[ad_1]

Chip Somodevilla/Getty Pictures Information

Written by Sam Kovacs

Introduction

As dividend traders, there are three bins which we have to tick earlier than hitting purchase on a inventory:

We have to just like the enterprise mannequin and its prospects. The mix of dividend yield and our estimate of future dividend progress should be engaging. The inventory must be undervalued.

After all there are numerous ramifications and particulars that go into these duties, and getting it proper requires ability, thought, and timeliness. However typically talking if a inventory ticks all 3 of those bins, you could be on a winner. It follows then, that there are 3 causes for which we’d then promote a dividend inventory:

The enterprise mannequin or the prospects have modified, and we now not prefer it. The dividend profile is now not engaging. Both the dividend has been reduce, or the prospects of dividend progress have worsened. The inventory has grow to be overvalued.

In all our years of masking dividend shares, I’ve by no means had any objections about factors 1 and a pair of. However level 3 will get a sure crowd going. The Purchase and Maintain group of traders by no means need to promote, even when valuations are loopy excessive. A few of these people will not be even involved with shopping for when a inventory is undervalued.

These are individuals who, like me, had uncle Warren Buffett form their funding philosophy. And so they have just a few Buffett quotes they prefer to throw my means any time we now have this debate.

The primary is:

It is higher to purchase a beautiful enterprise at a good value than a good enterprise at a beautiful value.

This assertion has been misunderstood by so many traders. It’s made to emphasize that enterprise high quality is extra essential than valuation. Why? As a result of a sturdy aggressive benefit is a strategic benefit, whereas valuation is a tactical benefit.

As soon as valuation resolves itself, there could be no good causes to personal a good enterprise, whereas a top quality enterprise continues to generate superior returns. However it’s best to underestimate this assertion as: high quality first, valuation second. It doesn’t imply that valuation does not matter, simply that high quality issues extra. If Warren Buffett quotes are our weapon of selection on this debate, I prefer to push again with this one:

Whether or not it is shares or socks, I like to purchase high quality merchandise at a reduction.

See, each high quality and value matter. Some people agree with the shopping for low a part of the equation, they simply disagree with the promoting excessive half. These people at all times hit me with the next Warren Buffett quote:

Our favourite holding interval is perpetually.

For context, in that exact letter to shareholders, Buffett follows up with:

We’re simply the alternative of those that hurry to promote and guide earnings when corporations carry out properly however who tenaciously hold on to companies that disappoint.

And here is the factor: I agree with this 100%. However traders typically make one key mistake: they interchange the phrase firm/enterprise with the phrase inventory too freely. Buffett right here is only speaking about operational efficiency. And when a inventory value goes up hand in hand with its earnings and efficiency, then we often see no purpose to promote both.

Our Technique by way of examples

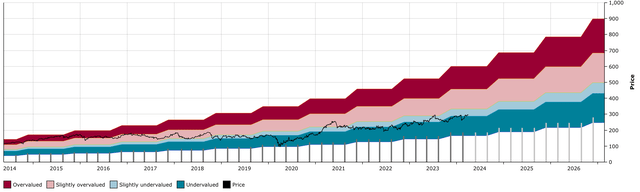

A typical instance I give of that is Snap-on (SNA). I constructed a place beginning in September 2020 at $145. As we speak SNA is buying and selling at $294, so it has greater than doubled, however we have but to promote a share.

We’re not in a rush to promote and guide earnings when corporations carry out properly.

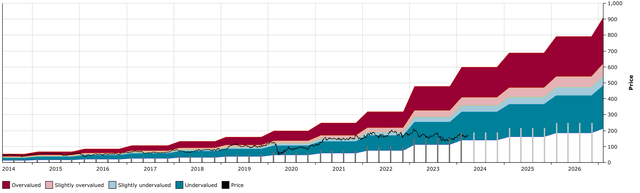

SNA DFT Chart (Dividend Freedom Tribe)

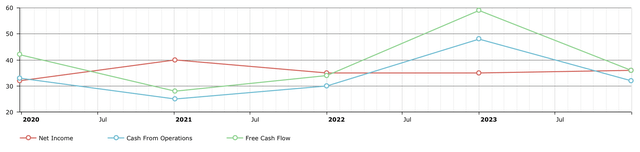

The DFT chart exhibits the rise in valuation ranges because the dividend will increase. Since 2020, SNA has grown its dividend at a 14% CAGR, and its payout ratios have remained steady within the 30-40% vary of earnings and free money stream.

SNA Payout Ratios (Dividend Freedom Tribe)

Regardless of the value doubling in 4 years, SNA remains to be removed from being overvalued. I need to stress that there’s a distinction between the enterprise doing properly, and the inventory value doing properly. Generally the enterprise is doing properly, however the inventory value does a bit of too properly. Then we transfer into overvalued territory. Let me provide you with an instance.

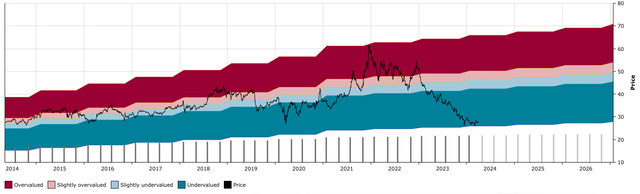

After having been consumers of Pfizer (PFE) all through 2020, we began telling traders that the inventory was a promote as we arrived in direction of the tip of 2021.

PFE DFT Chart (Dividend Freedom Tribe)

We did not get the highest, however we bought within the mid 50s. Pfizer’s fortunes modified quickly after, because the market realized it had projected vaccine gross sales ad-infinitum when the majority of the earnings have been actually to be made simply over a few years. It was clear to us, and it turned clear to everybody later, that the inventory value was doing higher than the enterprise. When this occurs, shares grow to be overvalued, and we determine to promote.

Anyone who can take a look at me within the eye and inform me it was a foul concept to promote Pfizer at $50 3 years in the past is apparent loopy. There, I stated it. At this level within the debate, some folks often get a bit grumpy and look by way of their assortment of inventory market adages they’ll throw in.

I often get hit with:

Time out there is extra essential than timing the market.

Sure that’s true, however it’s irrelevant. This quote signifies that you should not be shifting from equities to money forwards and backwards, as a result of equities have at all times been a superior asset to personal to construct wealth. You’ll be able to promote shares, with out jeopardizing your “time out there”, so long as you buy one other inventory with the proceeds of the sale.

The inventory market adage I at all times reply to this with is:

it is a market of shares, not a inventory market.

That is to say that at any cut-off date there are undervalued shares, overvalued shares, at all times one thing price promoting, at all times one thing price shopping for. For example, on the very time we instructed promoting Pfizer, we have been suggesting shopping for IBM (IBM).

IBM DFT Chart (Dividend Freedom Tribe)

IBM’s enterprise was within the midst of a metamorphosis after the Purple Hat acquisition and the lucky departure of Ginni Rometty as CEO. This was a case of the inventory value doing worse than the enterprise, which is commonly a prerequisite for creating undervalued shares.

So certain you would have purchased Pfizer after we stated “purchase” at $36.9 in 2020 and held onto your shares. Earlier than dividends, you’d have returned unfavorable 25%. Or you would have booked a 40% achieve, reinvested in an undervalued inventory like IBM, and gained one other 40% in that place, which you’d now be seeking to begin scaling out of additionally.

I consider these three examples above present our technique in actual time. These will not be “doctored” examples, all of that is documented on Searching for Alpha. Our philosophy is each easy and efficient:

Purchase Low, Promote Excessive, Get Paid to attend.

With that coated let’s transfer on to 2 shares which we consider are at present sensible buys for Q2 2024 in addition to 2 that traders ought to promote.

Purchase #1: Verizon

Verizon (VZ) is likely one of the finest shares that dividend traders can at present purchase.

Why?

It has a big moat round its enterprise because of the nature of the business, its giant spectrum holdings and in depth community. It has the most effective dividend monitor report amongst all its friends and yields 6.3%. It’s severely undervalued following the inventory value crashing in 2022 and 2023. It has been making a comeback and primarily based off our definition is now a momentum inventory. It’s properly positioned to revenue from fee cuts.

Verizon’s share value didn’t react properly in any respect to the Fed’s fee hike marketing campaign.

That is largely as a result of the market was fearful that the $150bn in debt was an excessive amount of debt.

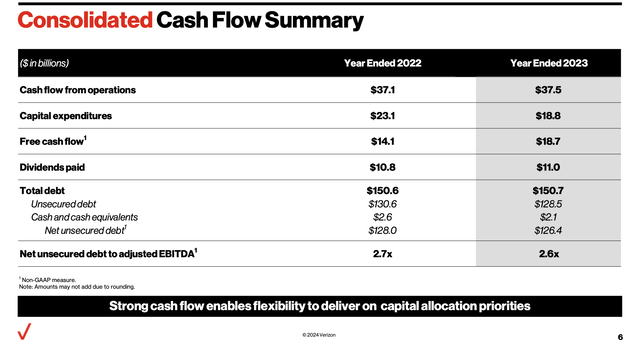

That is one thing I at all times shrugged to as a result of VZ’s debt is taken into account funding grade. Relative to EBITDA, debt is 2.6x, which isn’t low, however not painstakingly excessive both.

VZ Investor Presentation

Moreover cashflows are very steady, and as CapEx continues to pattern down after a interval throughout which it was elevated, VZ ought to have the wiggle room to proceed lowering its debt.

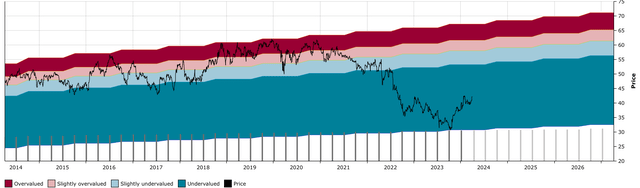

VZ DFT Chart (Dividend Freedom Tribe)

As you’ll be able to see within the DFT chart, whereas VZ is up 35% from its lows, it’s nonetheless considerably under its historic vary. Till 2022, For over 10 years VZ’s yield was steady between 4% and 5%.

This modified dramatically in 2022 and 2023, and I consider it was a gross overreaction.

The pace at which VZ has sprung again to life in 2024 is a testomony to this. In reality, if you take a look at momentum metrics, VZ’s 3 and 6 month efficiency is best than 90% of all US shares. Its 12 month efficiency is best than 80% of all US shares.

In line with the normal definition of the momentum issue, VZ is now a momentum inventory. It is obtained the wind in its again, and also you get 6.3% to attend. If you have not loaded up on VZ, now’s the time. It’s nonetheless a beautiful purchase at $42.

What may go fallacious with Verizon?

It’s clear that Verizon is getting loads of its momentum from the expectation that charges will probably be reduce, and given its excessive debt load will probably be considered by the market as a beneficiary. If for no matter purpose the Fed deviates from its hints and does not begin slicing charges till a lot later, we’d see sluggishness from VZ.

From an operations standpoint nevertheless, the fixed progress within the demand for knowledge makes it a sturdy, lengthy lasting enterprise which can proceed to function properly regardless.

Purchase #2: Nexstar Media

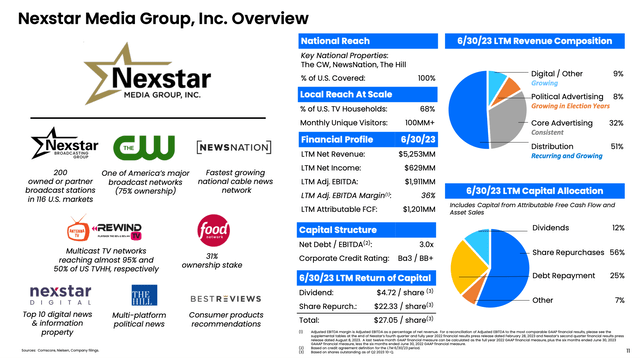

Nexstar (NXST) is a kind of corporations the place your mind does not need to consider it does so properly. Native TV stations? In 2024? Give me a break… till you see the precise numbers.

The slides under are from H2 2023 knowledge which is sort of dated now, however offers you an summary of the money generated capacity of NXST.

NXST Investor Presentation

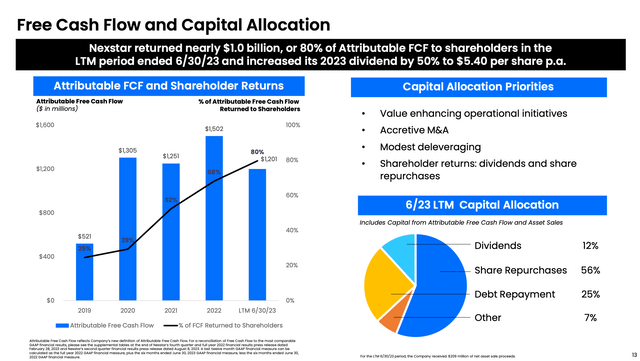

Consider it this manner: the inventory yields 4%, however the firm solely pays out 12% of its FCF as a dividend.

For these of you who’re good in math, which means that NXST is buying and selling at lower than 5x FCF.

NXST Investor Presentation

And this ignores the truth that political promoting, which NXST is the prime beneficiary of, goes up each cycle, however solely exhibits up within the income numbers each different 12 months: midterms and presidential.

Political advert spending goes to beat new information, possible 30% greater than the earlier cycle.

But the market is completely ignoring this, like “meh”.

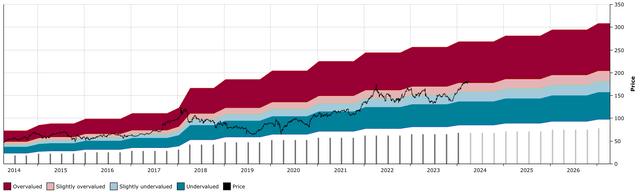

NXST DFT Chart (Dividend Freedom Tribe)

NXST elevated its dividend by 25% this 12 months. It elevated by 50% the earlier 12 months. NXST could possibly be a $300 inventory by the tip of the 12 months because the market will begin warming as much as its numbers coming in with political advert revenues. Within the meantime you get a 4% yield which is rising at thoughts numbing tempo.

In 2023, NXST additionally purchased again 11% of their shares. They’re going to be shopping for again extra in 2024. At these valuations, it simply is smart. Ultimately, the funding group will catch up. At $170, NXST is a tremendous purchase.

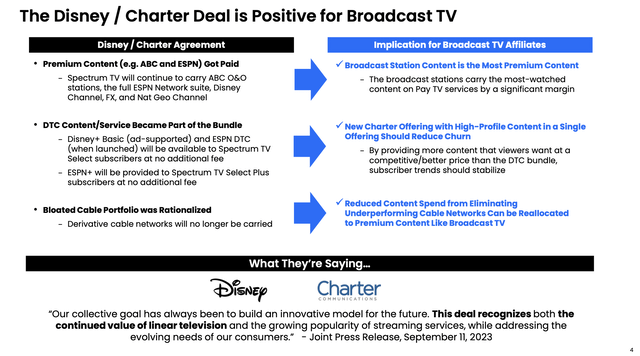

The character of tv and broadcasting rights has been altering. We have seen bundling of classical TV and the newer DTC subscriptions.

Administration is of the opinion that offers just like the Disney/Constitution deal exhibit that broadcast station content material is probably the most wished/premium content material and may proceed to learn Nexstar.

NXST Investor Presentation

Whereas I agree with this premise, it’s potential that the market is altering shortly and will trigger some pricing pressures on Nexstar which I’ve not foreseen.

Promote #1: AbbVie

I will be giving two sorts of sells, the primary which I consider is a superb firm, however is now turning into overvalued, and the second which I consider is abusing its Dividend Aristocrat standing with token dividend will increase AND is obscenely overvalued.

The primary is AbbVie (ABBV). We have been long run shareholders of AbbVie, as we believed that for years between 2018 and 2021 the market was exaggerating the affect that dropping Humira gross sales would have on the corporations profitability.

The dividend stored rising. The mannequin shifted to different merchandise.

Our monitor report with the inventory hasn’t been good although, We missed the final excessive in AbbVie.

In March 2022, it reached our prior “promote above” goal of $160. Due to the dividend profile, we determined to not promote, and bumped the promote above to $180.

A month later, the inventory peaked at $175.

We by no means bought any as a consequence.

AbbVie inventory went down and again up since then, and is now above $180.

ABBV DFT Chart (Dividend Freedom Tribe)

Is it tragic that we did not promote? No in fact not.

If I had a crystal ball and will have bought ABBV at $175 and purchased again at $135, then sure there might need been an additional 0.1-0.5% of efficiency on the portfolio degree, particularly when contemplating the chance price.

However let’s not suppose for a second that holding ABBV all through that time frame was a foul factor.

We purchased AbbVie at numerous factors, largely between $80 and $110, which got here with yields of anyplace from 4.5% to over 5% on the time.

Since then we have had 3 dividend will increase of 8%, 4.9% and 4.7%.

For sure that dividends rising at that fee with these type of yields if you purchase, do very properly in your portfolio.

Holding ABBV all through, or “getting paid to attend”, is a transparent instance of our technique.

In an fascinating flip of occasions, there was massive tailwinds to its botox line of merchandise.

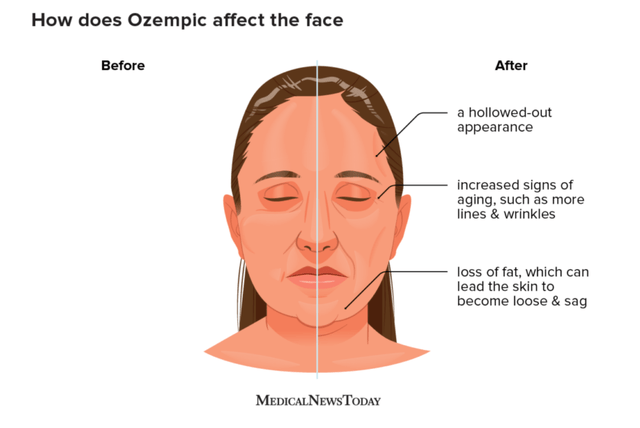

Why? Ozempic, and different weight-loss medicine are inflicting some hassle. Dermatologists are calling this “semaglutide face”, the general public goes for “Ozempic face”.

Principally speedy weight reduction results in sagging pores and skin, because the stretched out pores and skin does not have the time to naturally flex again to a tighter kind.

Medical Information As we speak

What is the apparent resolution? Botox in fact! Gross sales are up 12% YoY!

In line with AbbVie’s Head of Aesthetics:

And as we ask our shoppers and our prospects about it, actually, what we have discovered is that it does reinforce the long-term tailwind as a result of the bulk of people that interact in these medical weight reduction merchandise are extra all for aesthetics afterwards than they have been earlier than.

Now people, I am not going to offer a lecture on how bizarre it’s that after consuming lab designed meals, one should resort to lab designed weight reduction tablets, after which lab designed magnificence injections.

We appear as a society to have accepted this as regular. I suppose I am the lunatic. However I do not make investments on ideology, I make investments on details.

From a Searching for Alpha information article:

The Illinois-based pharma large posted $14.3B in web income for the quarter, with a ~5% YoY drop as international Humira web revenues fell ~41% YoY to $3.3B amid rising uptake for off-patent variations of the drug.

Nevertheless, its potential replacements for the biologic, Skyrizi and Rinvoq, added $2.4B and $1.3B to the topline with ~51% YoY and ~63% YoY progress, respectively, exceeding the consensus, in accordance with Bloomberg knowledge.

The corporate additionally raised its long-term outlook for the 2 medicine, anticipating over $27B in income from Skyrizi and Rinvoq in 2027, up from over $21B beforehand.

In the meantime, Botox Beauty and Botox Therapeutic introduced $718M and $776M with ~12% YoY and ~7% YoY progress, respectively, forward of Wall Avenue forecasts.

The explanation that ABBV was so low cost in 2019 to 2021, was due to the worry that Humira gross sales wouldn’t get replaced.

The numbers recommend they’re being changed. The timing of this will at all times be a bit of bit sensitive, which has led to the decrease revenues this 12 months. Nonetheless, as Humira’s contribution to revenues will get more and more decrease, its drag will get decrease and decrease.

By 2025 the corporate will return to progress, with excessive single digit progress all through the remainder of the last decade.

This could assist 4%-6% dividend progress all through the remainder of the last decade.

However I consider that the share value has now gotten forward of the enterprise efficiency, and that this anticipation is making AbbVie overvalued.

We’ve got began to take a small achieve at $180, and will probably be scaling out of the place because it knocks out additional benchmarks.

Promote #2: Emerson Electrical

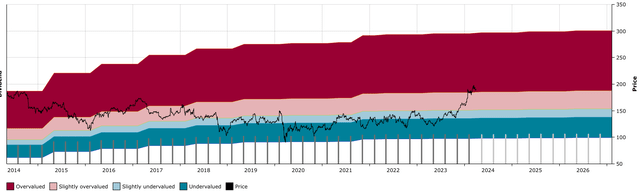

Emerson Electrical (EMR) is taken into account a dividend aristocrat. Not in contrast to aristocrats, I consider that EMR’s share value is behaving in an entitled method up in an ivory tower, disconnected from actuality. Of us this fairness doesn’t qualify as a dividend inventory in my eyes.

EMR yields lower than 2%, and for the previous 5 years has grown the dividend at a 1.4% compound annual progress fee. Are you aware how weak a dividend profile that is?

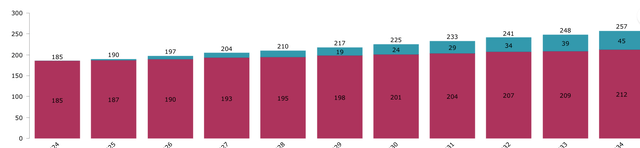

If you happen to make investments $10,000 in EMR on the present value, and reinvest the dividends on the present yield, whereas the dividend continues to develop at 1.4%, then that is what the dividend earnings from the place will appear like over the upcoming decade:

EMR Dividend Simulation (Dividend Freedom Tribe)

You can additionally simply purchase VZ and get 3x what you will get in 10 years, as we speak.

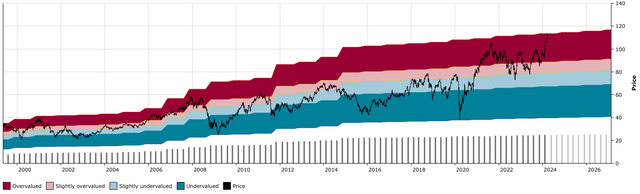

EMR’s value relative to its dividend is as excessive because it has traditionally gotten.

Trying again at a long run 25 12 months DFT chart (so the identical as these introduced above however over a 25 12 months span), we will clearly see that the one instances EMR’s valuations obtained this excessive was late 90s, 2001, 2007-2008, 2021.

EMR DFT Chart (Dividend Freedom Tribe)

You’ll be able to lecture me all you need on automation, and the way EMR is the beneficiary of all of this, relating to being a dividend investor, there isn’t a justification for being uncovered to this inventory on the present value.

If you happen to do personal EMR nevertheless, you most likely have a giant capital achieve which you’ll guide, and redeploy in an undervalued inventory which can increase your dividend earnings, shift you to worth, and set you up for achievement.

Conclusions

There may be at all times one thing to purchase, at all times one thing to promote, do not get hooked up to your shares, be keen to maneuver from overvalued names to undervalued. Do not be in a rush to promote, do not be in a rush to purchase. Use widespread sense to information your investing, and you may come out on prime.

[ad_2]

Source link