[ad_1]

The crypto market took an sudden hit on April 12 as a spontaneous decline within the value of Bitcoin and distinguished altcoins resulted in large liquidations. The origin of this widespread value dip stays largely unknown, amongst a plethora of believable causes, together with a current value correction within the US inventory markets.

Virtually $500 Million Liquidated In An Hour Amidst Crypto Flash Crash

In keeping with knowledge from CoinMarketCap, Bitcoin slipped by 4.49% within the final day, falling as little as $66,052. As anticipated, BTC’s decline reverberated by the market, with distinguished altcoins Ethereum and Solana recording every day losses to the tune of 8.12% and 12.16%, respectively

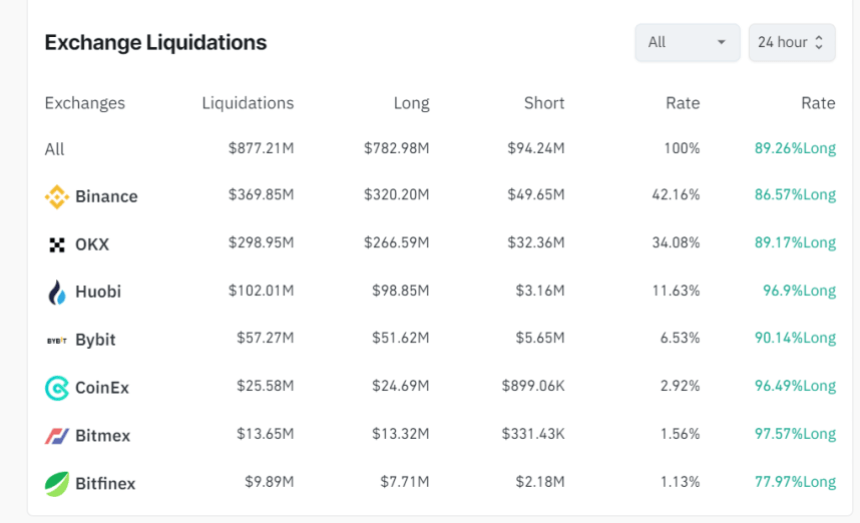

As earlier acknowledged, these losses translated into 277,843 merchants shedding their leverage positions as whole crypto liquidations reached $877.21 million within the final 24 hours primarily based on knowledge from Coinglass. Of those figures, lengthy positions accounted for $782.98 million, with brief merchants shedding solely $94.24 million.

Notably, $467 million in leverage positions have been closed inside an hour because of a common value decline. The very best quantity of liquidations at $369.85 million was recorded on Binance, whereas the one largest liquidation order valued at $7.19 million occurred within the ETH-USD market on the OKX change.

Supply: Coinglass

Curiously, Bitcoin’s value decline correlated with a dip within the US inventory market because the S&P 500 index declined by 1.6% to commerce as little as $5,108. This market crash was preceded by current CPI knowledge, which confirmed that the inflation fee rose to three.5% yr over yr in March.

Such stories solely point out that the US Federal Reserve (Fed) couldn’t be implementing any fee cuts quickly because it goals to pressure inflation all the way down to its annual goal of two%. This prediction is kind of bearish for the crypto market usually as Fed fee cuts enable buyers to comfortably search dangerous belongings corresponding to BTC with a possible of excessive yields.

Bitcoin Experiences Community Progress As Halving Approaches

On a extra optimistic be aware, Bitcoin has recorded an increase in non-empty wallets on its community forward of the Halving occasion on April 19. Blockchain analytics platform Santiment reported a rise of 370,000 BTC wallets holding lively cash during the last six days. Curiously, the analytic workforce is backing buyers to take care of this accumulative pattern all by the Bitcoin halving occasion.

On the time of writing, Bitcoin was buying and selling at $66,882, with a 44.80% enhance in its every day buying and selling quantity, which is at the moment valued at $43.80 billion. Nevertheless, Bitcoin’s value has usually been unimpressive in current occasions, with a decline of 1.33% and 6.20% within the final seven and 30 days, respectively.

Bitcoin buying and selling at $66,499.00 on the every day chart | Supply: BTCUSDT chart on Tradingview.com

Featured picture from The Impartial, chart from Tradingview

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site solely at your individual danger.

[ad_2]

Source link