[ad_1]

Richard Darko/iStock by way of Getty Pictures

Introduction

Many could also be questioning how nicely BDCs will fare in 2024, with charges nonetheless anticipated to say no. I’m an enormous believer within the sector and assume they’re extra than simply excessive rate of interest atmosphere investments. With the banking disaster roughly a 12 months in the past inflicting tighter lending requirements, I believe this may profit the sector for the long run.

And though many BDCs have rewarded shareholders these previous two years with further earnings due to their predominantly floating-rate portfolios, some have nonetheless confronted headwinds within the course of. One which has lately is the fourth-largest BDC, FS KKR Capital (NYSE:FSK). On this article, we’ll focus on why the BDC has bought off lately however why they’re nonetheless an incredible funding for income-focused traders.

Earlier Article

I final lined FS KKR Capital again in December: Is The Low cost To NAV Justified Or Is This BDC A Cut price? I rated the inventory a purchase however since then the inventory’s share worth has declined almost 6% on the time of writing. In it, I mentioned how the corporate had been impressively rising its portfolio by making acquisitions.

Moreover, I mentioned the BDC’s robust stability sheet which had upcoming debt maturities, however these have been well-laddered and lined by their robust liquidity profile. They’d additionally outperformed standard friends, Ares Capital (ARCC) and Predominant Road Capital (MAIN) in complete returns by 3 quarters, which I assumed was extremely spectacular contemplating the 2 are extra standard amongst traders. So, why has the BDC bought off whereas each ARCC & MAIN are each within the inexperienced?

Transient Overview

Earlier than we get into why the BDC bought off lately, let’s discuss concerning the firm. FSK is an externally-managed BDC, much like friends ARCC and Blackstone Secured Lending (BXSL) and is managed by FS/KKR Advisor.

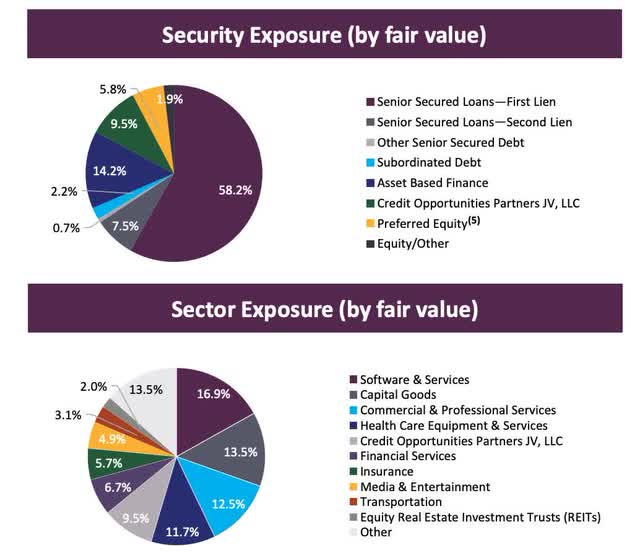

They’re the 4th largest BDC with 204 portfolio firms which have a complete honest worth of $14.6 billion. They make investments primarily in senior-secured investments with these accounting for 66.4% and 58% in first-lien loans throughout 24 industries. Like lots of its friends, in addition they have a large portion of their portfolio invested within the Software program & Providers sector at 16.9%.

FS KKR IP

So Why The Promote-Off?

Since my final article, FSK reported their This autumn earnings on the finish of February and the BDC disillusioned some traders with the rise in non-accruals through the quarter. Though BDCs have loved the additional earnings from portfolio firms, they’ve additionally confronted downward strain from larger rates of interest.

Via the primary 3 quarters, the corporate truly managed to lower non-accruals with these declining quarter-over-quarter by the primary 9 months. However in This autumn these accounted for five.1% at value and a pair of.6% at honest worth, up from 2.4% within the third quarter.

Non-accruals have plagued many BDCs, however the higher-quality ones like ARCC & BXSL have managed these prudently previously 12 months. BXSL truly managed to lower their non-accruals from 0.14% in Q1 to only 0.1% of complete investments. ARCC additionally noticed a decline in non-accruals from 1.7% at value to 1.3% to shut out the 12 months.

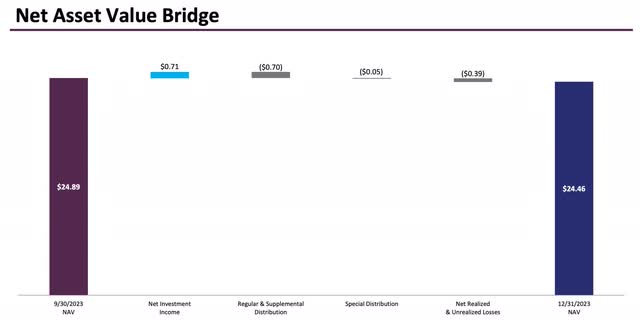

This, together with a drop in NII additionally precipitated FSK’s NAV share worth to say no quarter-over-quarter as nicely. Additionally they had a couple of challenges with credit inserting two further firms, Miami Seaside Medical Group & Reliant Rehab, on non-accrual. In This autumn there have been a complete of 5 firms positioned on non-accrual standing.

One other portfolio firm additionally confirmed materials deterioration of their ahead EPS projections. NII declined from $0.84 in Q3 to $0.75 whereas complete funding earnings fell 3.9% to $447 million over the identical interval. So, not an incredible quarter for the BDC to say the least.

FS KKR IP

With charges remaining larger for longer, non-accruals will proceed to be a headwind for BDCs. And though the FED nonetheless expects fee cuts within the close to future, these will possible have a lagging impact and nonetheless place downward strain on BDC debtors. This additionally causes larger internet bills, which impacts their NII. So, that is one thing traders within the sector ought to pay attention to when trying to make investments. I might be maintaining a detailed eye to see how FSK’s administration handles portfolio firms within the close to future.

Regardless of challenges, FSK did handle to speculate $680 million in new investments through the quarter, leading to portfolio progress of roughly $162 million. 58% of those have been add-on investments in current firms. However seeing by the variety of firms positioned on non-accrual and extra (firms) with deteriorating projections, FSK traders ought to be actually cautious going ahead.

Dividend Security

As a BDC investor, most care concerning the security of the dividend. For the fourth quarter, the dividend payout of $0.75 was lined by NII. The great factor is that BDCs who pay supplementals and/or specials can simply lower these at any time. The common dividend of $0.64 offers FSK dividend protection of 117% which is secure. And for the primary quarter, the BDC declared an extra $0.75 complete payout payable in April.

That is compared to an absolute favourite of mine and present holding BSXL, who had dividend protection of 125% throughout This autumn. For the full-year FS KKR Capital paid out $2.95 in distributions and introduced in a complete of $3.18 in internet funding earnings. So, for these anxious about their dividend security, that is greater than lined at the moment. Wanting ahead, if borrower credit score high quality continues to drop, the BDC will possible lower the supplemental however nonetheless pay a pleasant common dividend.

Liquidity Profile

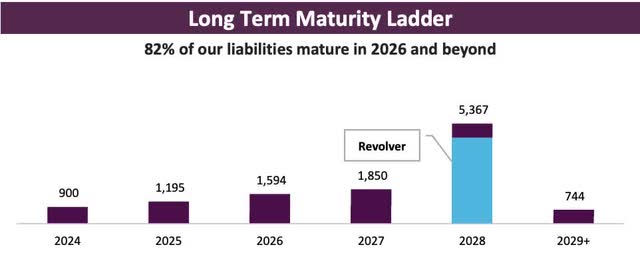

Whereas they do have $900 million in debt maturing this 12 months, FSK’s stability sheet stays in good condition with complete liquidity of $3.9 billion and net-debt-to fairness of 1.13x, in comparison with 1.10x to finish the third quarter. That is compared to the biggest BDC by market cap, Ares Capital’s 1.02x.

Nonetheless, they are going to possible should refinance their upcoming debt at larger charges as these have weighted-average rates of interest of 4.625% and 1.650% respectively. However as beforehand talked about, their liquidity profile stays robust. They’re additionally investment-grade rated by Fitch and Moody’s.

FS IP

Undervalued For A Motive

As seen by their borrower credit score high quality points, FSK at the moment trades at a P/NAV ratio of roughly 0.78x. That is compared to lots of its friends who at the moment commerce at premiums above NAV due to their engaging yields and distributions because of larger rates of interest.

Moreover, the present low cost of almost 28% sits larger than the 3-year common of 20.94%. So, these in search of strictly earnings, now could also be an excellent time to pounce on FSK because the valuation is engaging in the meanwhile. Nonetheless, resulting from their talked about credit score points leading to a drop in NAV and rise in non-accruals, I do not see the share worth appreciating a lot from right here till these points are resolved. And it gives little upside to their worth goal from the present worth of roughly $19. However once more, nice earnings play for traders searching for larger yields.

Searching for Alpha

Backside Line

Though FS KKR Capital has seen their borrower credit score high quality diminish quarter-over-quarter, the double-digit dividend yield stays engaging with dividend protection over 100%. Moreover, their stability sheet stays in good well being with manageable debt maturities within the coming months and ample liquidity.

At a P/NAV under its 3-year common and fewer than 1.0x at the moment, the BDC could also be too exhausting to cross for these searching for larger yields. Particularly with rates of interest anticipated to say no within the close to future. And though I’m downgrading the BDC to a maintain resulting from present borrower credit score points, I nonetheless assume they continue to be an incredible earnings play.

[ad_2]

Source link