[ad_1]

zhengzaishuru

Granite Ridge Assets (NYSE:GRNT) seems able to delivering a modest quantity of free money movement in 2024 earlier than dividends. If it maintains its quarterly dividend at $0.11 per share, its internet debt is projected to extend by $41 million through the 12 months.

This seems manageable for now, though Granite Ridge’s dividend is susceptible to being reduce if commodity costs drop considerably. Granite Ridge has round 43% of its 2024 manufacturing hedged, however this drops to round 12% for 2025 in the mean time.

I now estimate Granite Ridge’s worth at $8.00 at long-term (after 2024) costs of $75 WTI oil and $3.75 Henry Hub gasoline. Present 2025 and 2026 strip costs are averaging barely beneath this.

My estimate of Granite Ridge’s worth has gone down by $0.25 from December 2023 because of some minor issues about its rising debt, in addition to its 2024 manufacturing being a bit lower than I anticipated with its $275 million capital expenditure funds.

Late 2023 Permian Divestiture

Granite Ridge offered some Permian Basin belongings to Important Vitality in December 2023 by exercising its tag-along rights round Important’s Henry acquisition. The divested belongings concerned 45 gross (9.9 internet) producing wells, which contributed round 1,700 BOEPD to Granite’s 2023 manufacturing.

Granite Ridge’s share of the sale seems to contain 90% of the working pursuits that Important talked about in its press launch. Important indicated that the acquired belongings had been anticipated to extend its manufacturing by round 1,400 BOEPD in 2024, so Granite Ridge is giving up round 1,250 BOEPD in 2024 manufacturing (based mostly on Important’s three-stream reporting). With Granite Ridge’s two-stream reporting, this may in all probability translate to round 1,150 BOEPD to 1,200 BOEPD.

Granite is basically getting 1.103 million shares of Important Vitality, which at present have a price of practically $60 million. At present strip costs, Granite is giving up round $20 million in 2024 free money movement.

2024 Manufacturing

Granite expects to common roughly 24,250 BOEPD (47% oil) in 2024 at its steering midpoint. Granite’s This autumn 2023 manufacturing would have been round 24,500 BOEPD with none manufacturing from its divested belongings. Granite’s 2023 manufacturing would have been round 22,600 BOEPD with out manufacturing from its divested belongings.

Thus Granite Ridge is anticipating its 2024 manufacturing to be round -1% decrease than its adjusted This autumn 2023 manufacturing and round +7% increased than its adjusted 2023 manufacturing.

Manufacturing is predicted to be a bit lumpy in 2024, with Q1 2024 manufacturing anticipated to be all the way down to round 23,300 BOEPD and a ramp up in manufacturing anticipated in 2H 2024.

As a result of its emphasis on manufacturing development in earlier years, Granite Ridge’s base decline fee is within the low-40% vary, which is a bit on the excessive facet.

2024 Outlook

At present strip of $81 to $82 WTI oil and $2.40 Henry Hub gasoline, Granite is projected to generate $409 million in oil and gasoline income in 2024. Granite ought to be capable to understand a bit above Henry Hub for its pure gasoline manufacturing with NGLs (which look to have fairly robust costs for 2024) rolled up into that in its two-stream manufacturing reporting.

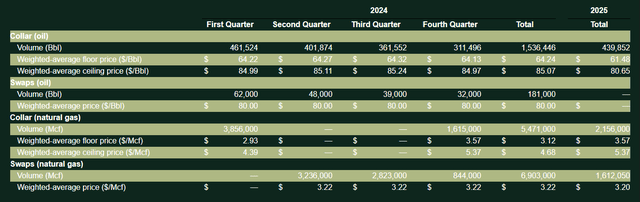

Granite Ridge’s Hedges (graniteridge.com)

Granite Ridge’s hedges have $10 million in estimated worth for 2024. Oil costs are getting close to the ceilings of Granite Ridge’s collars, however at present its oil hedges are nonetheless near impartial worth. Granite Ridge’s pure gasoline hedges account for that $10 million in constructive worth.

Barrels/Mcf

$ Per Barrel/Mcf (Realized)

$ Million

Oil (Barrels)

4,160,088

$80.00

$333

Pure Fuel [MCFE]

28,146,975

$2.70

$76

Hedge Worth

$10

Whole Income

$419

Click on to enlarge

Granite Ridge expects to have round $275 million in 2024 capital expenditures, together with $35 million for budgeted acquisitions and $240 million for growth capex.

The $35 million refers to acquisitions which have already closed in 2024 or are within the strategy of closing. Thus Granite Ridge will probably spend greater than that on acquisitions, with the ensuing influence of elevated manufacturing.

$ Million

Lease Working Bills

$62

Manufacturing Taxes

$31

Money G&A

$25

Money Curiosity

$10

Capital Expenditures

$275

Whole Bills

$403

Click on to enlarge

Granite Ridge’s steering at present strip costs ends in a projection of $16 million in free money movement for Granite Ridge earlier than dividends.

Granite Ridge’s $0.11 per share quarterly dividend provides as much as round $57 million per 12 months in dividends. Thus if Granite Ridge maintains this dividend for all of 2024, it should find yourself with $41 million in money burn after dividends.

Granite Ridge’s share repurchase program completed on the finish of 2023 and it has not began a brand new share repurchase program but.

Notes On Debt

Granite Ridge ended 2023 with $100 million in internet debt. Primarily based on its 2024 steering and present strip costs, it should finish 2024 with round $141 million in internet debt if it maintains its quarterly dividend at $0.11. This would go away it with leverage of 0.5x.

In November 2023, Granite Ridge’s credit score facility was amended to lower its borrowing base from $325 million to $275 million and improve its combination elected commitments from $150 million to $240 million.

Granite Ridge nonetheless seems to have a good quantity of room beneath its credit score facility, though it could be prudent to maintain its rising internet debt beneath management in future years.

Granite Ridge additionally seems able to protecting its quarterly dividend at $0.11 per share for now and will be capable to cowl that dividend if it slows its manufacturing development going ahead. It might want to steadiness manufacturing development with debt administration although.

Notes On Valuation

I’m now valuing Granite Ridge at $8.00 per share at my estimated long-term costs of $75 WTI oil and $3.75 NYMEX gasoline. For comparability, 2025 strip costs contain roughly $75 oil and $3.50 gasoline whereas 2026 strip costs contain roughly $71 oil and $3.80 gasoline.

I’ve trimmed my estimate of Granite Ridge’s worth by roughly $0.25 per share. This is because of its projected improve in internet debt and since its 2024 manufacturing development was a bit decrease than I anticipated given its $275 million capex funds.

I imagine that Granite Ridge will preserve its quarterly dividend at $0.11 per share for now, however there’s a threat that its dividend will get reduce if commodity costs drop considerably (with its 2025 manufacturing at present largely unhedged).

Conclusion

Granite Ridge is anticipating to extend its manufacturing (proforma for its December Permian divestiture) by round +7% in 2024 in comparison with 2023, though its manufacturing could dip barely in comparison with its proforma This autumn 2023 manufacturing.

Granite Ridge’s base decline fee is comparatively excessive because of its prior manufacturing development. That is resulting in Granite Ridge solely producing round $16 million in projected free money movement earlier than dividends at present 2024 strip costs.

Granite Ridge’s base decline fee ought to average if it goals for a restricted quantity of manufacturing development going ahead. Nevertheless, its dividend is vulnerable to being reduce if commodity costs decline considerably.

[ad_2]

Source link