[ad_1]

Final week noticed equities show mania-like signs in Germany and different mainland European markets, in addition to Japan, and some different locations.

However it was nothing in comparison with the US, the place one single inventory (clearly, you realize which one) was liable for a overwhelming majority of the beneficial properties for main indexes.

Nvidia’s (NASDAQ:) blowout outcomes fuelled a recent shopping for frenzy on Wall Road, the place the S&P 500 surpassed the 5,100 milestone for the primary time to set a brand new file.

The hit a recent all-time excessive on Friday, as Nvidia’s valuation topped $2 trillion, changing into the primary chipmaker to attain this feat.

Nonetheless, because the session wore on, tech shares began to ease again, earlier than closing close to their lows. This induced the key US indexes to publish some not-so-bullish-looking candles on their charts, suggesting we might see some weak spot immediately.

What’s Subsequent For Shares?

Thursday noticed Nvidia expertise a outstanding one-day surge. The rally propelled its market capitalization to $277 billion, marking the most important single-session improve in worth ever recorded, surpassing Meta (NASDAQ:)’s current $197 billion acquire.

However after the not-so-strong shut on Friday, this has raised query marks in regards to the potential sustainability of this tech-driven rally and its capacity to increase throughout different sectors.

Traders are questioning what the diminishing expectations for Federal Reserve fee cuts, fuelled by sturdy information indicating continued energy on the earth’s largest financial system, could imply for shares going ahead.

With over-stretched price-to-earnings ratios, many shares within the tech sector are liable to giving again some beneficial properties. But, thus far, each dip has been purchased, pointing to an insatiable urge for food for threat. Let’s see if that modifications within the week forward.

Many of the earnings at the moment are out of the best way, the percentages of early fee cuts slashed, and the fairness benchmarks have hit file highs in a interval that traditionally has not been nice for the markets.

On this situation, even essentially the most bullish traders could really feel {that a} correction, even when it seems to be a small one, is warranted. In a wholesome bull market, a correction is rarely a nasty factor.

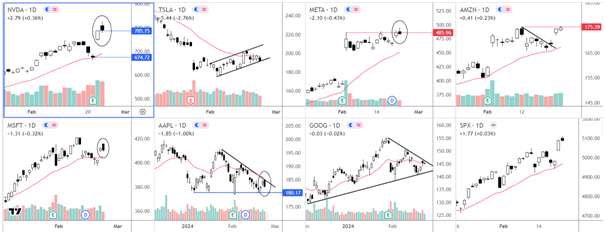

Magnificent 7 Charts Level to Warning

The rally in shares moderated on Friday, as traders presumably took revenue on their lengthy positions that that they had amassed throughout the week, realizing full effectively there may be all the time the potential for a correction at these elevated ranges.

Merchants at the moment are left questioning, whether or not to proceed shopping for any small dips they see or begin in search of shorting alternatives as soon as there’s a concrete bearish sign to work with.

Wanting on the charts of the large tech giants, Friday’s value motion does warrant some warning for the week forward.

Magnificent7 Shares Chart

Supply: TradingView.com

Nvidia inventory closed close to Thursday’s shut on heavy quantity, as traders presumably took revenue. The bearish shut is a warning that Monday might see some profit-taking after the eye-watering beneficial properties, doubtlessly weighing on the US indexes.

Tesla (NASDAQ:) additionally closed close to its lows, inside a bear flag sample. A break beneath the help development might give rise to some technical promoting within the days forward.

Meta Platforms (NASDAQ:) has had some issue clearing resistance across the $485/6 space and it was once more unable to posit an in depth above that degree on Friday. So, a little bit of a correction could also be on the playing cards. The bullish development has been very sturdy, although.

Microsoft (NASDAQ:) fashioned a bearish engulfing-like candle on its day by day chart Friday, suggesting that it might head again down in the direction of $400, and additional work off its “overbought” situations earlier than it doubtlessly strikes once more.

Apple (NASDAQ:) held beneath the bearish development line and the 21-day exponential transferring common, because it continues to commerce inside a descending triangle sample. Key help at $180 continues to be holding.

Nasdaq 100 Technical Evaluation

US Tech 100-Every day Chart

Supply: TradingView.com

The fashioned an inverted hammer on the day by day timeframe on Friday, which is a warning signal that the bullish development could have reached exhaustion after a relentless rally.

It requires bullish warning however just isn’t essentially a sign that the market has topped. The bears must see a decrease low kind beneath final week’s low at 17315 earlier than they’ll grow to be assured {that a} peak has been reached.

Standing on the best way of that degree is vital help at 17660. That is the world the bulls might want to defend this week in the event that they wish to keep this bullish development and elevate the Nasdaq to a brand new all-time excessive.

Nonetheless, if that 17315 degree breaks down, then a possible drop to check the December excessive at 16970 may very well be on the playing cards, with the November 2011 excessive coming at 16769.

So, at least, I’m anticipating to see a small pullback this week however have clear plans in case the bears take cost.

For now, we will solely assume that the retreat is a standard pullback you see in a wholesome bullish development. Let the charts information you and go away feelings and what “ought to” occur apart.

Learn my articles at Metropolis Index

[ad_2]

Source link