[ad_1]

Up to date on March 14h, 2024 by Nikolaos Sismanis

Invoice Gates is the sixth-richest particular person on this planet, behind solely Bernard Arnault, Elon Musk, Jeff Bezos, Larry Ellison, and Warren Buffet. His web value of ~$ 106 billion is an enormous sum of money. Not surprisingly, the Invoice & Melinda Gates Basis has an enormous funding portfolio of almost $42.3 billion, based on a latest 13F submitting.

That sort of wealth is one thing the overwhelming majority of us can solely dream of. Nevertheless, there may be one similarity between the on a regular basis investor and the wealthiest particular person on the planet.

We’re all searching for good shares to purchase and maintain for the long run. That’s the reason it’s helpful to assessment the inventory holdings of the Invoice & Melinda Gates Basis.

You may obtain our full listing of all 24 Gates Basis shares (together with essential metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

Observe: 13F submitting efficiency is completely different than fund efficiency. See how we calculate 13F submitting efficiency right here.

The Invoice & Melinda Gates Basis owns a number of extremely worthwhile firms with sustainable aggressive benefits. Most of the shares additionally pay dividends to shareholders and develop their dividend payouts over time.

This text will focus on all 24 shares held by the Invoice & Melinda Gates Basis.

Desk of Contents

You may skip to the evaluation for every of the Gates Basis’s prime 24 inventory holdings, with the desk of contents beneath. Shares are listed so as of the portfolio’s largest positions to smallest positions.

Microsoft (MSFT)

Berkshire Hathaway (BRK.B)

Canadian Nationwide Railway (CNI)

Waste Administration (WM)

Caterpillar Inc. (CAT)

Deere & Firm (DE)

Ecolab (ECL)

Coca-Cola FEMSA, S.A.B. de C.V. (KOF)

Walmart (WMT)

FedEx Corp. (FDX)

Waste Connections (WCN)

Schrodinger, Inc. (SDGR)

Crown Citadel Worldwide (CCI)

Coupang, Inc. (CPNG)

Madison Sq. Backyard Sports activities Corp. (MSGS)

United Parcel Service, Inc. (UPS)

Anheuser-Busch InBev SA/NV (BUD)

Danaher Company (DHR)

Kraft Heinz (KHC)

Hormel Meals (HRL)

Vroom Inc. (VRM)

Carvana Co. (CVNA)

On Holding AG (ONON)

Veralto Corp (VLTO)

It’s also possible to watch a video evaluation of Gates’ inventory holdings beneath:

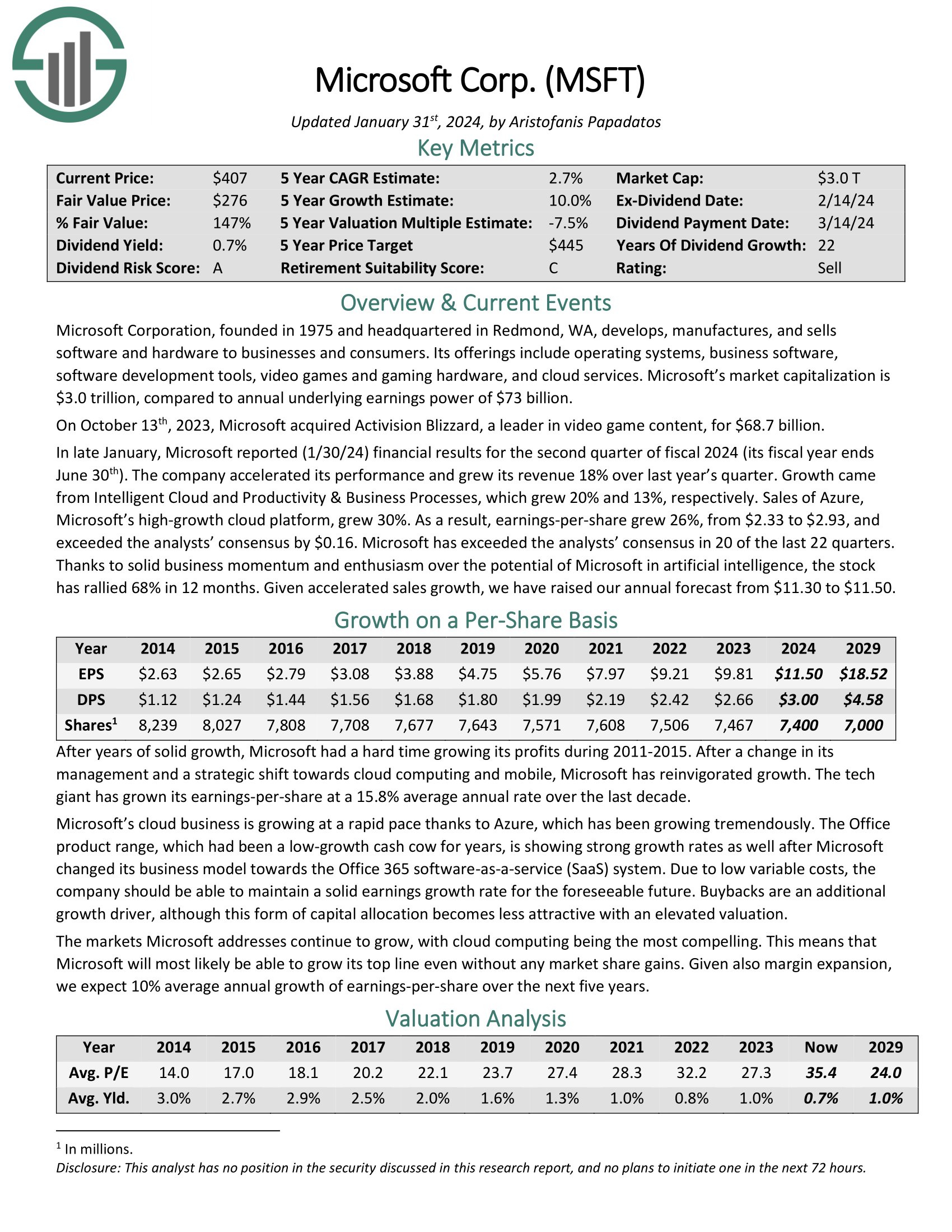

#1—Microsoft (MSFT)

Dividend Yield: 0.7%

Proportion of Invoice Gates’ Portfolio: 34.4%

Microsoft Company, based in 1975 and headquartered in Redmond, WA, develops, manufactures, and sells each software program and {hardware} to companies and shoppers. Microsoft is a mega-cap inventory with a market capitalization of $3.1 trillion.

Its choices embody working methods, enterprise software program, software program improvement instruments, video video games and gaming {hardware}, and cloud companies.

On October 13 th, 2023, Microsoft acquired Activision Blizzard, a pacesetter in online game content material, for $68.7 billion.

In late January, Microsoft reported (1/30/24) monetary outcomes for the second quarter of fiscal 2024 (its fiscal 12 months ends June thirtieth). The corporate accelerated its efficiency and grew its income by 18% over final 12 months’s quarter.

Development got here from Clever Cloud and Productiveness & Enterprise Processes, which grew 20% and 13%, respectively. Gross sales of Azure, Microsoft’s high-growth cloud platform, grew 30%.

In consequence, earnings-per-share grew 26%, from $2.33 to $2.93, and exceeded the analysts’ consensus by $0.16. Microsoft has exceeded the analysts’ consensus in 20 of the final 22 quarters.

Click on right here to obtain our most up-to-date Positive Evaluation report on Microsoft (preview of web page 1 of three proven beneath):

#2—Berkshire Hathaway (BRK)

Dividend Yield: N/A (Berkshire Hathaway doesn’t at the moment pay a dividend)

Proportion of Invoice Gates’ Portfolio: 17.5%

Berkshire Hathaway inventory is the third-largest particular person holding of the Gates Basis’s funding portfolio, and it’s straightforward to see why. It’s secure to say the cash is in good arms. Berkshire, underneath the stewardship of Warren Buffett, grew from a struggling textile producer into one of many largest conglomerates on this planet.

At present, Berkshire is a worldwide big. It owns and operates dozens of companies, with a hand in almost each main trade, together with insurance coverage, railroads, power, finance, manufacturing, and retailing. It has a market capitalization of just about $790 billion.

Berkshire will be considered in 5 components: wholly-owned insurance coverage subsidiaries like GEICO, Basic Re, and Berkshire Reinsurance; wholly-owned non-insurance subsidiaries like Dairy Queen, BNSF Railway, Duracell, Fruit of the Loom, NetJets, Precision Forged Components, and See’s Candies; shared management companies like Kraft Heinz (KHC) and Pilot Flying J; marketable publicly-traded securities together with important stakes in firms like American Specific (AXP), Apple (AAPL), Financial institution of America (BAC), Coca-Cola (KO) and Wells Fargo (WFC); and at last the corporate’s large money place.

In Berkshire’s annual letters to shareholders, Buffett usually evaluates the corporate’s efficiency when it comes to ebook worth. Guide worth is an accounting metric that measures an organization’s property minus its liabilities. The ensuing distinction is an organization’s ebook worth. It is a proxy for the intrinsic worth of a agency, which Buffett believes to be a very powerful monetary metric.

Berkshire doesn’t pay shareholders a dividend. Buffett and his associate Charlie Munger have at all times contended that they’ll create wealth at the next price than the dividend would offer to shareholders.

Whereas Berkshire inventory is probably not engaging for traders who need dividend earnings, there are few firms which have a monitor document almost as nice as Berkshire’s.

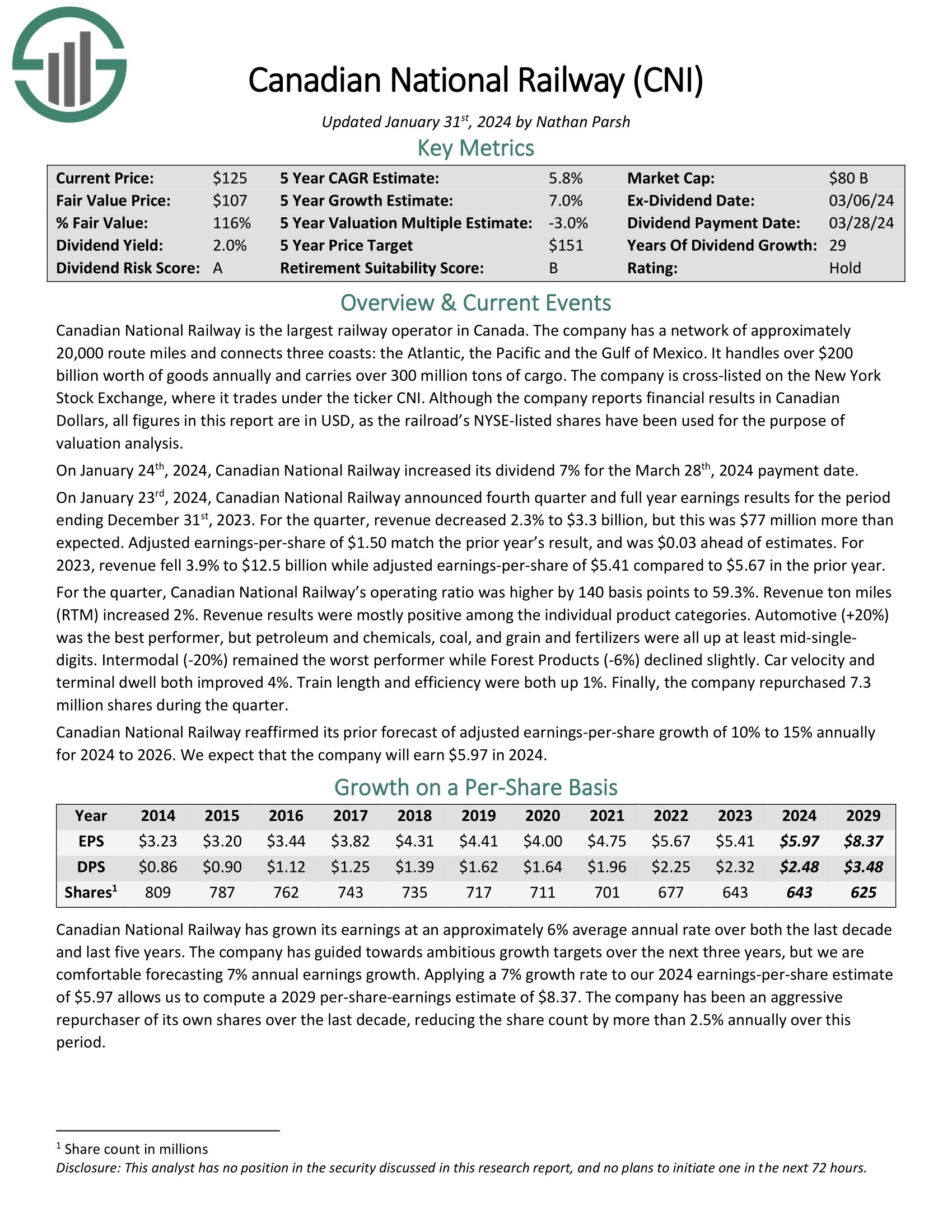

#3—Canadian Nationwide Railway (CNI)

Dividend Yield: 2.0%

Proportion of Invoice Gates’ Portfolio: 15.5%

Canadian Nationwide Railway is the one transcontinental railroad in North America. It has a community of roughly 20,000 route miles and connects three coasts: the Atlantic, the Pacific, and the Gulf of Mexico. It handles over $200 billion value of products yearly and carries over 300 million tons of cargo.

On January twenty third, 2024, Canadian Nationwide Railway introduced fourth quarter and full-year earnings outcomes for the interval ending December thirty first, 2023.

For the quarter, income decreased 2.3% to $3.3 billion, however this was $77 million greater than anticipated. Adjusted earnings-per-share of $1.50 matched the prior 12 months’s outcome and was $0.03 forward of estimates.

For 2023, income fell 3.9% to $12.5 billion whereas adjusted earnings-per-share of $5.41 in comparison with $5.67 within the prior 12 months. For the quarter, Canadian Nationwide Railway’s working ratio was increased by 140 foundation factors to 59.3%.

Income ton-miles (RTM) elevated by 2%. Income outcomes have been principally constructive among the many particular person product classes. Automotive (+20%) was the perfect performer, however petroleum and chemical substances, coal, grain, and fertilizers have been all up at the least mid-single digits. Intermodal (-20%) remained the worst performer, whereas Forest Merchandise (-6%) declined barely. Automotive velocity and terminal dwell each improved by 4%. Prepare size and effectivity have been each up 1%.

Lastly, the corporate repurchased 7.3 million shares throughout the quarter. Canadian Nationwide Railway reaffirmed its prior forecast of adjusted earnings-per-share development of 10% to fifteen% yearly from 2024 to 2026. We anticipate that the corporate will earn $5.97 in 2024

On January twenty fourth, 2024, Canadian Nationwide Railway elevated its dividend by 7% for the March twenty eighth, 2024, cost date.

Click on right here to obtain our most up-to-date Positive Evaluation report on Canadian Nationwide Railway (preview of web page 1 of three proven beneath):

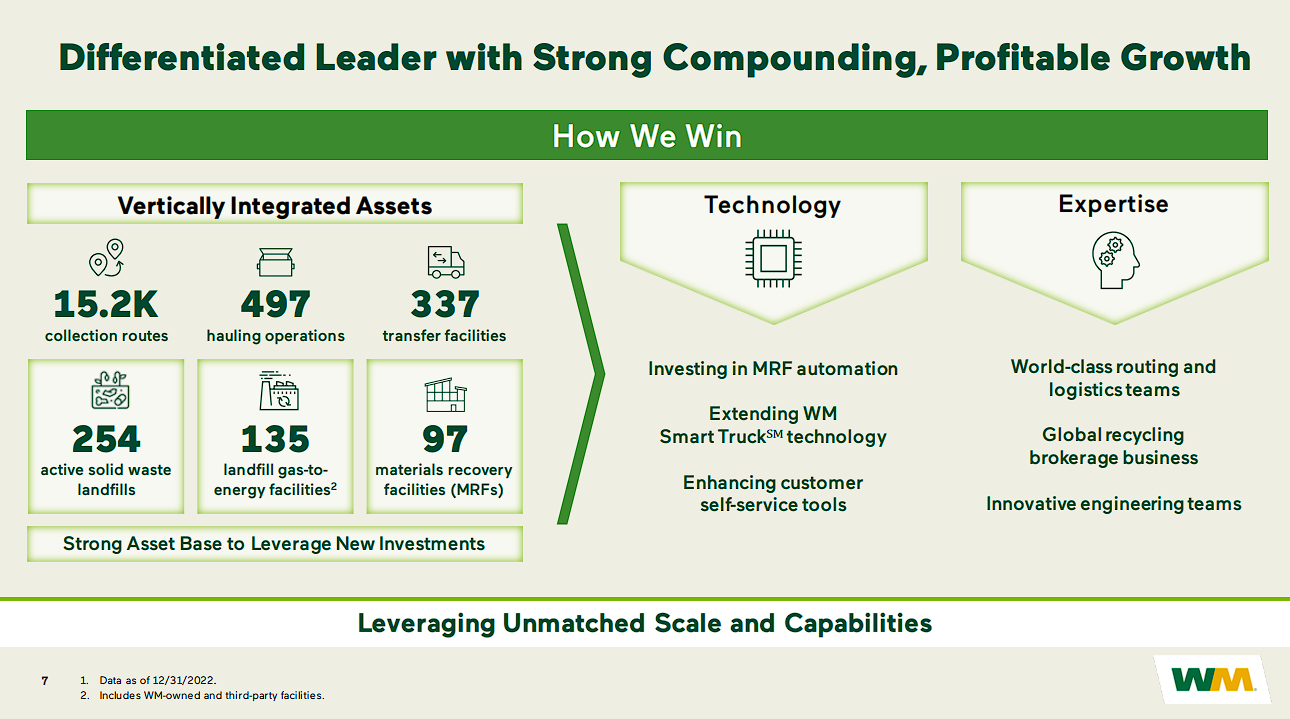

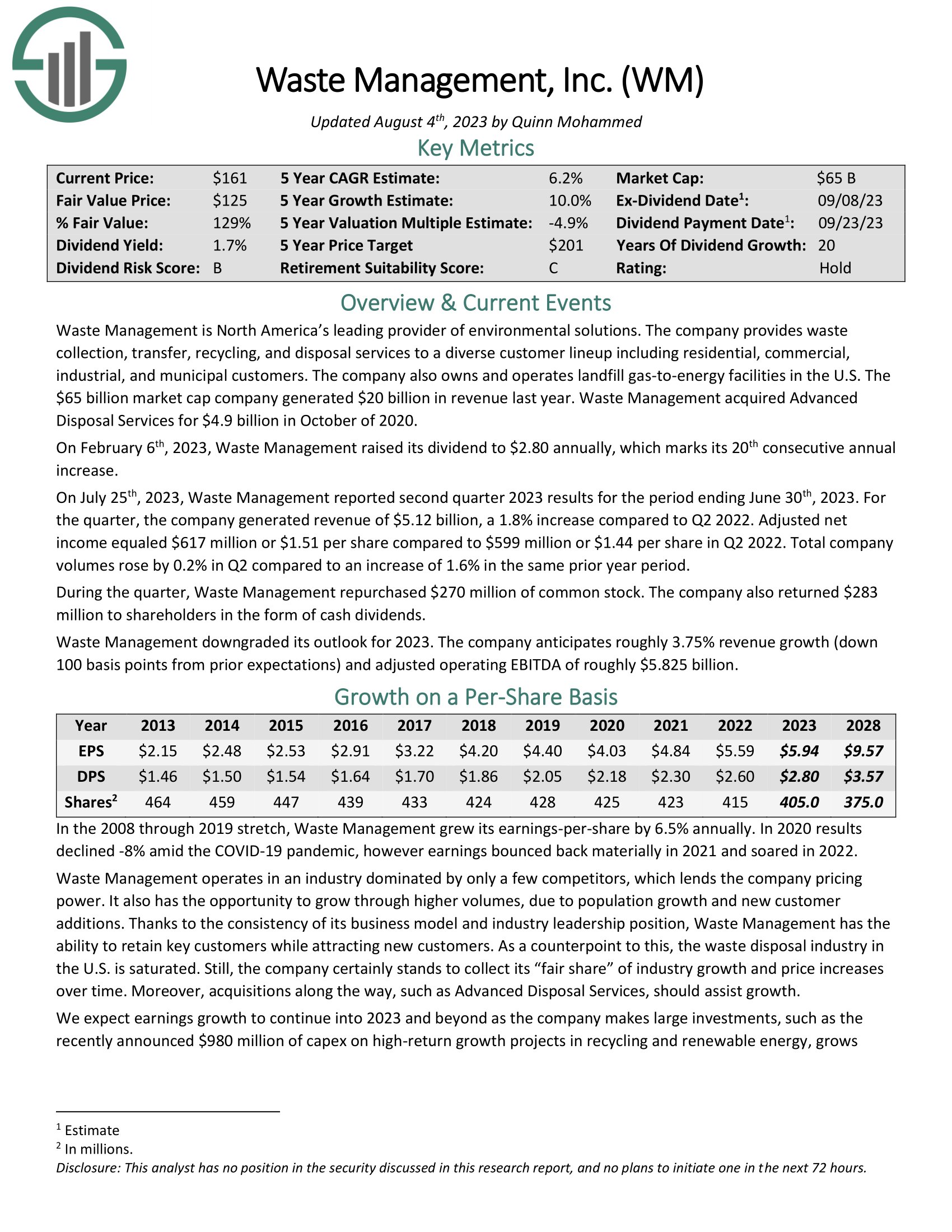

#4—Waste Administration (WM)

Dividend Yield: 1.4%

Proportion of Invoice Gates’ Portfolio: 15.4%

Waste Administration is the embodiment of an organization with a large financial “moat”, a time period popularized by Warren Buffett to explain a robust aggressive benefit that protects an organization from the complete ravages of market competitors. Waste Administration operates in waste removing and recycling companies. It is a extremely concentrated trade, with just a few firms controlling the vast majority of the market.

Supply: 2023 Investor Day Presentation

On February twelfth, 2024, Waste Administration reported fourth quarter 2023 outcomes for the interval ending December thirty first, 2023.

For the quarter, the corporate generated income of $5.2 billion, a 5.7% enhance in comparison with This fall 2022. Adjusted web earnings equaled $703 million or $1.74 per share in comparison with $537 million or $1.30 per share in This fall 2022. Assortment and disposal volumes rose by 1.1% within the fourth quarter.

Through the quarter, Waste Administration repurchased $312 million of widespread inventory. The corporate additionally returned $281 million to shareholders within the type of money dividends.

Waste Administration expects 2024 income to develop by between 6% and seven%, with assortment and disposal quantity development of 1%. The corporate additionally expects to repurchase $1 billion of its shares within the 12 months.

On March 1st, 2024, Waste Administration raised its dividend to $3.00 yearly, which marks its twenty first consecutive annual enhance.

Click on right here to obtain our most up-to-date Positive Evaluation report on Waste Administration (preview of web page 1 of three proven beneath):

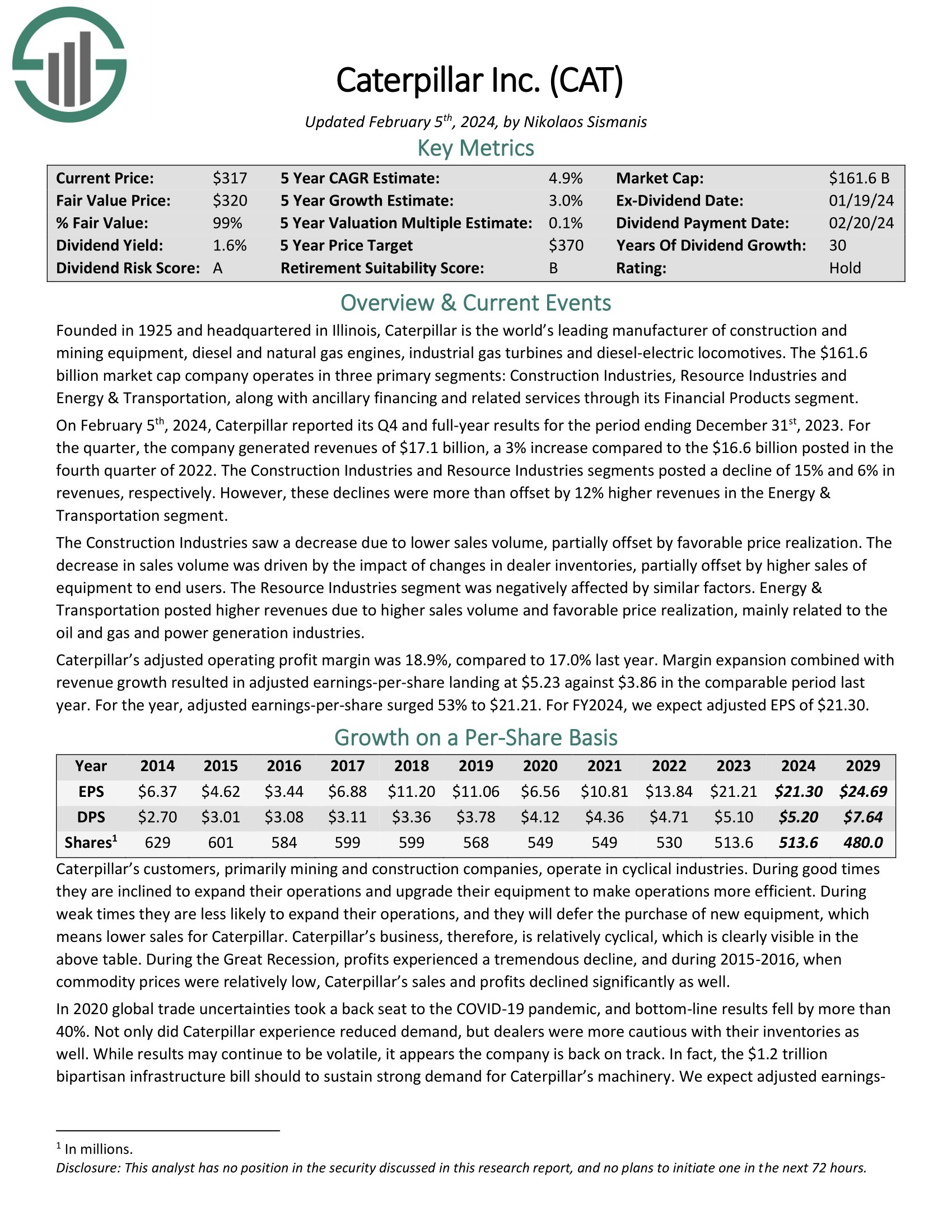

#5—Caterpillar (CAT)

Dividend Yield: 1.6%

Proportion of Invoice Gates’ Portfolio: 5.1%

Caterpillar is the worldwide chief in heavy equipment. It has a robust model with a dominant trade place. Caterpillar manufactures and markets heavy equipment, principally for the development and mining sectors.

The company operates in three major segments: Development Industries, Useful resource Industries, and Power & Transportation, together with ancillary financing and associated companies via its Monetary Merchandise section.

Supply: Newest Investor Day Presentation

On February fifth, 2024, Caterpillar reported its This fall and full-year outcomes for the interval ending December thirty first, 2023. For the quarter, the corporate generated revenues of $17.1 billion, a 3% enhance in comparison with the $16.6 billion posted within the fourth quarter of 2022.

The Development Industries and Useful resource Industries segments posted a decline of 15% and 6% in revenues, respectively. Nevertheless, these declines have been greater than offset by 12% increased revenues within the Power & Transportation section.

The Development Industries noticed a lower resulting from decrease gross sales quantity, partially offset by favorable value realization. The lower in gross sales quantity was pushed by the impression of modifications in seller inventories, partially offset by increased gross sales of kit to finish customers. The Useful resource Industries section was negatively affected by related elements.

Power & Transportation posted increased revenues resulting from increased gross sales quantity and favorable value realization, primarily associated to the oil and gasoline and energy era industries. Caterpillar’s adjusted working revenue margin was 18.9%, in comparison with 17.0% final 12 months.

Margin enlargement mixed with income development resulted in adjusted earnings-per-share touchdown at $5.23 in opposition to $3.86 within the comparable interval final 12 months. For the 12 months, adjusted earnings-per-share surged 53% to $21.21. ‘

For FY2024, we anticipate adjusted EPS of $21.30.

Click on right here to obtain our most up-to-date Positive Evaluation report on Caterpillar (preview of web page 1 of three proven beneath):

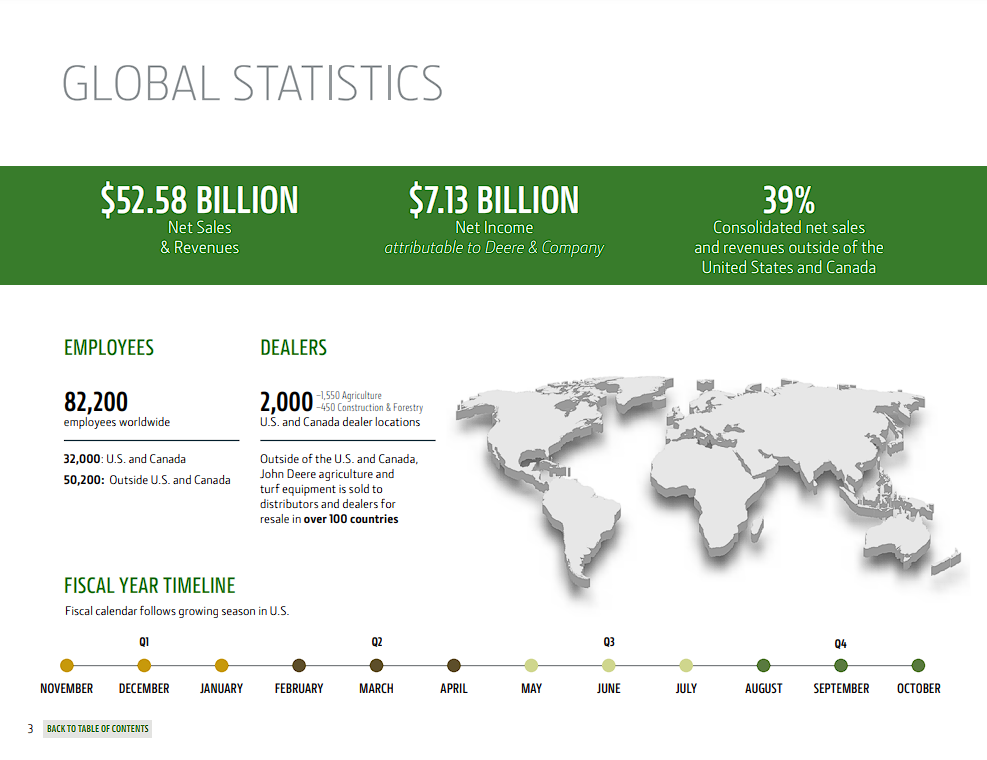

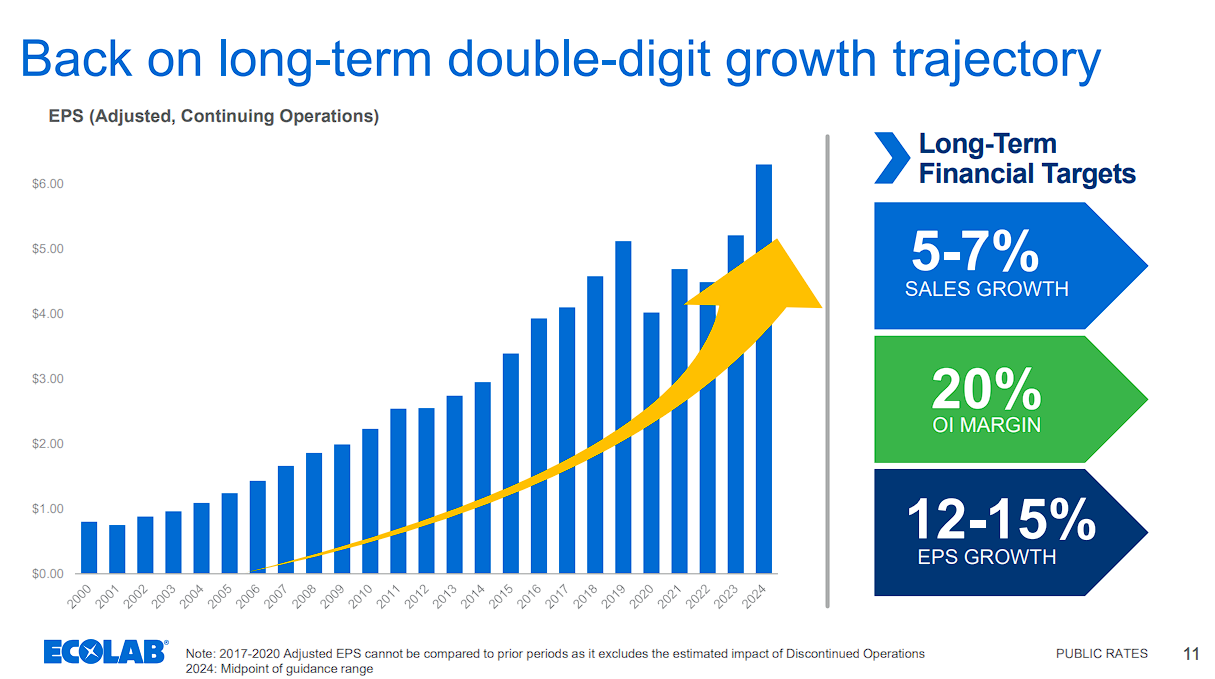

#6—Deere & Firm (DE)

Dividend Yield: 1.6%

Proportion of Invoice Gates’ Portfolio: 3.0%

Deere & Firm is the biggest producer of farm tools on this planet. The corporate additionally makes tools utilized in building, forestry & turf care, produces engines, and gives monetary options to its prospects. Deere was based in 1837.

Supply: Investor Reality Guide

In mid-February, Deere reported (2/15/24) monetary outcomes for the primary quarter of fiscal 2024. Gross sales slipped -4% over the prior 12 months’s quarter because the profit from sturdy demand for building tools was offset by a lower within the gross sales of the Manufacturing & Precision Ag and Small Ag & Turf segments.

Earnings-per-share dipped 5%, from $6.55 to $6.23, however exceeded the analysts’ consensus by $1.02. Administration said that demand for merchandise that assist farmers produce extra with decrease efforts stays sturdy. Nevertheless, the final two quarters have marked a pointy deceleration over the earlier quarters.

Because of this deceleration and its expectation for quantity gross sales to revert to mid-cycle ranges, Deere lowered its already lackluster steering for this fiscal 12 months, anticipating earnings of $7.50-$7.75 billion (vs. earlier steering of $7.75-$8.25 billion).

Click on right here to obtain our most up-to-date Positive Evaluation report on Deere (preview of web page 1 of three proven beneath):

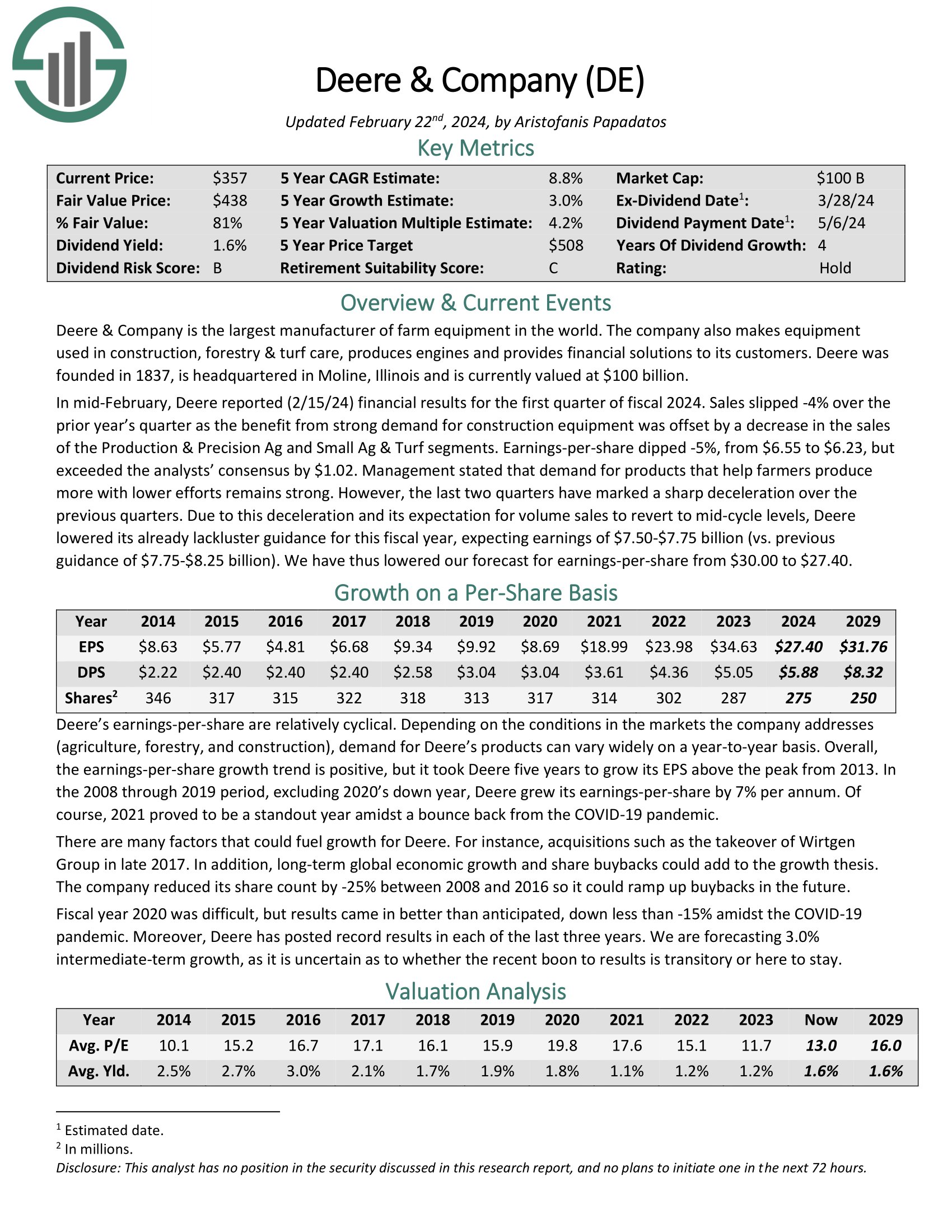

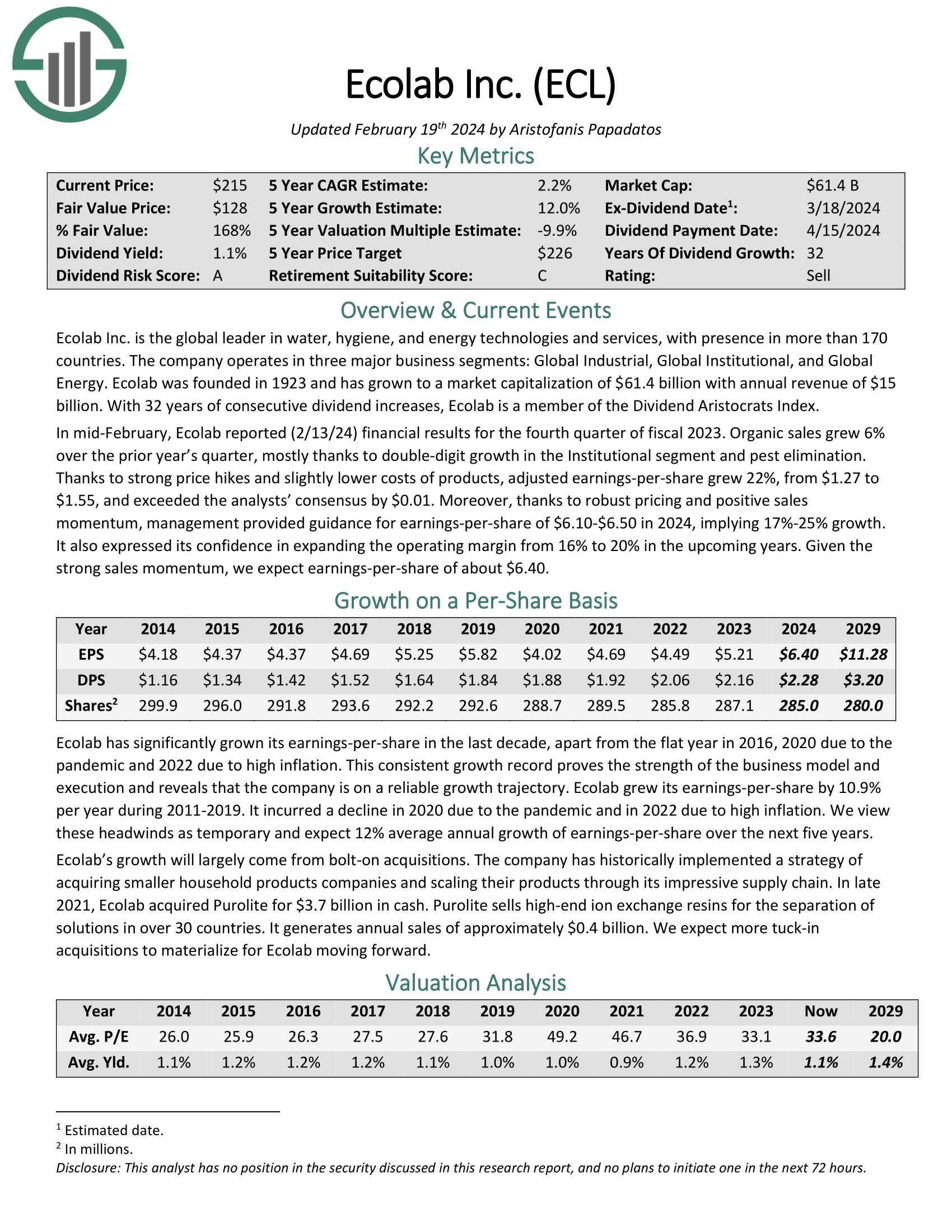

#7—Ecolab (ECL)

Dividend Yield: 1.0%

Proportion of Invoice Gates’ Portfolio: 2.5%

Ecolab was created in 1923 when its founder, Merritt J. Osborn, invented a brand new cleansing product known as “Absorbit”. This product cleaned carpets with out the necessity for companies to close down operations to conduct carpet cleansing. Osborn created an organization revolving across the product known as Economics Laboratory, or Ecolab.

Supply: Investor Presentation

In mid-February, Ecolab reported (2/13/24) monetary outcomes for the fourth quarter of fiscal 2023. Natural gross sales grew 6% over the prior 12 months’s quarter, principally because of double-digit development within the Institutional section and pest elimination.

Due to sturdy value hikes and barely decrease prices of merchandise, adjusted earnings-per-share grew 22%, from $1.27 to $1.55, and exceeded the analysts’ consensus by $0.01.

Furthermore, because of strong pricing and constructive gross sales momentum, administration supplied steering for earnings-per-share of $6.10-$6.50 in 2024, implying 17%-25% development.

It additionally expressed its confidence in increasing the working margin from 16% to twenty% within the upcoming years. Given the sturdy gross sales momentum, we anticipate earnings-per-share of about $6.40.

Click on right here to obtain our most up-to-date Positive Evaluation report on Ecolab (preview of web page 1 of three proven beneath):

#8—Coca-Cola FEMSA SAB (KOF)

Dividend Yield: 3.4%

Proportion of Invoice Gates’ Portfolio: 1.3%

Coca-Cola FEMSA produces, markets, and distributes Coca-Cola (KO) drinks. It provides a full line of glowing and nonetheless drinks. It sells its merchandise via distribution facilities and retailers in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Venezuela, Brazil, Argentina, and the Philippines.

Coca-Cola FEMSA is the biggest franchise bottler on this planet. The inventory is an attention-grabbing solution to achieve publicity to 2 very engaging rising markets: Latin America and South Asia.

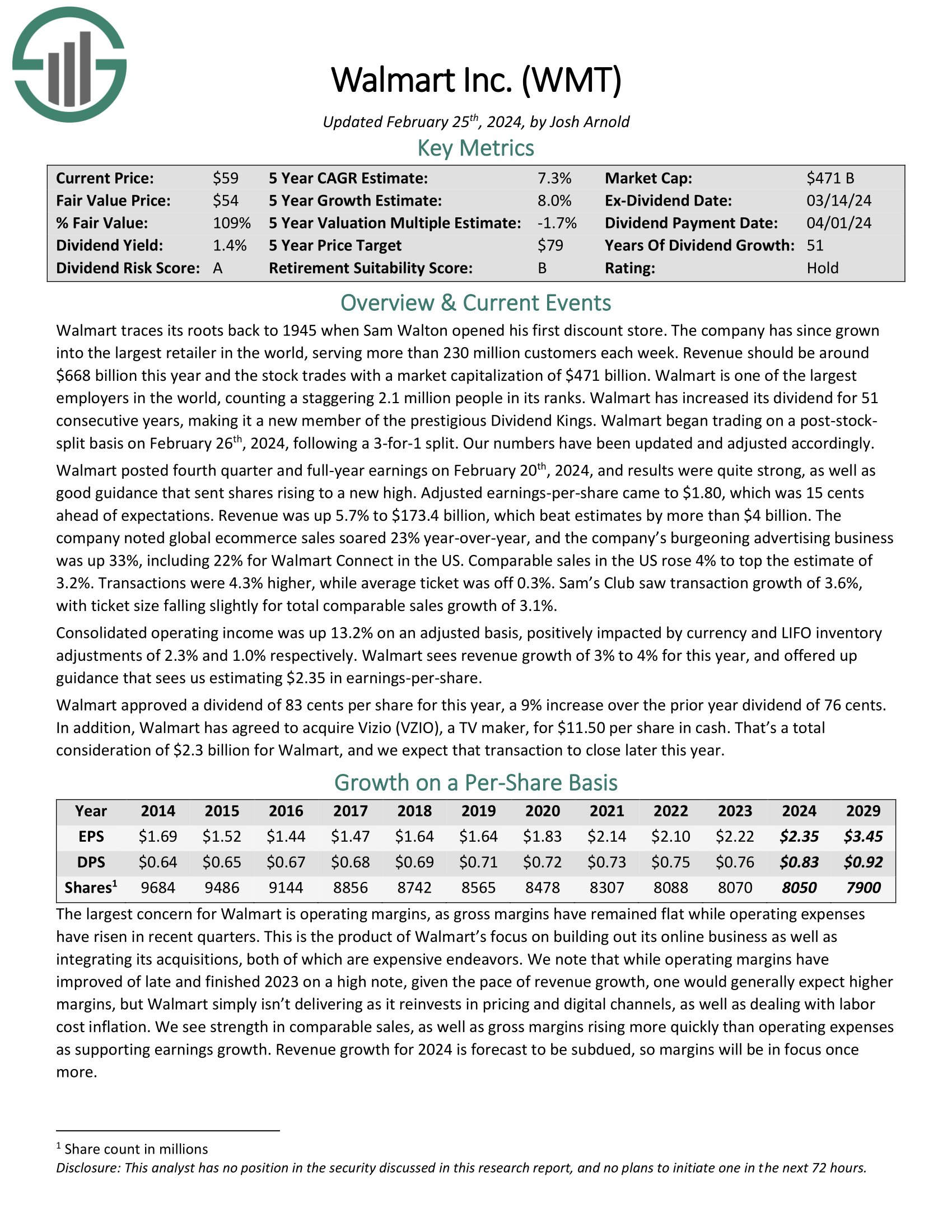

#9—Walmart Inc. (WMT)

Dividend Yield: 1.4%

Proportion of Invoice Gates’ Portfolio: 1.1%

Walmart is one other nice instance of an organization with sturdy aggressive benefits. It’s the largest retailer within the U.S., with annual income above $600 billion. The corporate got here to dominate the retail trade by holding a laser-like concentrate on lowering prices in all places, significantly within the provide chain and distribution.

Customers are likely to scale right down to low cost retail when occasions are tight, which is why Walmart continued to develop, even throughout the Nice Recession. In consequence, Walmart is arguably probably the most recession-resistant inventory within the Gates Basis’s portfolio.

This enables Walmart to lift its dividend every year like clockwork, even throughout recessions. Walmart has raised its dividend for over 40 years in a row.

Walmart posted fourth-quarter and full-year earnings on February twentieth, 2024, and outcomes have been fairly sturdy, in addition to good steering that despatched shares rising to a brand new excessive. Adjusted earnings-per-share got here to $1.80, which was 15 cents forward of expectations.

Income was up 5.7% to $173.4 billion, beating estimates by greater than $4 billion. The corporate famous that world e-commerce gross sales soared 23% year-over-year, and the corporate’s burgeoning promoting enterprise was up 33%, together with 22% for Walmart Join within the US.

Comparable gross sales within the US rose 4% to prime the estimate of three.2%. Transactions have been 4.3% increased, whereas the common ticket was off 0.3%. Sam’s Membership noticed transaction development of three.6%, with ticket dimension falling barely for whole comparable gross sales development of three.1%.

Consolidated working earnings was up 13.2% on an adjusted foundation, positively impacted by foreign money and LIFO stock changes of two.3% and 1.0%, respectively.

Walmart sees income development of three% to 4% for this 12 months, and supplied up steering that sees us estimating $2.35 in earnings-per-share. Walmart permitted a dividend of 83 cents per share for this 12 months, a 9% enhance over the prior 12 months’s dividend of 76 cents.

As well as, Walmart has agreed to amass Vizio (VZIO), a TV maker, for $11.50 per share in money. That’s a complete consideration of $2.3 billion for Walmart, and we anticipate that transaction to shut later this 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Walmart (preview of web page 1 of three proven beneath):

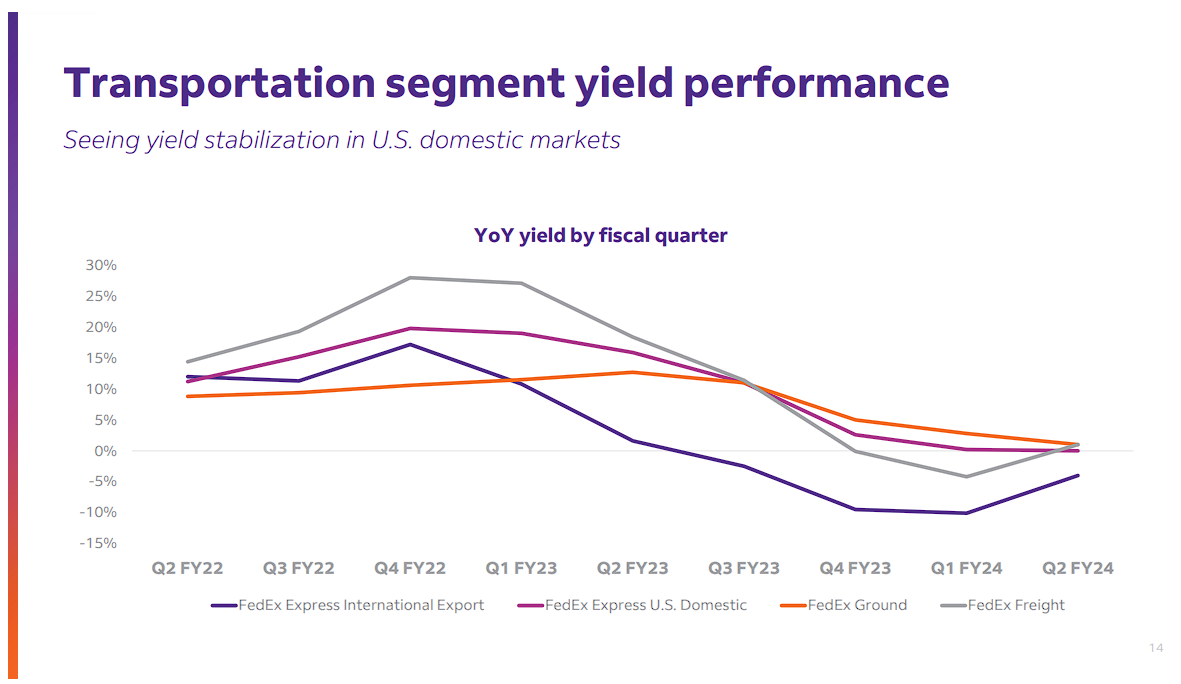

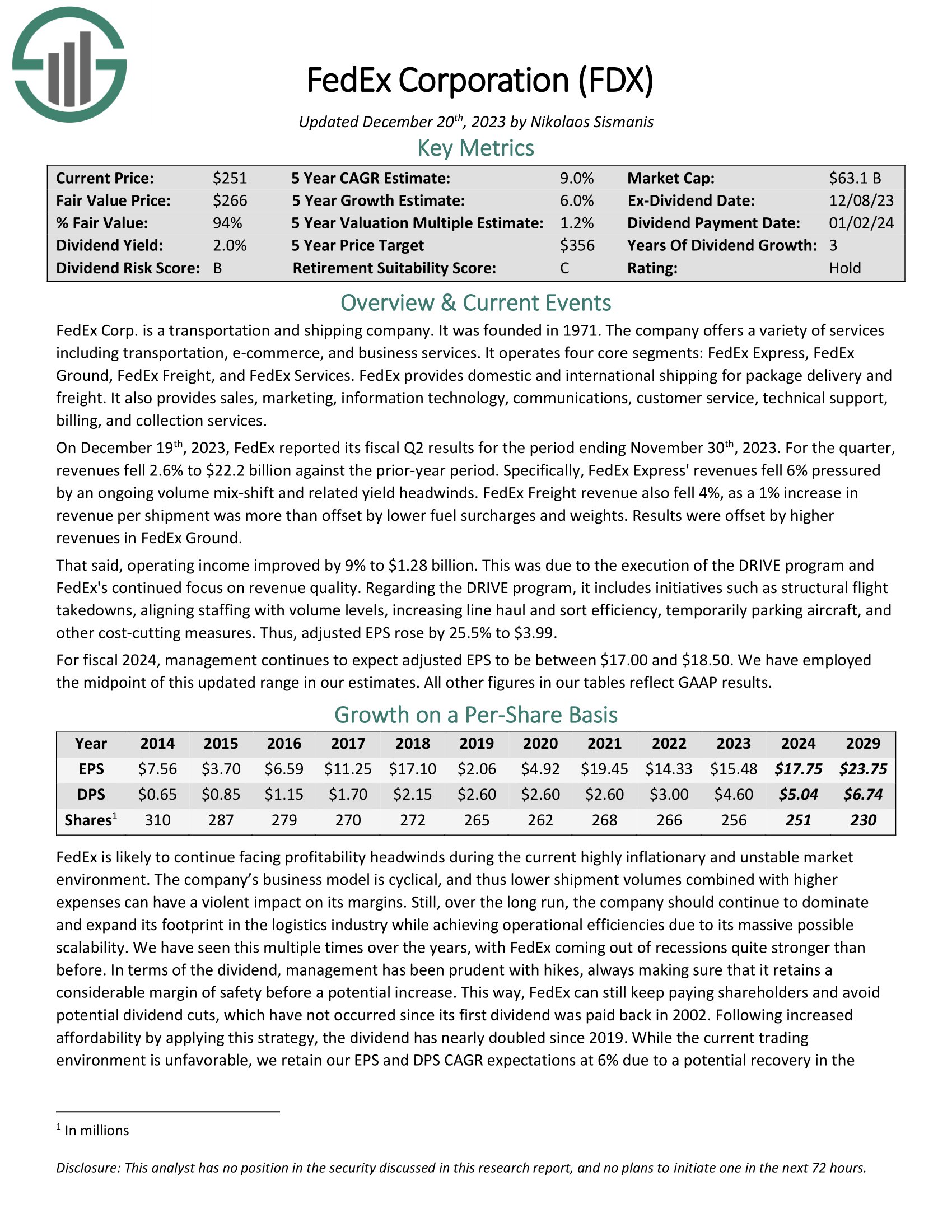

#10—FedEx (FDX)

Dividend Yield: 2.0%

Proportion of Invoice Gates’ Portfolio: 0.8%

FedEx Corp. is a transportation and delivery firm. The corporate provides quite a lot of companies, together with transportation, e-commerce, and enterprise companies. It operates 4 core segments: FedEx Specific, FedEx Floor, FedEx Freight, and FedEx Providers.

On December nineteenth, 2023, FedEx reported its fiscal Q2 outcomes for the interval ending November thirtieth, 2023. For the quarter, revenues fell 2.6% to $22.2 billion in opposition to the prior-year interval.

Particularly, FedEx Specific’ revenues fell 6%, pressured by an ongoing quantity mix-shift and associated yield headwinds. FedEx Freight income additionally fell 4%, as a 1% enhance in income per cargo was greater than offset by decrease gasoline surcharges and weights.

Outcomes have been offset by increased revenues in FedEx Floor. That mentioned, working earnings improved by 9% to $1.28 billion. This was as a result of execution of the DRIVE program and FedEx’s continued concentrate on income high quality.

Supply: Investor Presentation

Concerning the DRIVE program, it contains initiatives corresponding to structural flight takedowns, aligning staffing with quantity ranges, rising line haul and type effectivity, quickly parking plane, and different cost-cutting measures. Thus, adjusted EPS rose by 25.5% to $3.99.

For fiscal 2024, administration continues to anticipate adjusted EPS to be between $17.00 and $18.50. Now we have employed the midpoint of this up to date vary in our estimates. All different figures in our tables replicate GAAP outcomes.

Click on right here to obtain our most up-to-date Positive Evaluation report on FedEx (preview of web page 1 of three proven beneath):

#11—Waste Connections (WCN)

Dividend Yield: 0.7%

Proportion of Invoice Gates’ Portfolio: 0.8%

Waste Connections is a waste assortment, switch, disposal, and useful resource restoration enterprise within the U.S. and Canada. It provides numerous recycling companies, together with strong waste in addition to fluids used within the oil and gasoline drilling trade, serving to to extend the sustainability of these sectors.

The corporate was based in 1997 and is predicated in Canada, producing $8.0 billion in annual income and a market cap of $43.4 billion.

Waste Connections has boosted its dividend for 14 consecutive years, however the sturdy efficiency of the inventory means the yield is low at simply 0.8%. Nevertheless, we see sturdy dividend development prospects for the inventory within the years to come back.

#12—Schrodinger Inc. (SDGR)

Dividend Yield: N/A

Proportion of Invoice Gates’ Portfolio: 0.4%

Schrodinger, Inc. is a healthcare know-how firm. It operates a computational platform that goals to speed up drug supply, each for exterior shoppers and the corporate’s personal inner drug applications. Schrodinger carried out its preliminary public providing in February 2020. The inventory at the moment has a market capitalization of about $ 1.87 billion.

Schrodinger has thrilling development potential as a result of success of its drug supply platform and its massive and diversified buyer base.

Schrodinger has a protracted runway of development due to the excessive diploma of worth that its services and products present to prospects. Designing medicine is extraordinarily troublesome, complicated, prolonged, capital-intensive, and susceptible to excessive failure charges. This implies many purchasers will proceed to outsource this work to Schrodinger.

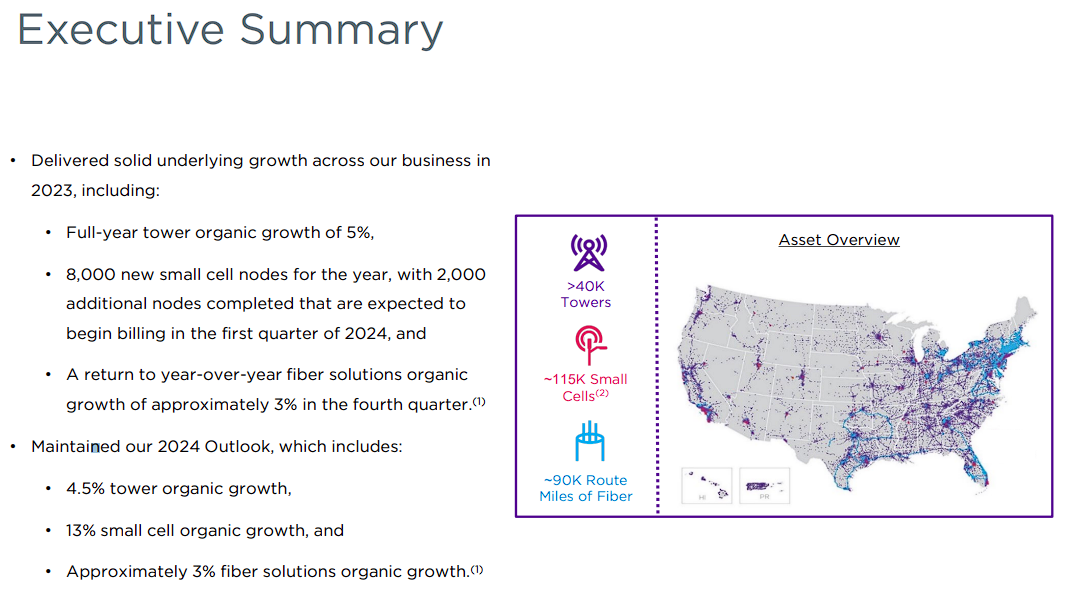

#13—Crown Citadel Worldwide (CCI)

Dividend Yield: 5.6%

Proportion of Invoice Gates’ Portfolio: 0.3%

Crown Citadel Worldwide is structured as an actual property funding belief or REIT. You may see our full REIT listing right here.

Crown Citadel owns cellphone towers with small cells the place bigger towers aren’t possible and fiber connections for knowledge transmission. The belief owns, operates, and leases greater than 40,000 cell towers and 90,000 route miles of fiber throughout each main US market, serving to it assist knowledge infrastructure throughout the nation.

Supply: Investor Presentation

Crown Citadel posted fourth-quarter and full-year earnings on January twenty fourth, 2024, and outcomes have been higher than anticipated on each the highest and backside strains. Funds-from-operations got here to $1.82, which was eight cents higher than anticipated.

It was additionally up from $1.77 within the third quarter. Income was $1.67 billion, down 5.1% year-over-year however barely forward of estimates. Web site rental income was $1.6 billion, up from $1.58 billion in This fall of final 12 months, whereas companies and different income was off from $186 million to simply $71 million.

Adjusted EBITDA was $1.08 billion, up barely from Q3 however down fractionally from final 12 months’s This fall.

The corporate reiterated its steering for 2024, with adjusted FFO set to be close to $6.90. Income is anticipated to be within the space of $6.4 billion.

We’ve set our estimate of FFO barely decrease than steering as CCI has struggled in latest quarters to hit its steering targets.

Click on right here to obtain our most up-to-date Positive Evaluation report on Crown Citadel Worldwide (preview of web page 1 of three proven beneath):

#14—Coupang, Inc. (CPNG)

Dividend Yield: N/A

Proportion of Invoice Gates’ Portfolio: 0.3%

Coupang is an e-commerce platform via its cellular apps and web sites, primarily in South Korea. It sells numerous services and products within the classes of house items, attire, magnificence merchandise, contemporary meals and groceries, sporting items, electronics, consumables, and extra.

The corporate has gained immense reputation nationwide resulting from its concentrate on quick and dependable supply companies. Coupang has constructed an intensive logistics community, together with its personal supply fleet and warehouses, to make sure fast and environment friendly supply to its prospects. It has pioneered the idea of “rocket supply,” promising next-day and even same-day supply for a overwhelming majority of its merchandise.

Coupang has additionally invested closely in know-how and innovation to boost its buyer expertise. Its cellular app and web site present a seamless and user-friendly interface, making it handy for patrons to browse and buy merchandise.

The corporate has additionally carried out numerous options corresponding to buyer evaluations, personalised suggestions, and simple returns, additional enhancing its general buying expertise.

#15—Madison Sq. Backyard Sports activities Corp. (MSGS)

Dividend Yield: N/A

Proportion of Invoice Gates’ Portfolio: 0.3%

Madison Sq. Backyard Sports activities Corp. is a diversified sports activities firm. It owns a number of sports activities franchises, together with the New York Knicks and the New York Rangers. It additionally owns improvement league groups such because the Hartford Wolf Pack and the Westchester Knicks of the NBA G League. It additionally owns e-sports properties, together with Knicks Gaming, and a controlling curiosity in Counter Logic Gaming (CLG).

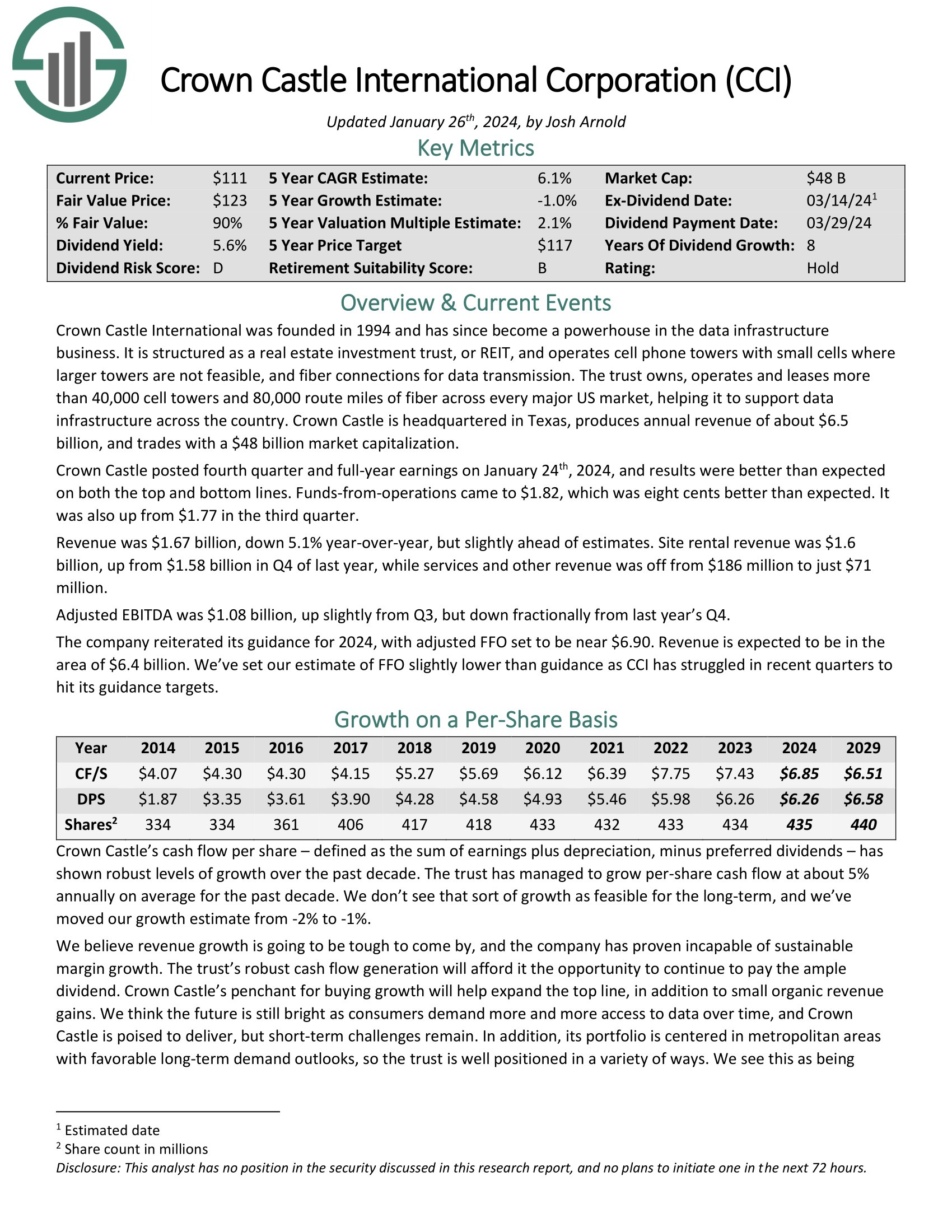

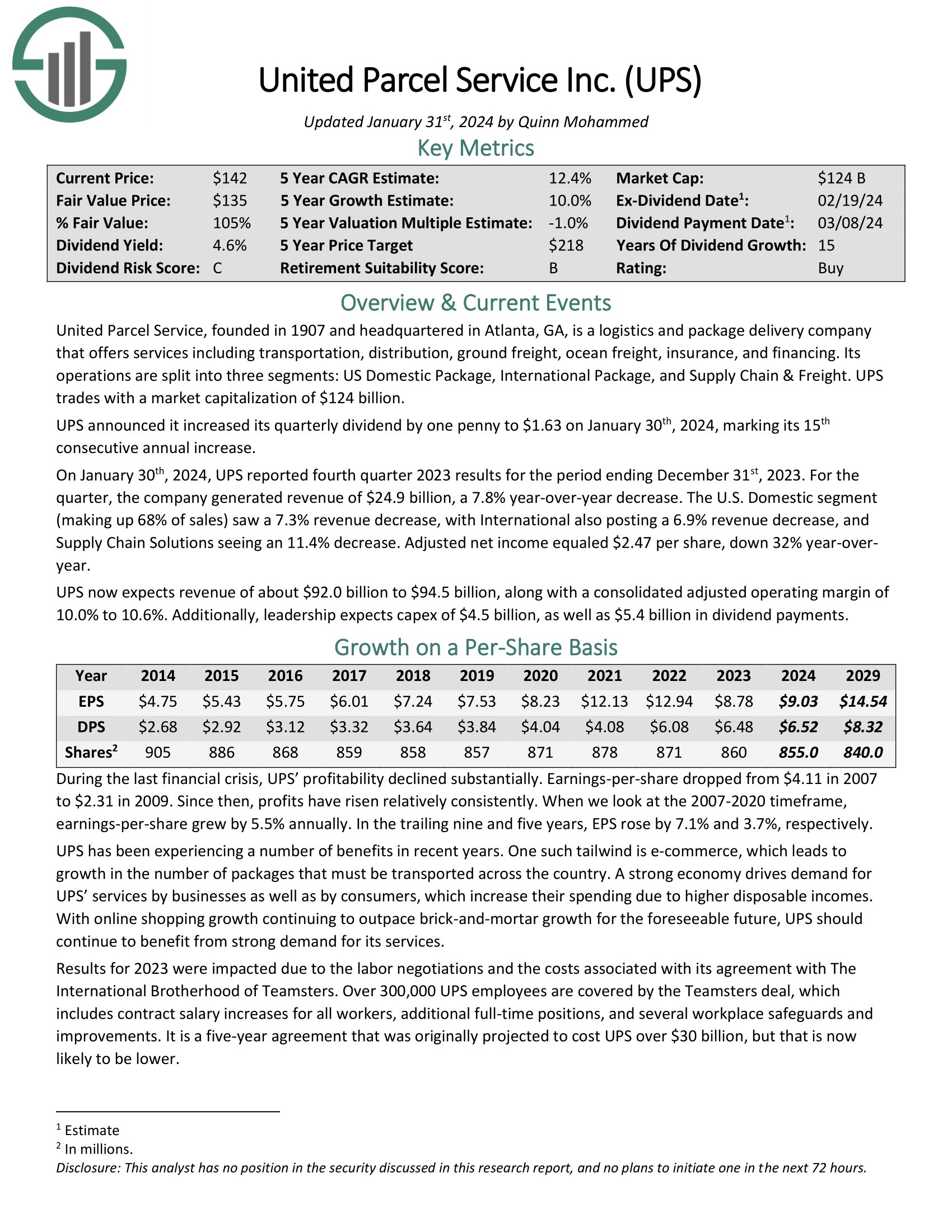

#16—United Parcel Service (UPS)

Dividend Yield: 4.2%

Proportion of Invoice Gates’ Portfolio: 0.2%

United Parcel Service is a logistics and bundle supply firm that provides companies, together with transportation, distribution, floor freight, ocean freight, insurance coverage, and financing. Its operations are cut up into three segments: U.S. Home Bundle, Worldwide Bundle, and Provide Chain & Freight.

The corporate’s continued development within the face of potential world financial headwinds is due largely to its aggressive benefits. UPS is the biggest logistics/bundle supply firm within the U.S.

It operates in a close to duopoly, as its solely main competitor to this point is FedEx. To make sure, Amazon (AMZN) is increasing its personal logistics enterprise, however it nonetheless stays a buyer of UPS as properly.

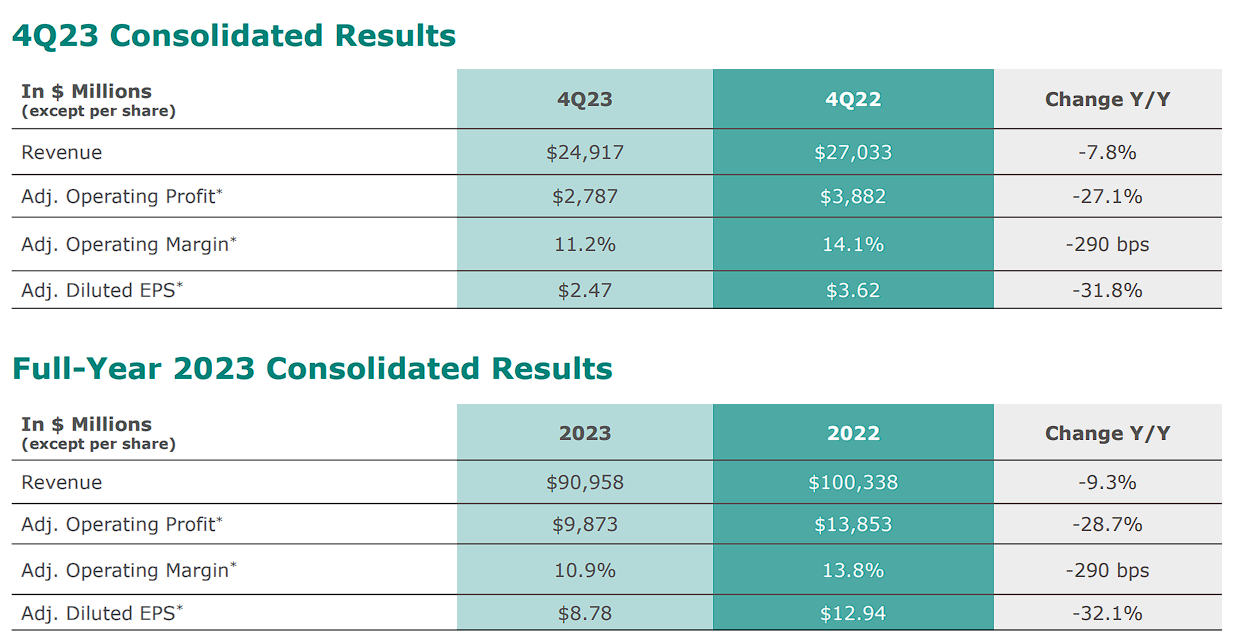

On January thirtieth, 2024, UPS reported fourth quarter 2023 outcomes for the interval ending December thirty first, 2023. For the quarter, the corporate generated income of $24.9 billion, a 7.8% year-over-year lower.

The U.S. Home section (making up 68% of gross sales) noticed a 7.3% income lower, with Worldwide additionally posting a 6.9% income lower and Provide Chain Options seeing an 11.4% lower.

Adjusted web earnings equaled $2.47 per share, down 32% year-over-year.

Supply: Investor Presentation

UPS now expects income of about $92.0 billion to $94.5 billion, together with a consolidated adjusted working margin of 10.0% to 10.6%.

Moreover, management expects capex of $4.5 billion, in addition to $5.4 billion in dividend funds.

Click on right here to obtain our most up-to-date Positive Evaluation report on UPS (preview of web page 1 of three proven beneath):

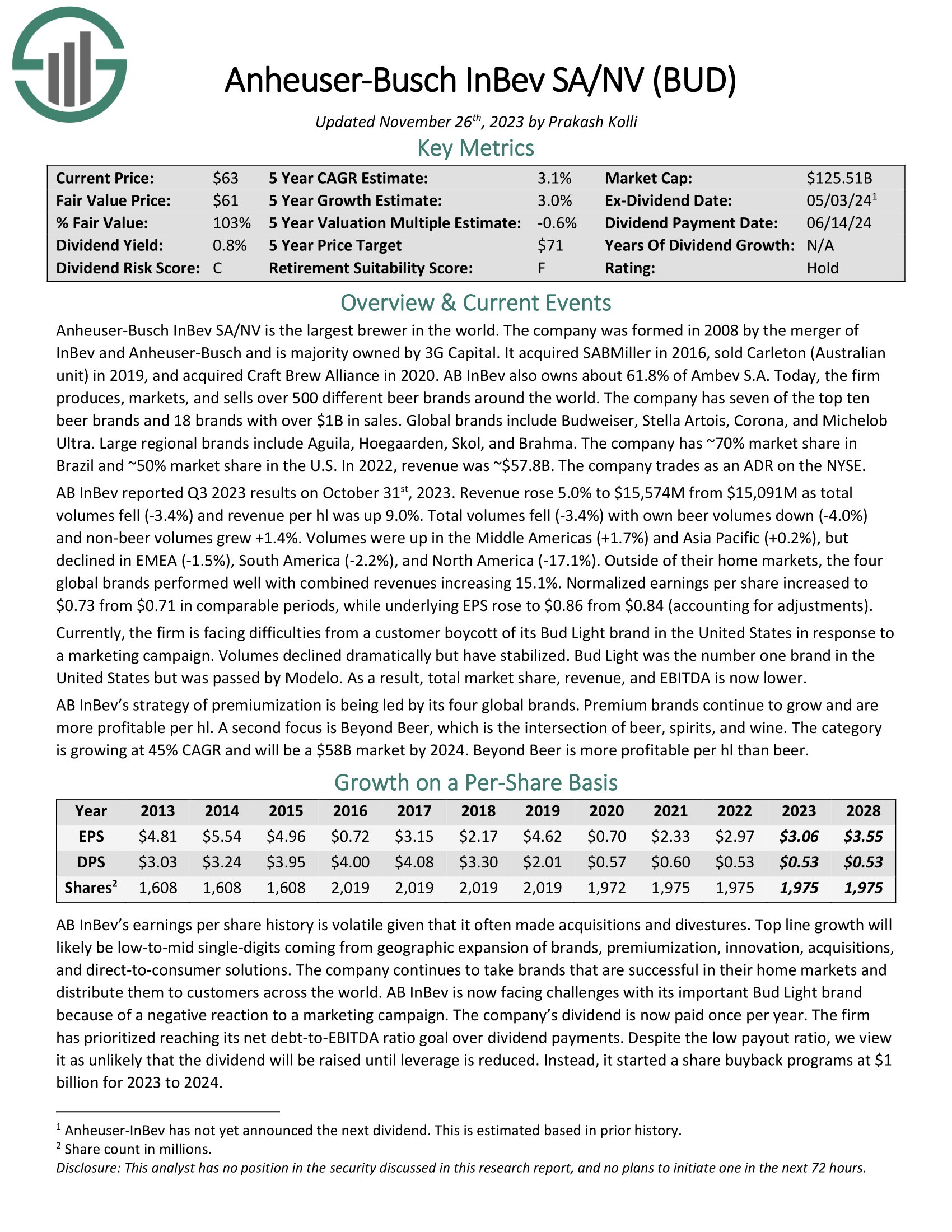

#17—Anheuser-Busch InBev SA/NV (BUD)

Dividend Yield: 1.3%

Proportion of Invoice Gates’ Portfolio: 0.2%

Anheuser-Busch InBev is a multinational beverage and brewing firm headquartered in Leuven, Belgium. It is likely one of the largest and most outstanding beer firms on this planet. The corporate was shaped via a sequence of mergers and acquisitions, together with the merger of Anheuser-Busch and InBev in 2008.

At present, AB InBev produces, markets, and sells over 500 completely different beer manufacturers all over the world. The corporate has seven of the highest ten beer manufacturers and 18 manufacturers with over $1B in gross sales. Main world manufacturers embody Budweiser, Stella Artois, and Corona. Massive regional manufacturers embody Aguila, Hoegaarden, Skol, and Brahma.

AB InBev reported Q3 2023 outcomes on October thirty first, 2023. Income rose 5.0% to $15,574M from $15,091M as whole volumes fell (-3.4%) and income per hl was up 9.0%. Complete volumes fell (-3.4%), with personal beer volumes down (-4.0%), and non-beer volumes grew +1.4%. Volumes have been up within the Center Americas (+1.7%) and Asia Pacific (+0.2%) however declined in EMEA (-1.5%), South America (-2.2%), and North America (-17.1%).

Exterior of their house markets, the 4 world manufacturers carried out properly, with mixed revenues rising 15.1%. Normalized earnings per share elevated to $0.73 from $0.71 in comparable intervals, whereas underlying EPS rose to $0.86 from $0.84 (accounting for changes).

At the moment, the agency is going through difficulties from a buyer boycott of its Bud Mild model in the US in response to a advertising marketing campaign. Volumes declined dramatically however have stabilized. Bud Mild was the primary model in the US however was handed by Modelo. In consequence, whole market share, income, and EBITDA at the moment are decrease.

AB InBev’s premiumization technique is led by its 4 world manufacturers. Premium manufacturers proceed to develop and are extra worthwhile per hl. A second focus is Past Beer, which is the intersection of beer, spirits, and wine. The class is rising at 45% CAGR and will probably be a $58B market by 2024. Past Beer is extra worthwhile per hl than beer.

Click on right here to obtain our most up-to-date Positive Evaluation report on BUD (preview of web page 1 of three proven beneath):

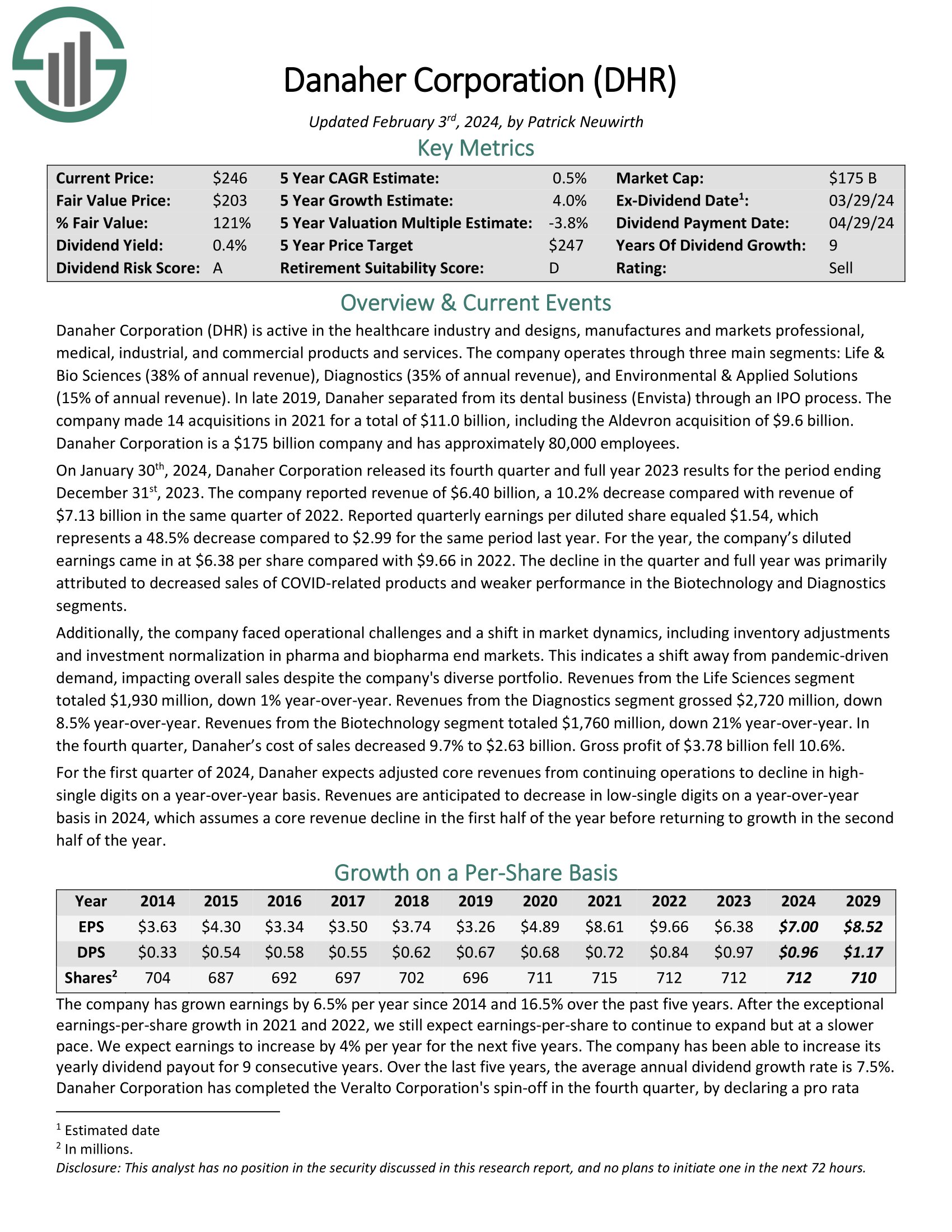

#18—Danaher Company (DHR)

Dividend Yield: 0.4%

Proportion of Invoice Gates’ Portfolio: 0.2%

Danaher Company (DHR) is energetic within the healthcare trade and designs, manufactures, and markets skilled, medical, industrial, and business services and products. The corporate operates via three essential segments: Life & Bio Sciences (38% of annual income), Diagnostics (35% of annual income), and Environmental & Utilized Options (15% of annual income).

In late 2019, Danaher separated from its dental enterprise (Envista) via an IPO course of. The corporate made 14 acquisitions in 2021 for a complete of $11.0 billion, together with the Aldevron acquisition of $9.6 billion. Danaher Company is a $175 billion firm and has roughly 80,000 staff.

On January thirtieth, 2024, Danaher Company launched its fourth quarter and full 12 months 2023 outcomes for the interval ending December thirty first, 2023.

The corporate reported income of $6.40 billion, a ten.2% lower in contrast with income of $7.13 billion in the identical quarter of 2022. Reported quarterly earnings per diluted share equaled $1.54, which represents a 48.5% lower in comparison with $2.99 for a similar interval final 12 months.

For the 12 months, the corporate’s diluted earnings got here in at $6.38 per share in contrast with $9.66 in 2022. The decline within the quarter and full 12 months was primarily attributed to decreased gross sales of COVID-related merchandise and weaker efficiency within the Biotechnology and Diagnostics segments.

Moreover, the corporate confronted operational challenges and a shift in market dynamics, together with stock changes and funding normalization in pharma and biopharma finish markets. This means a shift away from pandemic-driven demand, impacting general gross sales regardless of the corporate’s numerous portfolio.

Revenues from the Life Sciences section totaled $1,930 million, down 1% year-over-year.

Revenues from the Diagnostics section grossed $2,720 million, down 8.5% year-over-year.

Revenues from the Biotechnology section totaled $1,760 million, down 21% year-over-year.

Within the fourth quarter, Danaher’s value of gross sales decreased 9.7% to $2.63 billion. Gross revenue of $3.78 billion fell 10.6%.

For the primary quarter of 2024, Danaher expects adjusted core revenues from persevering with operations to say no in high-single digits on a year-over-year foundation.

Revenues are anticipated to lower in low-single digits on a year-over-year foundation in 2024, which assumes a core income decline within the first half of the 12 months earlier than returning to development within the second half of the 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Danaher (preview of web page 1 of three proven beneath):

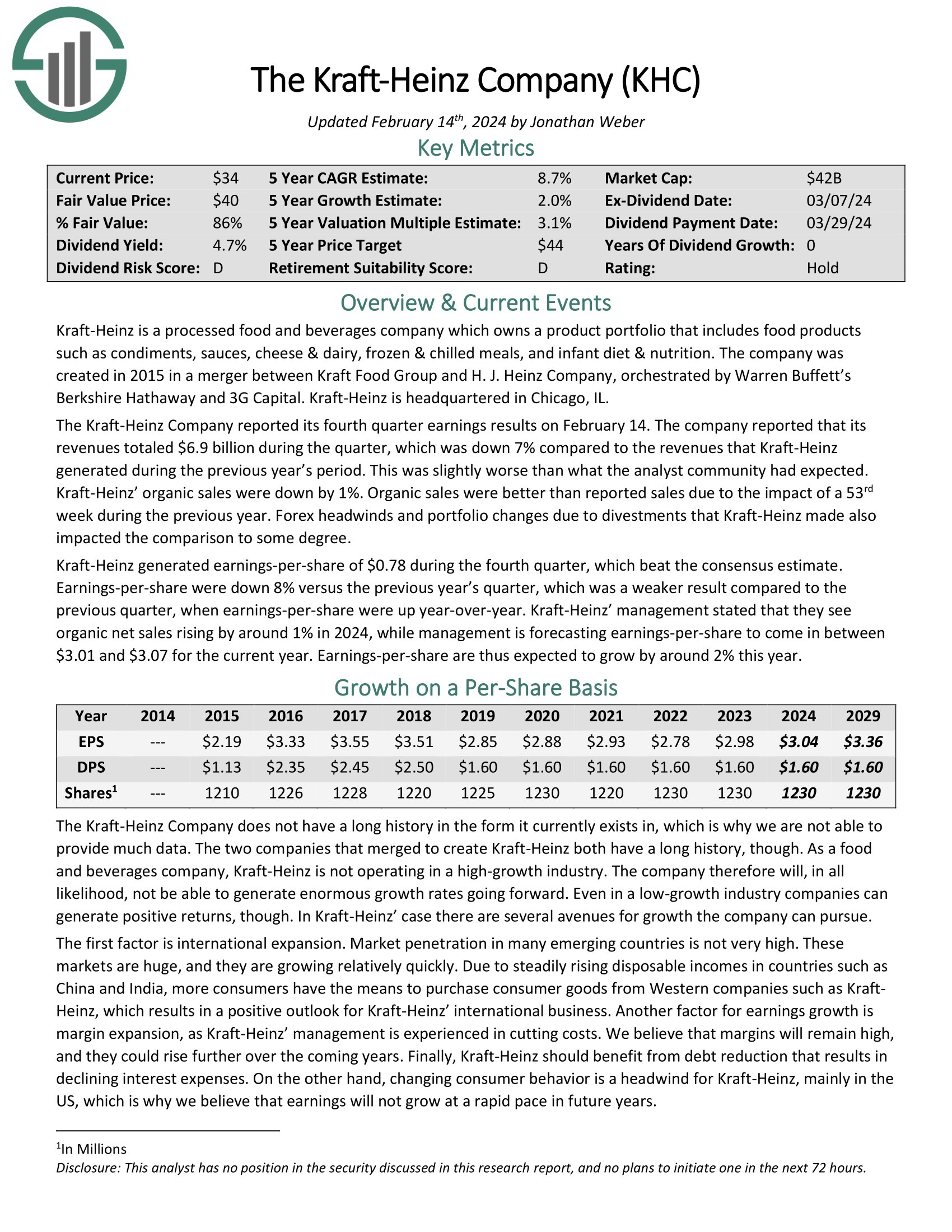

#19—Kraft Heinz (KHC)

Dividend Yield: 4.6%

Proportion of Invoice Gates’ Portfolio: 0.2%

Kraft–Heinz is a processed meals and drinks firm that owns a product portfolio that contains meals merchandise corresponding to condiments, sauces, cheese & dairy, frozen & chilled meals, and toddler weight-reduction plan & nutrition. The corporate was created in 2015 in a merger between Kraft Meals Group and H. J. Heinz Firm, orchestrated by Berkshire Hathaway and 3G Capital.

The Kraft-Heinz Firm reported its fourth-quarter earnings outcomes on February 14. The corporate reported that its revenues totaled $6.9 billion throughout the quarter, which was down 7% in comparison with the revenues that Kraft-Heinz generated throughout the earlier 12 months’s interval.

This was barely worse than what the analyst neighborhood had anticipated. Kraft-Heinz’s natural gross sales have been down by 1%. Natural gross sales have been higher than reported gross sales as a result of impression of a 53rd week throughout the earlier 12 months. Foreign exchange headwinds and portfolio modifications resulting from divestments that Kraft-Heinz made additionally impacted the comparability to some extent.

Kraft-Heinz generated earnings-per-share of $0.78 throughout the fourth quarter, which beat the consensus estimate. Earnings-per-share have been down 8% versus the earlier 12 months’s quarter, which was a weaker outcome in comparison with the earlier quarter when earnings-per-share have been up year-over-year.

Kraft-Heinz’ administration said that they see natural web gross sales rising by round 1% in 2024, whereas administration is forecasting earnings-per-share to come back in between $3.01 and $3.07 for the present 12 months. Earnings-per-share is thus anticipated to develop by round 2% this 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Kraft-Heinz (preview of web page 1 of three proven beneath):

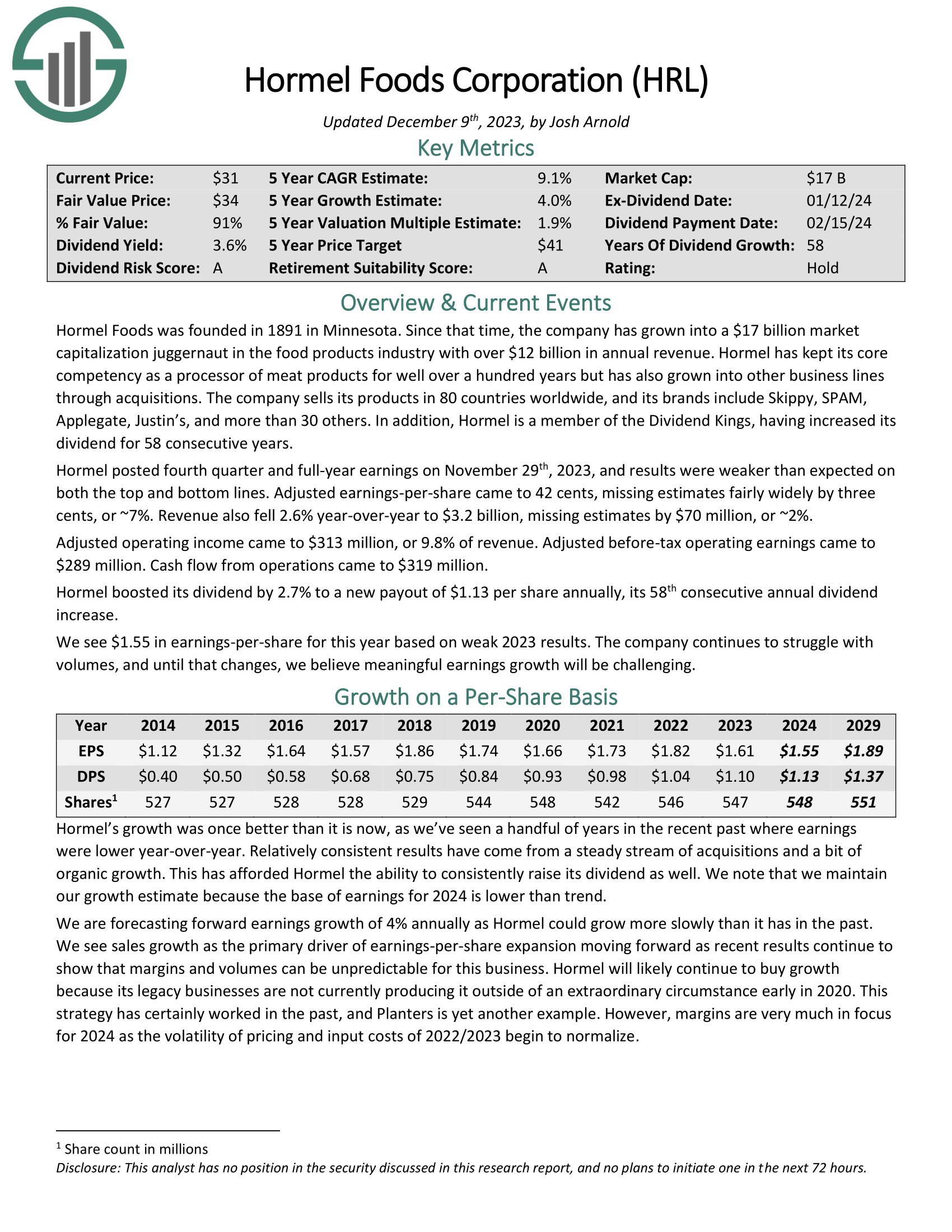

#20—Hormel Meals (HRL)

Dividend Yield: 3.3%

Proportion of Invoice Gates’ Portfolio: 0.1%

Hormel Meals was based in 1891. Since that point, the corporate has grown right into a juggernaut within the meals merchandise trade with almost $12 billion in annual income.

Hormel has stored with its core competency as a processor of meat merchandise for properly over 100 years however has additionally grown into different enterprise strains via acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Only a few of its prime manufacturers embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

As well as, Hormel is a member of the Dividend Kings, having elevated its dividend for 58 consecutive years.

Hormel posted fourth-quarter and full-year earnings on November twenty ninth, 2023, and outcomes have been weaker than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to 42 cents, lacking estimates pretty broadly by three cents, or ~7%.

Income additionally fell 2.6% year-over-year to $3.2 billion, lacking estimates by $70 million, or ~2%. Adjusted working earnings got here to $313 million, or 9.8% of income. Adjusted before-tax working earnings got here to $289 million.

Money movement from operations got here to $319 million. Hormel boosted its dividend by 2.7% to a brand new payout of $1.13 per share yearly, its 58th consecutive annual dividend enhance. We see $1.55 in earnings-per-share for this 12 months primarily based on weak 2023 outcomes.

The corporate continues to battle with volumes, and till that modifications, we imagine significant earnings development will probably be difficult.

Click on right here to obtain our most up-to-date Positive Evaluation report on Hormel (preview of web page 1 of three proven beneath):

#21—Vroom, Inc. (VRM)

Dividend Yield: N/A

Proportion of Invoice Gates’ Portfolio: 0.1%

Vroom is an e-commerce platform that focuses on promoting used autos on-line. Based in 2013 and headquartered in New York Metropolis, Vroom provides a streamlined course of for purchasing and promoting automobiles fully on-line, together with financing, trade-ins, and supply.

The corporate goals to disrupt the normal car-buying expertise by offering a handy, clear, and hassle-free various. Prospects can browse a wide array of pre-owned autos, full transactions digitally, and have their purchases delivered on to their doorstep.

#22—Carvana Co. (CVNA)

Dividend Yield: N/A

Proportion of Invoice Gates’ Portfolio: 0.1%

Carvana Co. is one other e-commerce platform specializing within the sale of used autos on-line. Established in 2012 and headquartered in Tempe, Arizona, Carvana provides a complete on-line market for purchasing, financing, and promoting pre-owned automobiles.

Just like Vroom, Carvana’s platform goals to simplify the car-buying course of by offering a seamless digital expertise, together with digital automobile excursions, financing choices, and residential supply companies.

Carvana operates on a mission to revolutionize the way in which individuals purchase automobiles by providing comfort, transparency, and a wide array of high quality used autos.

#23—On Holding AG (ON)

Dividend Yield: N/A

Proportion of Invoice Gates’ Portfolio: 0.04%

On Holding is predicated in Switzerland, and it develops and distributes sports activities merchandise worldwide. It provides its merchandise via unbiased retailers and distributors, on-line, and shops.

On has rapidly gained reputation amongst athletes and operating fans worldwide for its dedication to delivering distinctive consolation, efficiency, and elegance. The corporate has skilled fast development since its inception and has established a robust presence within the world sports activities market.

The product portfolio of On contains a variety of trainers tailor-made for various terrains, corresponding to highway operating, path operating, and all-terrain operating. They’ve additionally expanded their choices to incorporate attire and equipment like jackets, shirts, shorts, socks, and backpacks, which enhance their footwear line.

#24—Veralto Company (VLTO)

Dividend Yield: 0.4%

Proportion of Invoice Gates’ Portfolio: 0.02%

Veralto Company is a worldwide firm offering water analytics, therapy, marking and coding, and packaging companies. Its Water High quality section provides precision instrumentation and therapy applied sciences, whereas the Product High quality & Innovation section gives inline printing, marking, coding, design software program, imaging, and shade administration options. Previously DH EAS Holding Corp., Veralto was integrated in 2022 and is headquartered in Waltham, Massachusetts.

Extra Assets

See the articles beneath for evaluation on different main funding corporations/asset managers/gurus:

If you’re desirous about discovering extra high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

The foremost home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link