[ad_1]

JHVEPhoto

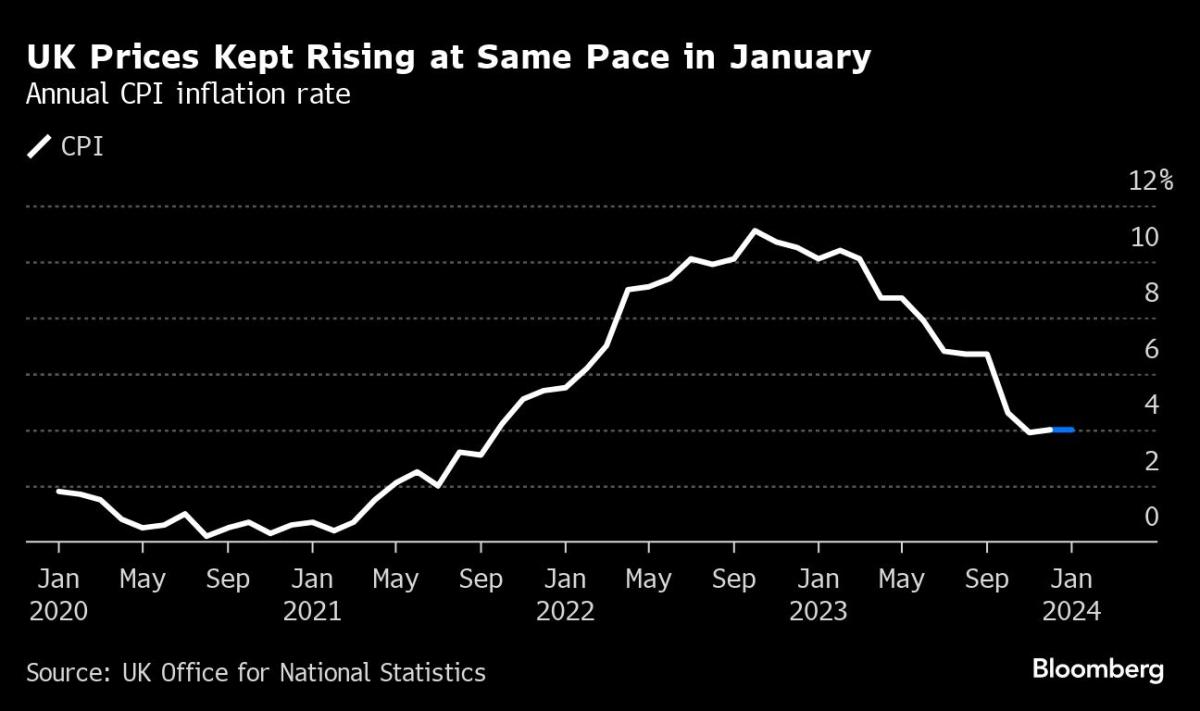

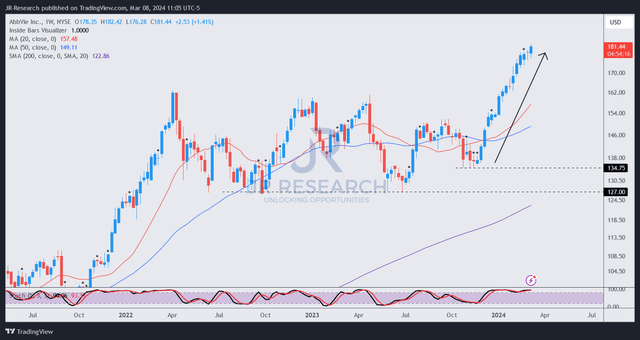

I’ve underestimated biopharma firm AbbVie Inc.’s (NYSE:ABBV) means to beat the near- and medium-term headwinds from Humira’s LOE. I assessed that the danger/reward of ABBV was well-balanced in my earlier replace in late November 2023. Nonetheless, that Maintain/Impartial thesis has proved to be too cautious. I had anticipated promoting stress to accentuate, doubtlessly resulting in a drop to the $130 assist degree earlier than bottoming out.

Nonetheless, the market has spoken. ABBV consumers returned with conviction, serving to the inventory stage a resilient backside near the $130 zone in November. AbbVie’s fourth-quarter earnings launch in February 2024 probably justified the market’s optimism, as AbbVie demonstrated its means to forge forward with its ex-Humira progress portfolio.

Accordingly, AbbVie posted an 8% income progress for FY23 for its ex-Humira portfolio. In This autumn, AbbVie posted a 15% progress. Consequently, I assessed that AbbVie has corroborated its long-term outlook as traders look previous the headwinds from Humira’s LOE. Administration underscored that AbbVie’s “diversified progress platform efficiently absorbed” the “largest lack of exclusivity occasion within the business.”

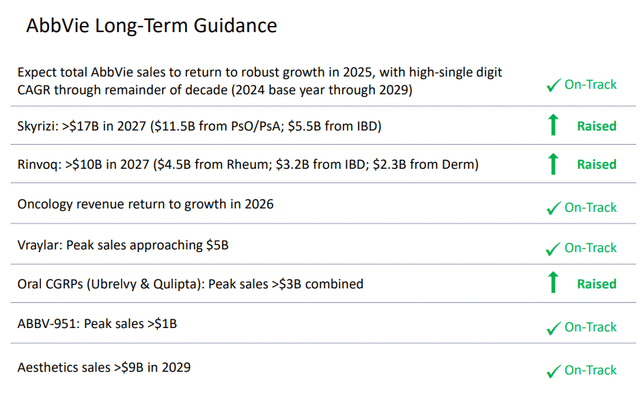

AbbVie delivered outstanding metrics in Skyrizi and Rinvoq, notching income progress of 52% and 63% in FY23, respectively. Moreover, AbbVie additionally lifted its long-term outlook for each the blockbusters, doubtlessly reaching a excessive of $27B in mixed annualized gross sales by 2027, up $6B from AbbVie’s earlier steering. Consequently, it is anticipated to blow previous Humira’s peak gross sales of $21B notched in 2022, showcasing AbbVie’s functionality to handle Humira’s LOE competently.

AbbVie long-term steering (AbbVie filings)

Moreover, administration assured traders of AbbVie’s upgraded long-term steering. Its latest acquisitions of ImmunoGen and Cerevel have additionally contributed to the corporate’s income trajectory, decreasing execution dangers. Administration highlighted that its long-term outlook has contemplated its latest acquisition. Accordingly, AbbVie telegraphed a midpoint adjusted EPS of $11.15 for FY24. Analysts’ estimates counsel AbbVie’s outlook might be conservative, as they penciled in an adjusted EPS forecast of $11.21.

Moreover, AbbVie maintained its long-term income steering of attaining a excessive single-digit income CAGR by way of 2029. AbbVie hasn’t materially upgraded its long-term outlook. Nonetheless, I consider the market has diminished its evaluation of AbbVie’s execution dangers, given its strong efficiency and robust steering of its ex-Humira portfolio. Consequently, I assessed it was justified for the market to re-rate ABBV’s earnings multiples, contemplating the upper income visibility attributed to its progress portfolio.

ABBV is valued at a ahead adjusted EBITDA a number of of 14x, nicely above its 10Y common of 10.6x. In different phrases, the market has quickly mirrored its optimism over its long-term potential, repricing it greater. In my earlier replace, I ought to have been extra optimistic about AbbVie’s means to beat Humira’s LOE dangers. Regardless of that, I will not all of a sudden go FOMO and begin chasing ABBV’s surging momentum. ABBV ought to stay a core play for healthcare traders in a diversified portfolio. Nonetheless, traders should be cautious about chasing its latest surge, as ABBV seems to be more and more expensive.

ABBV value chart (weekly, medium-term, dividend adjusted) (TradingView)

Revenue traders may level to ABBV’s comparatively engaging ahead dividend yield of three.4%. Nonetheless, ABBV’s 5Y complete return CAGR of 23.8% ought to inform traders that ABBV is primarily a capital appreciation play. There’s little doubt that AbbVie is a high-quality and basically sturdy healthcare inventory with a best-in-class “A+” profitability grade. Additionally, with ABBV recovering its long-term uptrend because it surged to a brand new excessive, I did not glean pink flags suggesting traders ought to think about slicing their publicity.

In different phrases, traders who missed including on AbbVie Inc.’s important dips ought to think about assessing its subsequent pullback whereas ready patiently for an additional alternative so as to add to their positions.

Ranking: Preserve Maintain.

Necessary notice: Buyers are reminded to do their due diligence and never depend on the knowledge supplied as monetary recommendation. Please all the time apply unbiased considering. Observe that the ranking will not be meant to time a particular entry/exit on the level of writing, until in any other case specified.

I Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a crucial hole in our view? Noticed one thing vital that we didn’t? Agree or disagree? Remark beneath with the purpose of serving to everybody locally to be taught higher!

[ad_2]

Source link