[ad_1]

JHVEPhoto

After analyzing a few of the most necessary IPPs (Impartial Energy Producers) globally, with at the moment’s article I need to convey your consideration to Ameresco (NYSE:AMRC). In case you are involved in firms coping with renewable vitality, on my profile EuroEquity Analysis you will discover a number of analyses. AMRC is a significant American EPC (Engineering, Procurement and Building) vitality firm, additionally participating in O&M and asset administration. It owns a complete capability of 508MWe (Megawatts equal) obtained by means of small-scale photo voltaic methods, storage methods, and RNG (renewable pure gasoline). Since November 2021, the inventory has skilled a 78% drop, primarily imputable to the delay within the building of a 537.5 MW storage plant for SCE (Southern California Edison) scheduled for August 2022 and never but totally accomplished. This brought on an total pipeline slowdown, possible monetary compensation to SCE, in addition to market consideration to AMRC’s covenants and, consequently, its monetary place. Ameresco, nonetheless, represents one of many main gamers within the trade, with all-around publicity to vitality transition and a enterprise able to being very positively affected by the elevated demand for renewable-related providers. A normalization of rates of interest between FY24 and FY25 may very well be the best catalytic occasion for the corporate. Elevated funding availability will translate into income progress, supported already now by document ranges of backlog at $3.9B, together with $1.3B totally contracted, as of December 2023. The tax credit launched by the Inflation Discount Act, notably Funding Tax Credit, and new investments in vitality methods can have a optimistic impact on OCF’s working outcomes and manufacturing, containing debt and enabling implementation of the funding program undertaken since 2022, targeted on natural progress with a spotlight additionally on the dynamic European section. To help the funding thesis, I carried out a DCF evaluation that returned a valuation of $23.32 a share. Though I discover the inventory worth engaging, I assign Ameresco a Maintain ranking, at the least till the discharge of additional optimistic developments relating to the SCE venture.

Enterprise Overview

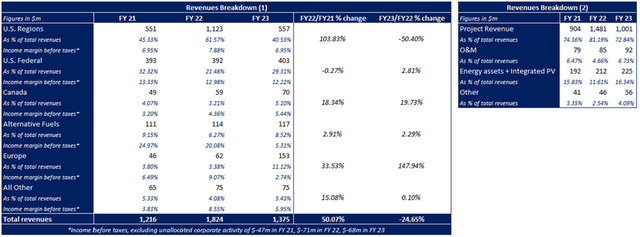

AMRC SEC Filings and Creator’s Evaluation

Ameresco’s enterprise is principally divided into 3 segments:

Undertaking is the principle exercise, consisting of the implementation of vitality tasks geared toward lowering the vitality consumption of buildings by means of

Vitality Financial savings Efficiency Contracting (ESPC), appearing as an ESCo (vitality service firm). In FY23, 72% (vs. 46% FY22) of its revenues have been certainly derived from federal, state, provincial, or native authorities entities, together with public housing authorities, public universities, and municipal utilities. In FY22, the section skilled a spike in revenues because of the recognition of the SCE venture. The above-mentioned issues with the venture, nonetheless, led to a slowdown in AMRC’s operations in FY23, leading to a 32% YoY lower in venture revenues, nonetheless above FY21 ranges. I count on revenues to speed up once more between FY24 and FY25, according to elevated demand for brand new renewable vegetation. Barring additional delays on tasks, I anticipate a return to FY22 highs as early as FY25. This enterprise space can be devoted to the development of small-scale renewable methods, typically mixed with vitality effectivity operations.

Most important opponents: McKinstry, CM3 Constructing Options, SitelogIQ, ABM Industries (ABM), Southland Industries, Vitality Methods Group, Johnson Controls (JCI), Schneider Electrical (OTCPK:SBGSF),and Honeywell Worldwide (HON).

O&M, by means of which the corporate presents Operation & Upkeep providers, on the clients’ discretion. This characteristic permits recurring revenues by means of contracts, normally on a multi-year foundation. Though the section was price slightly below 7% of complete revenues in FY23, it reached $92m, up steadily from $79m in FY21. I count on the identical degree of progress to be maintained within the coming years.

Most important opponents: EMCOR Group (EME), Consolation Methods USA (FIX), HON, JCI, and Veolia Surroundings (OTCPK:VEOEY).

Vitality property, a section by means of which revenues are obtained primarily by means of PPA contracts, for the sale of photovoltaic or wind energy (Vitality Provide Agreements), and for the sale of gasoline and RNG (Fuel Buy Agreements). This section, during which AMRC operates very like an IPP, is characterised by regular progress stimulated by the commissioning of latest RNG and PV vegetation. Administration anticipated that roughly 200 MWe of vitality property will come into service throughout 2024, together with energy battery property. As well as, 3 extra RNG vegetation are scheduled to be accomplished, considered one of which will probably be operational as early as January 2024, positioning itself as a significant participant within the trade. As of Dec23, vitality property are price 119% of web debt, down from 150% in Dec22, however according to what was present in earlier IPPs analyses.

Most important opponents: Archaea Vitality, Montauk Renewables (MNTK), Vanguard Renewables, Opal Fuels (OPAL) within the RNG enterprise. NextEra Vitality (NEE), Engie (OTCPK:ENGIY), and the assorted IPPs analyzed in earlier articles relating to photo voltaic & storage companies.

Newest Investments & Future Developments

The investments undertaken by Ameresco within the final 2 years have been geared toward rising the share of recurring revenues, notably the Vitality property and O&M segments, that are presently price about 24% of complete revenues. To grasp the significance of them, nonetheless, it’s crucial to have a look at EBITDA, with the 2 segments accounting for 64% of complete FY23 EBITDA. This makes them indispensable to make sure better stability to financial outcomes and money flows, which, in the intervening time, are characterised by excessive volatility because of the Undertaking section weight on complete revenues.

One other necessary growth issues the enlargement within the European market by means of the acquisition of the Italian firm ENERQOS, which has contributed to a 148% YoY enhance in revenues in Europe with an 11% share of complete revenues. It ought to be famous, nonetheless, that a lot of this income is project-related and subsequently not a recurring income. It might subsequently expertise vital adverse adjustments sooner or later, following a possible lower in demand.

As regards future developments, administration reiterated over the past convention name that the technique continues to be to retain for themselves an rising share of the tasks developed, in order to extend recurring income and make margins extra strong and fewer unstable. In addition they acknowledged that they could contemplate some disinvestment, ought to they want liquidity. Total, I consider that is the best strategy to deploy, according to that carried out by firms within the trade.

Standing on the SCE Undertaking

In October 2021 AMRC closed a contract price $892m with SCE for the EPC of a 537MW storage methods, together with 2 years of O&M to be accomplished by August 2022. Issues associated to inclement climate and provide chain disruptions led to a big delay within the supply and meeting of elements wanted to construct the plant. As of February 2024, two of the three items deliberate for the venture have been accomplished, exceeding the final word deadline imposed on the finish of 2022, which referred to as for ultimate completion no later than 2023. Failure to finish it on time contractually carries a penalty of as much as $89m.

The general outcomes of the operation have been adverse for Ameresco and, I’m satisfied, a few of it’s but to be mirrored within the firm’s monetary statements. The operation was accounted for in FY22, and the estimated prices of finishing the plant have been subtracted from complete revenues. As well as, the delay in work slowed the implementation of different tasks, miserable revenues in FY23 and, on the identical time, had a adverse affect on prices for transportation and logistics. Much more vital is the adverse affect on FY22 and FY23 FCFs, which can persist to some extent in FY24.

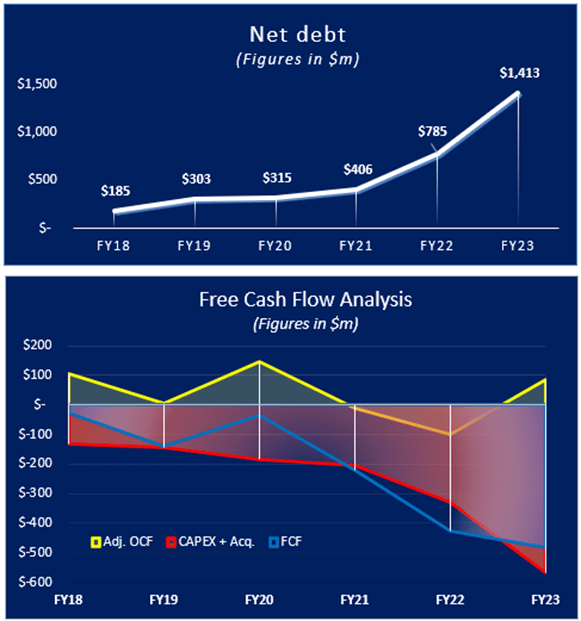

As well as, I count on a potential one-off price because of the penalty within the coming years, for a most cost of $89m. To help the operation, in addition to the implementation of the opposite tasks, the online debt elevated by $1B between FY21 and FY23 reaching $1.4B (company debt: $280m), additionally because of the larger quantity of funding wanted to finalize the SCE venture. The latter certainly required vital investments that weren’t offset by a rise in adjusted OCF (obtained by including advances on Federal ESPC tasks to OCF), which bottomed out in FY22 at -$100m after which recovered in FY23 to $84m.

In FY24, I count on an enchancment in working money era, however this won’t be adequate to fulfill the $350-400m Capex introduced by administration. The closely adverse FCFs of the previous 2 years and the adverse FCFs anticipated for the approaching years have and would require new debt to be taken on, with a consequent enhance in web debt. Nevertheless, elevating the required liquidity will probably be partly facilitated by the introduction of the ITCs, which can permit the corporate to boost tax fairness financing by lowering capital necessities for some tasks by 30%, particularly these to be held within the vitality portfolio.

AMRC SEC Filings and Creator’s Evaluation

Furthermore, failure to finish SCE by January 2024 resulted within the issuance of a $100m subordinated bond as an alternative choice to the capital enhance, as may be learn within the FY23 monetary assertion:

The modification additionally added a covenant that requires Ameresco to make use of commercially affordable efforts assuming regular market situations to boost and, by April 15, 2024, shut on a minimal of $100,000 fairness or subordinated debt financing if the Cathode web site beneath the Southern California Edison (“SCE”) contract doesn’t obtain substantial completion by January 31, 2024, which was not achieved. Web proceeds from such financing can be required for use to repay excellent quantities on the senior secured credit score facility.

Contemplating the above, I consider this transaction to be a missed alternative for Ameresco, from a potential alternative to a probable supply of issues within the coming months. I additionally query administration’s phrases on whether or not a capital enhance might turn into important to keep away from potential liquidity shortages within the brief time period. I consider that the principle folks chargeable for the deal are administration, which entered into an settlement with too brief a deadline for the development of a plant considerably above the historic goal of Ameresco’s earlier tasks. This resulted in a big expenditure of sources in an already notably tough financial setting on account of excessive inflation.

Commentary on Financial and Monetary Knowledge

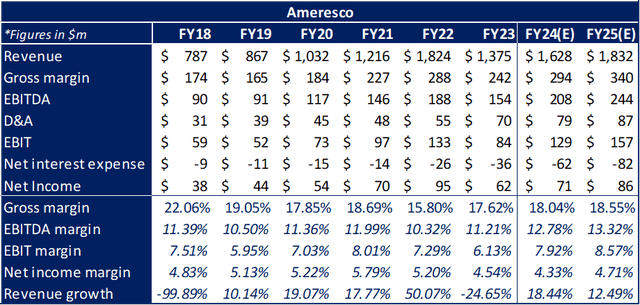

In FY23, Ameresco’s revenues decreased by 24.6%, beneath the steerage launched initially of the yr. The EBITDA margin confirmed an upward efficiency although, reaching 11.2%, near the highs achieved throughout the 6-year interval beneath overview. EBIT and Web Revenue margins, then again, have each hit lows (6.1% and 4.5% respectively) primarily on account of elevated D&A and curiosity bills.

Now turning to 2024, administration count on revenues and adjusted EBITDA to develop by 20% and 38%, respectively, though I personally count on income to extend by c.a. 18%, to contemplate points associated to the completion of the SCE venture. In Q1 2024, revenues and adjusted EBITDA ought to be within the vary of $225-275m and $20-30m respectively, with adverse non-GAAP EPS. In FY25, I count on revenues to achieve FY22 outcomes, with a rise in working margin, aided by economies of scale and the overcoming of issues associated to the Californian venture. The online earnings margin, then again, weighed down by larger curiosity prices and by potential one-off penalties prices, is prone to develop extra slowly and stay beneath the historic common worth noticed within the interval beneath overview.

AMRC SEC Filings and Creator’s Estimates

Most important Dangers

Though the appreciable alternatives related to the enterprise during which Ameresco operates, the corporate has sure dangers, each exogenous and endogenous, that may have severe repercussions on the solvency of the inventory and consequently on its share worth:

A continued excessive rate of interest setting can have severe repercussions on monetary efficiency, particularly after the current vital enhance in debt, with curiosity bills that might surge closely affecting profitability.

The SCE venture has highlighted issues with venture scheduling, a truth which may be repeated sooner or later, once more damaging financial efficiency in addition to its status.

AMRC could also be economically chargeable for the failure to extend deliberate vitality effectivity in tasks during which it operates as an EPC. Though the efficiency calculation is normally based mostly on technical manufacturing information quite than financial information, thus not affected by electrical energy worth volatility, this issue may very well be a further money drain sooner or later.

The trade during which it operates is very regulated, particularly the Undertaking section for which particular procedures regulated by the U.S. Division of Vitality have to be adopted. Adjustments in regulation might subsequently have a heavy affect on its financial outcomes.

Discounted Money Movement

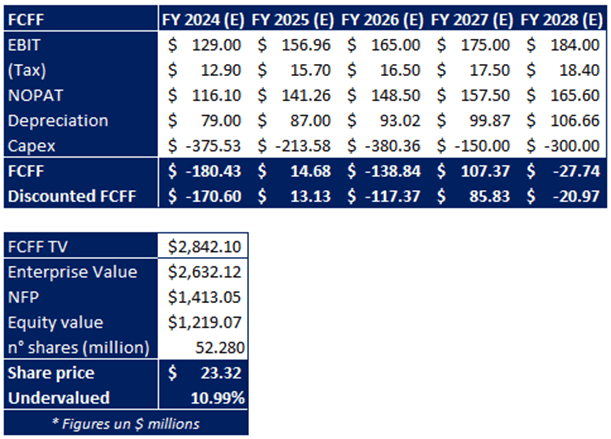

I carried out a DCF evaluation to evaluate AMRC’s intrinsic worth, returning a good worth of $23.3 per share, about 10% above the present market worth. I included throughout the estimates a discount in working outcomes because of the potential financial affect of the SCE venture. For the analysis, the next assumptions have been made:

Beta: 1.54x, obtained by Investing.com.

MRP (5.87%) and Danger-Free price (3.81%) have been obtained through the use of 2023 Fernandez’s information, weighted by the geographic breakdown of the corporate’s revenues. A price of fairness of 6.98% was obtained.

Price of debt (5.34%) was obtained from the ratio of curiosity expense to AMRC’s complete debt as of December 2023.

WACC = 5.76%, fairly a low worth due to the burden of debt, which presently has a better worth than market capitalization.

G = 2% according to the inflation goal within the US.

Creator’s Estimates and Evaluation

Conclusion

Creator’s Estimates and Evaluation

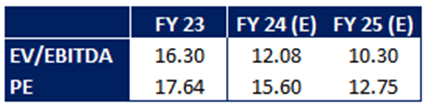

I consider Ameresco is an effective long-term funding alternative, particularly following the current worth drop. The enterprise seems to be diversified, with good positioning within the growth and EPC sectors. I choose positively the administration’s plans to attempt to enhance recurring revenues to stabilize monetary management, which is presently marked by nice volatility. As well as, the DCF and potential multiples evaluation present a slight undervaluation of the inventory, particularly relating to PE, which is predicted to enhance from 17.64x in FY23 to 12.75x in FY25.

Nonetheless, the errors made within the SCE venture are a robust adverse issue each in financial and reputational phrases however, most significantly, in monetary phrases. That’s as a result of they’re inflicting severe repercussions, akin to the necessity to present for the issuance of a subordinated bond or, alternatively, make a $100m capital enhance on account of covenants linked to the venture debt.

I presently assign a Maintain ranking to AMRC as, though I consider Ameresco is undervalued by way of worth, I believe it’s elementary to carefully monitor SCE venture evolution, FCF and debt degree in FY24.

[ad_2]

Source link