[ad_1]

Amidst the attract of expertise and renewable power, dividend kings quietly anchor portfolios with their steadfast reliability, providing stability in unsure markets.

Reaching dividend king standing requires a uncommon feat: growing dividends for over 50 consecutive years, a testomony to monetary resilience in in the present day’s risky financial system.

On this piece, we’ll check out three shares for not simply stability but in addition potential for development and earnings, making them important parts for long-term traders in search of resilience of their portfolios.

Make investments like the large funds for lower than $9 a month with our AI-powered ProPicks inventory choice device. Be taught extra right here>>

In a world of fast-changing expertise and shifts in renewable energies, dividend kings won’t seize the highlight, however their consistency makes them precious property for a lot of traders. Because the market faces uncertainty, traders search stability, and dividend kings present a dependable basis.

Incomes the title of a dividend king is not any small achievement. Firms should enhance dividends for not less than 50 consecutive years, showcasing uncommon monetary power and continuity in in the present day’s dynamic financial panorama. It is this reliability that units dividend kings aside.

Whereas they could not shine just like the tech stars on the Magnificent 7 or make headlines with AI breakthroughs, dividend kings excel in offering a reliable earnings stream, particularly useful for retirees.

Being in a mature enterprise section, these firms not solely keep a secure and rising dividend but in addition outperform the market, making them enticing for long-term worth traders who perceive the facility of compounding.

Regardless of market volatility affecting even dividend kings, these aiming for long-term development and a gradual earnings discover them a wonderful option to diversify portfolios and obtain monetary targets.

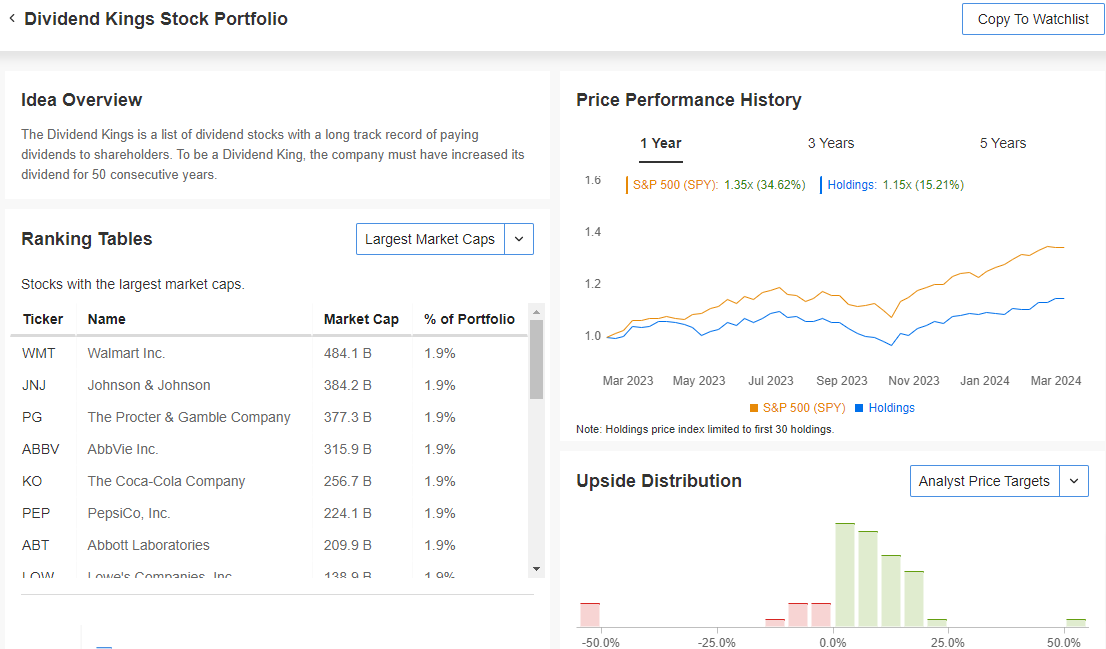

InvestingPro, Investing.com’s premium platform, affords a precious useful resource for figuring out dividend kings.

By filtering for dividend kings within the “Concepts” part, traders achieve entry to a complete checklist of firms with a exceptional dividend historical past:

Supply: InvestingPro

So, What are you ready for? Get InvestingPro now at a reduced value in the present day!

You may not solely achieve entry to portfolios of well-known traders and an expert screener but in addition to our 6 AI-driven methods which have persistently outperformed the during the last 10 years.

Click on right here to get began!

Listed here are three dividend kings which have confirmed to be sturdy investments and might supply traders vital general returns.

1. AbbVie: Dividend King With Bullish Potential

AbbVie (NYSE:) shines as a beacon of stability. As a dividend king, the corporate has not solely demonstrated spectacular development but in addition efficiently addressed investor issues concerning the patent safety of its key drug, Humira.

Up to now 5 years, AbbVie’s inventory has skilled a spectacular 180% enhance. A lot of this development was recorded within the first three years. Since then, the inventory has largely moved inside a buying and selling vary, prompting some traders to precise issues concerning the firm’s future.

AbbVie Returns

Supply: InvestingPro

The principle supply of those issues was the expiration of the patent safety for Humira. Nevertheless, the corporate’s latest monetary reviews have proven that these fears might have been considerably exaggerated.

Regardless of shedding patent safety for sure indications, AbbVie maintains a powerful market place. The corporate has efficiently relied on the introduction of alternative merchandise like Rinvoq and Skyrizi, whose revenues steadily grew and now represent greater than 1 / 4 of the overall income.

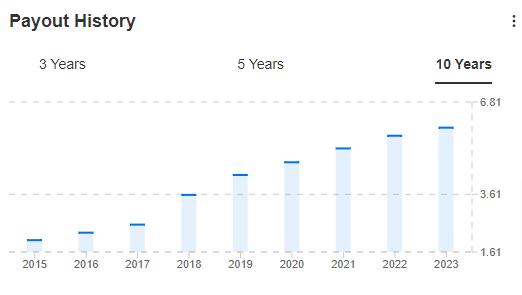

Analysts have praised AbbVie’s inventory contemplating these developments, and traders are actually more and more specializing in the enticing dividend yield of three.47% that the corporate affords. With an annual payout of $6.20 per share, AbbVie will not be solely a dependable funding for long-term traders but in addition a gorgeous goal for dividend hunters.

Dividend Historical past

Supply: InvestingPro

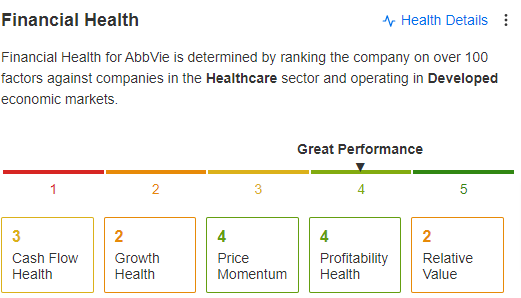

The monetary stability of AbbVie underscores its attractiveness as a long-term funding. Based on InvestingPro’s high quality rating, which considers greater than 100 particular person indicators, the corporate scores 4 out of 5 doable factors. That is additionally mirrored within the average payout ratio of round 46% on a free money stream foundation, indicating that the corporate nonetheless has room for future dividend will increase.

src=

Supply: InvestingPro

In a time of market uncertainty, AbbVie proves to be a rock within the storm. With a stable dividend coverage, sturdy alternative merchandise for Humira, and a strong monetary place, the corporate affords traders not solely stability but in addition vital potential for future development.

2. P&G: A Secure Inventory in Turbulent Instances

Procter & Gamble (NYSE:) can also be thought-about a stable anchor amongst traders in stormy waters. As a significant participant within the client items sector, the corporate boasts a formidable portfolio of manufacturers that proceed to take pleasure in recognition in each good and unhealthy occasions.

Final 12 months, P&G as soon as once more demonstrated its pricing energy and elevated income and revenue regardless of difficult situations. This illustrates the corporate’s power and its potential to thrive even in tough market situations.

With the anticipated enchancment within the financial state of affairs within the second half of 2024, P&G might enter a brand new section the place increased costs grow to be the norm on account of elevated wages and doubtlessly decrease rates of interest. This might present the corporate with additional alternatives to spice up its margin.

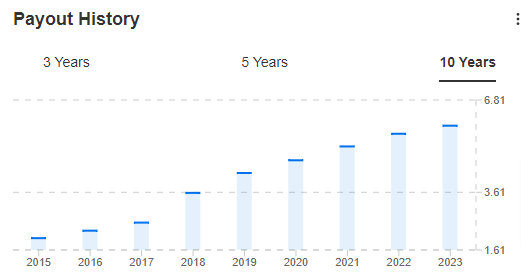

For long-term traders, P&G’s inventory additionally affords a gorgeous dividend. The corporate has been paying dividends to its shareholders for an unbelievable 68 years, constantly growing them.

Presently, the dividend yield is 2.35%, and with average payout ratios primarily based on earnings per share and free money stream (61.6% and 56.8%, respectively), there’s nonetheless appreciable potential for future will increase.

Dividend Historical past

Supply: InvestingPro

Within the final 5 years, P&G’s inventory has achieved a exceptional enhance in worth of over 77%.

Value Historical past

Supply: InvestingPro

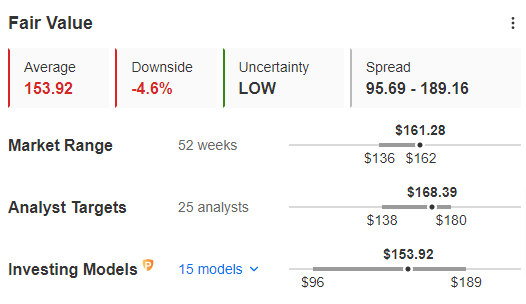

Analysts imagine that this will not be the tip of the highway. Based on estimates from 25 analysts captured on InvestingPro, the honest worth of the inventory is roughly $169, whereas it’s at present buying and selling at round $160.

Honest Worth

Supply: InvestingPro

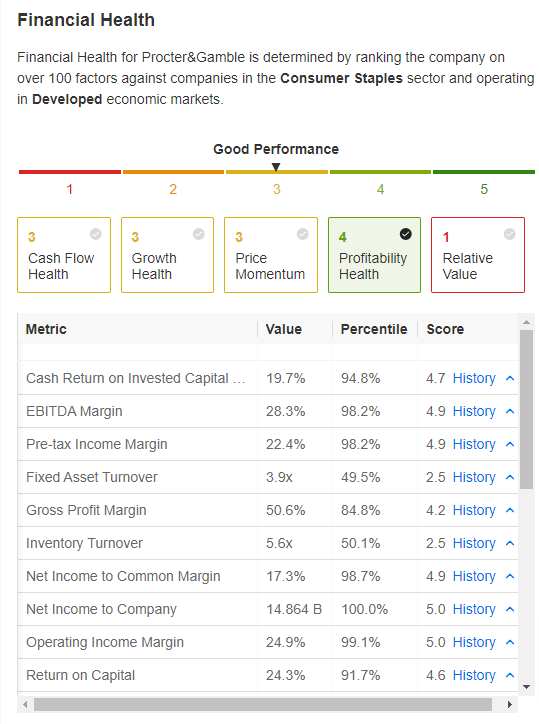

By way of high quality and monetary place, the buyer items large additionally performs properly. With a high quality rating of three out of 5 factors on InvestingPro, P&G significantly does properly within the profitability class, the place the corporate receives 4 out of 5 factors.

src=

Supply: InvestingPro

General, Procter & Gamble stays a dependable and enticing funding for traders, providing not solely stability but in addition potential for development and dividends.

3. Coca-Cola: A Inventory for Dividend Lovers

Relating to timeless investments, you possibly can depend on the shortlist of Warren Buffett’s favourite shares. And on the prime of this checklist has lengthy been the bubbling large Coca-Cola Co (NYSE:). The Oracle of Omaha swears by the reliability that stems from the corporate’s spectacular 63-year historical past of steady dividend development.

However what makes Coca-Cola so enticing to traders? A take a look at the corporate’s pricing energy reveals so much. Regardless of a long-term pattern of declining soda consumption, Coca-Cola’s loyal buyer base proves that it stays trustworthy to the model even in occasions of excessive inflation. This issue protects the corporate’s margins and earnings, making future dividend will increase virtually inevitable, particularly contemplating the nonetheless average payout ratios on an EPS and free money stream foundation.

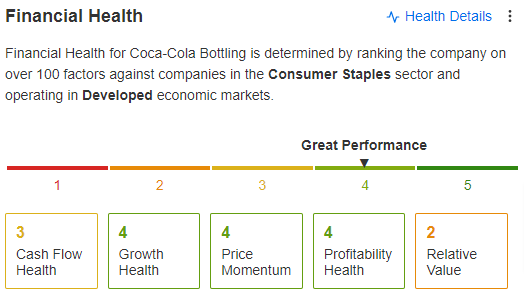

By way of monetary place, Coca-Cola, like the opposite two dividend kings, performs solidly. With 3 out of 5 factors, Coca-Cola proves to be secure and might simply navigate by financial turbulence.

src=

Supply: InvestingPro

However Coca-Cola will not be resting on its laurels. The corporate has steadily diversified its product portfolio. Whereas cola stays the center of the corporate, Coca-Cola now additionally affords a variety of teas, juices, and even power drinks to develop its income streams and adapt to altering client traits.

Within the final 12 months, KO inventory has gained 62%. Whereas the dividend yield of three.26% might not appear spectacular at first look, for income-oriented traders, the inventory gives a stable complete return that effortlessly surpasses inflation.

Value Historical past

Supply: InvestingPro

For traders in search of long-term stability and constant earnings, Coca-Cola undoubtedly stays an excellent alternative.

***

You should definitely try InvestingPro to remain in sync with the market pattern and what it means to your buying and selling. As with every funding, it is essential to analysis extensively earlier than making any choices.

InvestingPro empowers traders to make knowledgeable choices by offering a complete evaluation of undervalued shares with the potential for vital upside available in the market.

Subscribe right here for below $9/month and by no means miss a bull market once more!

Subscribe Right now!

Enter the code “PROTRADER” when putting your order and safe an extra 10% low cost on annual and two-year subscriptions of Professional and Professional+. Click on right here and do not forget the low cost code!

Disclaimer: Buying and selling shares and different monetary devices at all times includes a sure stage of threat. Previous efficiency will not be a dependable indicator of future outcomes. Investments within the inventory market can result in losses, and traders ought to concentrate on the opportunity of shedding their invested capital. It’s strongly beneficial that traders conduct their very own analysis and grow to be acquainted with particular dangers earlier than investing. This consists of contemplating market dangers, business dangers, firm dangers, in addition to particular person monetary targets and threat tolerances. It’s suggested that traders, particularly inexperienced ones, search impartial recommendation earlier than investing resolution. The usage of instruments and analyses offered by InvestingPro is for informational functions solely and shouldn’t be thought-about as funding recommendation. Any funding resolution is solely the duty of the investor. Please notice that buying and selling shares and different monetary devices includes vital dangers and will not be appropriate for all traders. It’s endorsed that traders solely make investments funds they will afford to lose.

[ad_2]

Source link