[ad_1]

filo

Article Goal

Historic outcomes are among the many first issues many traders take into account when analyzing ETFs. Aside from contrarians, traders seek for funds with strong one-year, three-year, and five-year returns, as that is proof the technique can work, however macroeconomic modifications or modifications within the portfolio’s composition. However you is perhaps questioning how nicely this simplistic technique works and figuring out that’s the goal of right now’s article. On this report, I’ll consider the “performance-chasing” technique by taking a look at trailing and ahead one-year, three-year, and five-year returns by phase and elegance for lots of of U.S. Fairness ETFs. I feel you may discover the outcomes useful, and I hope you need to use the data on this article to grow to be a greater investor.

ETF Efficiency Evaluation

Background

Many readers are aware of Portfolio Visualizer, a free device that permits you to examine the chance and returns of as much as 4 securities at a time. You can too “optimize” your portfolio by coming into a set of property and the interval to guage, however there’s one catch. By default, the device makes use of an asset’s historic metrics as inputs. Consequently, the output is what asset mixture would have labored greatest up to now, thereby offering some traders with a false sense of safety. Whereas it seems they’re doing correct due diligence, they’re simply checking previous efficiency.

One good thing about this text is that I’ve accomplished a variety of this backtesting for you. After gathering historic returns for lots of of U.S. Fairness ETFs, I intend to make use of the statistics to reply two key questions:

1. Are one-year, three-year, and five-year trailing returns good predictors of an ETF’s success, as measured by their corresponding one-year, three-year, and five-year ahead returns?

2. Are the outcomes comparable relying on the phase and elegance of the market (small-cap, mid-cap, and large-cap worth, mix, and development)?

This evaluation is prolonged, however I’ve tried to prepare the leads to such a manner that makes it a comparatively straightforward learn for you. Hopefully I’ve accomplished my job, however let’s get began by attempting to reply the primary query.

Trailing Returns By Phase

There are quite a few methods to guage and rank efficiency. Nonetheless, probably the most simplistic manner is to have a look at all ETFs regardless of the phase (small, mid, and huge) and elegance (worth, mix, and development). If an investor purchased the top-performing ETFs on December 31 and held them for a interval that matches the analysis interval, would they arrive out forward?

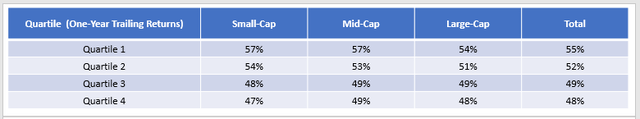

For probably the most half, the reply isn’t any, nevertheless it is determined by the phase. Utilizing over 4,000 knowledge factors for 576 U.S. Fairness ETFs over 23 years, traders deciding on the highest 25% of ETFs primarily based on their trailing one-year returns ended up with barely below-average returns the next 12 months (fifty fifth percentile).

Quartile 1: 55% Quartile 2: 52% Quartile 3: 49% Quartile 4: 48%

These outcomes recommend contrarian traders is perhaps onto one thing. ETFs ranked in Quartiles 3 and 4 had above-average efficiency the next 12 months, although the distinction is slight. Nonetheless, I additionally calculated figures primarily based on phase, as evaluating two ETFs in numerous classes (e.g., small-cap vs. large-cap) is unusual. Right here, we see some efficiency differentiation, summarized within the desk beneath.

The Sunday Investor

The contrarian strategy labored higher with the small-cap and mid-cap segments, however I am nonetheless not assured one-year trailing returns are something greater than an attention-grabbing knowledge level. Due to this fact, I like to recommend tossing this statistic utterly.

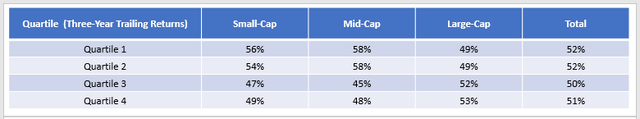

The outcomes aren’t any higher utilizing three-year trailing returns, although the performance-chasing technique labored higher with giant caps. The highest two quartiles did barely higher (forty ninth percentile) for the subsequent three years.

The Sunday Investor

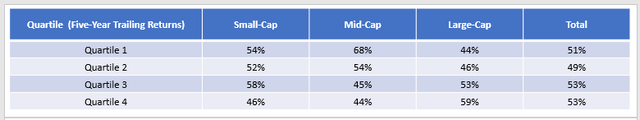

Lastly, the next desk signifies that large-cap traders shopping for ETFs primarily based on their five-year trailing returns have a significant benefit, with the highest quartile rating above common (44%) over the subsequent 5 years on common. Nonetheless, the alternative was true for small-cap and mid-cap ETFs.

The Sunday Investor

Listed below are three takeaways:

1. Analysts shouldn’t use one-year and three-year trailing returns to justify an funding in an ETF. Equally, they need to not low cost an ETF due to its poor one-year and three-year observe data. They’re enjoyable knowledge factors however shouldn’t dominate an analyst’s funding thesis.

2. 5-year trailing returns are higher predictors of ahead five-year returns for large-cap ETFs. ETFs ranked within the prime two quartiles carried out above common over the subsequent 5 years. Whereas it is not a slam-dunk technique, this strategy earns you a slight benefit and may also help slender your decisions.

3. There isn’t a proof that the best-performing small-cap and mid-cap ETFs during the last one, three, and 5 years will carry out nicely transferring ahead. The explanation may very well be as a result of much less is thought concerning the shares held in these funds or as a result of the pattern dimension is not but giant sufficient. Whereas my pattern dimension for large-cap ETFs over 5 years is ample at 108, it is solely 43 and 34 for small-cap and mid-cap ETFs.

Trailing Returns By Phase and Model: Massive-Cap ETFs

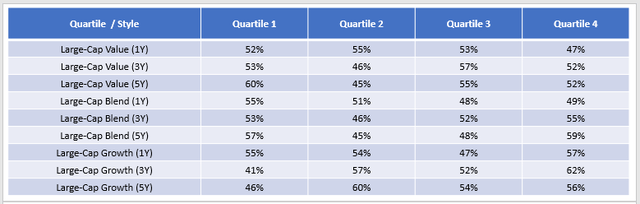

We are able to additional divide the evaluation by fashion (worth, mix, and development), however as a result of restricted data accessible for small-caps and mid-caps, I am solely comfy doing this with large-caps. I’ve summarized these outcomes beneath.

The Sunday Investor

Utilizing three- and five-year trailing returns, large-cap development ETFs rating within the prime quartile went on to rank within the forty first and forty sixth percentiles of their class over the subsequent three and 5 years. Apparently, the top-quartile performers within the large-cap worth and large-cap mix classes ended up rating beneath common on all intervals measured.

Massive-Cap Worth ETFs: In-Depth Evaluation

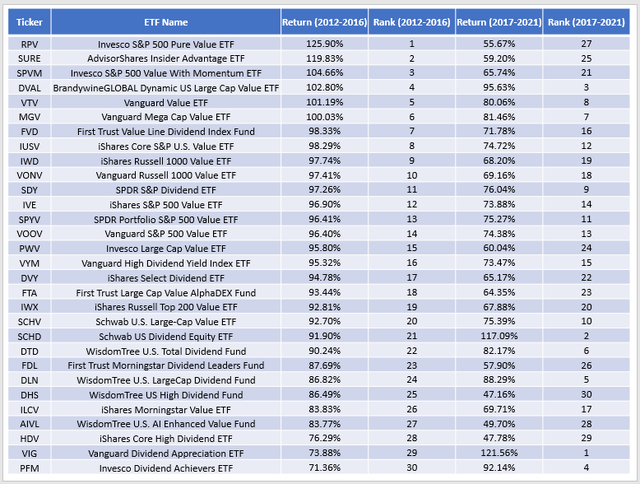

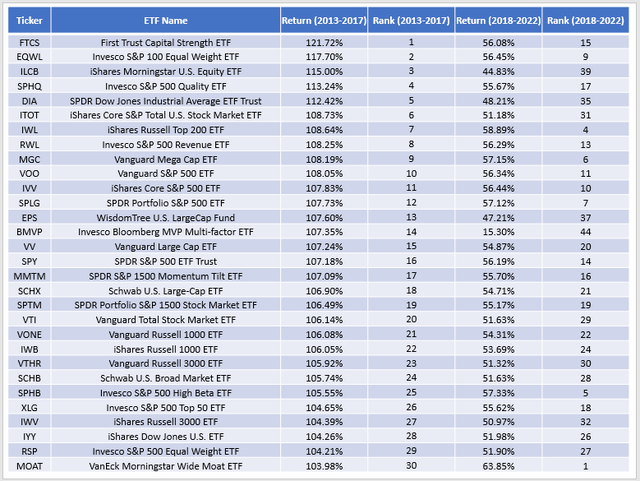

As all the time, there are exceptions value noting. Take into account the next desk of historic and ahead five-year returns for the 30 large-cap worth ETFs in my pattern as of December 31, 2016.

The Sunday Investor

These outcomes communicate for themselves and reveal there isn’t a correlation between historic and future five-year returns for large-cap worth ETFs for the 12 months ending December 2016. As a substitute, what is perhaps extra useful is analyzing above-average performers in two distinct five-year intervals (i.e., 2012 to 2016 and 2017 to 2021). This evaluation would show constant efficiency over ten years and would cut your decisions to the next:

BrandywineGLOBAL Dynamic U.S. Massive Cap Worth ETF (DVAL) Vanguard Worth ETF (VTV) Vanguard Mega Cap Worth ETF (MGV) iShares Core S&P U.S. Worth ETF (IUSV) SPDR S&P Dividend ETF (SDY) iShares S&P 500 Worth ETF (IVE) SPDR S&P 500 Worth ETF (SPYV) Vanguard S&P 500 Worth ETF (VOOV)

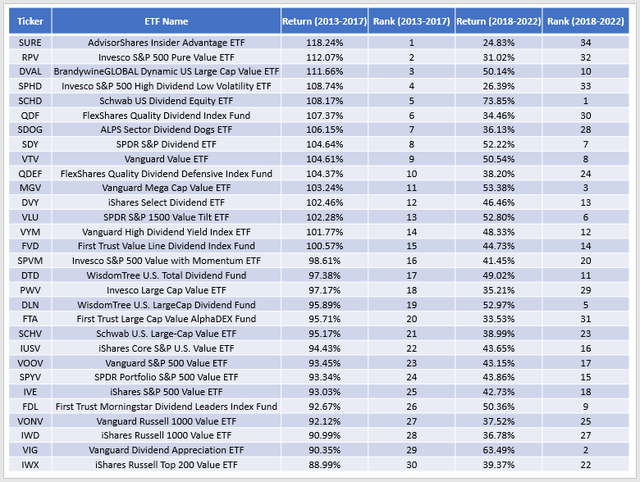

Should you’re not trying to shoot for the moon, it is a wise strategy. You’ve got already determined you need publicity to this market nook and easily want to improve your possibilities of success earlier than digging into an ETF’s technique and fundamentals, which might be time-consuming. Subsequent, let’s fast-forward one 12 months to December 31, 2017. Massive-cap worth traders on this date would have 35 decisions, 30 of which I’ve listed beneath.

The Sunday Investor

Once more, there is not a great correlation between historic and ahead five-year returns. Nonetheless, if we search for the above-average performers (i.e., these ranked #1-17 in each five-year intervals), we are able to rapidly slender issues down:

BrandywineGLOBAL Dynamic U.S. Massive Cap Worth ETF (DVAL) Schwab U.S. Dividend Fairness ETF (SCHD) SPDR S&P Dividend ETF (SDY) Vanguard Worth ETF (VTV) Vanguard Mega Cap Worth ETF (MGV) iShares Choose Dividend ETF (DVY) SPDR S&P 1500 Worth Tilt ETF (VLU) Vanguard Excessive Dividend Yield ETF (VYM) First Belief Worth Line Dividend Index Fund (FVD) WisdomTree U.S. Whole Dividend Fund (DTD)

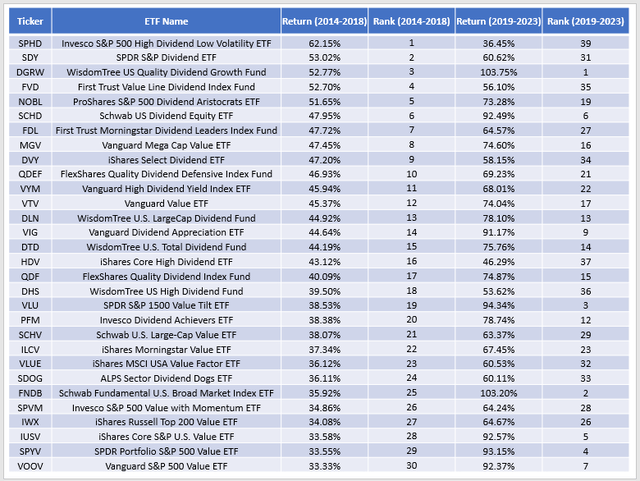

Lastly, let’s bounce ahead yet one more 12 months to December 31, 2018. On this date, there have been a minimum of 39 large-cap worth ETFs to select from, and the Invesco S&P 500 Excessive Dividend Low Volatility ETF (SPHD) was on the prime of the record with a 62.15% whole return from January 2014 to December 2018, confirmed right here. Nonetheless, SPHD would grow to be the worst performer in its class over the subsequent 5 years.

The Sunday Investor

From 2014-2023, probably the most constant large-cap worth ETFs had been:

WisdomTree US High quality Dividend Progress ETF (DGRW) ProShares S&P 500 Dividend Aristocrats ETF (NOBL) Schwab U.S. Dividend Fairness ETF (SCHD) Vanguard Mega Cap Worth ETF (MGV) Vanguard Worth ETF (VTV) WisdomTree U.S. LargeCap Dividend Fund (DLN) Vanguard Dividend Appreciation ETF (VIG) WisdomTree U.S. Whole Dividend Fund (DTD) FlexShares High quality Dividend Index Fund (QDF) SPDR S&P 1500 Worth Tilt ETF (VLU)

Massive-Cap Mix ETFs: In-Depth Evaluation

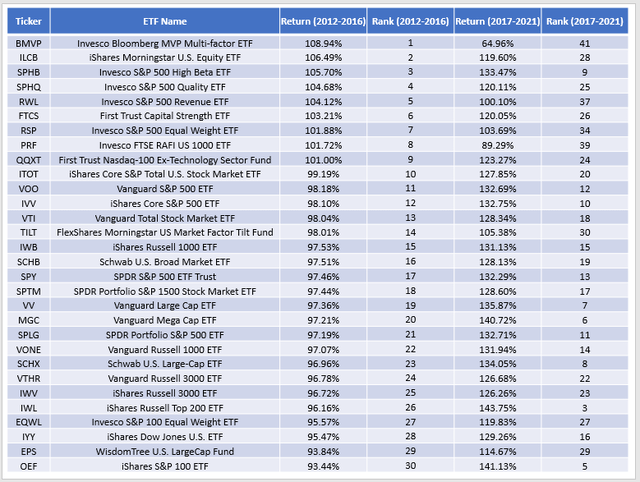

Subsequent, let’s transfer on to large-cap mix ETFs, beginning with what the image regarded like on December 31, 2016. As proven, there have been only a few cases the place the highest performers during the last 5 years had been additionally the highest performers over the subsequent 5 years.

The Sunday Investor

There are 41 ETFs in my pattern, so I take into account these rating within the prime 20 over each five-year intervals to be “constant” ETFs. They’re as follows:

Invesco S&P 500 Excessive Beta ETF (SPHB) Vanguard S&P 500 ETF (VOO) iShares Core S&P 500 ETF (IVV) Vanguard Whole Inventory Market ETF (VTI) iShares Russell 1000 ETF (IWB) Schwab U.S. Broad Market ETF (SCHB) SPDR S&P 500 ETF (SPY) SPDR S&P 500 Composite Inventory Market ETF (SPTM) Vanguard Massive Cap ETF (VV)

Apparently, apart from SPHB, all are plain vanilla funds with a easy market-cap-weighting scheme. ETFs with various weighting schemes ranked #22/41 on common from 2012 to 2016 and #28/41 from 2017 to 2018. Due to this fact, the proof over these ten years signifies that relating to easy large-cap mix publicity, the simplest resolution might be one of the best resolution.

One 12 months later, on December 31, 2017, traders had a minimum of 44 large-cap mix ETFs with five-year histories. The First Belief Capital Power ETF (FTCS) and the Invesco S&P 100 Equal Weight ETF (EQWL) had been good decisions for the subsequent 5 years, rating #15/44 and #9/44, respectively, from 2018 to 2022. On this sense, the performance-chasing technique labored nicely.

The Sunday Investor

Nonetheless, elevate your hand in case you purchased the VanEck Morningstar Large Moat ETF (MOAT) primarily based on its 103.98% whole return from January 2013 to December 2017, which ranked simply #30/44. It went on to rank #1 with a 63.85% whole return over the subsequent 5 years, and this latest success led VanEck to create extra “Large Moat” ETFs like MGRO, MVAL, MOTE, and SMOT. Granted, the five-year trailing returns for all 30 funds listed above are fairly shut, so whereas MOAT did not stand out then, it should not have been ignored simply because it lagged behind SPY by a number of proportion factors.

Nonetheless, following the identical methodology as earlier for figuring out probably the most constant performers, there have been 15, as follows:

First Belief Capital Power ETF (FTCS) Invesco S&P 100 Equal Weight ETF (EQWL) Invesco S&P High quality ETF (SPHQ) iShares Russell Prime 200 ETF (IWL) Invesco S&P 500 Income ETF (RWL) Vanguard Mega Cap ETF (MGC) Vanguard S&P 500 ETF (VOO) iShares Core S&P 500 ETF (IVV) SPDR S&P 500 ETF (SPLG) Vanguard Massive Cap ETF (VV) SPDR S&P 500 ETF (SPY) SPDR S&P 1500 Momentum Tilt ETF (MMTM) Schwab U.S. Massive-Cap ETF (SCHX) SPDR S&P 500 Composite Inventory Market ETF (SPTM) Vanguard Russell 1000 ETF (VONE)

This group has some funds with equal-weighting schemes (FTCS, EQWL), however 10/15 comply with plain vanilla market-cap-weighted methods. SPHQ additionally did nicely, however as mentioned on this article, the highest-quality firms are usually the biggest. Underlying profitability metrics like weighted common internet revenue margin and return on whole capital figures for the plain vanilla ETFs listed above strongly assist my declare that they’re high-quality ETFs, too.

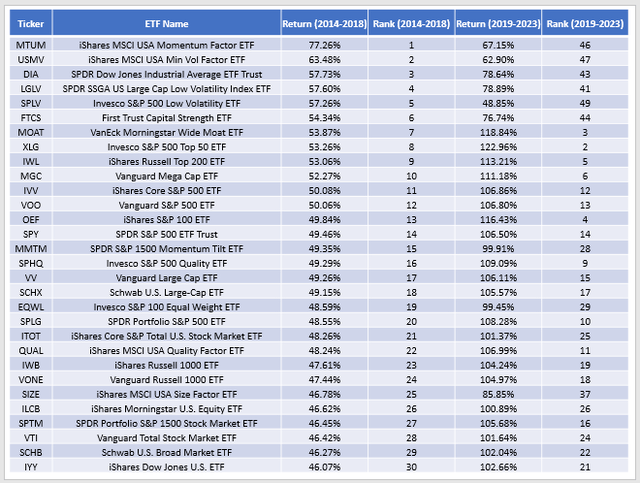

Let’s skip forward yet one more 12 months to December 2018, when there have been a minimum of 50 large-cap mix ETFs with a five-year historical past. Apparently, the 2 ETFs on the prime of the record adopted completely different methods (momentum and low-volatility) and outpaced most plain vanilla funds by a large margin. Sadly, traders relying on this efficiency to repeat had been dissatisfied. MTUM and USMV ranked #46/50 and #47/50 over the next 5 years, with DIA, LGLV, SPLV, and FTCS rating within the backside 20%.

The Sunday Investor

After we get previous the highest six ETFs talked about earlier, the ahead five-year returns for the highest performers find yourself fairly sturdy. Probably the most constant ones had been as follows:

VanEck Morningstar Large Moat ETF (MOAT) Invesco S&P 500 Prime 50 ETF (XLG) iShares Russell Prime 200 ETF (IWL) Vanguard Mega Cap ETF (MGC) iShares Core S&P 500 ETF (IVV) Vanguard S&P 500 ETF (VOO) iShares S&P 100 ETF (OEF) SPDR S&P 500 ETF (SPY) Invesco S&P 500 High quality ETF (SPHQ) Vanguard Massive Cap ETF (VV) Schwab U.S. Massive Cap ETF (SCHX) SPDR S&P 500 ETF (SPLG) iShares Core Whole U.S. Inventory Market ETF (ITOT) iShares MSCI USA High quality Issue ETF (QUAL) iShares Russell 1000 ETF (IWB) Vanguard Russell 1000 ETF (VONE)

Massive-Cap Progress ETFs: In-Depth Evaluation

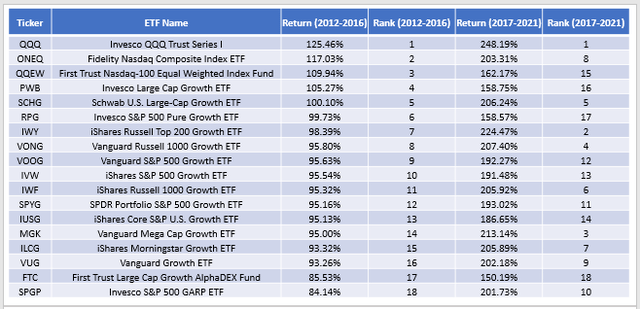

Lastly, let us take a look at large-cap development ETFs, a a lot smaller group. As of December 2016, solely 18 funds had a five-year historical past.

The Sunday Investor

As proven, the Invesco QQQ ETF (QQQ) led by a protracted shot from January 2012 to December 2016, delivering a 125.46% whole return. QQQ additionally ranked #1 from January 2017 to December 2021, with a 248.19% whole return, and for a lot of traders, the case is closed. Nonetheless, take into account that making use of the identical logic did not work out so nicely with RPV and BMVP for a similar 2012-2016 interval or for traders clinging to low-volatility ETFs like SPHD, USMV, LGLV, and SPLV in December 2018. Sadly, the one certain factor is that extra evaluation is required.

Quick ahead to December 2017, and the image appears to be like comparable. QQQ continues to be out in entrance, although its five-year ahead rating dropped to #2 behind the Invesco S&P 500 GARP ETF (SPGP), the worst-performing fund from 2012 to 2016. For these unfamiliar with SPGP, it modified Indexes in June 2019, so I place little emphasis on its historic outcomes. Nonetheless, Index modifications can render previous efficiency just about ineffective, and they’re widespread for these holding Invesco ETFs. To make certain, it’s best to all the time learn the footnotes within the efficiency part on the fund web page.

The Sunday Investor

QQQ has been constant, however so has the iShares Russell Prime 200 Progress ETF (IWY), the Vanguard Russell 1000 Progress ETF (VONG), and the iShares Russell 1000 Progress ETF (IWF). In comparison with QQQ, they’re going to by no means look good in any evaluation you run on Portfolio Visualizer, however like with MOAT, that does not imply it’s best to low cost them fully.

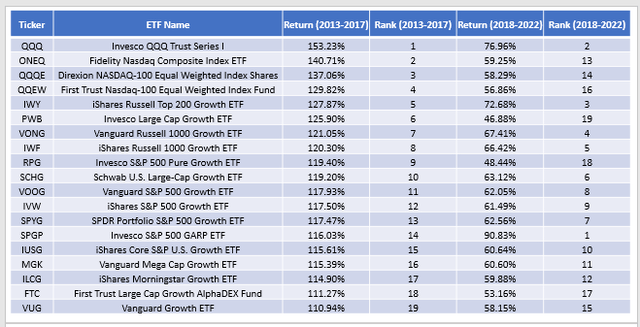

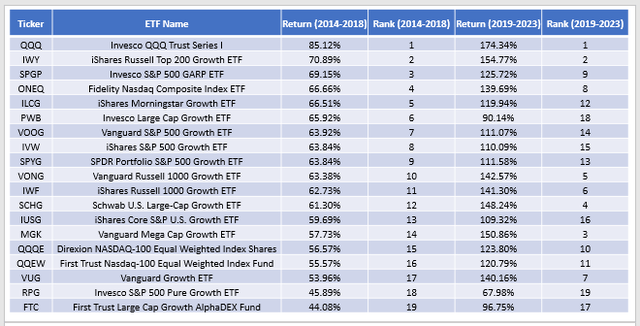

Lastly, take into account the five-year returns for the 19 large-cap development ETFs from 2014 to 2018. Once more, there’s little new to notice, as QQQ, IWY, and SPGP look nice. This may very well be the one space the place performance-chasing works.

The Sunday Investor

Even so, I am cautious to not low cost any ETF fully, as even latest poor performers just like the Invesco S&P 500 Pure Progress ETF (RPG) skilled success earlier than. Beforehand a Guggenheim fund, RPG ranked #2/11 on five-year returns for the 12 months ending December 2011 and was the #1 ranked large-cap development ETF for the five-year intervals ending December 2012, 2013, and 2014.

Funding Suggestion

This evaluation demonstrated that one-year, three-year, and five-year historic returns will not be good predictors of future outcomes. The one exception is within the large-cap development class, the place ETFs like QQQ and IWY routinely carry out nicely. It stays to be seen if this success can proceed, nevertheless it’s value noting that a number of of the consistent-performing large-cap ETFs are high-quality plain-vanilla funds. Easy methods, usually with low expense ratios, is perhaps one of the best resolution for a lot of traders.

I wrote this text as a result of many readers and analysts rely totally on previous efficiency when deciding if an ETF is value shopping for. The proof offered right now strongly signifies this strategy is flawed. Strong long-term returns (i.e., ten years) are a bonus, however I’ll proceed to focus my evaluation on the elemental strengths and weaknesses of an ETF’s underlying portfolio, which, luckily, might be decided with out efficiency charts. I hope you discovered this data useful, and when you have any questions, please be happy to remark beneath. Thanks for studying.

[ad_2]

Source link