[ad_1]

On this piece, we are going to attempt to analyze if these shares are nonetheless value shopping for at present costs

The shares we are going to analyze are Paramount World, Meta, and Micron.

In 2024, make investments like the large funds from the consolation of your house with our AI-powered ProPicks inventory choice software. Be taught extra right here>>

Within the following article, we are going to analyze the potential future efficiency of three shares which have reached key turning factors of their year-to-date trajectories. By diving into technical and basic metrics, we are going to discover the explanations behind their latest value actions and perceive the place they might go subsequent.

Previously few weeks, two of the three shares talked about beneath have posted first rate good points. In Meta’s (NASDAQ:) case, the inventory surged final week, solely to erase all its good points this week.

Here is the abstract of their exercise:

Paramount World (NASDAQ:): The inventory has risen by 10% since March 25.

Micron (NASDAQ:): The inventory surged by 12.5% throughout the identical interval.

Meta Platforms: Regardless of gaining 4.36% final week, Meta’s inventory gave again all its good points this week.

We are going to make the most of insights from InvestingPro to delve into these shares additional.

1. Paramount World

What’s Driving the Positive factors:

Paramount World plans to promote its manufacturing division in isolation, regardless of its modest money movement, it might appeal to the eye of different potential strategic patrons.

Funding agency Apollo World Administration (NYSE:) has submitted an $11 billion bid to purchase the movie and tv manufacturing division.

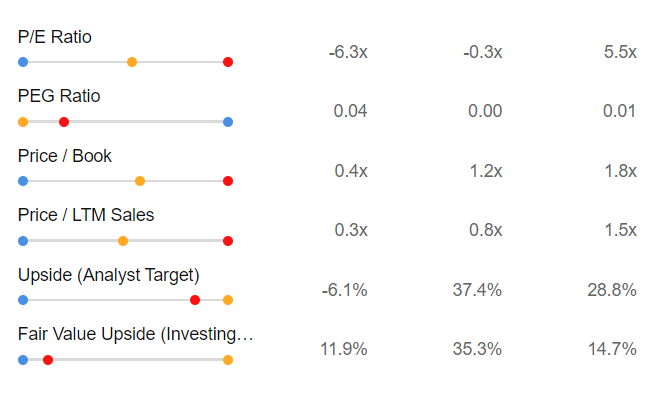

Supply: InvestingPro

Wolfe Analysis upgraded the ranking on Tutolo to Peer Carry out from Underperform because of the potential enhance in discretionary money movement. Current media protection suggests this might appeal to aggressive bids from Skydance.

Paramount’s Honest Worth, as summarized by InvestingPro, stands at $13.84, which is 11.9% greater than the present value.

InvestingPro subscribers tracked analysts’ forecasts, which point out a bullish goal value of $13.26 for the inventory.

Whereas each analysts and Honest Worth foresee a possible enhance, the danger profile is considerably regarding, with a good monetary well being rating of two out of 5.

Supply: InvestingPro

Paramount is now value 0.3x its income in comparison with 1.5x for the sector, and the Worth/Earnings ratio at which the inventory is buying and selling is -6.3X towards an business common of 5.5x, once more pointing to an undervaluation relative to the sector.

Analysts anticipate robust upward actions within the inventory as a consequence of latest information, aligning with the potential upside indicated by the Honest Worth, regardless of its disappointing annual good points.

2. Micron Know-how

What’s Driving the Positive factors:

BofA Securities modified the outlook by elevating the worth goal to $144 from the earlier $120 and sustaining a Purchase ranking on the Micron inventory.

The brand new goal displays potential progress pushed by demand for high-bandwidth reminiscence (HBM), which is changing into more and more essential for synthetic intelligence (AI) purposes.

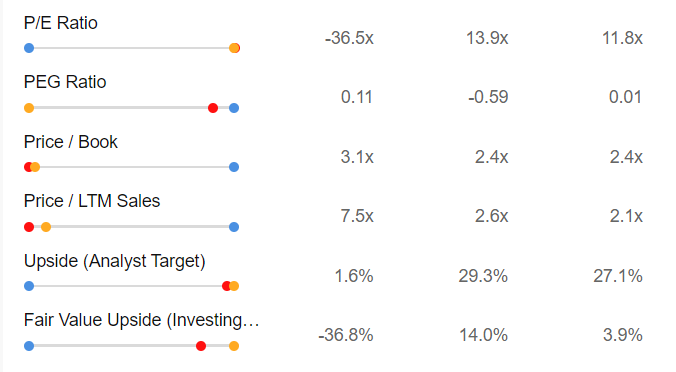

Supply: InvestingPro

InvestingPro’s Honest Worth for Micron, which mixes 12 funding fashions, sits at $78.5, marking a 36.8% lower from the present value.

Analysts, when discussing the goal value, specific bullish sentiments in direction of the inventory, setting it at $126.91. This determine considerably exceeds the common Honest Worth.

Regardless of the disparity between analysts’ projections and the Honest Worth, considerations concerning the inventory’s danger profile persist. Micron’s monetary well being is rated at 2 out of 5, indicating a considerably precarious state of affairs.

Supply: InvestingPro

Micron’s market worth is now over 7 instances its revenues, in comparison with the business common of simply over 2 instances. The inventory’s Worth/Earnings ratio is presently at -36.5x, whereas the business common is 11.8x. This confirms that Micron is presently undervalued relative to its business friends.

Buyers are optimistic concerning the firm’s efficiency, which has surged by 124% over the previous yr. This implies that the constructive pattern within the inventory could proceed.

Nonetheless, regardless of robust earnings, the Honest Worth outlook for Micron stays pessimistic. That is evident despite the fact that Micron could also be undervalued when in comparison with its rivals and the business.

3. Meta Platforms

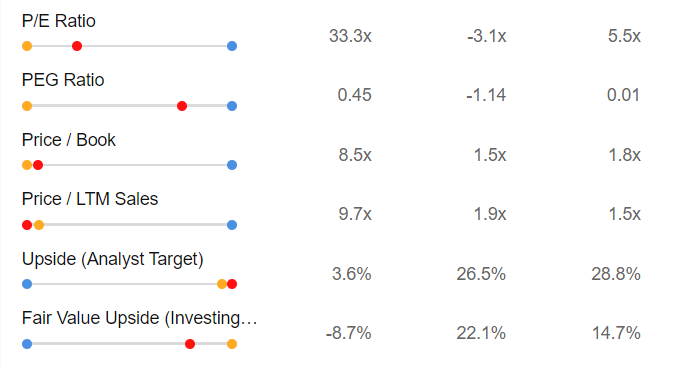

For Meta, InvestingPro’s Honest Worth, which summarizes 14 funding fashions, stands at $466.56, or 8.7% lower than the present value.

InvestingPro subscribers have been capable of observe the event of analysts’ forecasts surveyed, as for the goal value they’re bullish on the inventory, at $526.03.

Supply: InvestingPro

Whereas analysts and Honest Worth presently disagree on the opportunity of a draw back, excellent news additionally comes from the low-risk profile because it has a superb stage of economic well being, with a rating of 4 out of 5.

Supply: InvestingPro

We will see that Meta is now value nearly ten instances its revenues in comparison with 1.5x for the sector, and the Worth/Earnings ratio at which the inventory is buying and selling is 33.3X towards an business common of 5.5x, which stands to substantiate its overvaluation relative to the sector.

Meta Platform demonstrates robust monetary well being. The constructive efficiency because the starting of the yr has boosted investor confidence.

Nonetheless, the inventory’s valuations recommend overvaluation, indicating a possible pullback.

***

Take your investing recreation to the subsequent stage in 2024 with ProPicks

Establishments and billionaire buyers worldwide are already effectively forward of the sport in relation to AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and decrease losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own houses with our new flagship AI-powered stock-picking software: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty margin during the last decade, buyers have one of the best collection of shares out there on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or suggestion to take a position as such it’s not supposed to incentivize the acquisition of property in any means. I wish to remind you that any sort of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding determination and the related danger stays with the investor.

[ad_2]

Source link