[ad_1]

Many worldwide magnificence manufacturers have their eyes on South East Asia. With a big and numerous inhabitants, and loads of development alternatives, it’s an thrilling area. Representing consumers with various wants, and priorities in the case of magnificence and private care.

After crunching the numbers, listed here are the highest magnificence tendencies we’re seeing in South East Asia proper now, in line with detailed shopper information:

Make-up purchases have surpassed pre-pandemic ranges

SPF is huge, and it’s getting greater

Extra magnificence consumers are caring for their hair

Well being situations are pushing individuals towards specific merchandise

Tech needs to be an enormous a part of the sweetness buy journey

It’s all about unique and stylish merchandise

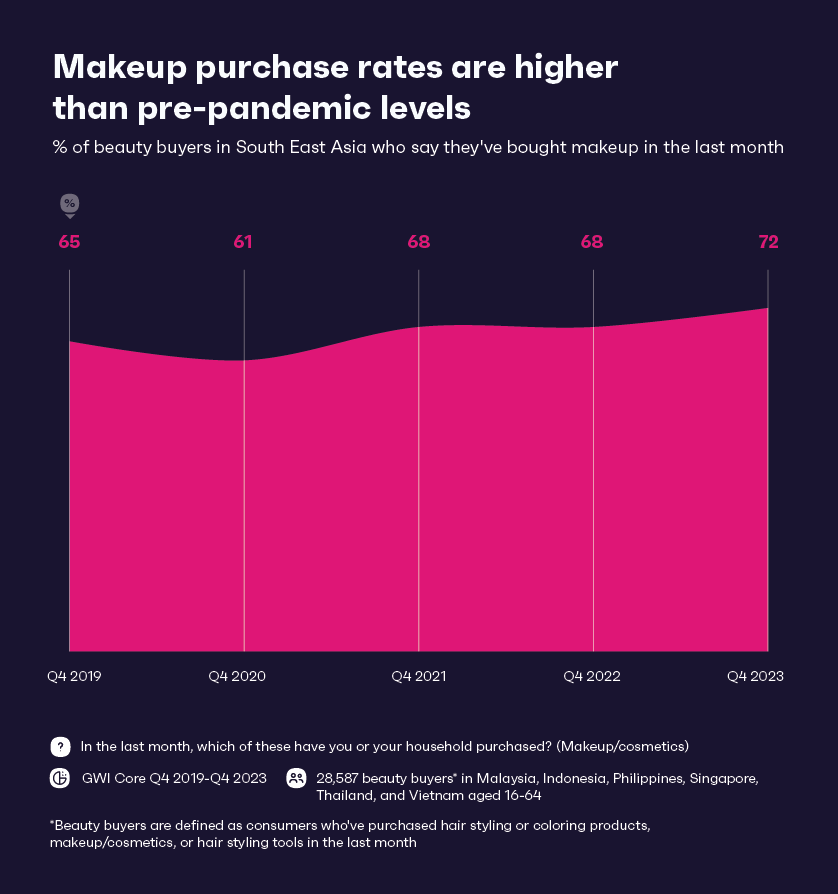

1. Make-up purchases have surpassed pre-pandemic ranges

The pandemic was an odd time, and whereas some industries soared, others didn’t. With fewer individuals within the area socializing, lockdowns, and mask-wearing when customers have been lastly allowed to go away their houses, it’s comprehensible that not many reached for make-up merchandise.

However since 2021, cosmetics gross sales in South East Asia have been on the rise, with self-reported purchases in 2023 above pre-pandemic ranges. The sharp rebound factors to pent-up demand from lockdowns.

The “lipstick impact” additionally feeds into this; individuals in South East Asia are shopping for small indulgences to deal with themselves throughout onerous instances, and a few are sporting daring colours to assist elevate their moods. We’ve seen year-on-year jumps in individuals shopping for blusher, lipstick, and eyeshadow within the area.

Since 2021, there’s additionally been a 23% rise within the variety of males in South East Asia shopping for make-up.

Largely because of extra male celebrities embracing make-up and inclusive advertising, manufacturers focusing on this area have new audiences to focus on.

The extent of development reveals how resilient the sweetness trade is in South East Asia. It didn’t take lengthy for it to catch as much as pre-pandemic purchases, and the world we stay in at present may be very completely different to 2019. Individuals are clearly nonetheless taken with make-up, and types want viewers insights to maintain up with alternatives and adjustments within the magnificence market.

2. SPF is huge, and it’s getting greater

It’s not probably the most glamorous of magnificence merchandise, however elevated consciousness of the influence of the solar on each well being and growing old has led to development in individuals reaching for SPF.

In South East Asia, 2 in 5 magnificence consumers have used suncream within the final week, and nearly as many have used a facial moisturizer with SPF.

Within the final two years, the variety of magnificence consumers in South East Asia who use suncream has grown 12%.

It’s clearly turn out to be a go-to product in many individuals’s routines.

Gen Z and child boomers are seeing the largest jumps in demand. And, almost 1 in 5 Gen Z magnificence consumers in SEA use anti-aging cream/serum, proving that youthfulness is a big commodity even amongst youthful audiences.

UV safety is an enormous magnificence development in Indonesia and Thailand specifically, as magnificence consumers in these nations come out high globally for utilizing facial moisturizer with SPF and suncream.

With a rising demand for SPF merchandise in South East Asia, manufacturers have a chance to determine themselves on this increasing market and converse to particular teams. This may very well be by way of broadening their vary, packaging merchandise in progressive methods, or including skincare advantages to formulation.

For instance, Thai customers are huge on anti-aging serum – over a 3rd of magnificence consumers right here use it weekly, whereas Indonesians use comparatively extra lipstick and lip liner. So manufacturers trying to break into these markets might do effectively by including anti-aging advantages to their formulation and broadening their product vary to incorporate SPF. Skincare-makeup hybrids have been constructing traction in the previous few years, and it seems to be like they’re right here to remain.

3. Extra magnificence consumers are caring for their hair

Hair and scalp care is rising in recognition amongst magnificence consumers in South East Asia. The quantity who use hair oil weekly has grown 17% year-on-year, with consumers on this area standing out for buying particular haircare merchandise.

Indonesia, for instance, is the nation on the earth almost definitely to make use of anti-dandruff shampoo, whereas Thailand stands out for utilizing volumizing merchandise. Manufacturers that harness pure elements to cleanse, strengthen, and revive tresses from root to tip stand to win huge with this regional viewers.

Magnificence consumers in South East Asia aren’t simply taken with caring for their hair although, they’re additionally into styling it. The quantity who’ve used a highlighter (+33%), relaxer (+14%), and hair wax (+21%) within the final week have all risen year-on-year.

This area’s elevated curiosity in styling and haircare might give manufacturers the chance to create extra multi-purpose merchandise, which change the look of hair, whereas nonetheless sustaining its well being. For instance, hair coloring packs with nourishing elements.

4. Well being situations are pushing individuals towards specific merchandise

The well being situations individuals endure from might steer them towards focused magnificence merchandise which promise aid. In South East Asia, sleep-related situations stand out as the commonest well being problem, with magnificence consumers right here being 13% extra more likely to expertise them than the typical shopper within the area.

The variety of magnificence consumers that suffer from sleep-related situations has grown 20% since 2020.

For manufacturers, there’s an opportunity to double down on options which support relaxation. Components like lavender, chamomile, or CBD can have a calming impact, and due to this fact assist put together the physique and thoughts for sleep. So, magnificence manufacturers ought to look to incorporate a few of these elements of their merchandise, and focus their messaging round making these consumers really feel pampered.

Magnificence consumers in South East Asia are additionally distinct for coping with skin-related situations, which means they could even be taken with merchandise which promise to be mild, fragrance-free, and have calming elements.

By catering to the distinctive well being struggles confronted by South East Asian customers, magnificence manufacturers stand to make significant connections by way of tailor-made merchandise. Firms that actually perceive this market and its relationship with well being usually tend to flourish in it.

5. Tech needs to be an enormous a part of the sweetness buy journey

Magnificence consumers in South East Asia are very taken with tech. Over half say they observe the most recent expertise tendencies and information, and the quantity who personal a VR headset (+10%) and use TikTok results (+6%) has grown between 2020-2023.

Because of this magnificence consumers in South East Asia are more likely to be eager on beauty-related tech – like LED masks and digital facial massagers.

Their curiosity in tech additionally means they’re extra open to embracing AI and AR within the buy journey. Manufacturers might look to make prospects’ buy journey extra immersive and customized; this may very well be by way of providing AR try-ons and permitting magnificence consumers to nearly pattern merchandise and shades, or by bringing AI into the acquisition journey.

In Singapore, over half of magnificence consumers say they’d be comfy utilizing an AI-integrated device to purchase a services or products.

AI may very well be used to deal with buyer queries, to supply suggestions, and even create customized magnificence subscriptions primarily based on buyer preferences. A very good instance is private care firm Shiseido‘s cutting-edge “sensible mirror” often known as the Skincare Advisor.

No matter expertise instruments firms select, many magnificence consumers in South East Asia are able to embrace it.

6. It’s all about unique and stylish merchandise

If manufacturers are going to interact with magnificence consumers in South East Asia, they’re going to need to embody what these customers need.

First off, magnificence consumers need manufacturers to be unique, fashionable, and younger. In Singapore, they’re 28% extra more likely to need adverts to make them chortle, and 1 in 4 ahead on memes weekly. So, retaining on high of the web tradition they’re driving ahead might make an enormous distinction. It’s additionally key to maintain magnificence consumers excited by releasing restricted version and unique collections, for instance, a quarterly assortment targeted on a hero ingredient.

By way of what these customers need manufacturers to do, they’re most forward for enhancing their on-line picture or fame, carefully adopted by working buyer communities and providing personalized merchandise.

Manufacturers might assist enhance their prospects’ picture by highlighting buyer success tales, or permitting followers to submit content material utilizing their merchandise for an opportunity to win a prize or be featured.

And in the case of personalized services or products, investing in session experiences on-line or in-store to gauge particular person wants and personalize suggestions is an effective option to go. This may very well be significantly interesting to any magnificence consumers that suffer with pores and skin complaints.

In a nutshell, the sweetness scene is simply as huge and versatile as ever. The tendencies we’ve outlined are shaping how we see and snag our favourite merchandise, and wonder manufacturers needs to be acquainted with them in the event that they wish to maintain their glow.

[ad_2]

Source link