[ad_1]

Eoneren

New providing summaries

CDX3Investor.com

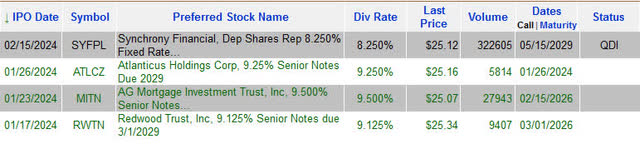

Synchrony Monetary (SYF) priced an providing of $500 million price of latest 8.25% fastened price reset non-cumulative sequence B most popular inventory, with the preliminary 8.25% dividend price to be paid till Might of 2029 at which level the most popular turns into callable, and if not known as, the speed resets to the then-current 5-year US Treasury price plus a diffusion of 4.044%. The brand new shares acquired credit score scores of BB- and B+ from S&P and Fitch, respectively. The brand new shares are buying and selling briefly on the OTC underneath image SYFPL, earlier than ultimately transferring to everlasting image SYF-B on the New York Inventory Change.

Atlanticus Holdings Company (ATLC) priced an providing of $50 million of latest 9.25% senior notes due 2029. The brand new notes are designed to be redeemable at any time after issuance, on the firm’s possibility. The brand new notes have been rated A by Egan-Jones Scores Firm and commerce on the New York Inventory Change underneath image ATLCZ.

Specialty finance firm Redwood Belief (RWT) priced an providing of $60 million of latest 9.125% senior notes due 2029. The corporate might redeem the notes early starting in March of 2026. The corporate indicated {that a} portion of proceeds might go in the direction of repaying or repurchasing beforehand issued debt, in addition to funding new funding exercise within the firm’s mortgage banking companies. The brand new notes have been rated BBB by Egan-Jones Scores Firm and commerce on the New York Inventory Change underneath image RWTN.

And AG Mortgage Funding Belief (MITT) priced an providing of $30 million of latest 9.5% senior notes due 2029. The corporate might redeem the notes early starting February 15, 2026. The corporate indicated {that a} portion of proceeds could also be used in the direction of repurchase or compensation of its convertible notes due this 12 months, in addition to to spend money on new residential mortgage backed securities. The brand new notes have been rated BBB- by Egan-Jones Scores Firm and commerce on the New York Inventory Change underneath image MITN.

SEC filings for additional info: ATLCZ, RWTN, MITN, SYF-B.

Shopping for new shares for wholesale

Most popular inventory IPOs typically contain a brief interval throughout which OTC buying and selling symbols are assigned till these securities transfer to their retail alternate, at which era they are going to obtain their everlasting symbols. For instance, the brand new Synchrony Monetary most popular mentioned above, which is initially buying and selling underneath image SYFPL on the OTC:

CDX3Investor.com

Particular person buyers, armed with an online browser and a web-based buying and selling account, can typically buy newly launched most popular inventory shares at wholesale costs identical to the large guys (see “Most popular Inventory Consumers Change Ways For Double-Digit Returns” for an evidence of how the OTC can be utilized to buy shares for discounted costs).

Those that have been following this technique of utilizing the wholesale OTC alternate to purchase newly launched shares for lower than $25 are extra capable of keep away from a capital loss if costs drop (in the event that they select to promote). Word that within the solid of the brand new Synchrony Monetary most popular, on 2/16/2024 shares have been altering palms round $24.92; as of this writing SYFPL is buying and selling at $25.12.

Your dealer will robotically replace the buying and selling symbols of any shares you buy on the OTC, as soon as they transfer to their everlasting symbols. A particular be aware relating to most popular inventory buying and selling symbols: Annoyingly, not like widespread inventory buying and selling symbols, the format utilized by exchanges, brokers and different on-line quoting providers for most popular inventory symbols just isn’t standardized.

For instance, a given Sequence A most popular inventory might need a logo ending in “-A” at TDAmeritrade, Google Finance and a number of other others, however this similar safety might finish in “PR.A” at E*Commerce and “.PA” at In search of Alpha. For a cross-reference desk of how most popular inventory symbols are denoted by sixteen standard brokers and different on-line quoting providers, see “Most popular Inventory Buying and selling Image Cross-Reference Desk.”

Previous most popular inventory IPOs beneath par

Along with protecting new most popular inventory and ETD choices, we additionally monitor previous choices, with alerts when securities fall beneath their par values. For all of 2023, the basket of CDx3-compliant most popular shares and ETDs (i.e. scoring 10 out of 10 on our compliance scale), traded beneath par worth of $25 as a bunch, with our inner “cut price desk” rely elevated in comparison with the previous ten 12 months common – that rely representing our tally of the quantity of top of the range most popular shares and ETDs accessible beneath their par values.

CDX3Investor.com

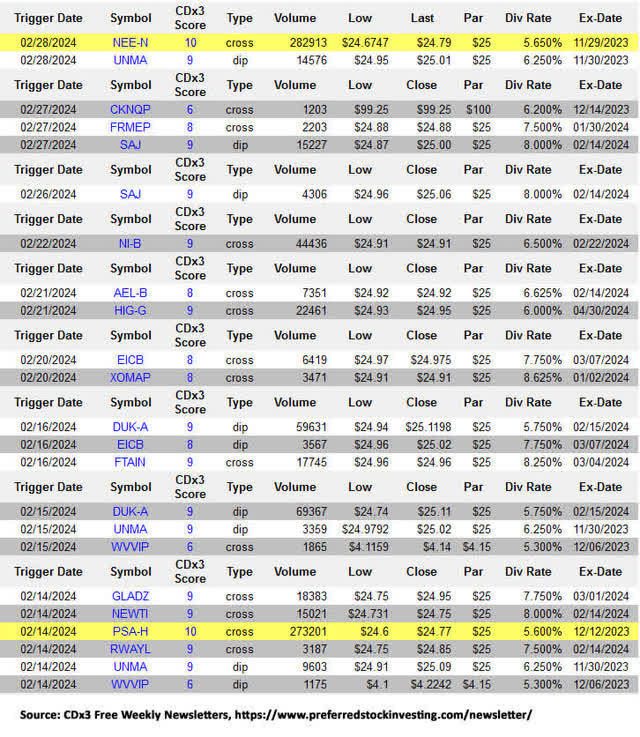

We monitor when completely different securities turn out to be accessible beneath par, and to shut this text, we want to share with you a number of the most up-to-date dips/crosses beneath par now we have noticed amongst particular person securities (be aware that yellow highlighted entries point out extremely rated securities eligible for the “CDx3 Cut price Desk”):

CDX3Investor.com

For these most popular inventory (and ETD) buyers not simply in new IPOs however beforehand issued securities, following par crosses can present helpful perception into which securities have lately turn out to be accessible within the market beneath their preliminary providing costs; for instance NEE-N is a ten out of 10 CDx3-compliant safety (highlighted in yellow), which crossed beneath par worth on 2/28.

Investor Takeaway

In our month-to-month In search of Alpha articles, we usually summarize all the brand new most popular inventory and alternate traded debt choices noticed over the course of the month; we additionally spotlight previous choices which have begun to commerce beneath par worth. Our aim is to maintain fixed-income buyers up-to-date on the assorted investments accessible within the present market, and we hope this month’s article has served this objective. See you subsequent time, and thanks for studying!

[ad_2]

Source link