[ad_1]

GordonsLife

Introduction & Funding Thesis

Crocs (NASDAQ:CROX) is an informal life-style footwear and equipment firm that has outperformed the S&P 500 and Nasdaq 100 YTD. The corporate launched its This fall FY23 earnings report in February, the place income and earnings grew 12% YoY and 11% YoY, respectively, beating expectations. The corporate noticed robust efficiency in its Crocs Model section, the place income grew 14% YoY to $3B, pushed by progress in its Clogs, Sandals, and Jibbitz product strains. In the meantime, income in its HEYDUDE section grew 6% YoY to $949M.

Shifting ahead, the corporate expects to see a slowdown in its income progress in FY24, the place it initiatives income to develop between 3-5% YoY, with the Crocs Model doing a lot of the heavy lifting, whereas income in its HEYDUDE section is predicted to stay flat. I consider that given Crocs’s robust model affinity and sturdy product innovation, it ought to proceed to see deeper market penetration within the coming years throughout buyer profiles each within the US and internationally, because it efficiently manages its franchises to drive larger buyer conversion charges and repeat consumers, resulting in rising Common Order Quantity (AOV). On the identical time, within the HEYDUDE section, it has seen early indicators of success throughout its merchandise, though income progress has been slower relative to the Crocs Model. Whereas the corporate hopes to duplicate the success of its Crocs Model over to HEYDUDE within the coming years because it expands its outlet retail technique whereas stabilizing gross margins, I consider that the inventory is at the moment attractively priced to drive important returns for long-term buyers trying to provoke a place. Subsequently, I’ll fee it a “purchase.”.

About Crocs

Crocs designs, develops, markets, distributes, and sells informal life-style footwear and equipment that mix consolation, type, and worth. The corporate operates below two enterprise segments: 1) Crocs Model, and a pair of) HEYDUDE Model. The Crocs Model consists of their iconic clogs, sandals, and personalised Jibbitz charms and equipment. The HEYDUDE Model presents sneakers which can be light-weight and functionally versatile throughout versatile silhouettes and carrying events.

When it comes to their go-to-market, they market their merchandise in additional than 80 nations, with a concentrate on six core markets that embody China, India, Japan, South Korea, the US, and Western Europe. They primarily depend upon wholesale and direct-to-consumer (DTC) to distribute their merchandise. In FY23, Crocs generated 52% of its income from its wholesale distribution channels, which embody home and worldwide multi-brand brick-and-mortar retailers, e-tailers, accomplice retailer operators, and worldwide distributors. The remaining 48% of income was derived from Crocs’s DTC distribution channels, which embody company-operated e-commerce websites, third-party marketplaces, full-price retail shops, and outlet shops.

The nice: Development in Crocs Model, Worldwide Enlargement, Sturdy Margins

The corporate reported its This fall FY23 earnings in February, the place income grew 12% YoY to roughly $4B. Out of the $4B in income, Crocs Model contributed $3B, or 75% of Whole Income, rising 14% YoY, whereas HEYDUDE contributed the remaining $950M, rising 6% YoY.

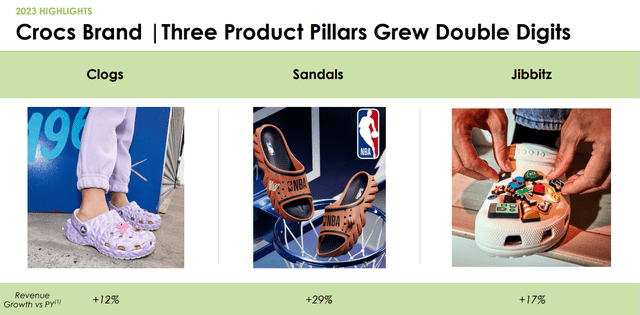

Throughout the Crocs Model, the corporate noticed robust progress throughout its three product pillars, which embody 1) Clogs, 2) Sandals, and three) Jibbitz, because it continued to innovate on its product strains, elevate their franchise administration capabilities, and drive memorable shopper moments via partnerships and collaborations.

In FY23, Clogs grew 12% YoY, pushed by each their basic and new Clog franchises. In the meantime, the corporate continued to achieve market share throughout their Sandals section, which grew 29% YoY and now makes up 13% of Crocs gross sales combine. I consider that Crocs’s Sandal section permits it to diversify income not solely throughout its present product combine but in addition throughout prospects, since 61% of shoppers that bought sandals on company-owned e-commerce channels had been new to the model, as per administration commentary through the earnings name. The administration additional elaborated, saying that prospects had been skewed extra in direction of females than males of their Sandal product line, whereas in addition they shopped extra ceaselessly, with a better AOV. On the identical time, the corporate can be centered on changing into extra agile with its tempo of innovation and pace to market. For instance, in This fall, the corporate examined slippers in 4 colours, which they had been capable of get to market 60% quicker than their regular product cycle. Lastly, the corporate noticed its Jibbitz enterprise develop 17% YoY, making up 9% of their whole gross sales combine. I consider that Crocs will proceed to see outsized progress in its Jibbitz section, because the secular pattern of personalization ought to proceed to behave as a tailwind whereas the corporate drives deeper market penetration each within the US and internationally.

This fall FY23 Earnings Slides: Income progress throughout merchandise within the Crocs Model

Shifting on to income distribution by geography, Crocs noticed 8% YoY progress in North America, whereas Worldwide Income grew 23% YoY. In the course of the earnings name, the administration acknowledged that they noticed double-digit progress in South Korea and the UK, whereas Australia and China grew triple-digits. The corporate believes that it ought to proceed to see outsized progress in worldwide markets, particularly in APAC, as there may be loads of untapped potential in that area, with China reporting file income in This fall however solely contributing 4% of whole revenues. I consider there is a chance in Asia as Crocs’s goal market embraces personalization at a speedy tempo over the approaching years, particularly as the dimensions of middle-income earners grows, and private disposable revenue rises within the area.

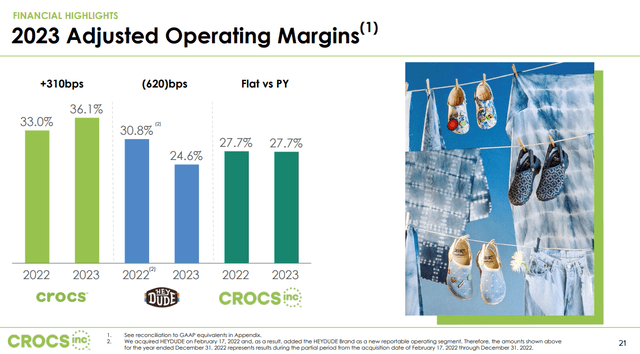

Shifting gears to profitability, the corporate improved its gross margins by 350 foundation factors YoY to 55.8%, pushed by a better Common Promoting Value (ASP’s) within the firm’s Crocs Model section throughout channels and product combine, larger worldwide pricing, and decrease discounting. On the identical time, the corporate additionally elevated its Adjusted revenue from operations by 11.4% to $1.09B, with a margin of 27.7%, flat YoY, as Adjusted SG&A bills as a share of income elevated from 26.7% in FY22 to twenty-eight.7% in FY23, whereas the corporate continued to spend money on advertising, expertise, and infrastructure to assist its future progress prospects.

This fall FY23 Earnings Slides: Crocs’s working margins throughout its enterprise segments

I consider that Crocs ought to proceed to see progress in its Crocs Model section, because it leverages its model affinity to drive sturdy product innovation, efficient franchise administration, and buzz-worthy advertising collaborations and partnerships to increase its market share amongst buyer profiles by efficiently participating and changing them into repeat consumers, resulting in larger ASP’s. I’m additionally optimistic concerning the firm’s concentrate on driving deeper market penetration of the Crocs Model internationally, because it continues to develop as a share of whole income to 32.5% in FY23 from 29.4% in FY22. On the identical time, as the corporate continues to drive a better share of its gross sales digitally YoY, which embody gross sales on their web sites, third-party marketplaces, and wholesale gross sales to international e-tailers, this could permit the corporate to unlock larger working margins.

The unhealthy: HEYDUDE’S progress story wants to select up, however is coupled with macroeconomic headwinds

In the meantime, the corporate’s HEYDUDE enterprise section generated $949M in income, rising 6% YoY at a a lot slower tempo in comparison with the Crocs Model. Though HEYDUDE continued to achieve market share in FY23, as per Circana’s retail monitoring service, up 200 foundation factors from FY22, there have been some challenges in This fall, the place revenues for HEYDUDE had been down 19% YoY, as the corporate offered fewer sneakers and ASP’s had been flat YoY, as distribution from each wholesale and DTC channels contracted. I consider that the corporate is conscious of those challenges because it takes a extra centered method to stock allocation whereas stabilizing gross margins via full-price promoting on digital channels.

Nevertheless, I’m partially involved with the administration’s plan to open 30 HEYDUDE outlet places all through FY24 whereas projecting income progress of their HEYDUDE section to stay flat. Whereas retail channels derive one third of revenues for the Crocs Model within the US, replicating the success for HEYDUDE can include its personal set of challenges, particularly for the reason that success of Crocs and its enterprise segments are depending on sturdy shopper spending. Presently, HEYDUDE derives most of its income from North America, and with inflation nonetheless above the Fed’s long-term goal fee of two.2% and rates of interest within the vary of 5.25–5.5%, there’s a rising likelihood of an financial slowdown, for my part. Ought to there be a weak point within the labor market, that might translate to slower shopper spending and decrease gross sales throughout each the Crocs Model and HEYDUDE. Given the retail growth plans for HEYDUDE, a macroeconomic slowdown within the US might spell hassle for the corporate’s prime and backside strains.

Tying it collectively: Crocs is a “purchase”

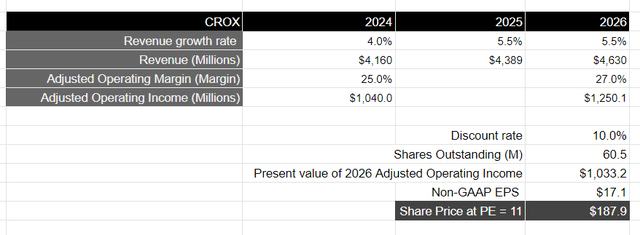

Wanting ahead, Crocs expects to see a slowdown in its income progress in FY24, the place it initiatives to develop between 3-5% YoY, with the Crocs Model projected to develop 4-6%, whereas income progress from HEYDUDE stays flat. In the meantime, it expects its Adjusted Working Margin to additionally decline YoY to 25%, which might end in an Adjusted Working Earnings of roughly $1.040B, a decline of 4.5% from FY23.

Wanting additional out till FY26, I consider that Crocs ought to proceed to develop its income, a minimum of within the mid-single digits, because it sees deeper market penetration of its merchandise within the Crocs Model each within the US and internationally, whereas rising its presence of HEYDUDE on the identical time. This might imply that the corporate ought to produce a minimum of $4.6B in income by FY26. Assuming that Adjusted working margins develop from a projected 25% in FY24 to 27% in FY26, it ought to translate to an Adjusted Working Earnings of roughly $1.2B, or a gift worth of $1.03B, when discounted at 10%.

Taking the S&P 500 as a proxy, the place its corporations develop their earnings on common by 8% over a 10-year interval with a price-to-earnings ratio of 15–18, I consider that Crocs ought to commerce at 0.6x the a number of of the S&P 500, given its projected earnings progress fee. This might translate to a PE ratio of 11, or a value goal of $187, which represents an upside of 46% from its present ranges, making it a “purchase”.

Writer’s Valuation Mannequin

Conclusion

Crocs has seen phenomenal progress in its Crocs Model in FY23 whereas sustaining robust profitability. Given the corporate’s model affinity and operational excellence, I count on it to proceed to develop its market share each within the US and internationally of its Crocs Model, because it drives sturdy product innovation, robust franchise administration, and buzz-worthy advertising to interact and convert prospects into repeat consumers with larger AOV’s. Whereas the corporate nonetheless has some work to do to repeat the success of its Crocs Model in its HEYDUDE section, I consider the inventory is at the moment attractively priced from a risk-reward standpoint, making it a “purchase”.

[ad_2]

Source link