[ad_1]

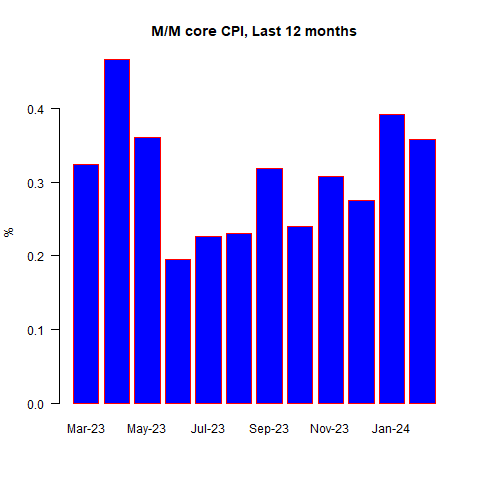

I have to say that I didn’t see this one coming. Credit score the place credit score is due, although: whereas Road economists have been just a bit low (consensus was +0.40% , +0.30% ), the CPI swap market no less than bought headline proper (there being no marketplace for core inflation CPI swaps) by pricing in +0.47%, seasonally adjusted.

The precise print was +0.44% on headline CPI, and a lusty +0.36% on core. I used to be decrease, despite the fact that I bought the massive items proper. I had some tails going the incorrect approach. Let’s get into it.

M/M Core CPI, Final 12-Months

The issues which threw me have been airfares and used automobiles. Primarily based on declines in jet gasoline, I had anticipated that airfares can be roughly -6% m/m, and I merely bought the signal incorrect as they have been +6.6%. Jet gasoline was tighter on the East Coast, and I think regional variations there may be what precipitated this huge divergence.

If I’m proper, then airfares will underperform jet gasoline over the following few months. If, as an alternative, it’s a cost-of-labor or cost-of-equipment factor, or if it’s elevated pricing energy from airways due to capability constraints, then airfares gained’t drop again and that might be a foul signal.

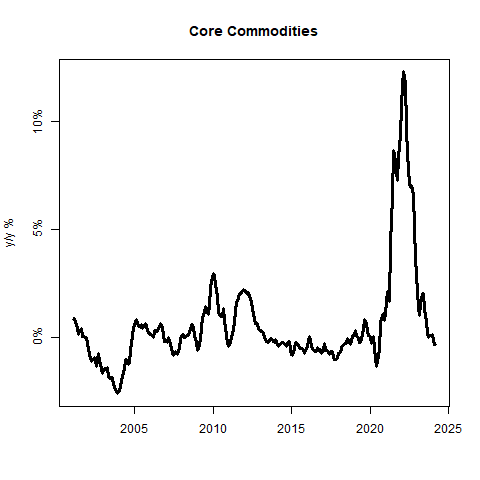

Equally, Used Automobiles continues to outperform the Black E book survey. I had penciled in -1%, and Kalshi markets have been round -1.5%, however Used Automobile CPI got here in at +0.5%. It is a risky sequence, and this miss is simply attention-grabbing as a result of Used Automobiles retains lacking a bit of excessive in comparison with the Black E book survey. That might be a difficulty of pattern combine, however I’m undecided. New Automobiles have been -0.10% m/m. Automobile and Truck Rental was +3.83% after -0.74% final month, in order that’s one other higher tail. Total, core items have been regular at -0.3% y/y.

Core Commodities

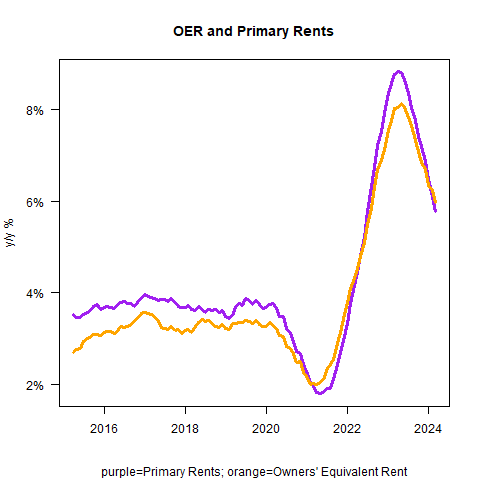

I mentioned I bought the massive items proper. I seek advice from rents. Do not forget that final month we had a big deviation between House owners’ Equal Lease (OER) and Lease of Main Residence. Usually, these two monitor fairly intently, however often they deviate and final month OER was 0.2% increased than Main Rents.

That contributed to the very excessive median CPI in January, and there was a ton of debate about whether or not the BLS had achieved one thing bizarre with the survey – they’d, in January 2023, refined the OER weighting technique and there was concern that this was a ‘combine’ downside that was going to proceed to push OER increased than Main Rents for some time.

The BLS contributed to this sense of confusion by sending out a blast electronic mail that appeared to recommend it was so; they needed to stroll that again and to their credit score did a really good webinar and have spent loads of time this month explaining in excruciating element how the OER survey is performed.

Backside line: there’s nothing to see right here; generally the 2 sequence diverge barely. Furthermore, as I’ve identified beforehand, when costs are declining it tends to imply that the price of imputed utilities is declining which, since they’re deducted from the rental survey used for OER means OER ought to be barely increased than Main Rents over time. Not 0.2% per thirty days, although, and I anticipated this aberration would principally shut this month.

It did, with OER +0.44% m/m (was +0.56% final month) and Main Rents +0.46% m/m (was +0.36% final month). Yr over yr, they’re about the identical however OER has moved barely above Main.

OER and Main Rents

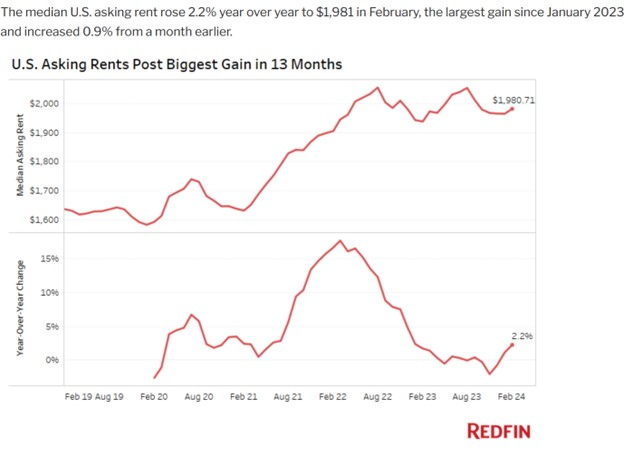

So the stunning half to me was that Main got here up some to assist shut that hole, not that the hole closed. I proceed to anticipate rents to decelerate, together with everybody else – solely, as I’ll preserve saying till I’m blue within the face, we aren’t going to enter lease deflation as so many individuals have been forecasting (people appear to be backing off that now!) however reasonably we must always drop into the two%-3% vary y/y earlier than rebounding later this yr.

There appears to be proof of that within the impartial lease measures. Under is a chart from a current Redfin (NASDAQ:) information launch. It bears noting, after all, that these lease measures additionally all went into deflation and misled all of these economists who lean on these high-frequency-but-low-quality knowledge. (Having mentioned that, Redfin does appear to be higher than some others, however it’s nonetheless measuring one thing completely different than what the CPI is measuring).

Median US Asking Rents

Now, the story begins to turn out to be a bit of clearer, albeit regarding. Core companies rose to five.4% y/y from 5.2% y/y, whereas core items was unchanged as I famous above. Rents are coming down, however outdoors of rents we’re seeing some stabilization at higher-than-pre-COVID ranges.

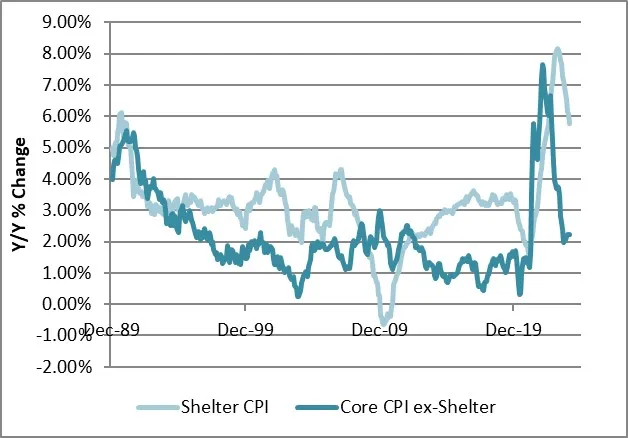

The chart beneath exhibits Shelter CPI, and Core CPI ex-Shelter, which has been roughly steady for 3 months round 2.25%. That sounds nice, since 2.25% on CPI is roughly equal to 2% on the Fed’s PCE goal besides that 2.25% is increased than it was pre-COVID. The theme, and we’re seeing it in a number of locations, is inflation being sticky at increased ranges than it was pre-crisis.

Shelter CPI and Core CPI ex-Shelter

There have been some good elements to the report – notably Meals, which was tame m/m for each Meals at Dwelling (-0.03% m/m versus +0.37% final month) and Meals Away from Dwelling (+0.10%, was +0.47%), though the latter might be not sustainable given rapidly-rising wages. Nonetheless, it’s constructive. Until you’re shopping for child meals, which is +9.2% y/y!

Really, infants bought much more costly this month. The biggest improve within the classes used for Median CPI was Toddler/Toddler Attire. On the whole, attire classes have been right-tail gadgets this month. However there weren’t sufficient of them to clarify the excessive core CPI. Median was +0.39% (my estimate); since that’s proper in step with core it says the tails weren’t what moved this quantity. It’s simply that this month, inflation rose at one thing like a 4.25%-4.75% annualized tempo.

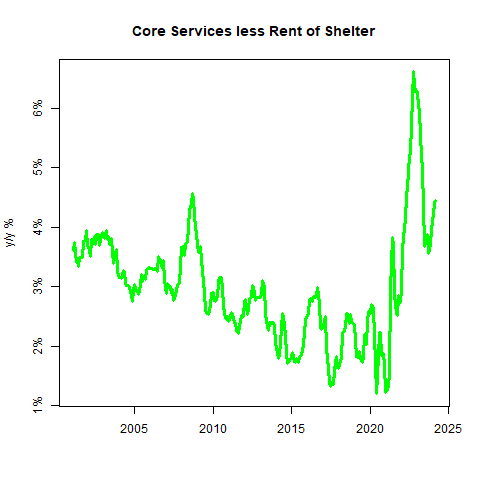

With this, and with Core Companies ex-shelter (“Supercore”) at +0.47% m/m – which suggests supercore accelerated to +4.3% y/y – it’s inconceivable that the Fed will but contemplate reducing charges. It’s attainable that they could later within the yr, however there may be far an excessive amount of exuberance within the bond market about that prospect.

Core Companies much less Lease of Shelter

Certainly, there’s far an excessive amount of exuberance typically. Shares rose on an inflation report displaying that inflation was increased than anticipated. I’m not saying that equities ought to crash on this knowledge, however that’s the type of response that you just are likely to see in bubbles. The market can be semi-reserved going into an financial report, however then rallies afterwards whatever the knowledge.

I’ve seen that type of atmosphere, the place such a factor occurred repeatedly, a few occasions in my profession they usually by no means ended properly. To leap on this knowledge, as if it was in any approach constructive, says that folks have been simply ready till after the quantity to purchase, they usually have been going to purchase it doesn’t matter what. That’s not a wholesome market, particularly when that occurs at excessive costs reasonably than low costs.

I proceed to anticipate median inflation to say no to the high-3s, low-4s, perhaps dipping a bit of decrease than that in Q3 if rents backside then as I anticipate. The underside line is that we’re close to ranges the place I’ve been anticipating inflation to get sticky, and it appears to be occurring. I didn’t see this specific month being sticky, however the basic tenor of the information is smart to me.

Authentic Put up

[ad_2]

Source link