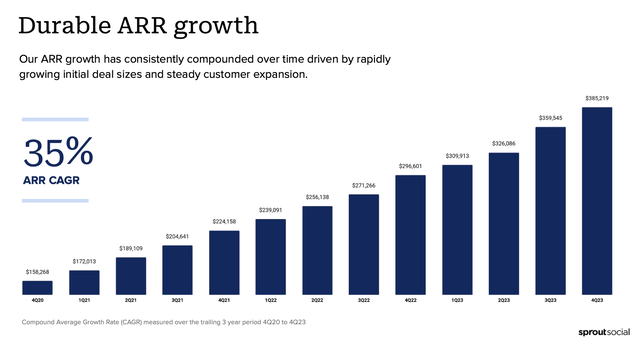

Sprout Social is purpose-built for social media managers, and the present macro panorama is unfavorable for this area of interest. Firms are slashing their gross sales and advertising and marketing budgets – each for promoting spend in addition to the G&A headcount that helps it. Whereas social media administration as a core firm perform will proceed to see secular tailwinds, we’ll seemingly see retrenchment as corporations tighten their belts. DIY competitors. Sprout Social’s instruments are helpful however not groundbreaking. Managing social media posts and operating analytics on marketing campaign efficiency will be finished with in-house instruments, or with extra general-purpose opponents like HubSpot (HUBS). ARR slowdown. To what extent has Sprout Social already reached saturation in some market segments? Sprout Social’s ARR provides are displaying a sequential slowdown as the corporate scales.

By far, nonetheless, the largest argument in opposition to investing in Sprout Social is its valuation. At present share costs close to $64, Sprout Social trades at a market cap of $3.59 billion. After we internet off the $98.1 million of money in opposition to $55.0 million of debt on Sprout Social’s newest stability sheet, the corporate’s ensuing enterprise worth is $3.55 billion.

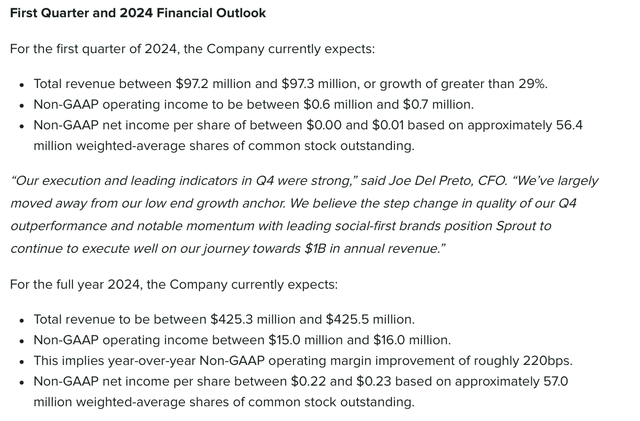

In the meantime, for the present fiscal 12 months FY24, Sprout Social is guiding to $425.3-$425.5 million in income, representing 27% y/y progress, in addition to 220bps of working margin growth:

Sprout Social outlook (Sprout Social This autumn earnings launch)

In opposition to this income outlook, Sprout Social trades at 8.4x EV/FY24 income. In pandemic-era instances, paying a excessive single-digit income a number of for a ~30% progress inventory was regular – however within the period of ~5% rates of interest, this a number of stands proud like a sore thumb, particularly for a corporation that’s dealing with an hostile macro local weather (gross sales and advertising and marketing staffers are being laid off in droves).

Although I am unable to dispute that Sprout Social has seen robust execution to this point, the inventory has turn out to be a commonplace “excessive worth for good efficiency” sort of play, and I do not assume there’s a lot upside left from right here. Lock in positive factors and transfer to the sidelines.

This autumn obtain

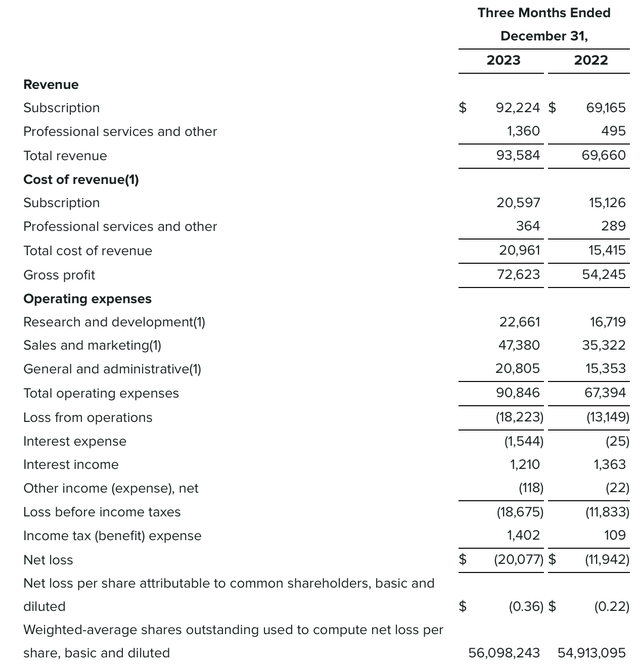

Let’s now undergo Sprout Social’s newest quarterly leads to better element. The This autumn earnings abstract is proven beneath:

Sprout Social This autumn outcomes (Sprout Social This autumn earnings launch)

Income grew 34% y/y to $93.6 million, forward of Wall Avenue’s expectations of $91.0 million (+31% y/y) by a good three-point margin. Word that whereas income did speed up three factors versus 31% y/y progress in Q3, the corporate is anticipating progress to decelerate again all the way down to 29% y/y in Q1.

Administration famous a powerful quarter for go-to-market execution. Per CEO Justyn Howard’s remarks on the This autumn earnings name:

We’re getting into 2024 with notable momentum and an increasing scope of progress alternatives. Earlier this month, we had been rated because the primary greatest software program product by G2 throughout your complete software program business, including to management throughout all the main classes through which we compete. We imagine our product management and excellent execution have Sprout place for a breakout 12 months as we outline class management.

Throughout This autumn, we noticed continued file new enterprise ACVs and complete ACV progress of 43% year-over-year. We added file internet new natural 10K and 50K prospects, and our premium product connect price is now 30%, with premium product ARR rising better than 50% year-over-year. We added file internet new ARR, a file enhance in deferred income, and step change enhance in RPO and CRPO.

New RPO, or complete contract worth bookings, was practically 80% larger than any quarter in our historical past. New CRPO bookings elevated practically 3x year-over-year. Our focus technique is yielding highly effective outcomes.”

As a reminder, Sprout Social is concentrated on shifting upmarket to the enterprise. The corporate notes that low-end, “non core” ARR is now lower than $800k. Conversely, single prospects producing over $50k in ARR grew 37% y/y. Large buyer wins within the quarter included X.com (previously generally known as Twitter), Brown-Forman, DHL, and the U.S. Chamber of Commerce.

But we do be aware a sequential slowdown in ARR provides. ARR in This autumn grew 30% y/y to $385.2 million, including $26 million in net-new ARR within the quarter: versus $33 million in Q3. We be aware that This autumn tends to be a giant quarter for software program firm bookings, as prospects look to exhaust their IT budgets for the 12 months.

Sprout Socia ARR traits (Sprout Social This autumn earnings launch)

From a profitability standpoint, Sprout Social’s professional forma working margins expanded barely to 1.8%, from 0.8% within the year-ago quarter.

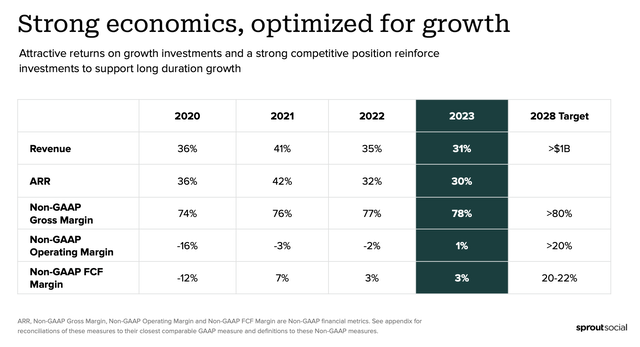

Sprout Social long-term mannequin (Sprout Social This autumn earnings launch)

As proven within the chart beneath, Sprout Social’s long-term progress plan requires over $1 billion income by 2028 (requiring a minimal of a 24% progress CAGR by means of 2028) and hitting a 20%+ professional forma working margin by then.

Key takeaways

At >8x ahead income, I see many higher alternatives to spend money on the software program business (names I am significantly enthusiastic on in the intervening time embody Okta (OKTA), Asana (ASAN), and Appian (APPN). Promote Sprout Social right here and lock in positive factors earlier than they erode.

[ad_2]

Source link