[ad_1]

aeduard

It has been a troublesome two-year stretch for gold builders, and whereas i-80 Gold Corp. (NYSE:IAUX) administration staff took benefit of the favorable market surroundings in 2020 to promote its final firm (Premier Gold), and outperformed the sector considerably in its first two years as a spin-out beneath i-80 Gold (2021, 2022), 2023 was a troublesome 12 months for the share worth – and 2024 hasn’t began out any higher. Nonetheless, whereas a number of different builders have seen their share costs sink due to a scarcity of entry to capital, a scarcity of stories circulate, and never being any nearer to manufacturing given the tough surroundings, i-80 Gold has made a number of new discoveries, has been one of many few corporations with entry to capital to proceed advancing its initiatives, and it has put certainly one of its mines into manufacturing already, with a big improve in gold manufacturing anticipated by This fall of this 12 months.

Sadly, the extraordinarily unfavourable sentiment sector-wide and share dilution associated to the Paycore Minerals deal have weighed on the inventory, with IAUX testing its all-time lows, even with the gold worth at all-time highs. And whereas it’s understandably discouraging for buyers, this isn’t a case of deteriorating fundamentals which have led to a downgrade within the story. The truth is, the story has solely gotten higher, and is eighteen months nearer to realizing its aim of turning into a 400,000 ounce gold producer than it was at its all-time highs in This fall 2022 above US$3.00 per share. It is also value noting that whereas i-80 has lagged producers, its share-price efficiency hasn’t been that completely different than many builders, and it is truly outperformed most builders since inception (Q2 2021). So, on condition that the story continues to enhance (rising useful resource, potential for a cope with a JV companion at its flagship asset, larger gold worth), I see this as a case of the newborn being thrown out with the bathwater.

On this replace we’ll dig into the This fall outcomes, latest developments, and why this disconnect within the share worth appears like a shopping for alternative.

Granite Creek Mine – Firm Web site

This fall & FY2023 Outcomes

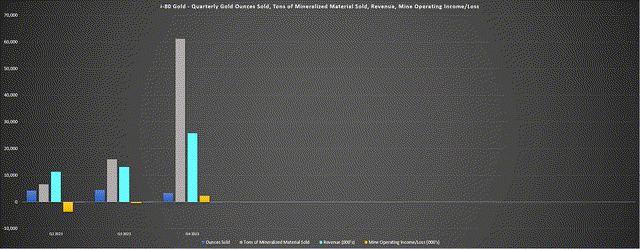

i-80 Gold launched its This fall and FY2023 outcomes earlier this month and had a strong 12 months and quarter general. For starters, the corporate noticed larger manufacturing from its Granite Creek Mine (~130,000 tons mined final 12 months) whereas persevering with to get well ounces from residual leaching, leading to gold gross sales of ~3,400 ounces in This fall at a median realized worth of $1,996/oz, and the sale of ~61,200 tons of mineralized materials of which ~29,500 tons was sulfide materials for This fall income of $25.8 million. This was a big improve from the ~$11.6 million in income in This fall 2022 and helped the corporate to report mine working revenue of ~$2.35 million within the interval (This fall 2022: mine working lack of ~$3.46 million).

As for the full-year outcomes, income elevated to $54.9 million (FY2022: $37.0 million) with the numerous improve within the sale of mineralized materials at Granite Creek, the brand new oxide sale settlement in place, with i-80 reporting whole gold gross sales of ~14,600 ounces and the sale of ~84,000 tons of mineralized materials.

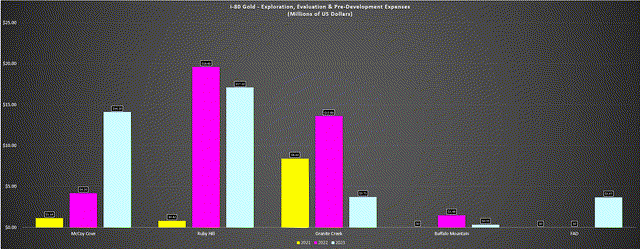

i-80 Gold – Quarterly Gold Ounces Offered, Tons of Mineralized Materials Offered, Income, Mine Working Earnings – Firm Filings, Creator’s Chart i-80 Gold – Exploration, Analysis & Pre-Growth Bills – Firm Filings, Creator’s Chart

Concerning progress on drilling/creating its property, the corporate accomplished over 3,900 meters of underground improvement at Granite Creek and put in a deeper properly to enhance its dewatering capabilities for when it accesses the higher-grade South Pacific Zone. In the meantime, the exploration ramp at Cove was superior over 800 meters, and i-80 drilled over 60,000 meters throughout its portfolio, a comparatively modest quantity of drilling contemplating the variety of discoveries it is made throughout its portfolio. Nonetheless, given the unfavorable financing surroundings and the potential to make use of proceeds from a joint-venture for drilling sooner or later vs. having to lean on fairness raises at depressed ranges, I feel the lowered funds final 12 months made sense to keep away from any additional share dilution.

Lastly, it is vital to notice that whereas we noticed elevated share dilution separate from its financings final 12 months apart from larger money burn which weighed on the share worth (~39 million shares issued), this was associated to the Paycore acquisition and milestone funds for Ruby Hill, with these milestone funds to Waterton since full.

As for its money place, i-80 completed the 12 months with ~$16 million in money however has since bolstered its stability sheet with a brand new ~$18 million financing accomplished final month. This can bridge the hole till now and the deliberate joint-venture settlement which was introduced 4 months in the past and is anticipated to be introduced within the subsequent seven weeks based mostly on the 4-month due diligence interval plus a 60-day extension (that means a choice is to be made by Might fifth).

So, with the potential for a big money injection for i-80 Gold if we see the joint-venture companion signal a deal, confidence from the market that the corporate has a extra everlasting financing resolution and an extra vote of confidence within the potential of this undertaking relying on the companion’s market cap, I count on this to end in a 180-degree flip in sentiment for the inventory and assist to place a flooring beneath the inventory.

Current Drilling Outcomes

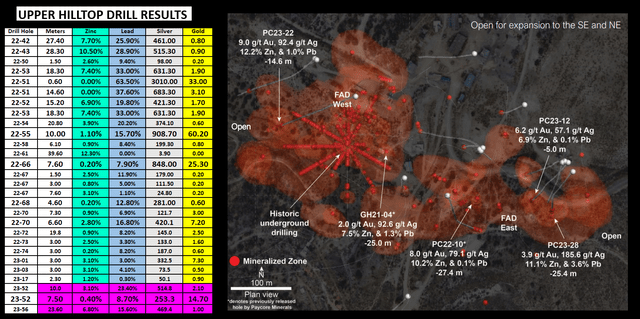

Shifting over to latest developments, i-80 Gold has had appreciable success drilling throughout all its property and, as I identified in a earlier replace, it has made a number of new discoveries (gold and base metals) and is ready up for vital useful resource development on condition that its present ~15 million ounce useful resource base doesn’t embody the next deposits:

South Pacific Zone (Granite Creek) Blackjack (Ruby Hill) East Hilltop (Ruby Hill) Higher Hilltop (Ruby Hill) Decrease Hilltop (Ruby Hill) FAD (Ruby Hill).

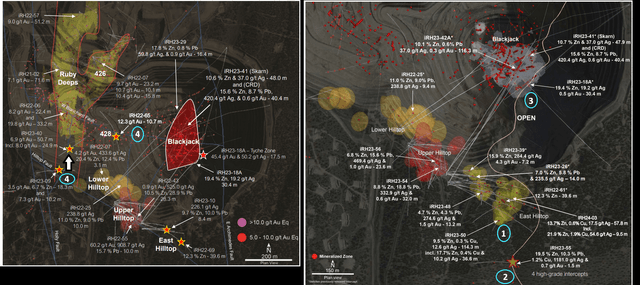

As well as, the corporate has elevated the mineralized footprint at Ruby Deeps (high-grade gold deposit at Ruby Hill) and made two new sulfide discoveries that it has been too busy to comply with up on (Tyche, 428 Zone), with the Tyche drill hit being a top-15 drill intercept in Nevada over the previous 5 years with 17.5 meters at 45.4 grams per ton of gold. And earlier than transferring onto Cove, which i-80 expects to be its highest-grade future spoke for its Hub & Spoke mannequin, there are a couple of vital factors value making from an exploration upside standpoint.

Ruby Hill Drilling Success – Firm Presentation, Creator’s Annotations (1-4)

1. Essentially the most southern hit at its new East Hilltop discovery was an enormous hit of 114.3 meters at 9.5% zinc, 0.30% copper and ~0.3 grams per ton of silver, suggesting that East Hilltop may have a significant useful resource base at engaging grades.

2. A latest gap drilled south of East Hilltop was 1.5 meters at 19.5% zinc, 10.3% lead, 1.2% copper, 34 ounces per ton of silver and 0.70 grams per ton of gold, properly above the typical grade of East Hilltop and pointing to useful resource development potential south of East Hilltop to doubtlessly add additional tons to the polymetallic potential right here.

2. The southern most gap at Blackjack hit a formidable 30.4 meters at 19.4% zinc and ~0.6 grams per ton of silver, above Blackjack’s common grade and there stays a 300 meter hole between East Hilltop and Blackjack that’s but to be examined.

3. FAD’s jap most gap hit an unbelievable intercept of 25.4 meters at ~14.7% lead/zinc, 3.9 grams per ton of gold and ~6 ounces per ton of silver and FAD’s western most gap yielded an intercept of 14.6 meters at 9.0 grams per ton of gold, ~3 ounces per ton of siler, and 13.2% lead/zinc, suggesting that grades stay very engaging at each ends of the deposit with it nonetheless open to the southeast and northeast.

4. Ruby Deeps’ most southern gap hit a formidable 24.9 meters at 8.0 grams per ton of gold and 50.7 meters at 6.9 grams per ton of gold, above useful resource grades within the 2021 TR and pointing to the potential to develop this useful resource base at larger grades. As well as, the 428 Zone to the east of Ruby Deeps hit 10.7 meters at 12.3 grams per ton of gold, suggesting additional upside at grades which might be almost 2x that of Ruby Deeps present useful resource.

5. The South Pacific Zone (Granite Creek) is yielding outcomes properly above the typical grade of the Granite Creek useful resource and stays to the north on pattern with the large Turquoise Ridge Complicated (20+ million ounces of high-grade sources), with beforehand drilled Homestake holes hitting 1.2 meters at 15.7 grams per ton of gold and 6.1 meters at 7.0 grams per ton of gold as much as 400 meters north of i-80’s drilling thus far. As well as, the grades and widths seem like enhancing at depth (like what we noticed with Barrick’s Turquoise Ridge Underground Mine), with three of i-80’s deeper intercepts hitting 5.6 meters at 25.6 grams per ton of gold, 6.6 meters at 15.7 grams per ton of gold, and 19.7 meters at 15.5 grams per ton of gold. Simply as vital, two hits nearer to floor that will likely be mined earlier hit very strong intercepts of 21.9 meters at 31.1 grams per ton of gold and seven.6 meters at 36.6 grams per ton of gold, properly above my base case grade assumption of 10.0 grams per ton of gold at Granite Creek.

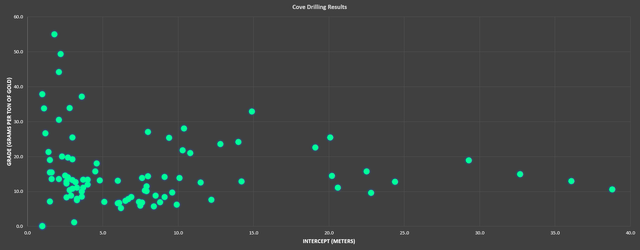

Cove Drill Outcomes – Firm Filings, Creator’s Chart

Shifting over to Cove which had drill outcomes most just lately, that is an asset with a historical past of manufacturing ~2.6 million ounces of gold and ~100 million ounces of silver beneath earlier operators and is i-80’s most spectacular asset at present on the gold aspect with industry-leading grades of 10.9 grams per ton of gold. The truth is, if Cove had been in manufacturing in the present day, it could be an identical grade to Alamos Gold’s (AGI) flagship Island Gold Mine. And whereas Cove was already an asset to be impressed with from the Premier Gold days, the outcomes popping out of this asset have additionally been world class relative to different deposits/mines in Tier-1 jurisdictions, with spotlight intercepts of 400-500 gram-meters that embody:

38.8 meters at 10.6 grams per ton of gold 32.7 meters at 14.9 grams per ton of gold 36.1 meters at 12.9 grams per ton of gold 20.1 meters at 25.4 grams per ton of gold.

…and its most up-to-date gap of 14.9 meters at 32.9 grams per ton of gold. Because the chart above exhibits, the majority of intercepts are properly above the ten.9 gram per ton useful resource grade and even factoring in dilution, it’s trying like this may very well be a 12.0 gram per ton of gold asset or higher. The truth is, the typical intercept drilled thus far at Cove (together with two intercepts positioned at zero values when labeled as NSI) is 7.9 meters at ~15.6 grams per ton of gold. And whereas drilled grades clearly do not translate on to future mined grades, the outcomes are exceeding my expectations.

It is also value noting that the Helen Zone is the higher-grade of the 2 zones (Hole, Helen), it will likely be mined first if Cove is green-lighted for manufacturing and the typical intercept right here is ~7 meters at ~19 grams per ton of gold, dwarfing its present useful resource grade of ~11 grams per ton of gold for ~733,000 ounces. So, with ounces to be accessed earlier set to doubtlessly are available in at a few of the greatest grades of any mine globally, I feel this asset alone justifies i-80 Gold’s ~$400 million market cap in the present day, and Granite Creek Underground + Cove mixed are trying like they’ve the potential for a mixed 3.5+ million ounce useful resource at 11.5 grams per ton of gold within the #1 ranked mining jurisdiction. Importantly, these high-grade deposits are solely separate from the high-grade Granite Creek Open Pit, which is among the highest-grade open-pit initiatives in america, and, after all, Ruby Hill, which has turn into its flagship asset.

Ongoing Developments

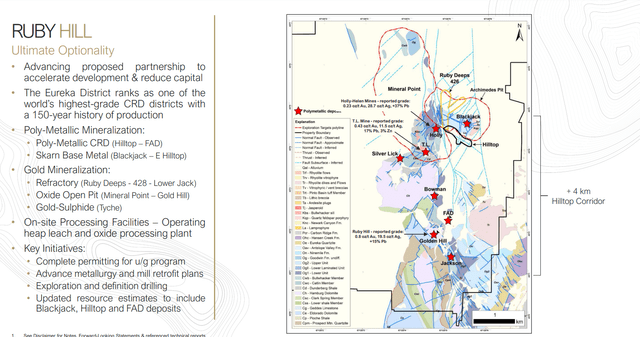

For these unfamiliar, i-80 Gold introduced in early November a non-binding time period sheet for a possible joint-venture settlement at its flagship Ruby Hill Undertaking the place the corporate has made a number of new discoveries (428 Zone, Tyche Zone, East Hilltop, Decrease Hilltop, Higher Hilltop) to cut back its financing wants and ideally usher in a companion to assist develop this asset whereas it maintains a majority working curiosity. That is the fitting transfer for the corporate on condition that it has been a tough surroundings to boost capital for builders and the polymetallic aspect of this story is an improve from the preliminary technique of three high-grade gold mines feeding a central autoclave. And whereas this can be a comparatively low capex alternative on condition that it has an current CIL plant on web site that might doubtlessly be transformed to a flotation plant, giving up a few of its future manufacturing in a joint-venture deal to cut back its financing wants appears like a wise plan for 2 causes:

1. It is higher to have 60-70% of an asset that is in a position to transfer into building (and in the end manufacturing) in an accelerated method and generate mine web site free money circulate than have 100% of an asset that’s accumulating mud and cannot be introduced into manufacturing in a well timed trend and/or requires vital leverage to convey into manufacturing which in the end creates elevated threat for shareholders

2. An operator that has expertise with base metals could be a pleasant asset to have on condition that i-80’s main focus is gold and it by no means hurts to have a second set of eyes and powerful monetary backing within the kind of a bigger operator when creating a brand new asset.

As for joint-venture discussions, they seem like progressing properly, with the corporate showing fairly assured that they’ll safe a companion in Q2 of this 12 months. The beneath quotes are taken from a November interview with i-80 Gold’s CEO Ewan Downie, and the excerpts following which might be from the convention name:

“It nonetheless has to shut, we nonetheless have a number of months of doing definitive paperwork on a deal of this scale as a result of not solely are we anticipating to be transferring base metals concentrates however the gold mineralization from right here we count on will likely be processed at Lone Tree longer-term. So there’s numerous agreements going right into a partnership right here.”

– i-80 Gold CEO, Ewan Downie (emphasis added).

“That partnership agreements are actively being superior and we count on that partnership to be introduced through the second quarter of this 12 months.”

– i-80 Gold This fall 2023 Convention Name (emphasis added).

“In 2022 we found the Hilltop zones, that are very a lot polymetallic and due to these base metals discoveries, we had vital inbound curiosity in what we’re doing and ‘would you think about a companion’. Creating three initiatives without delay, we thought it was prudent to think about a companion to assist fund that undertaking and the success that we had been having facilitated our skill to think about a number of completely different alternatives of partnership. We selected one which primarily as a result of we stay the operator of the undertaking and it is a well-known companion whose received an awesome observe file of supporting the businesses that they work with.”

– Current Interview, i-80 Gold CEO, Ewan Downie.

Plus, it is vital to notice that on condition that the polymetallic alternative is additive to the preliminary aim of turning into a 250,000 ounce gold producer, i-80’s company-wide future gold-equivalent ounce manufacturing [GEO] wouldn’t endure by bringing in a companion, and would truly be larger. It’s because I see the potential for i-80 to supply 250,000 to 270,000 ounces each year from its gold property (three mines feeding a central autoclave plus current settlement for 750 tons per day of roaster capability for double-refractory ore at Cove), and the potential for a manufacturing profile of ~100,000 GEOs to ~240,000 GEOs relying on grades, recoveries/payability and throughput charges for the polymetallic alternative. Therefore, assuming a 60/40 JV, this might give i-80 Gold a ~400,000 GEO manufacturing profile on the excessive finish of my estimates for the bottom metallic potential (~300,000 GEOs on the low finish), properly above the corporate’s preliminary aim at inceptions of 250,000 ounces of company-wide gold manufacturing.

Clearly, there are not any ensures relating to the joint-venture discussions, even when I’m very assured that it’s going to shut. This confidence stems from the truth that there is a dearth of high-grade and low capex polymetallic initiatives in Tier-1 ranked jurisdictions, by no means thoughts the truth that there is a porphyry kicker at Ruby Hill which will surely be a game-changer for i-80 Gold and a sweetener for any potential companion. For my part, this makes Ruby Hill stand out relative to different initiatives, by no means thoughts the truth that this may very well be fast-tracked into manufacturing inside two years, assuming the receipt of a constructive financial examine vs. different initiatives like La Colorada Skarn (PAAS) that will have scale however are as much as a decade away from manufacturing from multi-billion greenback capex payments.

“We expect that the Ruby Hill Property has the textbook geological system for locating a significant porphyry deposit. Ruby Hill has all of the substances. We’ve the disseminated gold mineralization as you see at Mineral Level, the distal carbonate alternative deposit [CRD] mineralization like we’re seeing at Hilltop and FAD, and the distal zinc-lead wealthy skarns that we now have at Blackjack. So the large query is that we now have all of the substances for certainly one of these large programs; the place is the porphyry?”

– 2022 Interview, i-80 Gold CEO, Ewan Downie.

Ruby Hill Undertaking – i-80 Gold Presentation Hilltop Mineralization – Firm Web site

Earlier than transferring on, it is vital to level out that this isn’t your common polymetallic alternative or mining district. The truth is, the Eureka District the place i-80 Gold added ~1,500 hectares of land with its Paycore acquisition is exclusive within the sense that it was one of many world’s highest-grade carbonate alternative deposit districts which started manufacturing within the 1860s and was america’ first vital silver-lead district. This included the historic Ruby Hill Mine, which noticed previous mined grades upwards of 40 grams per ton gold-equivalent, inserting its grades above that of Fosterville.

And whereas there isn’t any assure that i-80 Gold delineates one other 1 ounce per ton gold useful resource, the corporate has a 4-kilometer hall (“Hilltop Hall”) left to check that was missed by the old-timers due to being beneath alluvial cowl, and it is seen an unbelievable hit fee for its polymetallic deposits thus far, with high-grade zinc, lead, silver, gold and traces of copper/molybdenum in a number of zones which might be at present being delineated. As well as, there isn’t any scarcity of high-grade gold, with its newly found 428 and Tyche zones carrying gold grades of 12-45 grams per ton of gold over thick intercepts.

As acknowledged by Lambert Molinelli & Co. in his work discussing the Eureka District:

“The principle reason behind the unexampled prosperity of the mining pursuits of Eureka is to be discovered within the character of the ores. They’re self-fluxing. They carry from 15 to 60 % of lead and ample iron and silica to obviate the need of importing overseas materials for smelting functions. Eureka is the one recognized mining district possessing this vital benefit. However this huge manufacturing, it’s typically thought that these mines have but to see their greatest days, all the opposite extra promising properties within the district having as but hardly entered upon the good success that most likely awaits them within the close to future.”

“Some of the encouraging options is that these wealthy our bodies have been discovered on the lowest depth penetrated on the lode, having been reached at a distance of 1 thousand toes beneath the floor, and its proportions in that course are as but solely a matter of conjecture. This supplies that the mineral deposits within the district are usually not, as previously argued, merely floor our bodies, liable to offer out as explorations had been carried on, however that the good belt on Ruby Hill and its contents are everlasting, and will likely be present in larger proportions as additional depth is attained”.

– Eureka And Its Assets – A Full Historical past of Eureka Nation, Nevada – Lambert Molinelli & Co.

The Larger Image

As for the larger image, I count on 2024 to be a transformational 12 months for i-80 with a number of catalysts as we see maiden sources declared on a number of deposits, the receipt of permits for setting up a decline at Ruby Hill, a rise in its drill program in H2 as the corporate is prone to improve its drill program if it receives a money injection from the joint-venture, and general a way more de-risked story Lastly, manufacturing ought to improve meaningfully in H2 at Granite Creek because it brings the brand new high-grade South Pacific Zone on-line later this 12 months. In a latest interview, i-80 Gold’s CEO shared the next concerning the South Pacific Zone and near-term manufacturing:

“We’re inside three or 4 months of accessing that zone (South Pacific). With the addition of South Pacific, we might count on our manufacturing to go up considerably from that 30,000 ounces to most likely in 2025 to over 100,000 ounces. In 2025, we might additionally doubtless look to convey on some mining and take a look at mining at Ruby Hill.”

– Current Interview, i-80 Gold CEO, Ewan Downie.

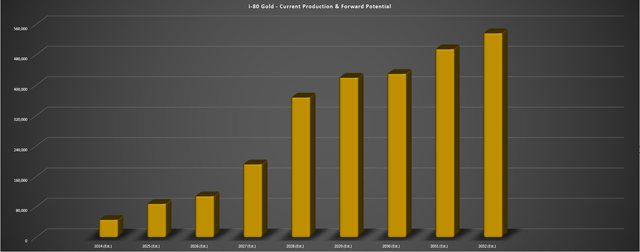

Because the above feedback counsel, i-80 Gold will see a big improve in working money circulate subsequent 12 months, with the potential to extend Granite Creek Underground’s mining charges to nearer to 800 tons per day with the addition of the South Pacific Zone, and by way of the larger image, i-80 Gold has an industry-leading development profile, with the potential to extend manufacturing by over 10x searching to 2028. Plus, with three different property (Lone Tree, Granite Creek Open Pit, Mineral Level) separate from its high-grade Gold Hub & Spoke Mannequin and Ruby Hill Polymetallics, the corporate has the property within the portfolio to develop to 550,000+ ounces longer-term if it had been to convey Granite Creek Open Pit into manufacturing.

This makes i-80 Gold fairly distinctive, with most builders in the present day having 150,000 to 300,000 ounce each year potential at greatest, however with i-80 already having the property in its portfolio to show right into a producer with the size of an Alamos Gold (~$5.0 billion market cap) or Lundin Gold (~$3.0 billion market cap), with producers with high-grade property with scale sometimes commanding premium valuations, particularly when working in Tier-1 ranked jurisdictions.

i-80 Gold Conceptual Manufacturing Profile – Firm Filings, Creator’s Chart

The truth is, simply 4 brief years in the past, Kirkland Lake Gold traded at over 22x free money circulate in 2019 at its peak previous to its Detour Gold buy (~$10.5 billion enterprise worth with ~$463 million in annual free money circulate). And this was hardly a setup with ebullient sentiment sector-wide in Q3 2019. I’m not stating this to counsel that the typical gold producer ought to commerce at over 22x EV/FCF as KL was a unicorn (high-grades, excessive margins, greatest jurisdictions, new discoveries close to current infrastructure permitting for low-capex development and easy accessibility to new ounces). Nonetheless, with i-80 Gold becoming an identical mannequin to Kirkland Lake Gold (high-grades, greatest jurisdictions, new discoveries close to current infrastructure permitting for low capex development), I feel IAUX may simply commerce above a $2.5 billion market cap or ~US$6.00 per share later this decade if it might probably develop right into a 350,000 to 400,000 ounce producer, and I’d count on it to be a go-to title given its Tier-1 jurisdiction profile, with solely a handful of names with scale left within the sector with this distinction (Evolution, Northern Star, Hecla, Agnico).

Kirkland Lake Gold – Annual Free Money Movement & Share Worth Efficiency – Firm Filings, Creator’s Chart, Netcials

Insider Shopping for

i-80 Gold actually has bold plans to develop into the second largest gold producer in Nevada with a manufacturing profile of 400,000 GEOs, and whereas I would usually be skeptical of a plan this aggressive, the corporate has 4 issues going for it.

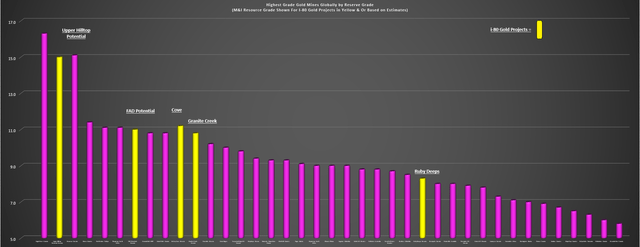

1. Its initiatives, if in manufacturing in the present day, could be among the many highest-grade gold mines globally, with Cove and Granite Creek at 11+ grams per ton of gold and rivaling Alamos Gold’s (AGI) flagship operation Island Gold for grades, Higher Hilltop trying like may it rival the highest-grade gold mines globally (Eagle River, Kiena, Macassa) on a gold-equivalent foundation, and FAD trying prefer it may have 10+ gram per ton gold-equivalent grades as properly, with outcomes from higher Hilltop and FAD proven beneath. Lastly, Ruby Deeps ought to see a big improve in grades and measurement on condition that i-80 Gold has elevated the mineralized footprint of this layer and persistently drilled a lot larger grades than what we have seen within the earlier useful resource estimate (~1.6 million ounces at ~6.6 grams per ton of gold). That is vital, as a result of grade is king on this sector, and high-grade initiatives can survive by way of any cyclical downturns, with its ~11 gram per ton gold deposits (Granite Creek/Cove) benefiting from ~$700/ton rock values at present gold costs.

Highest Grade Gold Mines Globally (Reserve Grade) vs. i-80’s M&I Useful resource Grade & Estimated Gold-Equal Grades at Higher Hilltop/FAD – Firm Filings, Creator’s Chart & Estimates

The three greatest holes on a gram-meter foundation at Higher Hilltop embody 10.0 meters at ~78 grams per ton gold-equivalent, 28.3 meters at ~22 grams per ton gold-equivalent and 27.4 meters at ~19 grams per ton gold-equivalent.

Higher Hilltop and FAD Drilling – Firm Filings, Creator’s Desk, Firm Presentation

2. i-80 Gold advantages from having brownfields past-producing websites with current infrastructure, and a central processing facility at Lone Tree with over $1.2 billion in estimated sunk prices. This provides i-80 Gold one of many lowest-cost paths to 400,000 ounces each year in its developer peer group and likewise helps from a allowing and improvement standpoint, with its working mine Granite Creek already permitted and the corporate hoping to move underground subsequent 12 months at Ruby Hill.

3. i-80 Gold advantages from being within the top-ranked jurisdiction globally (Nevada), and this might not be extra vital in in the present day’s geopolitical surroundings. The truth is, Agnico Eagle additionally had a really aggressive enterprise mannequin 20 years in the past because it appeared to broaden LaRonde and produce 4 new gold mines on-line (Lapa, Goldex, Pinos Altos, Meadowbank), and one cause for its success and constant manufacturing development was that it targeted on the most secure jurisdictions, considerably de-risking its development plans vs. different corporations which have had a tougher time conserving mines on-line or bringing them into manufacturing in any respect by venturing into much less favorable jurisdictions.

4. The corporate isn’t re-inventing the wheel and is using an identical technique (Hub & Spoke Mannequin) to Nevada Gold Mines LLC with a number of high-grade mines feeding central processing amenities. And the corporate has made a number of key additions with very related expertise in Nevada at these websites to assist convey this plan into fruition with almost 150 years of expertise, together with Matt Gili (Former CTO at Barrick Gold, Former EGM at Cortez District in Nevada), Todd Esplin (Earlier Autoclave Superintendent & Metallurgical Companies Superintendent at Barrick’s Goldstrike Mine), Andy Cole (Former GM at Barrick’s Goldstrike Mine), Jon Laird (Former Mining Supervisor at Turquoise Ridge, Undertaking Supervisor at El Nino/South Arturo/Goldstrike), and Tony Carroll, Former Course of Supervisor/Capital Initiatives Supervisor at Barrick who beforehand managed giant capital initiatives at Goldstrike and Cortez – NGM’s two largest mining complexes.

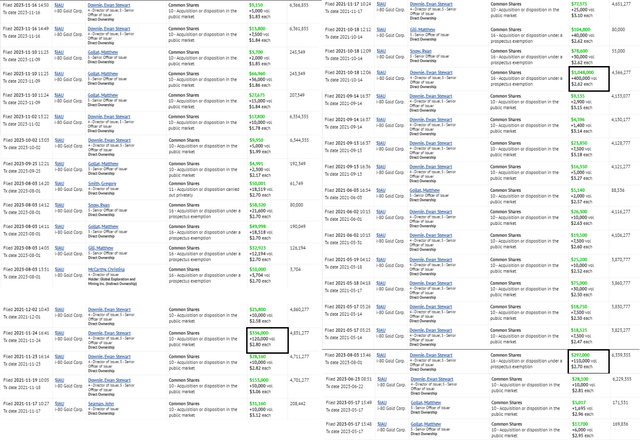

i-80 Gold Insider Shopping for – SEDI Insider Filings

Whereas it actually helps to have the most effective grades, the most effective jurisdictions, a number of new discoveries close to present infrastructure, modest capex necessities relative to its developer friends and a staff that is finished it earlier than along with a CEO with a robust observe file of deal-making, there isn’t any larger vote of confidence than insider shopping for. And in a sector the place we sometimes see a dearth of insider shopping for, this has not been the case with i-80 Gold, the place we have seen constant and vital insider shopping for from its President & COO Matt Gili, its Government Vice President Matt Gollat, and its CEO Ewan Downie.

These buys are proven above, with properly over 2 million shares bought by insiders within the open market at costs starting from C$1.78 to C$3.03 or US$1.34 to US$2.30, together with a number of giant blocks of 400,000 shares at C$2.62 [US$1.97], 120,000 at C$2.80 [US$2.10], 110,000 at C$2.70 [US$2.03], 100,000 at C$2.35 [US$1.77], 200,000 at C$2.80 [US$2.10].

This alignment with shareholders and vital insider shopping for means that administration is assured of their skill to execute on its plans, and these purchases don’t embody vital shopping for in non-public placements as properly, together with over 340,000 shares mixed bought by insiders in probably the most two latest financings at larger costs than in the present day’s ranges. So, whereas it has been a irritating elevator journey down within the inventory, this isn’t a case of insiders not having any pores and skin within the sport. The truth is, we now have seen a few of the constant and aggressive insider shopping for sector-wide by i-80’s administration, offering further confidence that they’re working tirelessly to ship worth for shareholders (on condition that they’re vital shareholders themselves), and the very last thing they need to see their very own stakes diluted.

Abstract

In an space of the valuable metals sector (builders) that is starved for capital and the place sentiment stays despondent, i-80 Gold has been punished far worse than its producer friends. The truth is, the latest pullback within the inventory has left it buying and selling at a market cap of simply ~$400 million, a valuation that is barely half that of early-stage builders which have but to even put out a useful resource like New Discovered Gold (NFGC) and Snowline Gold (OTCQB:SNWGF).

That is even supposing I imagine i-80 Gold is on knocking on the door of getting a ~20 million ounce gold-equivalent useful resource base, has the sector’s prime development profile if it might probably execute efficiently and has made so many discoveries that it is needed to prioritize these which it is in a position to comply with up on, with it just lately extra targeted on conserving money and drilling the best precedence ounces which might be deliberate to be mined first given the capital starved surroundings.

In the present day, I feel the market is unfairly punishing i-80 Gold relative to different builders on condition that it has a a lot decrease capex path to construct a ~400,000 ounce manufacturing profile and it has a number of JV companions at Ruby Hill. And whereas I may perceive the numerous low cost to its estimated web asset worth of ~$1.49 billion (at present buying and selling at lower than 0.30x P/NAV) and underperformance if it had been making an attempt to go it alone and had its again up in opposition to the wall from a financing standpoint, I do not see this because the case right here anymore with a number of events, a big improve in money circulate era at Granite Creek later this 12 months, and the potential for a second money circulate generator (Ruby Hill Polymetallics) in 2026.

In abstract, I see this excessive disconnect within the share worth vs. the gold worth as making a shopping for alternative with an estimated 180%+ upside to truthful worth (US$3.65), and I’ve just lately elevated my place additional at US$1.25.

[ad_2]

Source link