[ad_1]

ymgerman

In my earlier article about Getty Pictures (NYSE:GETY), I assigned a worth goal of $8 per share and outlined the case for my bullish place. Forward of the March 14th earnings name, I felt the necessity for a more in-depth examination of the corporate’s qualitative traits. On this article, I keep my worth goal of $8 per share based mostly on a rising P/E ratio, Getty’s strategic partnership with Nvidia (NVDA), and a forecasted demand development within the digital licensing phase as an entire. To briefly clarify the movement of this text, I first summarize the information surrounding a proposed refinancing settlement and the implications of not pursuing this selection. Then, I take into account historic traits within the P/E ratio to help my declare that the corporate is being primed for development. Lastly, I discover two qualitative elements of the corporate that I consider will later function the primary driving forces behind this development (specifically, Getty’s partnership with Nvidia and development within the digital licensing phase).

Administration Decides In opposition to Refinancing Settlement

Getty Pictures launched a plan to refinance senior time period mortgage amenities set to mature February nineteenth, 2026. The language present in Getty’s 8-Ok submitting on 02/07/2024 was relatively optimistic, suggesting this might lead to higher mortgage phrases and optimized curiosity expense. Contemplating that Getty Pictures has had a mean LTD/TA ratio of 0.56 since 2022, nearly 3 times the benchmark for technology-based corporations, I used to be skeptical of the optimism. As said in my earlier article on Getty Pictures, buyers must search for energetic steps by administration to scale back long-term debt if any constructive momentum is to be anticipated, and this simply felt like a band-aid was utilized. My sentiment was solidified when S&P International Scores described the refinancing settlement as “leverage impartial.” Consequently, it got here as welcome information to me when Getty Pictures in the end determined in opposition to the refinancing settlement of their 8-Ok submitting on 02/15/2024. Getty pointed to under anticipated curiosity financial savings, which I suspected could be the case provided that the federal rate of interest has been trending larger and will stay stagnant throughout 2024.

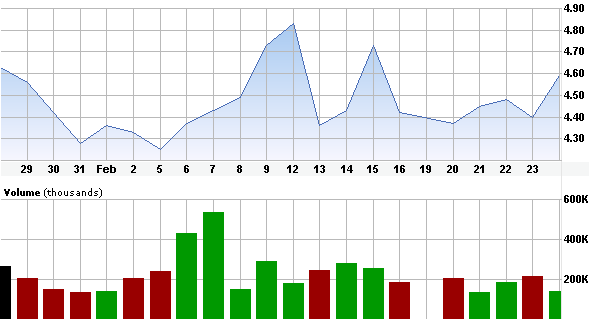

Inventory Worth – GETY – February 2024 (E*Commerce)

Primarily based on fluctuations within the inventory worth, the information seemed to be met with a combined response from buyers, with worth trending barely upward from February seventh, 2024.

This information is one thing that I prefer to name a “nothingburger.” What I imply is, Getty Pictures deliberate to enter a refinancing settlement, after which they backed out, so it is simply numerous speak with no change. What can buyers take away from this? The combined response of the inventory worth signifies to me that it’s nonetheless time to purchase Getty Pictures. Administration is clearly methods to scale back the corporate’s debt. It merely didn’t work out on this case. I feel it will be overly pessimistic to conclude that administration won’t ever discover a tangible answer. Nevertheless, if retail buyers await information of such an settlement to be within the headlines, greater buyers will swoop in and trigger the inventory worth to rise, leading to missed positive aspects. This may sound like a little bit of reverse psychology, however we will see this already beginning to unfold if we evaluation some key ratios within the fundamentals.

P/E Ratio Signifies Optimistic Sentiment

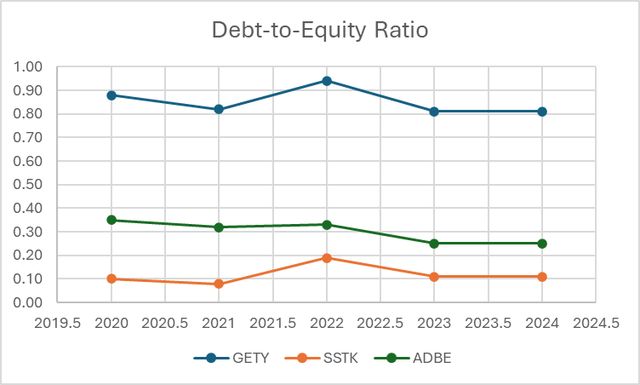

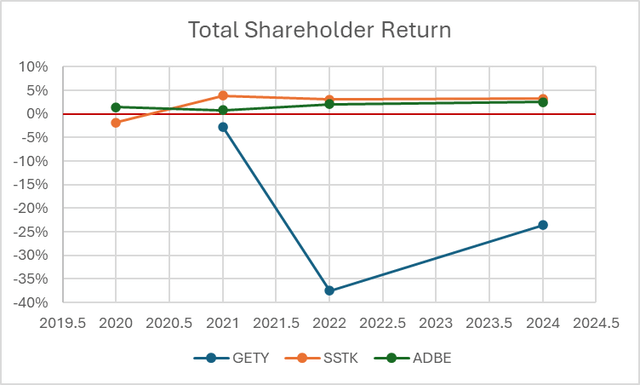

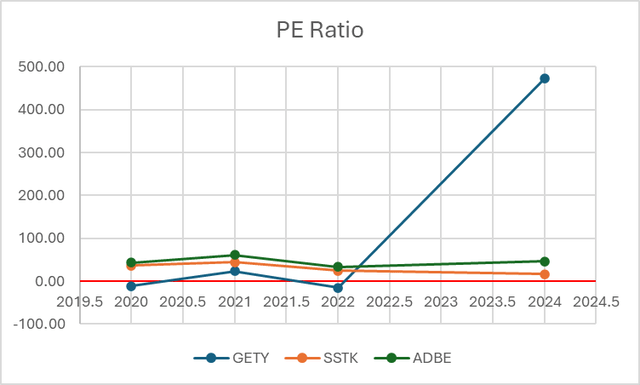

Getty Pictures has lackluster fundamentals in comparison with Shutterstock (SSTK) and Adobe (ADBE). If the typical investor examined the charts under, with out realizing the names of the businesses, Getty Pictures wouldn’t be seen as aggressive as the opposite corporations. Getty’s debt-to-equity ratio has stagnated, whole shareholder return has been persistently unfavourable, however curiously sufficient, the PE ratio has skyrocketed.

Debt-to-Fairness Ratio (stockanalysis.com) Whole Shareholder Return (stockanalysis.com) PE Ratio (stockanalysis.com)

At first look, one may be inclined to see the above common LTD/TA ratio, hearken to this speak of a foregone refinancing settlement, and conclude that rising curiosity expense is in charge for lowering earnings per share, leading to an elevated PE ratio. Nevertheless, one analyst agency I got here throughout aptly factors out that, “That is how most candidates reply this query and sadly that is incorrect. It is an arithmetic reply that fails to account for the equal change in Inventory Worth.” Inspecting the debt-to-equity ratio, we truly see a lower in early 2023, and the PE ratio does not enhance till after this, so there should be one other clarification.

Whereas topic to debate, and maybe a disappointing conclusion for these wanting an goal technique to calculate the worth of a inventory, I consider {that a} inventory worth represents nothing greater than what an individual is prepared to pay for it. Think about a quote from Warren Buffett, “You could have all these emotions in regards to the inventory. The inventory has no emotions about you.” Warren goes on to elucidate that you could be bear in mind who instructed you in regards to the inventory, what you paid for it, and many others., however the inventory worth doesn’t care. Over the previous 52 weeks, buyers have been paid as little as $4.30 for shares of Getty. I’m positive that a lot of these buyers combed over the basics, seemed on the historic inventory worth, learn information articles, and possibly even talked to associates earlier than putting their order. At one other level within the yr, different buyers paid as a lot as $4.80 per share, and sure thought of lots of the identical metrics earlier than putting their orders. No matter what worth was paid, every investor seemingly posited that every one the present details about Getty Pictures was already integrated into the inventory worth. As conveyed in The Clever Investor, assessing the validity of this declare is difficult.

It’s my opinion {that a} inventory worth is ruled extra by psychology than fundamentals. Given the rising PE ratio and stagnating debt-to-equity ratio, I consider we will infer that buyers have positioned higher consideration on the qualitative elements of Getty Pictures. Due to this fact, we should consider Getty’s core enterprise and see if the corporate’s aspirations are more likely to materialize.

Getty Pictures Bets on the Way forward for Generative AI

In a strategic transfer, Getty Pictures and Nvidia are collaborating to develop Generative AI by iStock, a text-to-image platform geared toward offering legally compliant inventory photographs for small and medium companies. This standalone model of Getty’s preliminary AI picture generator, based mostly on Nvidia’s Picasso mannequin skilled solely on Getty’s inventive and iStock’s inventory photograph libraries, assures “commercially secure” picture technology. Traders ought to take notice that regardless of this assurance, Getty provides compensation of $10,000 per picture for any unexpected points with Generative AI by iStock, in distinction to the limitless compensation with Generative AI by Getty Pictures. The companies, priced at $14.99 for 100 prompts, with every producing 4 photographs, additionally promise upcoming options equivalent to inpainting and outpainting.

Demand for AI-generated companies is anticipated to double by 2029 (with a CAGR of 11.9%) in line with market analysis agency Valuates. Grand View Analysis Agency forecasts that the AI generator market measurement could have an CAGR of 17.5%. International Market Insights reported an analogous CAGR of 16.5% from 2023 to 2032.

In early 2023, an article by The Verge described Getty Pictures and Shutterstock as being on the alternative ends of a authorized debate in regards to the implementation of generative AI for picture growth. Looking back, I feel this will likely have adversely affected market sentiment by portraying Getty Pictures as behind the occasions, since many consider that AI will proceed to play a bigger function sooner or later. Quite the opposite, I consider that Getty is taking proactive steps to safeguard its content material and to safe income streams whereas embracing the way forward for generative AI.

Just like Getty Pictures, Shutterstock has expanded its partnership with OpenAI by offering the corporate with entry to its picture database. Who has the higher partnership? Getty and Shutterstock each have expansive repositories, so I really feel like we might be remiss if we didn’t additionally take into account how Nvidia compares to OpenAI. I feel the winner is obvious from a valuation standpoint. OpenAI is valued at $80 billion, whereas Nvidia simply turned over $2 trillion. To not point out that OpenAI is extremely depending on Nvidia’s GPUs, as are many different opponents on this area. Nevertheless, Nvidia is seldom discovered amongst high ranked generative AI corporations (take a look at this text, for instance). Primarily based on the assets Nvidia has at its disposal, and the rising development of generative AI, Nvidia’s dominance on this area isn’t a matter of if, however when.

Traders must also be leery of the current lawsuit filed by Elon Musk in opposition to OpenAI. Personally, I discover this case to be very attention-grabbing because it pertains to the way forward for AI, however the particulars of the case are past the scope of this text (YouTuber Matthew Berman just lately uploaded a video that gives a superb 40-min abstract of the lawsuit). What buyers ought to be aware of is that if Elon prevails in opposition to Sam Altman, Microsoft (MSFT), and OpenAI, it will have a crippling impact on the profitability of OpenAI. In such a situation, GPT-4 together with different types of synthetic basic intelligence would grow to be open sourced and out there for the nice of humanity. Unrestricted entry to this kind of know-how would compromise the aggressive fringe of Shutterstock’s alliance with OpenAI.

Taking these items into consideration, I feel Getty Pictures has a qualitative edge over Shutterstock by way of its superior partnership.

Development within the Digital Licensing Sector

In my earlier article throughout October 2023, the inventory worth for Getty Pictures dropped roughly 14% after a downgrade by Redburn Atlantic. On the time, issues have been raised in regards to the future demand of internet marketing. Following in November 2023, The Benchmark Firm and Wedbush Securities re-iterated their earlier score of Getty Pictures as a ‘sturdy purchase.’ Macquarie and Imperial haven’t issued any new steerage since August 2023. With a while away from the noise of huge hedge funds, we have now a possibility to view this from a distinct perspective.

In line with info posted by Allied Market Analysis, photographs as a service market are anticipated to develop at a mean CAGR of 4.2% between now and 2032. In one other market report revealed by Credence Analysis, they referred to as for a mean CAGR of seven% between 2023 and 2030. Customized Market Insights calculated an analogous CAGR of 6%.

Getty Pictures is working in a sector the place many are calling for development over an extended time frame. With the inventory worth being psychologically based mostly, what I consider we have now witnessed over the previous few months is fearmongering. Some huge buyers suppose the sky is falling, and this has precipitated smaller buyers to take their lead in an try to attenuate losses. Minimized losses can even lead to minimized positive aspects.

Dangers

The outlook introduced in my thesis depends on a number of key assumptions that buyers ought to take into account earlier than deciding about this inventory. The extra seemingly you suppose these dangers are to materialize, you must make investments much less of your cash in Getty Pictures.

First, my evaluation will depend on competent administration taking steps to eradicate and scale back the corporate’s debt. Apart from administration enjoying an energetic function in debt administration, there might be exterior components that stop Getty Pictures from making well timed funds sooner or later. If Getty Pictures have been to face money movement points from prospects who usually are not paying, or if there’s a lower within the demand for picture licensing, then this might result in the corporate’s insolvency. Getty has a bigger debt-to-equity ratio than its opponents, so this matter ought to be given additional consideration by buyers.

Whereas the way forward for generative AI seems to be a promising one, I can’t be sure in regards to the function that Getty Pictures or Nvidia will proceed to have on this area. For now, I assess the danger of a market disruption as low, but when these two corporations don’t take steps to dominate the area, they’re more likely to fall behind to Shutterstock and OpenAI. Traders ought to monitor the information for continued updates in regards to the progress of those corporations within the area of generative AI.

Lastly, if the digital licensing sector as an entire have been to enter decline, this might undoubtedly have a unfavourable affect on Getty Pictures. Nevertheless, this explicit danger would have related results on Adobe and Shutterstock, with Adobe being extra diversified and sure extra tolerable of such an occasion.

Conclusion

My evaluation of Getty Pictures reveals a nuanced panorama the place qualitative components play a pivotal function in shaping the funding narrative. Administration’s resolution to abstain from a refinancing settlement, albeit initially seen optimistically, underscores their dedication to strategic debt administration. The following combined market response within the days that adopted signifies an opportune entry level for buyers cognizant of the continued efforts to alleviate the corporate’s debt burden.

Regardless of obvious lackluster fundamentals in comparison with business counterparts, the hovering PE ratio prompts a reevaluation of the standard metrics that govern market sentiment. Recognizing the psychological underpinnings of inventory pricing is essential for a complete understanding this example, particularly within the context of Getty’s qualitative elements.

The partnership with Nvidia positions Getty Pictures as a frontrunner within the burgeoning Generative AI market, fostering a commercially secure setting for picture technology. This, coupled with the forecasted development in digital licensing companies (in addition to AI-generated companies), underscores the corporate’s potential for future profitability.

The anticipated development within the digital licensing sector, regardless of short-term market noise, presents a compelling case for long-term buyers. Whereas acknowledging inherent dangers, notably in debt administration and market dynamics, I like to recommend a cautious but optimistic positioning. Getty Pictures, with its strategic initiatives and qualitative focus, emerges as a powerful contender in a sector poised for sustained development. Because the market navigates uncertainties, prudent buyers might discover worth in Getty Pictures by contemplating the underlying strengths, potential market disruptions, and the evolving panorama of generative AI.

[ad_2]

Source link